Buffett Gets The Scaries

Plus: S&P Sector Update; Earnings Season Wraps-up; and much more!

"The most important quality for an investor is temperament, not intellect."

- Warren Buffett

"I'm in a glass case of emotion."

- Ron Burgundy

Happy Saturday!

Give-back week for the big US markets following the post-election rallies while crypto went interplanetary. I’d be worried but the Vix is back down so I guess we’re all good? Ha.

Hope you enjoy today’s newsletter!

- Ryan

Street Stories

Buffett Gets The Scaries

When the world’s most famous investor gets worried about the market, people take note. And right now, Uncle Warren appears to be as concerned as he’s ever been.

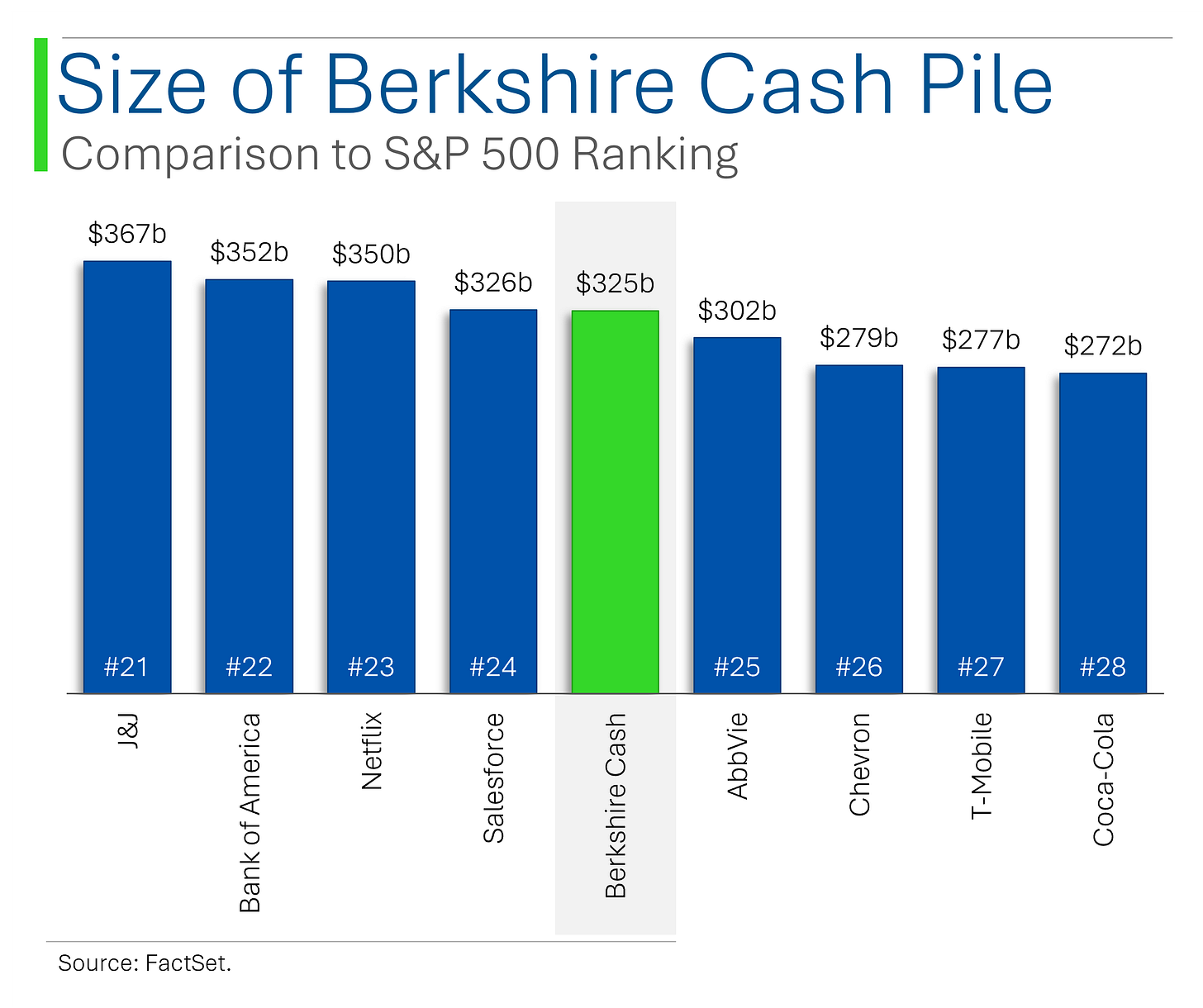

When the Oracle of Omaha’s Berkshire Hathaway reported in early November, many of us were shocked to see that his cash pile (including short-term investments, like T-Bills) had ballooned to $325 billion.

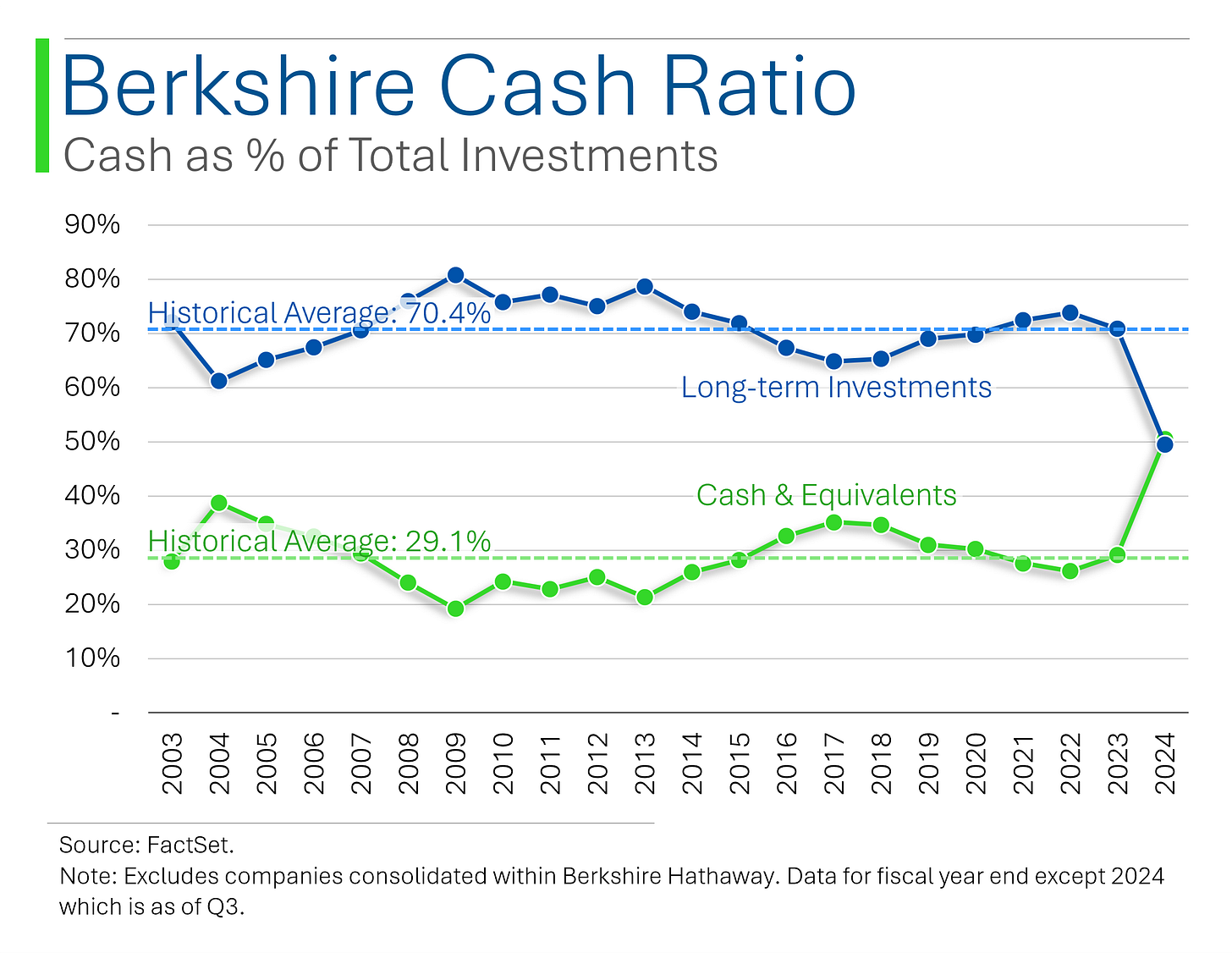

Now Berkshire owns several businesses on a consolidated basis - like Geico and Acme Brick Company - that don’t show up in the ‘long-term investments’ bucket, but the value of liquid, tradeable shares is now officially less than the money he’s got sitting on the sidelines. Ooof.

And since numbers of this scale can often lose their meaning, if Buffett’s cash was an S&P 500 company it would rank 25th, just shy of Netflix and Salesforce.

Gulp.

To put a finer point on why this is historically significant, at no point in the last 20 years has Buffett ran a higher Cash-to-Total Investment ratio.

Not in even in the Great Financial Crisis.

What makes this even more impactful is that Warren Buffett is one of the great proponents of staying invested and not trying to ‘time the market’. He knows as well as anyone that the stock market generally goes up - even over the short-term.

In fact, over the last 25 years the stock market has only had significant negative returns on a one year bases three times: The DotCom bubble, the Great Financial Crisis and the popping of the pandemic’s ‘Everything Bubble in 2022.

However, the market is now nearly as expensive as it’s ever been on a P/E multiple basis. Only 5% of the time this millennium has the S&P 500 traded at a higher forward multiple: The DotCom bubble and the pandemic bubble.

Not exactly great company…

And when the stock market gets expensive, it rarely ends well.

As you can see below, the 18 month outlook for the market when the S&P’s P/E multiple gets into the ‘Danger Zone’ tends to be particularly terrible.

(Note: all the positive returns for 22x and 23x below are all from 2020/2021 and 2000 - with the ensuing stock market meltdown falling just outside of the one year window)

If this is concerning to folks, that’s not clearly evident in the market’s performance. Since President Trump’s election the market has made several fresh new all-time highs - adding to the 47 from earlier in the year.

Nor has it slowed down Apple - Buffett’s largest investment. Selling Apple has represented the largest source of cash for Uncle Warren, with the ~516 million shares he’s sold over the last year worth around $116 billion at current prices.

If the greatest investor of all-time dumping $116 billion of your shares doesn’t slow down your share price, then we are truly in unique times.

Post-Election Sectors

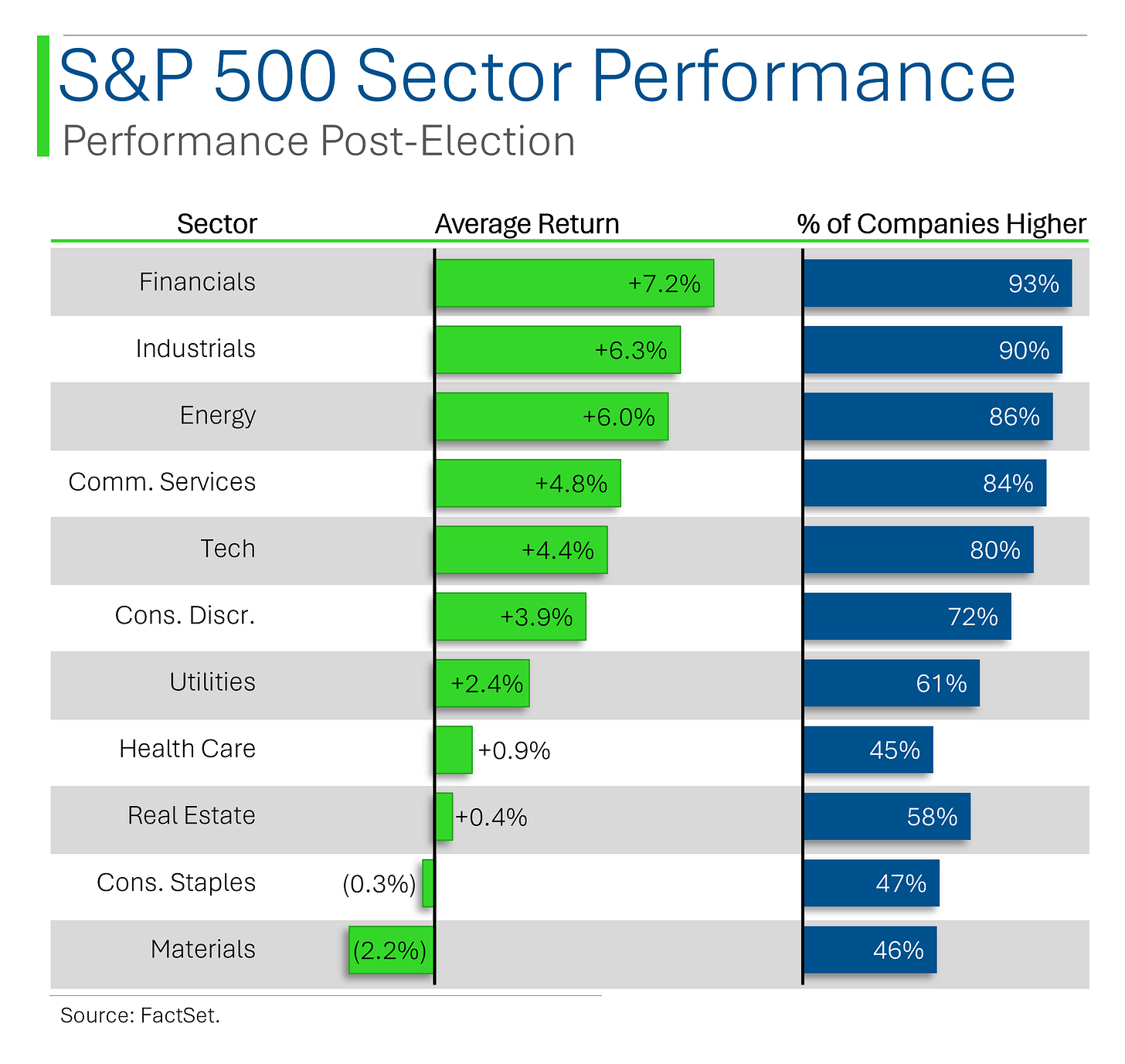

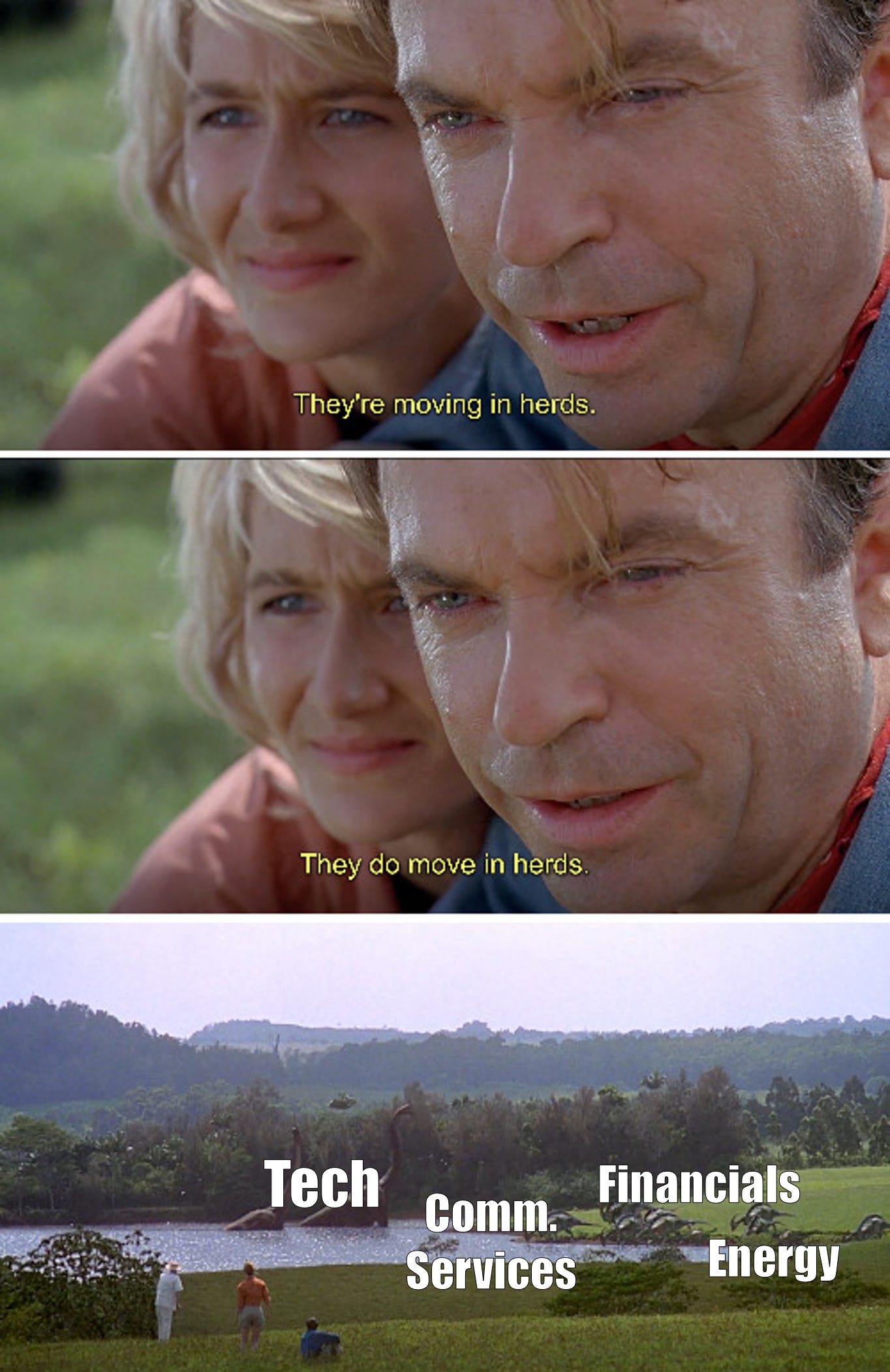

While the stock market has ripped following President Trump’s re-election, not all sectors have been created equal.

Financials (+7.2%), Industrials (+6.3%) and Energy (+6.0%) have been the biggest winners. This has been covered a lot, with de-regulation and protectionist policies seen as the biggest contributing factors in the optimism.

What surprised me was just how high the percentage of winners has been - especially since earnings season hasn’t wrapped up.

Tech stands out as the most mixed following Trump’s election, with lots of big winners as well as a pile of losers. While Communication Services has the tightest distribution of performance.

Vix Takes Chill Pill

The Chicago Board Options Exchange's Volatility Index AKA ‘The Vix’ took a big step downward this week as volatility post-election appears to be a thing of the past.

Often referred to as ‘Wall Street’s fear gauge’, the Vix seems to be telling us that the market has a post-election hangover and needs some time to sleep it off.

Reporting Wrap-Up

As of this writing, 441 companies in the S&P 500 have so far reported their latest quarter (counting ones post-October 10th).

I’d go as far as to say that there aren’t any glaring red flags apparent, as the split of Beats, In-Lines, and Misses roughly matches up with recent quarters and we aren’t seeing any material downward shifts.

The Beats-to-Misses for Revenue is nearly 2x which is comparable to recent quarters, while Beats-to-Misses for EPS of 3.6x remains which strong.

Sector-wise, Tech and techy Communication Services have seen the highest percentage of EPS beats (+80%), while some of the most economically sensitive sectors, like Real Estate, Materials and Consumer Discretionary have seen much lower rates of beats (<60%).

Joke Of The Day

Knock, knock. Who’s there? Control freak. Now you say, “Control freak who?”

Macro Update

Retail Sales [Friday]

October Retail Sales rose 0.4% m/m, beating expectations of 0.3%, with September’s figure revised sharply higher to 0.8%. Despite hawkish implications from upward revisions, analysts see limited immediate impact as November’s CPI (11-Dec) and retail sales (17-Dec) will be pivotal ahead of the 18-Dec FOMC decision.

October Producer Price Index [Thursday]

October Producer Price Index (PPI) rose 2.4% year-over-year (y/y), up from 1.9% in September, while core PPI increased 3.1% y/y, exceeding the prior 2.9%. Monthly gains were modest at 0.2% m/m for headline and 0.3% m/m for core, with labor market data signaling continued strength as initial claims fell to 217K from 221K the prior week.

Consumer Price Index [Wednesday]

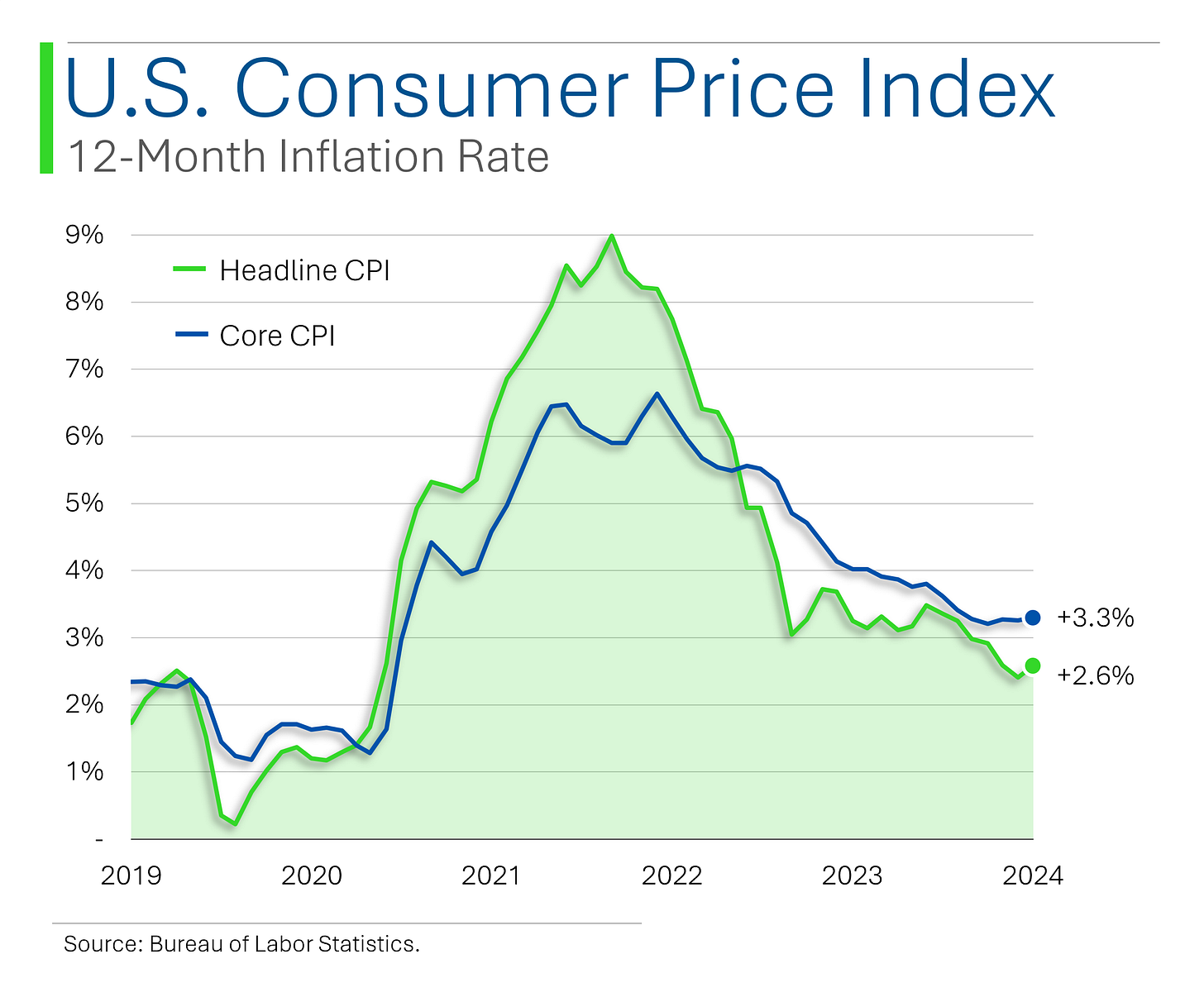

October CPI came in as expected, with headline inflation up 2.6% y/y and core inflation up 3.3% y/y, reflecting steady disinflation from prior months. Shelter costs were again troublesome, +0.4% m/m and accounted for over half of the total increase.

Survey of Consumer Expectations [Tuesday]

Inflation:

Median 1-year inflation expectations fell 0.1pp to 2.9%, the lowest since October 2020, while 3-year and 5-year expectations dropped to 2.5% (-0.2pp) and 2.8% (-0.1pp), respectively.

Unemployment:

Mean unemployment expectations fell 1.7pp to 34.5%, the lowest since February 2022, indicating improved labor market sentiment. Households also expect a lower likelihood of job loss and greater chances of finding a job if laid off, signaling stronger confidence in job stability.

Trivia

Today’s trivia is on Blockbuster Video (RIP).

What year was Blockbuster Video founded?

A) 1980

B) 1985

C) 1990

D) 1995Where was the first Blockbuster store opened?

A) Toronto, Canada

B) Miami, Florida

C) Los Angeles, California

D) Dallas, TexasAt its peak, how many stores did Blockbuster have worldwide?

A) About 3,000

B) About 6,000

C) About 9,000

D) About 12,000What policy did Blockbuster institute in 2005 to fend off competition?

A) Free popcorn.

B) Rent one, get one free.

C) No charge for not rewarding cassette.

D) No more late fees.

(answers at bottom)

Market Movers

Friday

Bloom Energy (BE) [+59.2%] Signed a deal with American Electric Power for up to 1GW of supply.

Palantir Technologies (PLTR) [+11.1%] Moving its stock listing from NYSE to Nasdaq, starting November 26.

Applied Materials (AMAT) [-9.2%] Strong Q4 results overshadowed by weak Q1 guidance and geopolitical risks.

Ulta Beauty (ULTA) [-4.6%] Berkshire Hathaway slashed its stake in the company by 96%.

Thursday

Wynn Resorts (WYNN) [+8.7%] Fertitta Entertainment's 9.9% stake likely to become more active soon.

Walt Disney (DIS) [+6.2%] Q1 revenue and EPS beat, driven by direct-to-consumer growth, though linear TV underperformed.

Hims & Hers Health (HIMS) [-24.5%] Amazon’s One Medical launched a competing telehealth service.

Rivian (RIVN) [-14.3%] Reuters reported plans to scrap Biden's $7,500 EV tax credit.

Wednesday

Rocket Lab USA (RKLB) [+28.4%] Signed a big multi-launch contract and raised Q4 guidance, boosting confidence.

The Honest Co. (HNST) [+25.2%] Crushed Q3 EBITDA expectations and raised full-year guidance.

Spotify Technology (SPOT) [+11.4%] Strong Q3 operating income and subscriber numbers impressed investors.

Spirit Airlines (SAVE) [-59.3%] Bankruptcy rumors surfaced after failed merger talks with Frontier.

Instacart (CART) [-11.0%] Q3 beat, but Q4 guidance raised concerns over slowing growth and higher costs.

Tuesday

Shopify (SHOP) [+20.3%] Q3 revenue and KPIs crushed expectations, with a strong Q4 outlook.

Monday

RadNet (RDNT) [+19.1%] Beat Q3 expectations and raised guidance for its imaging segment while announcing an AI partnership.

Block, Inc. (SQ) [+11.9%] Gained an overweight rating, with optimism about growth in digital payments.

monday.com (MNDY) [-15.1%] Raised FY24 guidance but fell on weaker-than-expected Q4 projections.

Taiwan Semiconductor (TSM) [-3.6%] Reuters reported a U.S. order to stop chip sales for AI to China.

This Week In History

Stock Market Crash (November 11, 1929): Following the October crash, markets continued to decline, deepening the Great Depression's economic impact.

Bretton Woods Conference Concludes (November 15, 1944): Establishing the International Monetary Fund (IMF) and World Bank, this conference reshaped global financial systems post-World War II.

NASDAQ Stock Market Debuts (November 8, 1971): The world's first electronic stock market began operations, transforming trading practices and financial markets.

Suez Canal Opens (November 17, 1869): The inauguration of the Suez Canal revolutionized global trade by connecting the Mediterranean Sea to the Red Sea, significantly reducing maritime travel time.

Market Update

Trivia Answers

B) Blockbuster was founded in 1985.

D) The first location was in Dallas, Texas.

C) Peak Blockbuster has about 9,000 locations.

D) No more late fees started in 2005. The rent one get one free promotion started in 1999.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Super insightful charts on Buffett’s allocation, thanks for sharing.

Tier 1 newsletter!

Buffett is 94. Munger died last year at 99. My guess is he’s planning for a post-Warren world. Conglomerates went out of fashion decades ago. On his death, his shareholding will be dispersed to multiple charities and foundations. Trustees of big foundations will want a diversified portfolio of stocks, not a single holding in a conglomerate. Furthermore I can’t see Greg Abel holding out against the fashion for break-ups in the way Buffet and Munger did.