🔬 Buybacks: the Good and the Dangerous

Plus: Reddit's first earnings since IPO actually didn't suck (I'm shocked); Disney's did suck a bit; and much more

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

- Benjamin Graham

"That's what I do. I drink and I know things."

- Tyrion Lannister

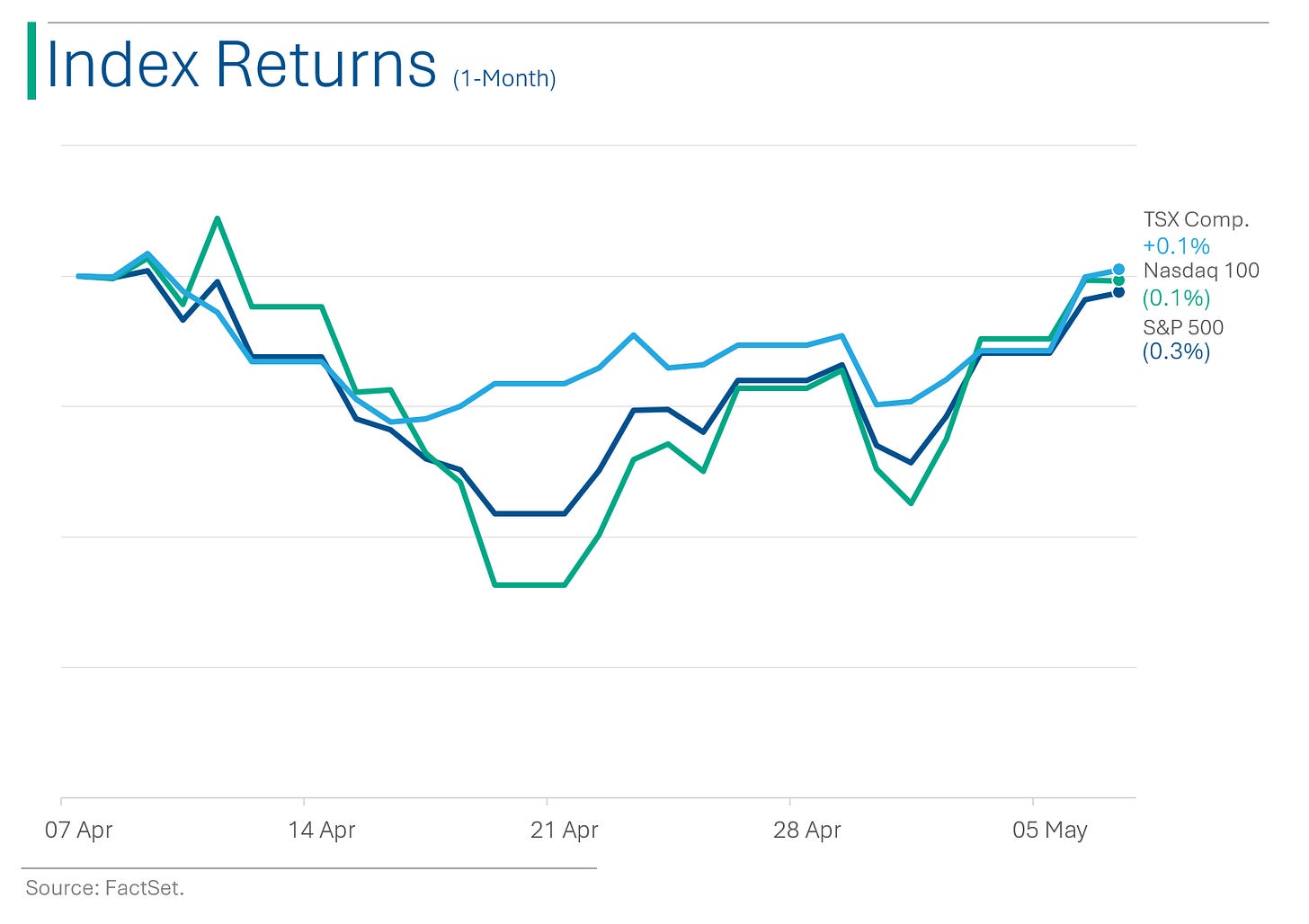

Bit of a soft day for the big US markets, with the S&P 500 (+0.1%) just up barely for it’s fourth straight day of wins, while the Nasdaq (-0.1%) failed to do the same.

8 out of 11 sectors closed higher, led by Materials (+1.2%) and Utilities (+1.1%). Consumer Discretionary (-0.6%) and Tech (-0.5%) finished at the bottom.

Another huge day for earnings with ~400 US companies reporting (see ‘Market Movers’ at bottom).

Palantir (-15%) got smoked after yesterday’s after-hours earnings release, despite a strong outlook. 🤖

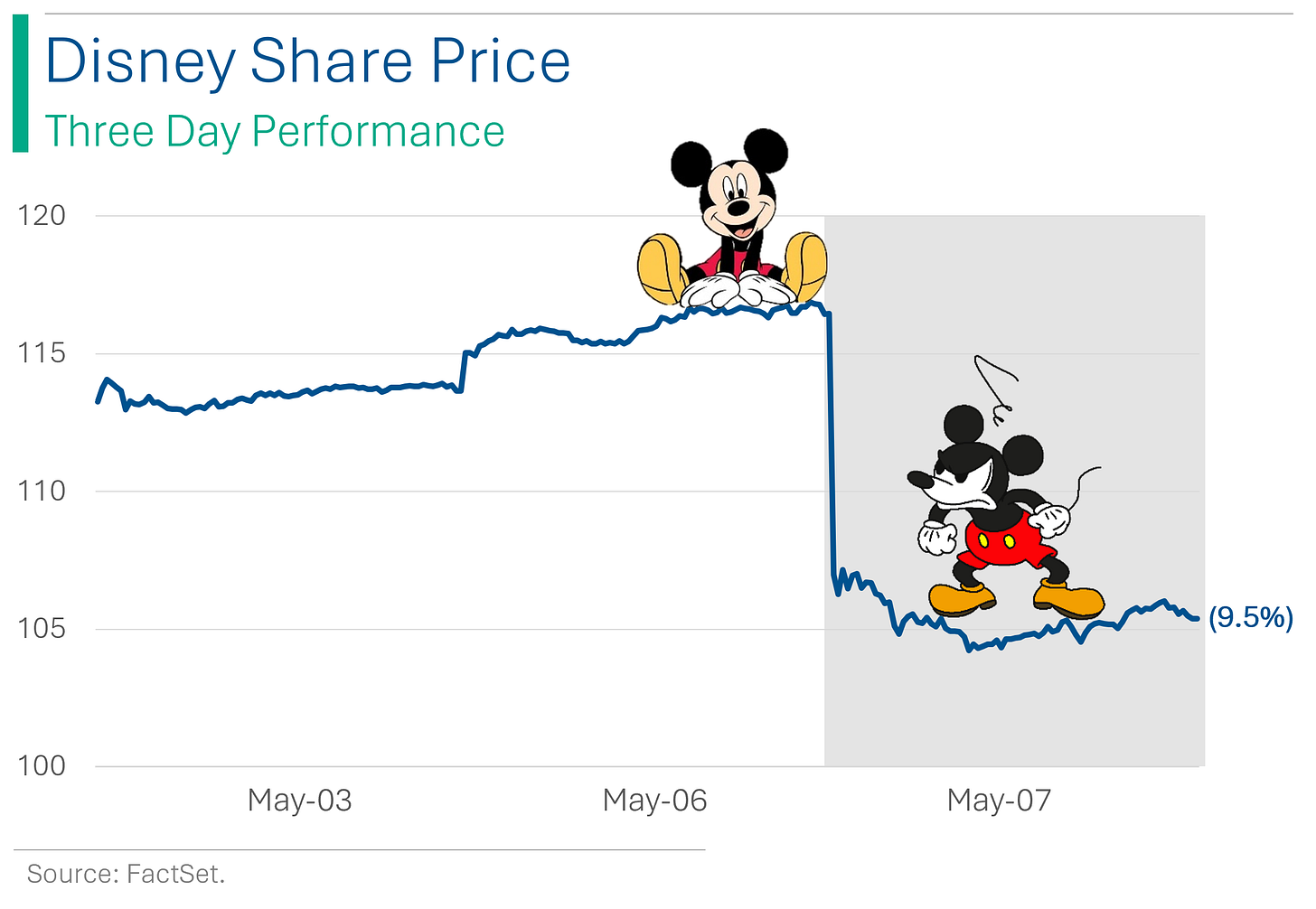

Disney flopped 9.5% on a weak Q2 guide, particularly regarding an anticipated slowdown in Parks & Experiences.🎢

Crocs jumped 7.8% on beats for Revs and EPS. I know nobody cared, I just think it’s funny that Crocs is a real company. 🙃

Street Stories

Apple’s Mega Buyback

When Apple reported last Thursday, the results were solid enough, with modest beats on Revs and EPS. What propelled the shares up 6.0%, however, can mostly be attributed to its announced plan to do a ginormous $110 billion share buyback over the coming months: The largest in one history.

While the shares definitely needed a bit of a helper (they were down 10.1% this year before the announcement), this continued Apple’s efforts to scrape up its shares out of the grubby hands of the general populous and into happy retirement in its cozy treasury.

In fact, Apple has been at this for a while now, with record breaking buybacks in 6 of its last 7 fiscal years (in 2020 they only did a modest $50 billion scoop). Their biggest rival for largest company in the world status - Microsoft - has only ever managed a $60 billion repatriation back in 2021.

Over the last 6 fiscal years, Apple has spent an incredible $465 billion on buybacks. For context, Walmart - the 13th biggest company in the US - has a total market cap of $483 billion.

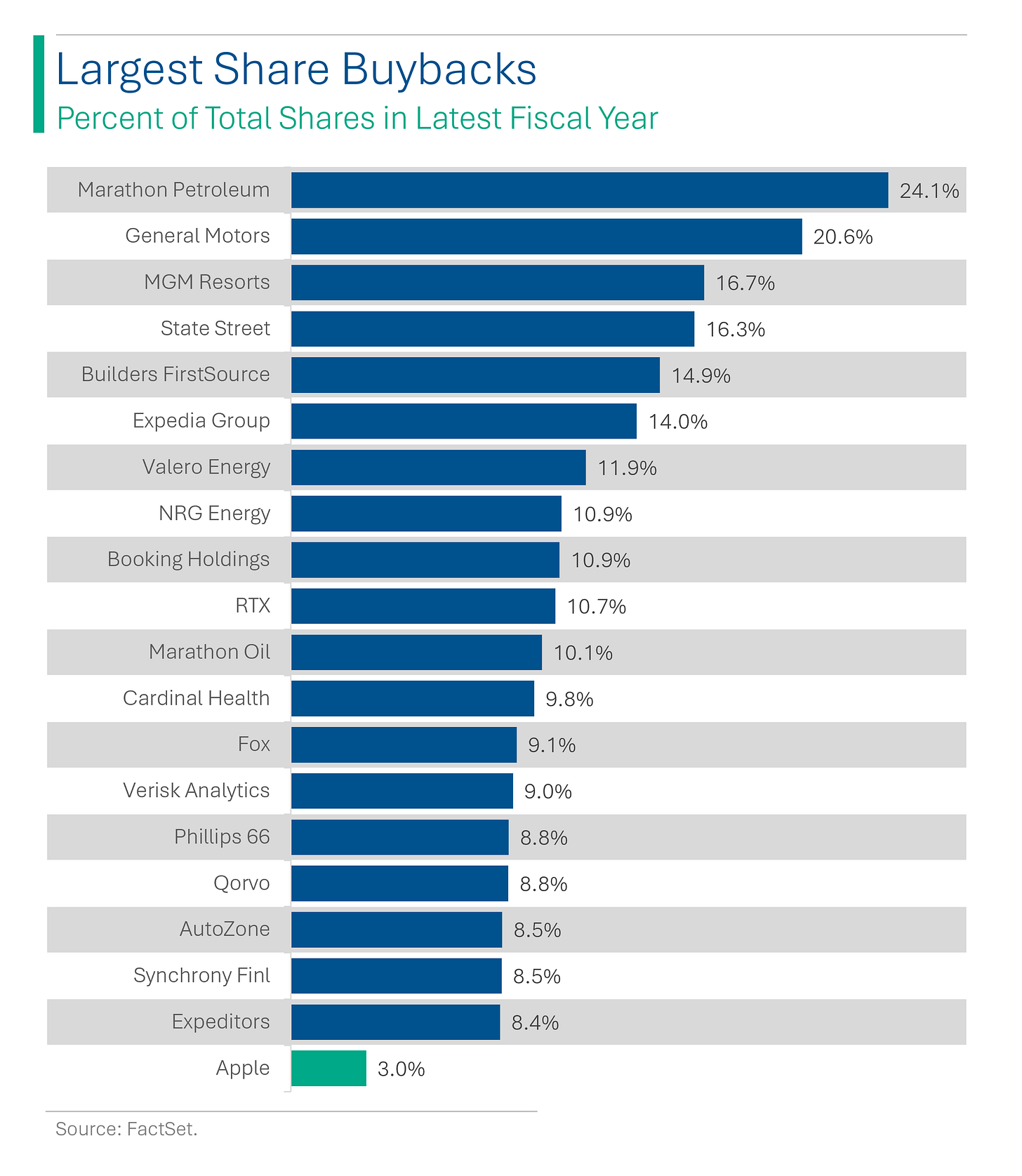

For those still learning about the stock market and this arcane form of corporate enthusiasm, buying back shares can increase the value of an individual’s holdings in a company. For example, in fiscal 2023 Apple bought back around 3.0% of its shares, meanings that without any further purchases, an investor in Apple now owns 3.0% more of the company than it did beforehand.

Buybacks are especially helpful when a company’s shares are depressed to below where management feels their ‘intrinsic value’ lies. The act of buying them for cash (or occasionally by taking out additional debt) then represents a sound investment in the business.

Buybacks when shares are over extended could also be looked at as imprudent since management is spending more then the shares are probably worth (but that is subjective).

The net result of Apple’s buybacks over the years has resulted in a dramatic decrease in the number of shares outstanding. Since peaking in 2012, Apple has reduced the number of its shares outstanding by an incredible 42%.

But while Apple is the King of large buybacks, it doesn’t come close to some of its much smaller peers on a percentile basis. For example, Marathon Petroleum bought back 24% of it shares in 2023, following 29% and 13% in 2022 and 2021 respectively.

Even lumbering General Motors bought back 21% of its shares last year - although some might argue that money would have been better spent on Capex and R&D.

And it’s probably fair to say that large buybacks aren’t going to stop anytime soon, as a lot of companies watching their shares languish they may consider buybacks as a way to reignite their stock price and return capital to shareholders. In a recent Bloomberg article, Goldman Sachs is quoted as forecasting 2024 and 2025 as banner years for corporate repurchases.

It is worth noting, though, that not everything about buybacks is great and wonderful. Buybacks take cash. Cash that could be used for other purposes.

And while rewarding shareholders is generally a good strategy, it isn’t if it comes at the expense of growing the company in a sustainable, forward-looking manner. The list of ‘Largest Buyback Programs’ at the top included a $50 billion program by GE back in 2015. I think we can all agree that with hindsight that wasn’t the company’s best use of capital.

Another good example is Boeing, which I railed on quite heavily in ‘Why Boeing Is A Terrible Company’. If they had focused on making better products instead of short-term rewards to shareholders, they would likely be a much better company today. And 346 people might not have lost their lives.

Disney Flops Another Quarter

The supposedly restructuring House of Mouse didn’t do enough to earn a pass from the Street with the shares up ~30% for the year.

Revenue posted a minor beat ($22.08B vs. Wall Street consensus at $22.12) but only up 1.2% over last year’s Q2. EPS did have a solid beat ($1.21 ex-items vs. est. $1.10), and importantly their streaming businesses (Hulu and Disney+) posted their first ever profitable quarter - albeit negative if you lump in ESPN+. Still, the -$18 million in operating profit at streaming was miles better than the -$659 million from Q2 last year.

What really caught the company out was soft guidance, including full-year EPS growth of 25% - up from a 20% previously but not punchy enough to get the thumbs up from investors. Additionally, they pointed to expected weakness in the Parks and Experiences division as the post-Covid surge has reversed course in FY25.

Reddit’s First Q

The rollercoaster ride for Reddit shares continues after its first quarter, with the shares popping 15% in pre-market trading after reporting after the close.

Deets:

- Q1 Revenue: $243m vs. Wall Street consensus for $214m [+13.5% BEAT]

- Q1 Average Revenue Per User (ARPU): $2.94 vs. estimate for $2.80 [+5.0% BEAT]

- Daily Active Users: 82.7%, up 37% YoY.

Biggest news was the guidance, with the company calling for Q2 Revenue well ahead of Wall Street’s consensus estimate ($240-$255m vs. Street at $228m) and a forecast for the company to be EBITDA positive (Q2 EBITDA: $0 to $15m vs. Street at ($18.2m)) for the first times ever.

Joke Of The Day

Why was the vampire removed as CEO? He couldn’t appeal to the stakeholders.

Hot Headlines

Washington Post / TikTok files court challenge to U.S. law that could lead to ban. The petition for review contends that the law violates the First Amendment rights of its 170 million U.S. accounts in an “extraordinary and unconstitutional assertion of power” based on vaguely expressed national security concerns.

Not sure opening with ‘we have the data from 51% of Americans’ is the best opening chess move. 🤷♂️🤫

Reuters / Royal Caribbean recruiting ~10,000 to meet surging demand. The number of people taking cruises hit a record in 2023, and with the surge in demand and larger vessels, labor needs are growing.

Yahoo Finance / Fed’s Kashkari says rates likely on hold for ‘Extended Period’. Interestingly he joined the ranks of economists singling out persistent housing inflation as a potential indicator that neutral interest rates, those that neither restrict nor stimulate the economy, may be higher in the short term (ie: 2% inflation may not be the goal for now).

CNBC / Amgen and new rivals could threaten Novo Nordisk and Eli Lilly’s weight loss drug dominance. Amgen’s drug, MariTide, is taken less frequently than Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, and may cause longer-lasting weight loss than the market leaders’ injections.

Viking Therapeutics, Altimmune, Structure Therapeutics, AstraZeneca also entering the fray.

CNBC / Private equity firms circle Peloton for potential buyout. Fingers crossed! (mostly cuz my buddy Paul lost his shirt betting on a take-over that Scott Galloway said was coming 2yrs ago and I’m sick of talking about it.)

Trivia

Today’s trivia is on Goldman Sachs, the black prince of Wall Street.

When did Marcus Goldman and Samuel Sachs found the company that bears their names?

A) 1920

B) 1869

C) 1900

D) 1982Goldman Sachs had its public offering in which year?

A) 1955

B) 1932

C) 2015

D) 1999Goldman Sachs introduced a major economic concept with the acronym "BRIC" in 2001. What does it stand for?

A) Britain, Russia, Italy, Canada

B) Belgium, Romania, Iceland, Cyprus

C) Brazil, Russia, India, China

D) Bulgaria, Romania, India, CroatiaWhat notable financial role did former CEO Henry Paulson serve after leaving Goldman Sachs?

A) Secretary of Commerce

B) Secretary of the Treasury

C) Chairman of the Federal Reserve

D) Director of the National Economic Council

(answers at bottom)

Market Movers

Winners!

Coca-Cola Consolidated (COKE) [+17.7%] Q1 EPS at $17.33 ex-items up from $16.20 last year; Revenue hits $1.59B, a slight increase from $1.57B. Plans to buy back up to $3.1B of common stock, buoyed by robust FCF and margins.

Peloton Interactive (PTON) [+15.5%] CNBC reports several private equity firms exploring acquisition; discussions with at least one firm ongoing.

Fabrinet (FN) [+10.8%] FQ3 revenue and EPS exceed expectations; Q4 forecasts surpass consensus. Continued weakness in Telecom through 2025, but Datacom sees uplift from NVDA/AI trends.

FMC Corp (FMC) [+9.5%] Q1 revenue aligns, EBITDA outperforms by about 6% due to cost cuts and lower expenses. Q2 EBITDA outlook weak, but volume and price growth expected to resume with new products contributing positively.

Mueller Water Products (MWA) [+8.8%] Significant Q2 revenue and EBITDA outperformance; upgraded FY forecasts. Continued demand strength and margin gains from efficiencies.

Crocs (CROX) [+7.8%] Q1 sees revenue and EPS above forecasts; lifts FY24 EPS outlook while revenue meets consensus. Growth noted across all regions, though HEYDUDE faces an 8-10% decline in FY sales.

International Flavors & Fragrances (IFF) [+6.5%] Q1 results top estimates with EBITDA margin beating consensus. Anticipates high end of FY guidance with unexpected volume growth in Scent.

Kenvue (KVUE) [+6.4%] Q1 earnings and sales surpass forecasts with strong organic growth in Self Care, offset by Skin Health and Beauty underperformance. Slight uptick in FY revenue projection despite inventory cuts.

Hims & Hers Health (HIMS) [+6.1%] Q1 results driven by subscriber growth and efficient marketing; Q2 and FY24 guidance raised. Strong unexpected organic demand noted.

Losers!

Builders FirstSource (BLDR) [-18.9%] Q1 revenue and EBITDA exceed expectations; reaffirmed FY guidance amidst challenges like a weaker Multi-Family market and higher mortgage rates. Stock rose over 20% YTD before the announcement.

Palantir Technologies (PLTR) [-15.1%] Q1 EPS met expectations, revenue exceeded; raised FY24 outlook though underwhelmed some investors. Noted strong Commercial and Government revenues and rising AIP demand, despite growth sustainability concerns.

Lucid Group (LCID) [-14.1%] Q1 earnings fell short, revenue aligned; lower margins but better-than-expected ASPs. Reaffirmed production guidance for about 9K vehicles in FY24 and maintained schedule for Gravity launch. Concerns remain over increasing FCF burn.

Teradata (TDC) [-13.8%] Q1 earnings and revenue met targets, but cloud ARR underperformed due to significant headwinds. Lowered Q2 EPS guidance; management predicts delays in reaching 2025 ARR and revenue goals.

Datadog (DDOG) [-11.5%] Q1 results beat expectations with stronger margins, though deferred revenue was light. Q2 and FY guidance raised, but results didn't meet high buyside expectations influenced by rapid public cloud growth in other companies.

Walt Disney (DIS) [-9.5%] Fiscal Q2 revenue consistent, EPS and operating income surpassed expectations; raised FY EPS outlook. Warned of flat y/y operating income in Experiences segment for Q3 and weaker Entertainment DTC results led by Disney+ Hotstar; still expects profitable streaming in Q4. Stock had surged nearly 30% YTD.

Tesla (TSLA) [-3.8%] Reports indicate a drop of 18% y/y in China-made EVs in April, totaling 62,167 vehicles; deliveries of Model 3 and Model Y from China fell 30.2% from March.

Market Update

Trivia Answers

B) GS was founded in 1869.

D) Goldman IPO’d in 1999.

C) BRICs stands for Brazil, Russia, India, China.

B) Paulsen served as Secretary of the Treasury.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Interesting post! Enjoyed it.