Bulls on Parade: Earnings Estimates & Investor Euphoria

Plus: The S&P vs. The World

"The stock market is filled with individuals who know the price of everything, but the value of nothing."

- Philip Fisher

“And there is no such thing as a no sale call. A sale is made on every call you make. Either you sell the client some stock or he sells you a reason he can't. Either way a sale is made, the only question is who is gonna close? You or him?”

- Jim Young, Boiler Room

Hey Readers!

Short one today as I’m still recovering from all the holiday cheer but still wanted to share a few a things I found interesting this week.

Hope you all have a great rest of the year and I’ll catch you in 2025!

Warmest of regards,

- Ryan

Street Stories

Bulls on Parade: Earnings Estimates & Investor Euphoria

There’s no denying the fact that the stock market is expensive. Or that the few times in recent memory that it’s been more expensive - on a P/E multiple basis - it’s ended… well, ‘poorly’1.

1. The DotCom bubble and the COVID ‘Everything Bubble’ are the only incidents.

While there’s potentially some ‘irrational exuberance’ taking place, what can’t be denied is that the big US companies that make up the S&P 500 remain in good form.

As you can see below, Wall Street estimates for the index’s earnings prospects 12 months out remain in the double-digits. In fact, only around a quarter of the time in the last 20 years have they been stronger.

And even that number is obscured by the fact that most of those times have been recovery periods following massive meltdowns, where the denominator hasn’t exactly been a particularly hard comp to lap (post-Financial Crisis and post-Covid being the clearest examples).

Basically, things are good. Really good.

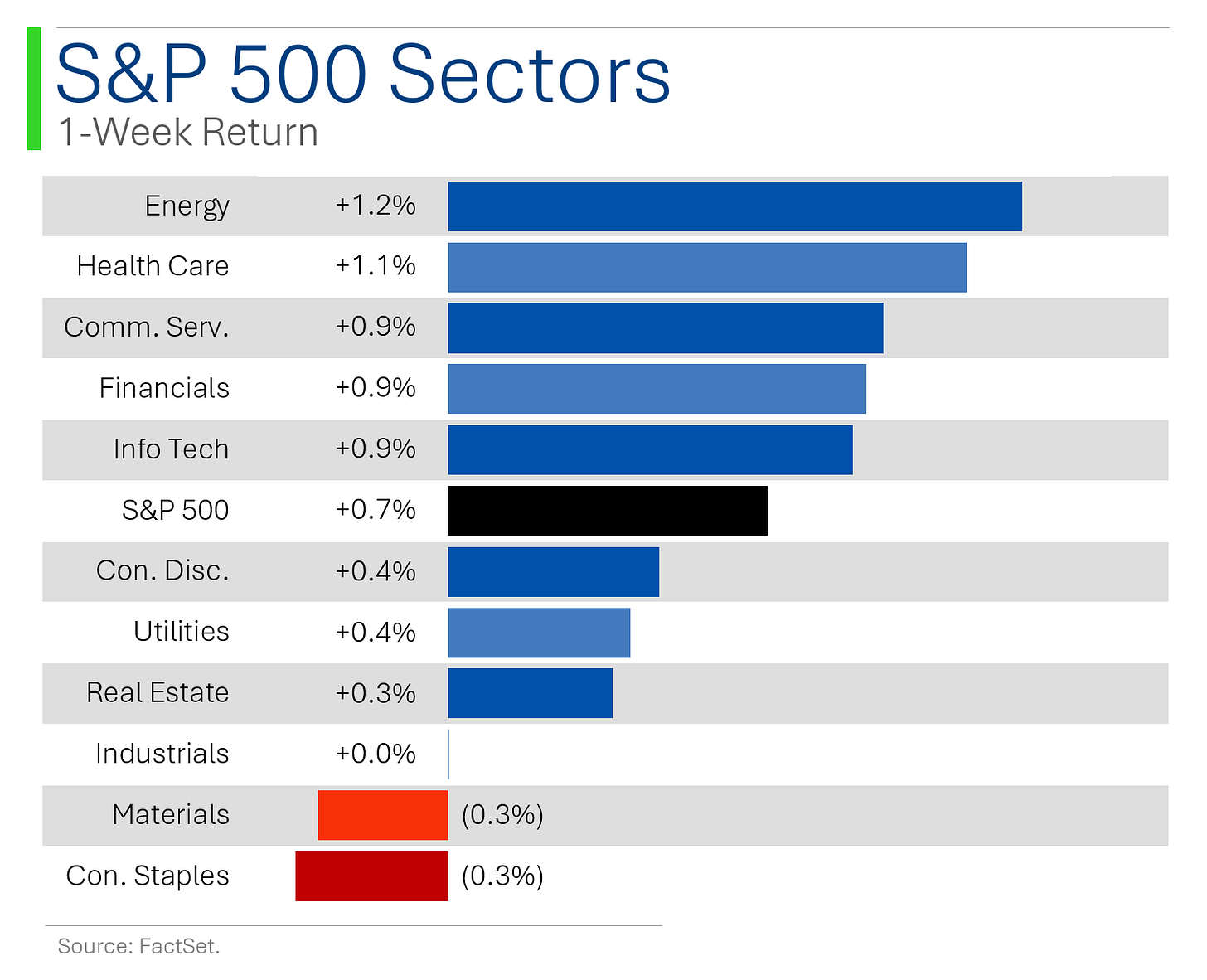

It’s worth noting though, that even a rising tide lifts boats differently.

Tech, Health Care and Industrials are expected to continue to grow EPS at gargantuan rates. While Staples, Real Estate and Utilities are on the weaker end of the spectrum.

As always, I think the more context we add to our investment processes, the better positioned we are for the future.

Yes, the market ain’t cheap. And one day we will see a correction. But with an investment universe filled with great companies and buckets of growth, it’s never a good idea to find yourself too far on the sidelines. ✌️🙃

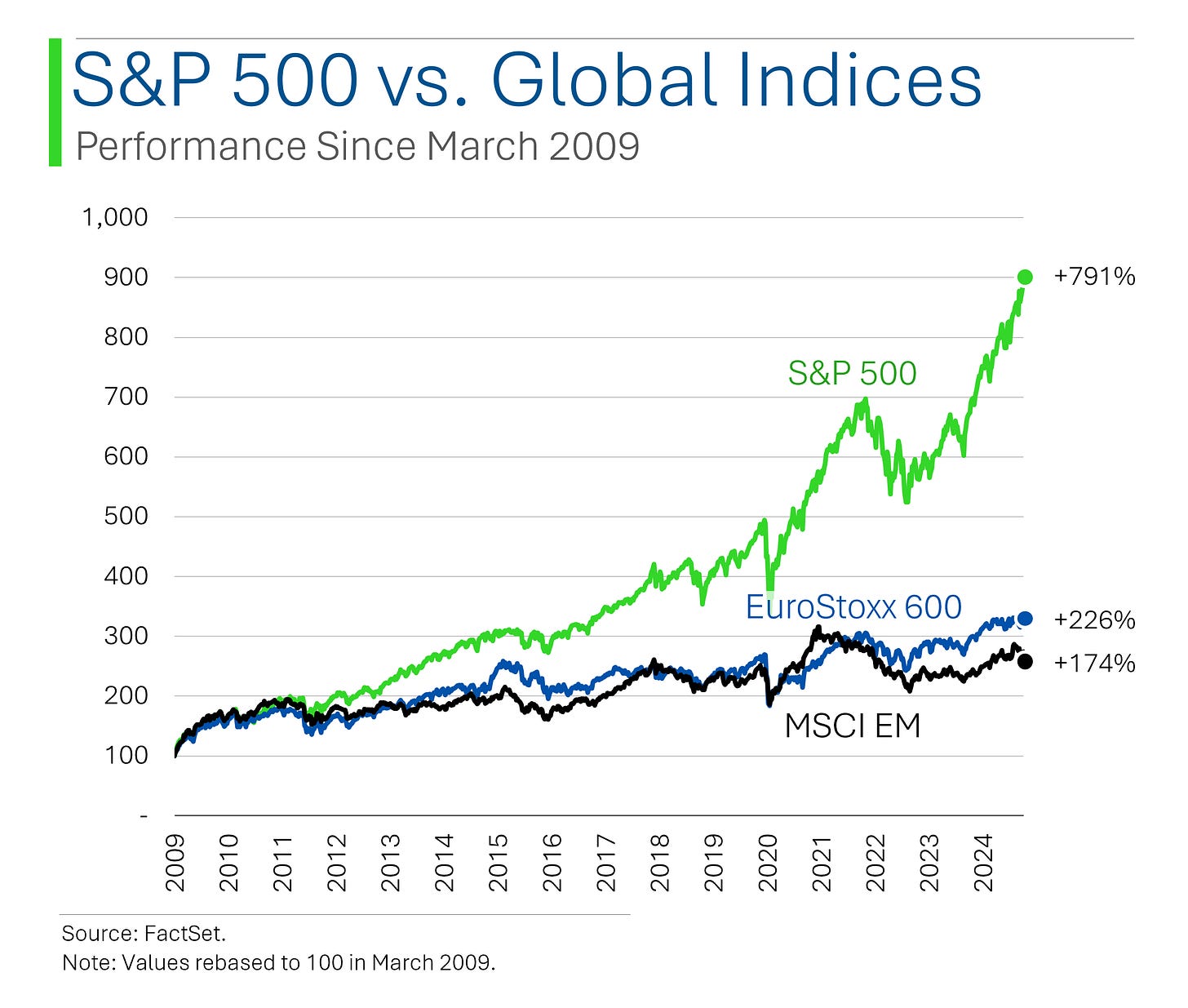

S&P Juggernaut

When I started investing in Canada at 16, I thought Canadian companies - mostly miners and oil plays - were great investments. When I worked in investment banking in London (RIP Credit Suisse), I thought European companies held their own on the global stage.

I’m sure there is a fancy word for this - like ‘familiarity bias’ - where we over estimates the importance or value of things six inches from our faces.

In investing this probably isn’t particularly helpful trait.

The cold hard truth is the US has hands down, unequivocally been the best place to put your investing dollars - or euros or quid.

And while there’s always talk about America ‘losing it’s edge globally’, over the past two decades - for the stock market at least - the opposite has been true. Since 2008 the S&P 500 has outperformed the MSCI World Index (ex-US companies) by an average of 7.1% ANNUALLY.

For those unfamiliar, the MSCI World Index captures the large and mid-cap companies across the 23 ‘developed market countries’, and represents around 85% of the free float-adjusted market capitalization within each country.

Basically, the rest of the developed world has been left in ‘Merica’s dust.

As you can see above, since the early ‘90s, Europe’s biggest companies held there own against the US but around 2008 an inflection happened. America - which triggered the Great Financial Crisis - bounced back stronger than ever while rest of the world struggled to beat a Standing 8 Count.

Even Emerging Markets - represented above by the MSCI Emerging Markets Index - has went from a rocket ship to a leaky canoe.

A stat that I find particularly illustrative is that since I moved back to Canada from London in November 2013, England’s benchmark FTSE 100 Index is up 21%. The S&P 500? +239%.

This isn’t meant to be some pro-America puff piece - although apparently we are going to be the 51st state soon, so maybe I should mind my Ps and Aboots.

Rather I’m just trying to stress that as investors we don’t need to make our lives more difficult by being myopic, dogmatic or pigeonholing ourselves into just what’s familiar. It’s a big investing world and you need to put your money where the growth and innovation is happening.

If you’re hunting for whales, you can’t just trawl the ponds.

Joke Of The Day

A Freudian slip is when you say one thing but mean your mother.

What do you call a bear with no teeth? A gummy bear.

Trivia

Today’s trivia is on Pfizer.

When was Pfizer founded?

A) 1948

B) 1849

C) 1905

D) 1967After its discovery, Pfizer developed the first mass-produced antibiotic during World War II. What was it?

A) Erythromycin

B) Amoxicillin

C) Penicillin

D) TetracyclineIn which year did Pfizer launch Viagra, a revolutionary treatment for erectile dysfunction?

A) 1989

B) 1998

C) 2002

D) 1998Pfizer's largest acquisition to date, involving a $68 billion deal, was with which company?

A) AstraZeneca

B) Wyeth

C) Bayer

D) Merck

(answers at bottom)

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Market Update

Trivia Answers

B) Pfizer was founded in 1849.

C) Pfizer’s mass production efforts quickly made it the world’s largest producer of Penicillin.

D) Pfizer launched Viagra in 1998.

B) Wyeth was Pfizer largest deal. The other companies are still publicly traded.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.