🔬Cathie Wood's ARK Has (Losing) Money Problems

Plus: Meta's disaster of a quarter (ok, it wasn't that bad); the TikTok ban is official; and much more

"Money is a terrible master but an excellent servant."

- P.T. Barnum

"How can I be a fascist? I don't control the railways or the flow of commerce!"

- Barbie (2023)

Flat day for the big US markets (S&P 500 +0.0%, Nasdaq +0.1%) following a strong couple of trading days as sentiment turns around from last week’s Chicken Little phase.

7 of 11 sectors closed higher with Staples (+0.9%) and Utes (+0.6%) leading the charge. Industrials (-0.8%) finished last, despite strong March Durable Goods orders (rose 2.6% m/m vs consensus for 2.0%).

Tons of reporting yesterday, with Hasbro (+11%), WabTec (+10%) and CoStar (9%) the big winners, as well as Tesla (+12%) following Tuesday’s after-close release. Old Dominion Freight (-11%), Teledyne (-11%) and Enphase (-6%) were the losers this quarter.

Street Stories

How’s Aunt Cathie?: ARK Innovation’s (ex-)Queen of Wall Street

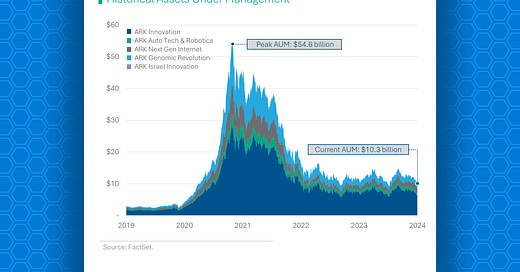

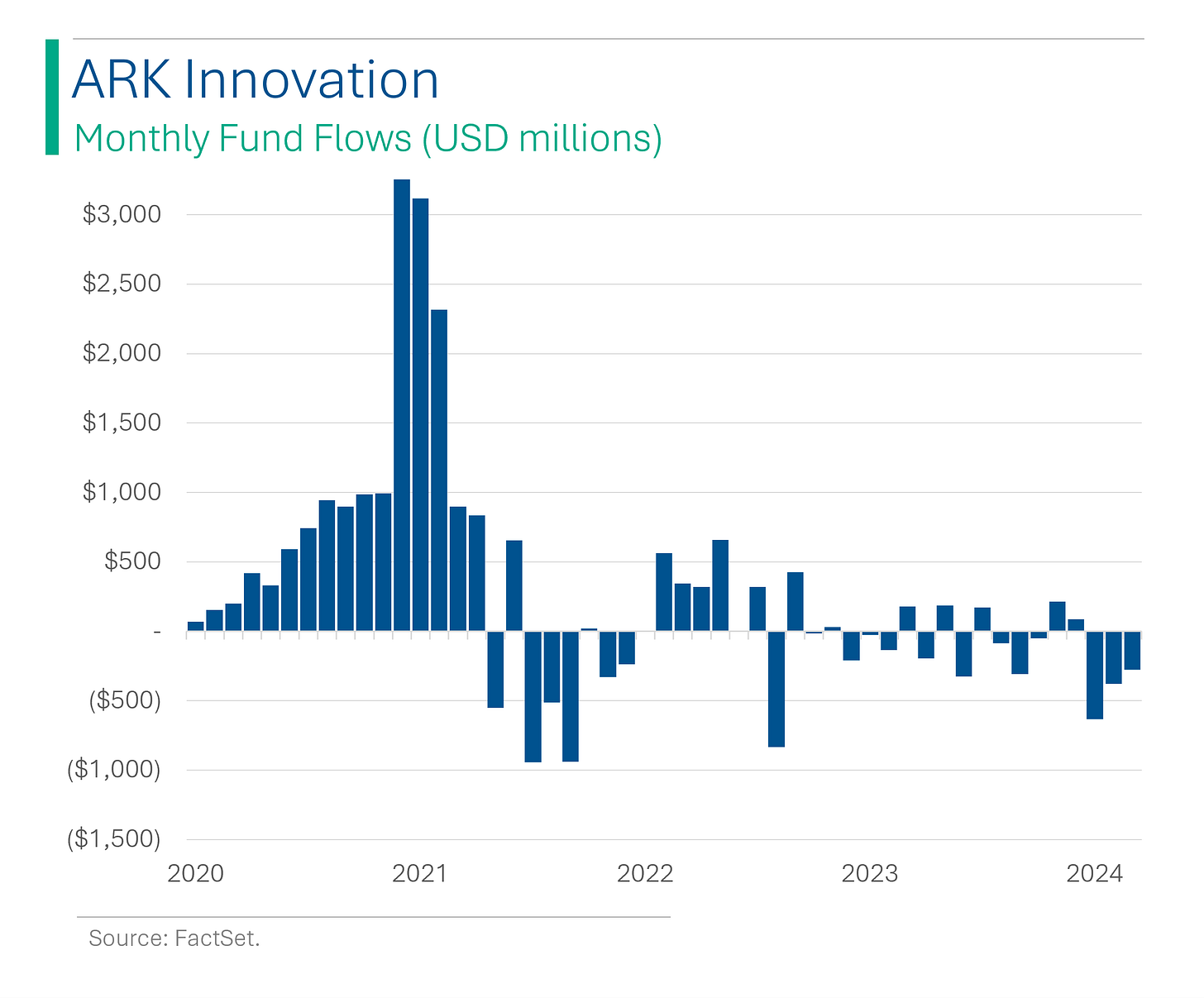

I ask this because her lead fund, ARK Innovation, has been in serious redemption mode, shedding around $1.3 billion since the start of the year (extra bad when you only manage $10 billion). Pro tip: You want assets to grow.

For those of you who weren’t following the markets back in the heady days of the pandemic, Cathie Wood was the poster child lady of the insane mini-tech bubble we saw for a few years. Her main fund, the ARK Innovation ETF, which was launched back in 2014, rose to fame in the aftermath of the initial COVID market shock around March 2020.

Over the next 11 months, she managed a staggering +330% return and every time you turned on CNBC or Bloomberg TV, there she was - spreading the gospel of a high tech, innovation fueled future.

Labelled the ‘anti-Warren Buffett’, whose fundamental driven, value-based style was labelled ‘quaint’ and ‘antiquated’ in this new economy - just like it was in the DotCom bubble. The parallels were comical.

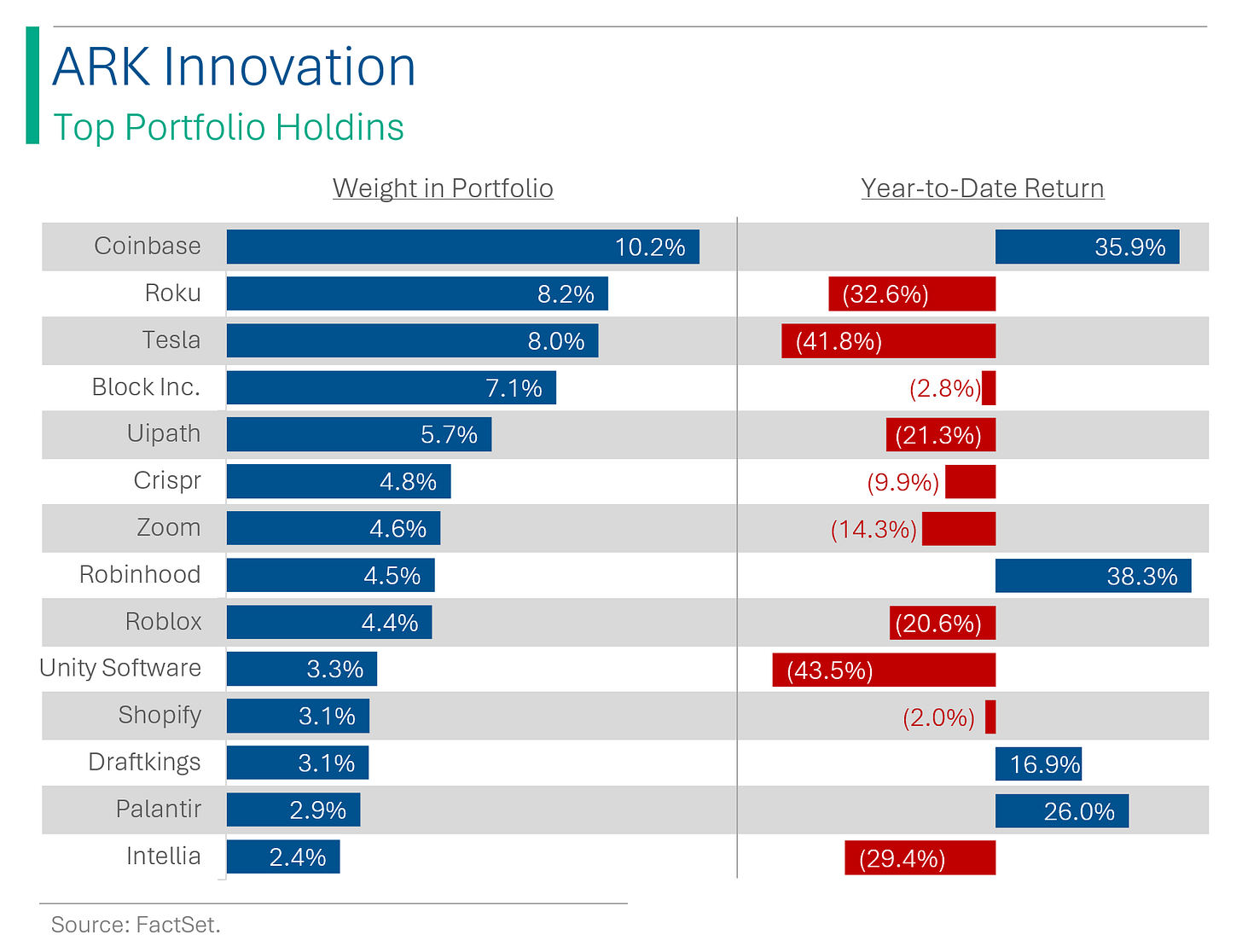

Fast forward a few years, and it’s clear that ARK wasn’t the levered bet on the future it was prescribed to be. There were some truly innovative names in the portfolio, but a lot were… sorta lame: Like Netflix’s ugly cousin, Roku, or Zoom (I mean, Skype’s been around since 2003, how is that innovation?). I actually did a video on this back in 2022.

Anywhoo, over the last five years, ARK’s main fund has actually had a negative 9% return. Her antiquated antithesis Warren Buffett? He’s up 93%.

And she hasn’t turned it around or won any new friends this year. Formerly a longtime holder of Nvidia, she dropped that early in 2023 (you know, before it quintupled). Adding to a crumbling Tesla position hasn’t helped, nor has her odd love affair with Roku, which has been a Top 5 holding of hers forever.

Take-Away: I’ll admit, some of the stuff Cathie has said has sounded completely nuts to me - like her $1.48 million target for Bitcoin for 2030 which would put the market value of the crypto at $21 trillion (the GDP of Europe is $17 trillion). But I do like when people truly believe in something and I’m confident she is sincere in her convictions.

It’s fun to laugh at the Masayoshi Sons (Softbank’s CEO) of the world when they lose billions on Uber, but if not for them who would

lose tens of billions on WeWorkmove the world forward?

Meta’s Q1

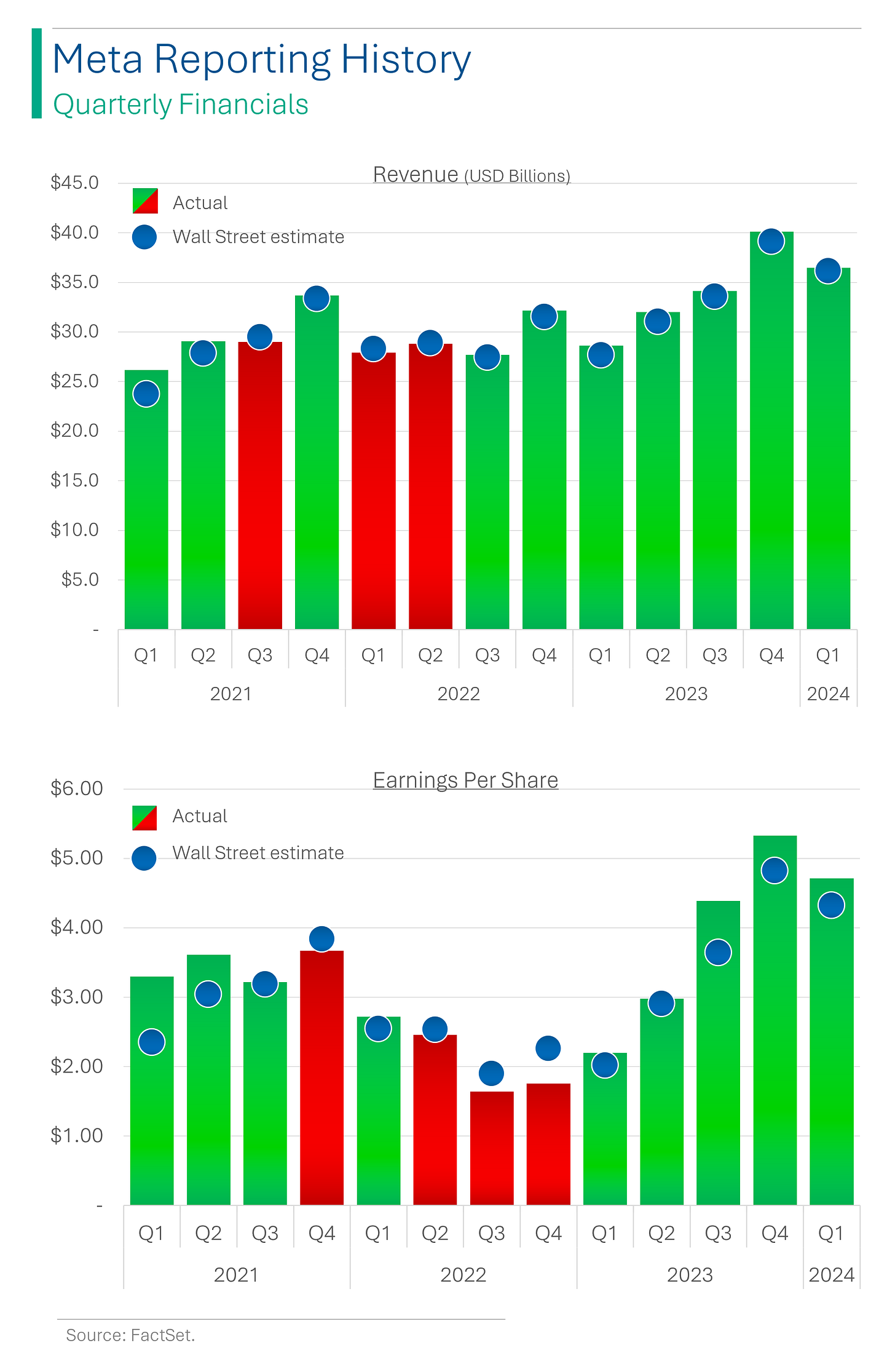

Meta reported after close yesterday and the tire fire that is their shares might still be smoldering, following a 15% drop in afterhours trading. The company said ‘AI’ 80x in their presentation (actually) but I guess the magic words have lost their power.

The quarter was ok - in-line revenues and a tidy beat on EPS. However, their revenue guidance for Q2 fell below where Wall Street’s estimates laid ($36.5-39.0 billion vs. $38.3 billion estimate) so they went to the penalty box.

TikTok Ban Is Official

President Biden signed the bill into law outlawing TikTok’s foreign (*cough Chinese*) ownership, giving the company nine months to divest or be forbidden.

The company is set to challenge the new law, which came to pass over fears of data sharing with the Chinese government - a claim TikTok vigorously denies.

In a move of defiance, TikTok's boss Shou Zi Chew encouraged users to share uplifting TikTok tales and vowed to fight the law as unconstitutional, suggesting the platform’s drama is far from over…. like a really bad TikTok dance.

Metaverse The Destroyer

Meta CEO Zuck loves virtual reality so much he literally changed the name of his company. While I laughed at the time… ok, I’m still laughing.

Since the company started breaking out Reality Labs - their metaverse and VR division - separately, the firm has seen nothing but massive losses and little progress in growing revenues ($440 million in Q1 vs. $339 million last year’s Q1).

This quarter they sprinkled in another $3.85 billion in losses to bring the staggering grand total to $46 billion.

Joke Of The Day

What do fish say when they hit a concrete wall? Dam!

A rich man is one who isn’t afraid to ask the clerk to show him something cheaper.

Hot Headlines

Moderna PR / Moderna and OpenAI announce collaboration to mRNA Medicine development. In the few months since adopting ChatGPT Enterprise, Moderna has deployed more than 750 GPTs across the Company that help drive automation and productivity.

CNBC / IBM shares plummet 8% on Q1 revenue miss and announcement of $6.4 billion acquisition of HashiCorp. The cloud-computing deal is expected to compliment its Red Hat division (from their $34 billion 2019 acquisition). Investors didn’t seem to agree.

Forbes / The Apple Vision Pro reinforces the continuing problem with VR adoption. Putting a big heavy thing on your face isn’t something most people are jumping at the opportunity to try, and that’s why Apple has slashed it 2024 plan to sell 700-800k to just 400-500k. It’s sweet though, just maybe not $3,500 sweet.

CNBC / Why the Fed keeping rates higher for longer may not be such a bad thing. High inflation is partly the result of strong economic growth, which hasn’t been derailed by rates at their current level. And rates are the best option to keep inflation at bay.

Daily Faceoff / Thailand beats Kuwait 57-0 in one of the most lopsided international hockey games ever. And I thought I got lit up in my beer league…

Trivia

Today’s trivia is on ARK Investment Management.

In which year was ARK Investment Management founded?

A) 2010

B) 2012

C) 2014

D) 2016Before founding ARK, Cathie Wood worked at which company?

A) Costco

B) AllianceBernstein

C) Goldman Sachs

D) JP MorganWhich publication named Cathie Wood the best stock picker of 2020?

A) Crazy Tech Investor Weekly

B) Bloomberg

C) The Wall Street Journal

D) Financial TimesWhat unique approach does ARK take towards stock selection?

A) Looking at short-term gains

B) Investing based on government advice

C) Thematic investing

D) Following traditional market indexes

(answers at bottom)

Market Movers

Winners!

Tesla (TSLA) [+12.1%]: Q1 EPS and revenue missed due to unexpected negative FCF from inventory buildup, expected to reverse in Q2. Analysts remain positive, citing stronger GM from lower costs and Autopark revenue, acceleration in Model 2 production, and focus on AI/FSD by Musk.

Hasbro (HAS) [+11.9%]: Q1 sales outperformed with operating income and EPS beating expectations significantly. Noted improvement from its operational excellence program and better business mix. Strong licensing portfolio performance, maintained 2024 guidance.

CoStar Group (CSGP) [+8.7%]: Q1 EPS and revenue exceeded forecasts, EBITDA was positively surprising. Increased FY24 EPS, revenue, and EBITDA guidance due to strong subscriptions post-homes.com launch. Analysts noted record Q1 bookings despite softer core revenue.

HashiCorp (HCP) [+7.8%]: Bloomberg reported an IBM offer at $35/sh, about 20% above Tuesday's close. This follows reports of nearing a deal.

Texas Instruments (TXN) [+5.6%]: Q1 revenue and EPS slightly better, guided higher than consensus for upcoming revenue, marking the first forecast rise in seven quarters. Improved bookings and partial growth in the Industrial segment noted, despite ongoing destocking and margin concerns.

Boston Scientific (BSX) [+5.7%]: Beat Q1 earnings, revenue, and OM expectations. Organic growth well above consensus, led by Cardiology enhancements. Q2 and FY guidance surpasses expectations, despite high market anticipations and challenging comparisons.

Losers!

Old Dominion Freight Line (ODFL) [-11.1%]: Q1 revenue, operating income, and EPS largely aligned with expectations despite a larger-than-expected volume decline. Industry conditions remain challenging, but recent signs may indicate improving demand.

Teledyne Technologies (TDY) [-11%]: Q1 EPS and revenue fell short, though orders rose 7.8% y/y. Q2 EPS and FY24 EPS guidance were cut, citing impacts from weaker short-cycle imaging and instrumentation markets. Flat FY24 sales expected, supported by marine, aviation, and some defense sectors.

Helen of Troy (HELE) [-9.5%]: FQ4 earnings and revenue exceeded expectations with strong FCF. Noted pressures from discretionary spending shifts and a weak Beauty & Wellness sector during a mild cold/flu season. FY25 guidance and restructuring-plan savings forecasts lowered.

Enphase Energy (ENPH) [-5.6%]: Q1 earnings and revenue below forecasts, with a significant 34% q/q decline in U.S. sales and weaker gross margins. Q2 revenue guidance below consensus, noting persistent soft U.S. demand and slow inventory turnover, though growth in Europe remains a highlight.

Market Update

Trivia Answers

C) ARK was founded in 2014.

B) Crazy Aunt Cathie worked at AllianceBernstein.

B) Bloomberg named her Investor of the Year in 2020.

C) Thematic investing.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.