🔬Bonfire of the EV Vanities

Plus: Sometimes you get lucky; and much more!

"In God we trust; all others bring data"

-Michael Bloomberg

"I'm in a glass case of emotion."

-Ronald Joseph Aaron Burgundy

Mixed day for the big US markets with the S&P 500 +0.1% and the Nasdaq +0.3%, with most names up but Nvidia slipping again (-1.9%).

6 of 11 sectors closed higher, with Real Estate and Consumer Discretionary at the top of the pile (both +0.9%). Staples (-0.5%) and Materials (-0.3%) were worst off.

Notable companies:

BlackBerry (BB) [+10.9%]: Q1 EPS and revenue beat; cybersecurity and IoT ahead of consensus; Q3 EPS and revenue guidance mostly in line; FY25 EPS and revenue guidance reaffirmed; noted enhanced OEM partnerships, professional services expansion, and some EV demand pullback.

Walgreens Boots Alliance (WBA) [-22.2%]: Q3 EPS missed, though revenue beat; FY24 EPS guidance lowered; plans for significant additional US store closures.

Elanco Animal Health (ELAN) [-20.6%]: Announced major drug Zenrelia will have a safety warning label, expected to hinder US adoption.

More below in ‘Market Movers’.

I won’t be releasing a StreetSmarts on Monday due to Canada Day. I mean, mostly because I’ll be hungover but. Nm, you get it. 🍁🍺🏒🦫

Street Stories

Bonfire of the EV Vanities

Being a good friend means doing a lot of things. One of those things is not bringing up EVs to a friend who you know invested in the hype.

Let me give you a ‘for instance’…

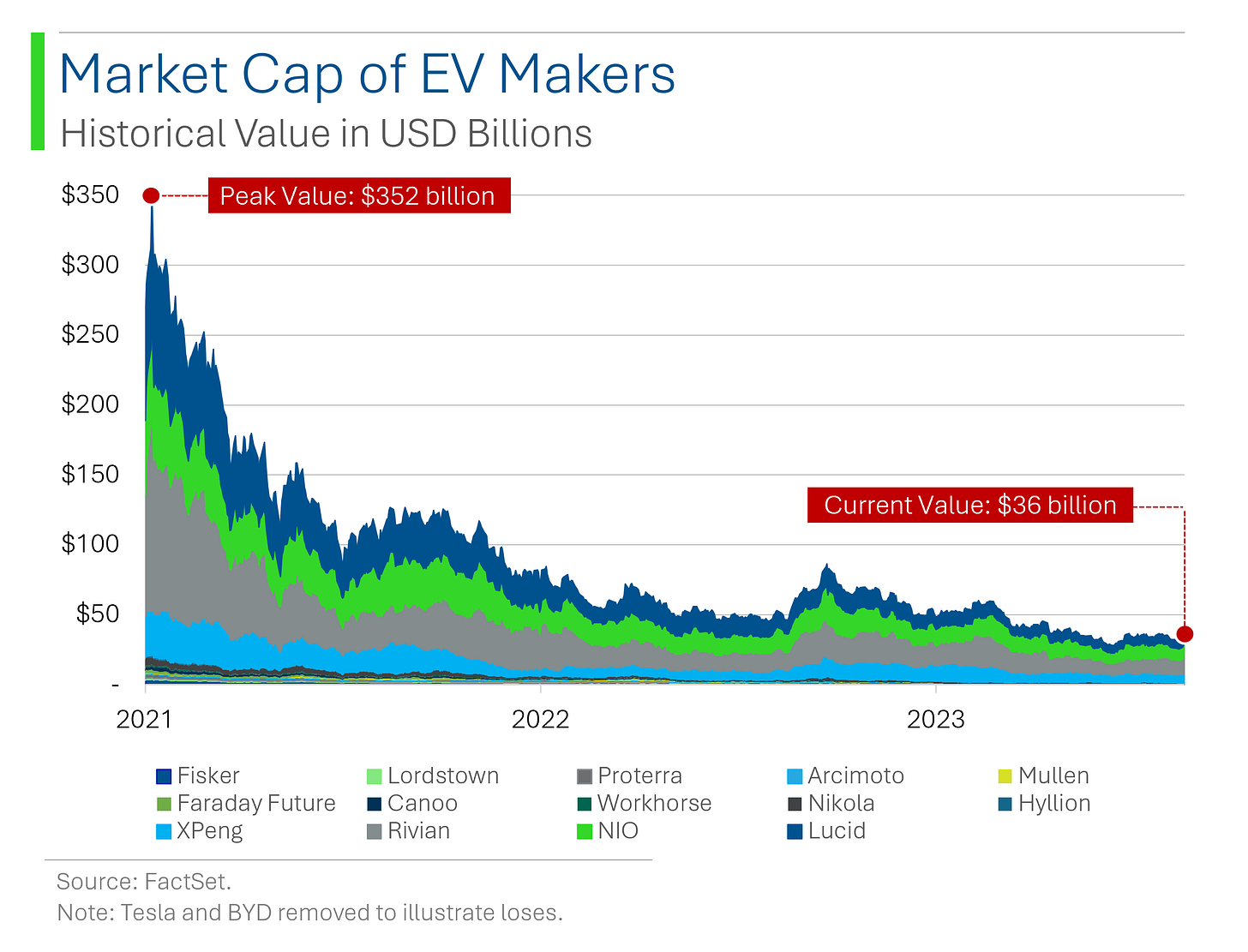

As you can see above, it hasn’t really worked out too well for the pure play EV players, save for Tesla and BYD. The vast majority have contributed to what has come to pass as one of the single largest secular incinerators of investor capital.

EVs have an important future ahead but increasingly it seems that future will primarily be in the hands of the legacy automakers barring only a handful of pure plays like BYD and Tesla.

Over the last three years, the ‘also rans’ of the EV space (basically everyone save for Tesla and BYD) have combined to destroy about $316 billion in market value.

Looking back it’s pretty wild to think that at one point Rivian and Lucid, now worth $15 billion and $6 billion respectively, once held market caps of $152 billion and $91 billion.

For context, Ford and GM currently have market caps of $48 and $52 billion.

And, you know, positive earnings and cashflow.

AMC vs. Cinemark

I don’t know much about the cinema space beyond periodically following the meme-stock rallies when AMC gets bid up; issues a bunch of equity; promises a million things; and then goes back down again.

I’m thankful for this as it probably saved me from a bunch of losses.

Interestingly though, I was looking around and found out that AMC isn’t the biggest player in the movie theatre game. I mean, they are if you look at the number of theatres; in this regard, they are the biggest player in the world with around 900 venues.

Still, they are a smaller company than CINEMARK (I immediately hate them for changing to an all-caps name in 2022). Despite having only 501 theatres, they are roughly 2x the size of AMC - meme-rallies and pumped retail equity offerings be damned.

Revenue-wise, AMC is proportionate to their jumped up peer: they have ~80% more theatres and ~60% more revenue.

Looking at profitability, however, yields a different picture. CINEMARK (the all caps are killing me) spit out 40% more EBITDA in 2023 than AMC.

Maybe instead of gimmicks and retail pandering, AMC should just, like, do what CINEMARK (ughh) is doing?

Joke Of The Day

The economy’s so bad, Exxon-Mobil laid off 15 Congressmen.

Hot Headlines

Bloomberg / Purdue’s bankruptcy went too far. My hero Matt Levine weighs in on the Supreme Court’s decision to grant immunity to the Sackler family for essentially causing the opioid epidemic. Literal monsters.

CNBC / Walgreens stock plunges 22% as drugstore chain slashes profit guidance in ‘challenging’ consumer environment. I learned two rules investing in health care companies professionally for a decade: Invest in health insurers because they are a government sponsored oligopoly; and pharmacies are in a race to the bottom.

Market Watch / Interactive Brokers accepts $48 million loss tied to NYSE glitch. Good. If you weren’t watching, on June 3rd a glitch at the NYSE showed Warren Buffett’s Berkshire Hathaway A shares trading at a price 99.8% lower than it should have been. Plucky investors tried to buy shares at the (obvious) discount but many found themselves getting filled at the much less appetizing price around $741k per share (currently the A shares are $615k a share). Imagine being a Redditor punting a few shares as a joke and then getting hit with a multimillion dollar margin call.

Bloomberg / Nearly 25% of all US office space will be vacant by 2026, according to Moody's. The ratings agency estimates a potential $250 billion hit due to the impact of WFH and migration of companies out of major urban centers.

CNBC / Chinese automakers expected to achieve 33% global market share by 2030. Consultancy AlixPartners forecast this, as currently the figure sits at ~21%.

Bloomberg / US mortgage rates fall for fourth straight week. The average for a 30-year, fixed loan was 6.86%, the lowest level in about three months according to Freddie Mac data.

Trivia

Today’s trivia is on financial crises and bubbles.

What was a key factor in the 1997 Asian Financial Crisis?

A) Dot-com bubble

B) Housing bubble

C) Currency devaluation

D) Oil price shockDuring what period did the United States experience 'Stagflation'?

A) 1950s

B) 1960s

C) 1970s

D) 1980sWhich term describes the economic situation of Germany in the 1920s?

A) Deflation

B) Stagflation

C) Hyperinflation

D) Reflation

(answers at bottom)

Market Movers

Winners!

BlackBerry (BB) [+10.9%]: Q1 EPS and revenue beat; cybersecurity and IoT ahead of consensus; Q3 EPS and revenue guidance mostly in line; FY25 EPS and revenue guidance reaffirmed; noted enhanced OEM partnerships, professional services expansion, and some EV demand pullback.

Restoration Hardware (RH) [+9.2%]: Announced chairman & CEO Gary Friedman's purchase of $10M of company stock.

Apogee Enterprises (APOG) [+8.1%]: FQ1 earnings beat though revenue a bit light; flagged lower volumes but noted positive margin impacts from mix; Architectural Services backlog improved; raised FY25 EPS guidance.

Viking Therapeutics (VKTX) [+7.1%]: Initiated overweight at Morgan Stanley; cited pipeline and best-in-class potential in the obesity market.

Palantir Technologies (PLTR) [+4.7%]: Voyager Space announced a strategic partnership with the company.

McCormick & Co. (MKC) [+4.3%]: Fiscal Q2 EPS beat on better organic sales, GM upside, and lower tax rate; EBIT also ahead; reaffirmed key aspects of FY guidance; confident in mid to high-end of (1%) to +1% constant currency sales outlook for 2024.

Losers!

Walgreens Boots Alliance (WBA) [-22.2%]: Q3 EPS missed, though revenue beat; FY24 EPS guidance lowered; plans for significant additional US store closures; reviewing about 25% of its 8600 US stores; management noted a difficult operating environment including pressures on US consumer and eroded pharmacy margins.

Elanco Animal Health (ELAN) [-20.6%]: Announced Zenrelia will have a safety warning label, expected to hinder US adoption.

Levi Strauss (LEVI) [-15.4%]: Fiscal Q2 EPS ahead on better GM performance (lower product costs and favorable mix); DTC a bright spot, offsetting weaker international sales; sales missed; FY EPS guidance unchanged despite beat vs expectations for upward revision; elevated 2H investments an overhang.

SM Energy (SM) [-10.5%]: Agreed to acquire Uinta Basin oil and gas assets from XCL Resources for $2.55B; approved 11% increase in fixed quarterly dividend policy; authorized a new $500M share repurchase program.

AeroVironment (AVAV) [-7.7%]: FQ4 earnings, revenue, and margins better; backlog declined sequentially (recent awards not yet reflected); midpoint of FY25 EPS guide below Street with higher R&D investment seen in nearer term (including for Group 1 UAV, JUMP 20, and HAPS programs).

International Paper (IP) [-7.2%]: Suzano announced it will not pursue acquisition of International Paper.

Hims & Hers Health (HIMS) [-7.1%]: Hunterbrook Media discussed alleged issues with "knockoff" GLP-1 weight loss drugs offered by the company; Hunterbrook Capital, the hedge fund associated with Hunterbrook Media, is short HIMS shares.

Visa (V) [-2.6%]: Share block reportedly being shopped through JPMorgan.

Market Update

Trivia Answers

C) Currency devaluation was a leading cause of the Asian Financial Crisis.

C) Stagflation was a hallmark of the 1970s economy.

C) Germany experienced hyperinflation in the 1920s. Thankfully it didn’t lead to anything bad. 😕

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Solid meme and chart game today. Excellent!