🔬Broadcom Keeps Chip Dream Alive

Plus: Elon's $30 Trillion plan; 2024 has been an 'all-time high' machine; and much more!

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

- Henry Ford

“I don’t know. Fly casual”

- Han Solo

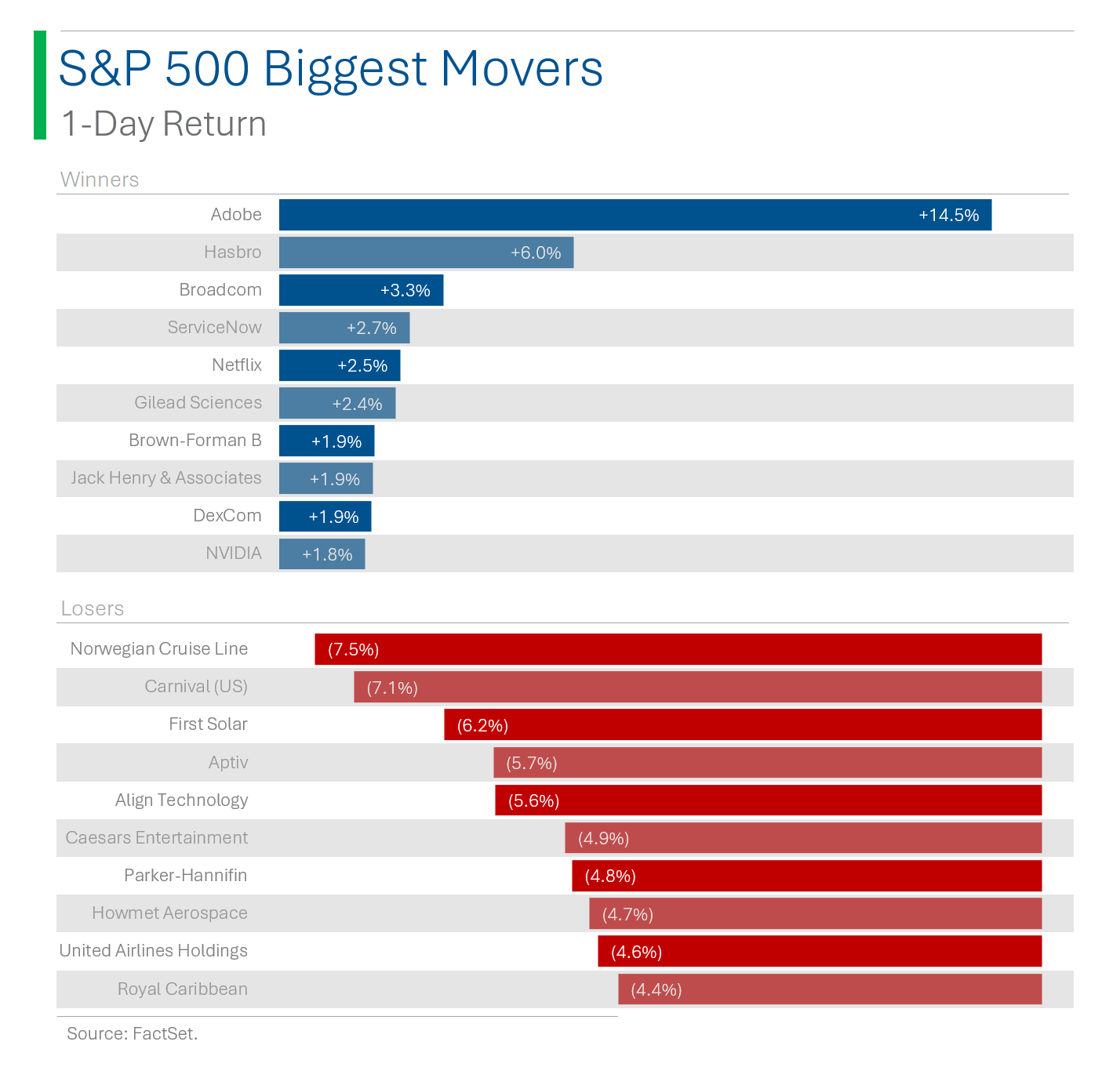

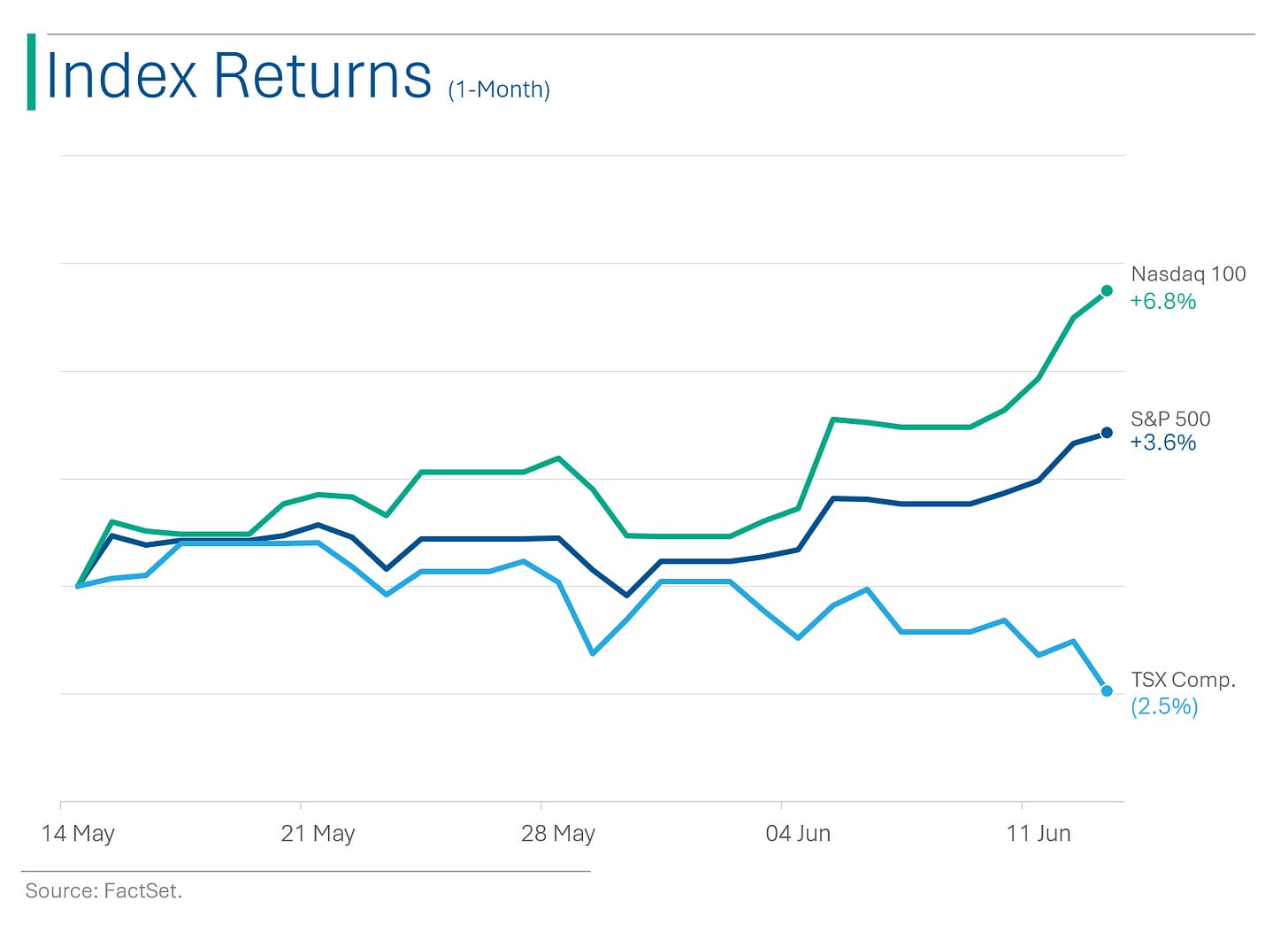

Weak end to a strong week for the big markets, with the S&P 500 -0.04% and Nasdaq +0.1%. For the week the S&P was +1.6% and the Nasdaq +3.2%.

Only 4 of 11 sectors closed higher on the week, but what mattered was that heavyweight Tech (+6.4%) and dragged the market higher with it. Energy (-2.3%) had the worst week as oil prices dropped 3.3% since last Monday.

Apple’s plunge into AI including a partnership with OpenAI and the forthcoming Apple Intelligence carried the Tech sector to new heights, while solid earnings from Broadcom and Adobe helped.

CPI Inflation came in flat MoM and +3.3% YoY vs. Street expectations for +3.4%. Nothing heroic but good enough not to spoil the market’s fun.

Notable companies:

Adobe (ADBE) [+14.5%] Fiscal Q2 results ahead; positive takeaways on Digital Media ARR beat, bookings strength, raised FY24 guidance, and gen-AI momentum.

Restoration Hardware (RH) [-17.1%] Q1 earnings missed with revenue slightly better; flagged customers' interest-rate sensitivity and softening growth in April; Q2 revenue-growth guide below the Street.

Shopify (SHOP) [+4.6%] Upgraded to BUY from HOlD at Evercore ISI; cited strong competitive position and successful product innovation.

More below in ‘Market Movers’.

Street Stories

Broadcom Keeps Chip Love Affair Going

Broadcom reported a decent - albeit not amazing - quarter on Thursday, and it’s worth flagging because it was enough to continue the AI/chip rally that has been the story of the year.

Revs beat by 3.6% ($12.5 billion vs. Wall Street consensus at $12.1 billion) and EBITDA by 5.4% ($7.4 billion vs. Street at $7.1 billion), and they inched their annual revenue target up to $51 billion from $50 billion.

That was apparently enough to push shares up +12.2% on Thursday and another +3.3% on Friday (they also make chips for iPhones and Apple’s new AI efforts likely added to the exuberance). Seems like any excuse will do at this point to push shares higher.

The print also led to the Street pushing up revenue estimates down the line, with 2026 seeing a bump by +2%.

As you can see below, Wall Street has been continuously pushing these estimates higher over the last two years. Only AMD has really seen the growth sentiment take a chill pill.

Estimates for the chip sector have seen one of the most dramatic shifts in sentiment I’ve ever witnessed, with investors and the Street having built in aggressive numbers for the next few years.

Let’s hope this comes to pass, otherwise there could be a lot of pain coming from such lofty expectations and beefy valuations. 🤷♂️🤞

The Market’s All-Time Highs

So far in 2024, the S&P 500 has closed at a new all-time high 21 times. The run-rate figure for the year is 63 which would put 2024 in the books as the third best year for all-time highs since 1978 (as far back as I can get daily data).

Tesla’s Future $30 Trillion Valuation (according to Elon)

Whatever your feelings about Elon Musk, no one will ever accuse him of being a pessimist. At their annual general meeting on Thursday, the big news was shareholders voting to maintain his $56 billion pay package and authorizing the company’s move to a Texas domiciliation.

What also happened was that during Elon’s address to the crowd, he laid out his ambitious strategy to turn Tesla into the world’s first $30 trillion dollar company (note: the biggest companies ever have been Microsoft, Apple and Nvidia barely breaking $3 trillion).

The rough math is that he sees Tesla selling 100 million of its Optimus humanoid robots per year for a profit of around $10k each. Slap a 20x to 25x P/E multiple on that, sprinkle in another $5 to $10 trillion for autonomous driving, and BOOM! $30 trillion company! Easy peasy!

Joke Of The Day

My buddy Paul was fired from the M&M factory for throwing out all the W's.

I knew kids who were suspended at school for playing "cops and robbers" on the playground. The kids who were cops were suspended with pay, though.

Hot Headlines

Axios / Supreme Court gives Starbucks a vital win in their ongoing battle with unions. The Court ruled in favor of the coffee chain following their firing of seven employees who tried unionizing one of their Memphis locations. Which they didn’t like.

Unheard / The rise of California’s vanlords: A new class of landlord is exploiting the homeless. Vans and RVs now pepper the biggest cities, as a lack of affordable housing is forcing people towards unconventional alternatives to traditional housing.

Forbes / Adobe shares pop 15% as customers are paying up for for generative AI services. Shares have hit a rough patch since peaking in November 2021, but new AI features to flagship Creative Cloud, Document Cloud and Experience Cloud are reaccelerating growth, and led to a strong beat on last week’s Q2 print.

Yahoo Finance / Toyota shareholders demand vote against chairman in aftermath of safety testing scandal. Two major proxy groups are pushing for a vote to remove Chairman Akio Toyoda, the grandson of the founder, at the upcoming June 18th shareholder meeting, pushing the blame for the lack of internal controls on his shoulders. Ya, he might lose face but he ain’t going nowhere.

WSJ / The big loser in Tesla’s shareholder vote is Delaware. With about two-thirds of S&P 500 companies incorporated in the state, Tesla’s move raises the spectre of companies with strong management control to uproot to more ‘amenable’ jurisdictions.

CNBC / Fed’s Kashkari says it’s ‘reasonable’ to predict a December rate cut. Lame. And also - why does he also look like he’s thinking about murdering someone?

Trivia

Today’s trivia is on the New York Stock Exchange.

Before 2006 when the New York Stock Exchange became a for-profit organization, the only people allowed to execute trades over the exchange had to hold a ‘Floor Seat’ - effectively a prestigious membership with the organization. Adjusting for inflation, what was the highest price paid for a ‘Seat’ on the exchange?

A) $35 million

B) $150 thousandC) $6 million

D) $2.9 million

What was installed in the gallery of the New York Stock Exchange in 1967?

A) A Monet

B) Bullet-proof glass

C) A statue of the god Jupiter

D) A Bull fresco

The NYSE is 232 years old but that doesn’t make it the oldest stock exchange in the US. That honor goes to:

A) Philadelphia

B) Hoboken

C) Boston

D) Chicago

(answers at bottom)

Market Movers

Winners!

Adobe (ADBE) [+14.5%] Fiscal Q2 results ahead; positive takeaways on Digital Media NNARR beat, 2H Creative Cloud ARR commentary, bookings strength, raised FY24 guidance, and gen-AI momentum.

Hasbro (HAS) [+6.0%] Upgraded to buy from neutral at Bank of America; consensus doesn't fully account for success of digital gaming strategy, especially Monopoly Go!; cited industry inventory levels, Costco commenting toys top performing non-food category past two months.

Clover Health (CLOV) [+5.8%] First company to announce revised Medicare Advantage Star rating, up to 3.5 Stars from 3.0; update significantly improves financial outlook for FY25.

Shopify (SHOP) [+4.6%] Upgraded to outperform from in line at Evercore ISI; cited strong competitive position and successful product innovation.

R1 RCM (RCM) [+4.4%] Holder New Mountain disclosed details about continued discussions on a potential transaction.

Gilead Sciences (GILD) [+3.6%] Trading higher with positive comments from Jefferies on new preclinical data for oral GLP-1 small-molecule GS-4571 coming at ADA next week.

Losers!

Restoration Hardware (RH) [-17.1%] Q1 earnings missed; revenue slightly better; flagged customers' interest-rate sensitivity and softening growth in April; Q2 revenue-growth guide below the Street; reaffirmed FY guidance ranges; analysts somewhat positive on demand inflection and wider catalog mailings.

MSC Industrial (MSM) [-10.4%] Guided Q3 EPS below the Street; cut FY average daily sale growth and OM guidance; flagged ongoing heavy-manufacturing softness and slower ramp in Core Customer; noted headwinds from mix and unexpected dilution from web price realignment.

W.W. Grainger (GWW) [-1.6%] Downgraded to hold from buy at Erste Group; cited slowing sales growth last quarter, falling GM and OMs.

Datadog (DDOG) [-1.4%] Downgraded to sell from neutral at Monness, Crespi, Hardt & Co.; cited rich valuation after this month's rally, with shares up ~9% MTD; also said gen AI hype unlikely to boost revenue this year.

Market Update

Trivia Answers

A) $6 million. In 1929 a Seat was sold for $625,000 which is around $6 million in today’s dollars. The stock market imploded shortly after on October 24, 1929 (“Black Thursday”), helping to trigger the Great Depression. Seats were trading as low at $17,000 by the 1940s. Ouchy!

B) Bullet-proof glass. It stemmed from a prank by a group of activists led by Abbie Hoffman, where they went into the gallery overlooking the trading floor and threw fist-full of dollars (some real, some fake) onto the traders below.

A) The Philadelphia Stock Exchange was founded in 1790 - a full two years ahead of the NYSE.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

All Time High machine indeed! Feels like this is one of the most hated bull markets of all time.

On another note, the Kashkari pictures had me cracking up!

Nice write up!