🔬Bonfire of the Chip Vanities

Plus: Bitcoin's fourth 'halving' was a thing (but sellers didn't care); Trump Media scrambles to stop short sellers; and much more

"The stock market is filled with individuals who know the price of everything, but the value of nothing."

- Philip Fisher

“And there is no such thing as a no sale call. A sale is made on every call you make. Either you sell the client some stock or he sells you a reason he can't. Either way a sale is made, the only question is who is gonna close? You or him?”

- Jim Young, Boiler Room

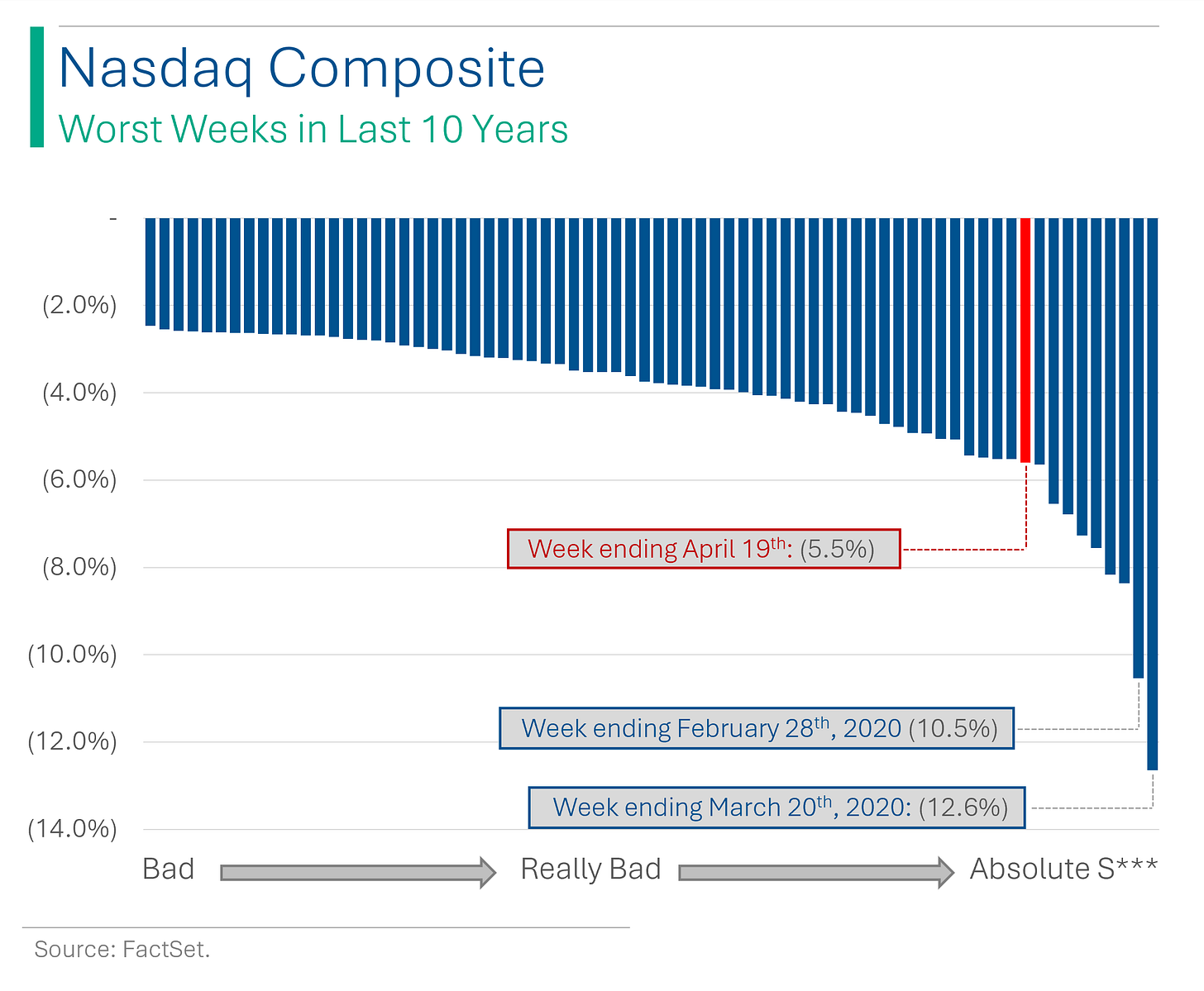

The big us markets had a bad finish to a s**** week (S&P 500 -0.9%, Nasdaq -2.1%). The S&P finished the week down 3.0% while the Nasdaq had its worst week since the pandemic, plummeting 5.5%.

6 of 11 sectors closed up higher on Friday but this was mostly driven by defensives like Utilities (+1.9%) and Staples (+1.4%). Only three sectors closed higher on the week (Utilities +1.9%; Staples; +1.3%; and Financials +0.8%).

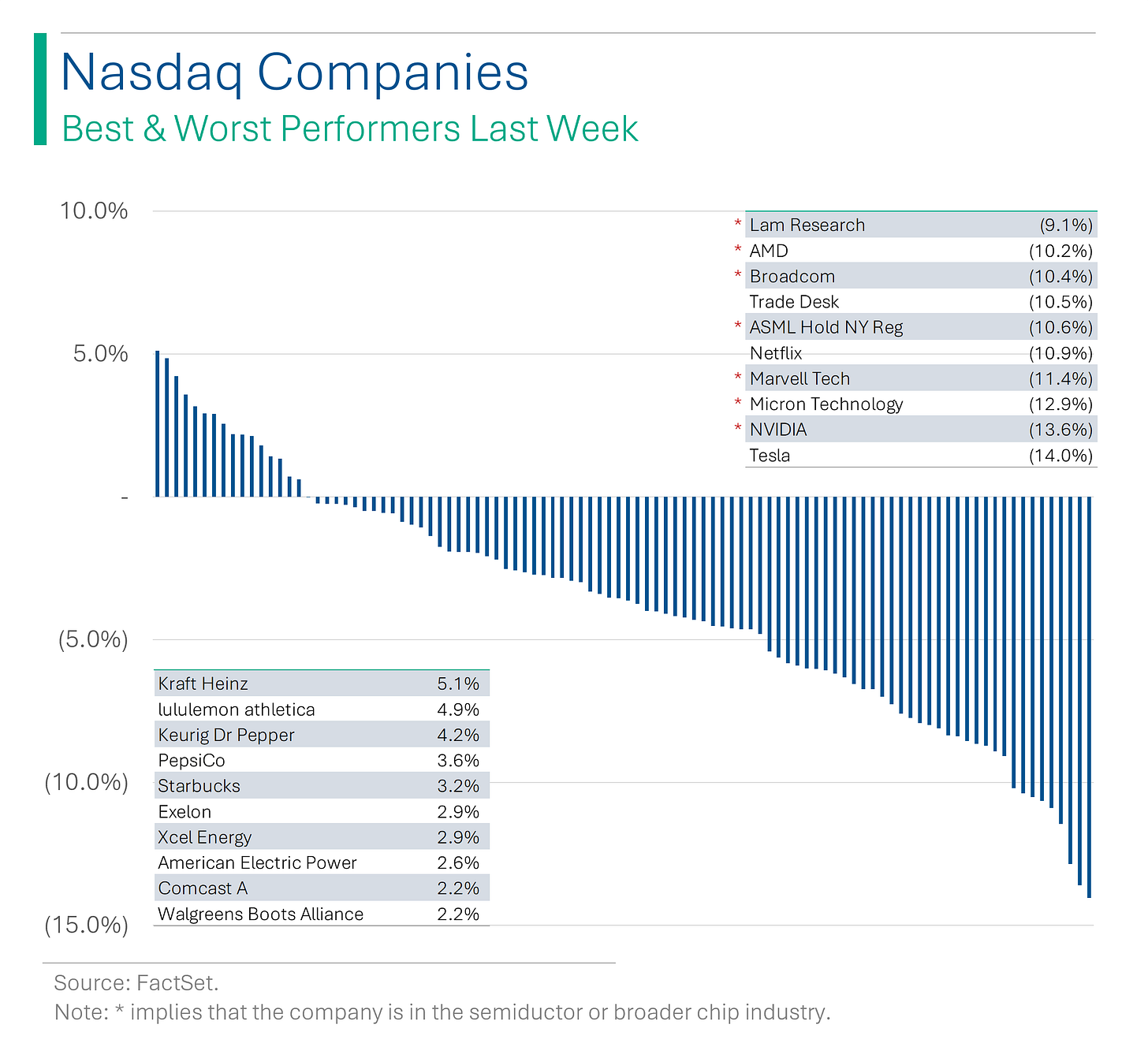

Biggest news was the implosion of the chip sector, with Nvidia down 14% this week. Soft guidance and few catalysts really suck sometimes.

Street Stories

Bonfire of the Chip Vanities

I hope everyone had a good week because your portfolio probably didn’t. The slew of negative rate news, geopolitical risk and a mediocre start to Q1 reporting made last week the worst for the Nasdaq since November 2022.

To start, virtually all the gains for the year - which were quite strong relative to history - were wiped out over the last week and a bit. The S&P 500 and Nasdaq went nearly vertical in the wrong direction, wiping out 1.3 trillion and 1.4 trillion in market cap, respectively. Good grief!

Compared to returns in the past, this was the 10th worst week in the last 10 years, and nearly all of the examples of weaker performance came during the Covid pandemic (or when the pandemic bubble burst in 2022).

For a bit more context, only 2.3% of weeks in the last 10 years have been as bad or worst. And when you consider that we spent +2 years in a global pandemic, that’s quite telling.

Within the Nasdaq 100 - my favorite index - only 16 companies (16% err) showed a positive return. Importantly, those were mostly companies that had little to do with Tech and especially the chip sector and its contracting AI bandwagon.

Chip companies had it the worst, as the bubble around everything AI took a step back. The SOX Semiconductor index - which had been drinking Red Bull mixed with kerosine based jet fuel for the last year - had one of it’s biggest meltdowns since the Dot-Com bubble burst. Fan favorite Nvidia was the target of some of the worst selling.

While the AI story is going to be a multi year investment opportunity, so many of these companies have been standing on a flag pole. I like many of these companies for the long-term but at this point it’s impossible to tell if this wind storm will turn into a hurricane. And the ones clinging for life on said flag pole might have bigger to come.

Bitcoin Halving

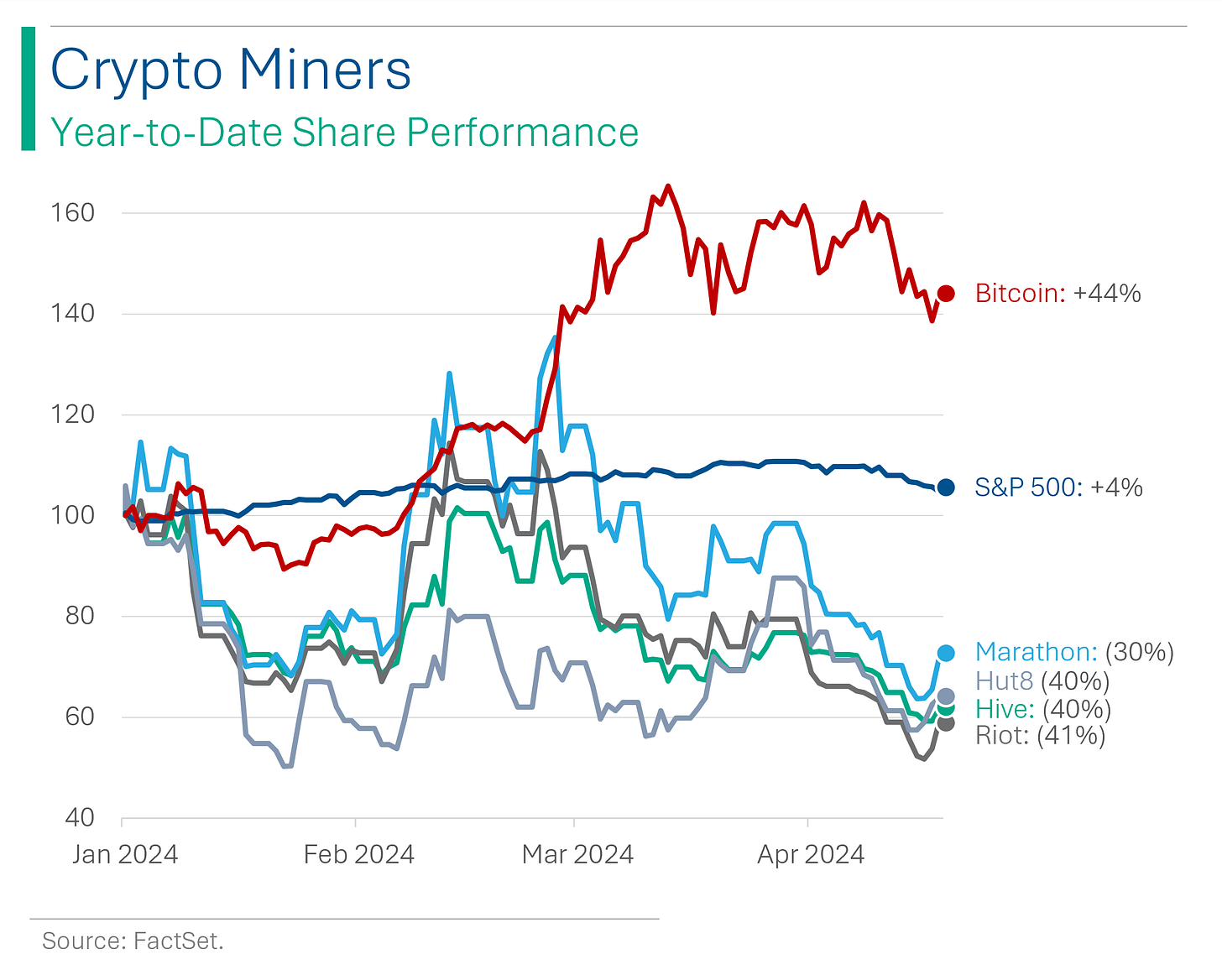

Bitcoin's fourth halving has reduced miner rewards from 6.25 to 3.125 bitcoins, impacting the profitability and likely prompting industry consolidation among miners like Marathon and Riot.

The price of Bitcoin, which recently hit a new all-time high of $76k, has been volatile before the halving and may not see significant increases post-event, as the effect is believed to be already priced in by analysts from JPMorgan and Deutsche Bank. Historically halving events were viewed as a bullish as it increased scarcity but as the price rallied hard prior the event that is not expected to be the case this time.

Analyst expectations suggest cautious market behavior ahead, with an emphasis on the operational efficiency of mining companies in response to decreased block rewards.

Trump Media Tries to Fight Short Sellers.

Trump Media has alerted Nasdaq to potential market manipulation from ‘naked’ short selling of DJT stock. This comes after Trump Media offered shareholders detailed instructions on how to avoid lending their shares to short sellers. Former President Donald Trump owns nearly 60% of Trump Media shares.

Ah, the famous ‘ski jump’ trading pattern. Very bearish.

Joke Of The Day

A Freudian slip is when you say one thing but mean your mother.

What do you call a bear with no teeth? A gummy bear.

Hot Headlines

Reuters / Tesla cuts US prices of Models Y, X, S by $2,000. News comes days after the first-quarter deliveries of the world's most valuable automaker missed market expectations. Tesla shares got incinerated this week, down 14%.

WION / Finland accuses Russia of orchestrating migrant crisis at border and requests help from EU. Implication is that Russia is using migrants to cause social strife within the country, which has now shut down eight of its nine checkpoints with Russia. The only one that remains open is dedicated to rail travel only.

CNN Business / The US dollar has been popping but what has been driving it and what does that mean for Americans? Higher rates, strong economy and a flight to safe haven assets has pushed USD higher.

The Guardian / Amazon UK could be forced to recognize union as GMB wins right to hold ballot. A win would give the GMB the right to discuss terms and conditions such as pay, hours and holidays with Amazon. No word on their pee bottle policy.

Axios / Commerce Secretary Gina Raimondo says China microchip threat is a national security issue. In an interview airing Sunday she's focused on preventing the governments of China and Russia from obtaining U.S.-designed advanced microchips due to national security concerns.

Trivia

Today’s trivia is on Pfizer.

When was Pfizer founded?

A) 1948

B) 1849

C) 1905

D) 1967After its discovery, Pfizer developed the first mass-produced antibiotic during World War II. What was it?

A) Erythromycin

B) Amoxicillin

C) Penicillin

D) TetracyclineIn which year did Pfizer launch Viagra, a revolutionary treatment for erectile dysfunction?

A) 1989

B) 1998

C) 2002

D) 1998Pfizer's largest acquisition to date, involving a $68 billion deal, was with which company?

A) AstraZeneca

B) Wyeth

C) Bayer

D) Merck

(answers at bottom)

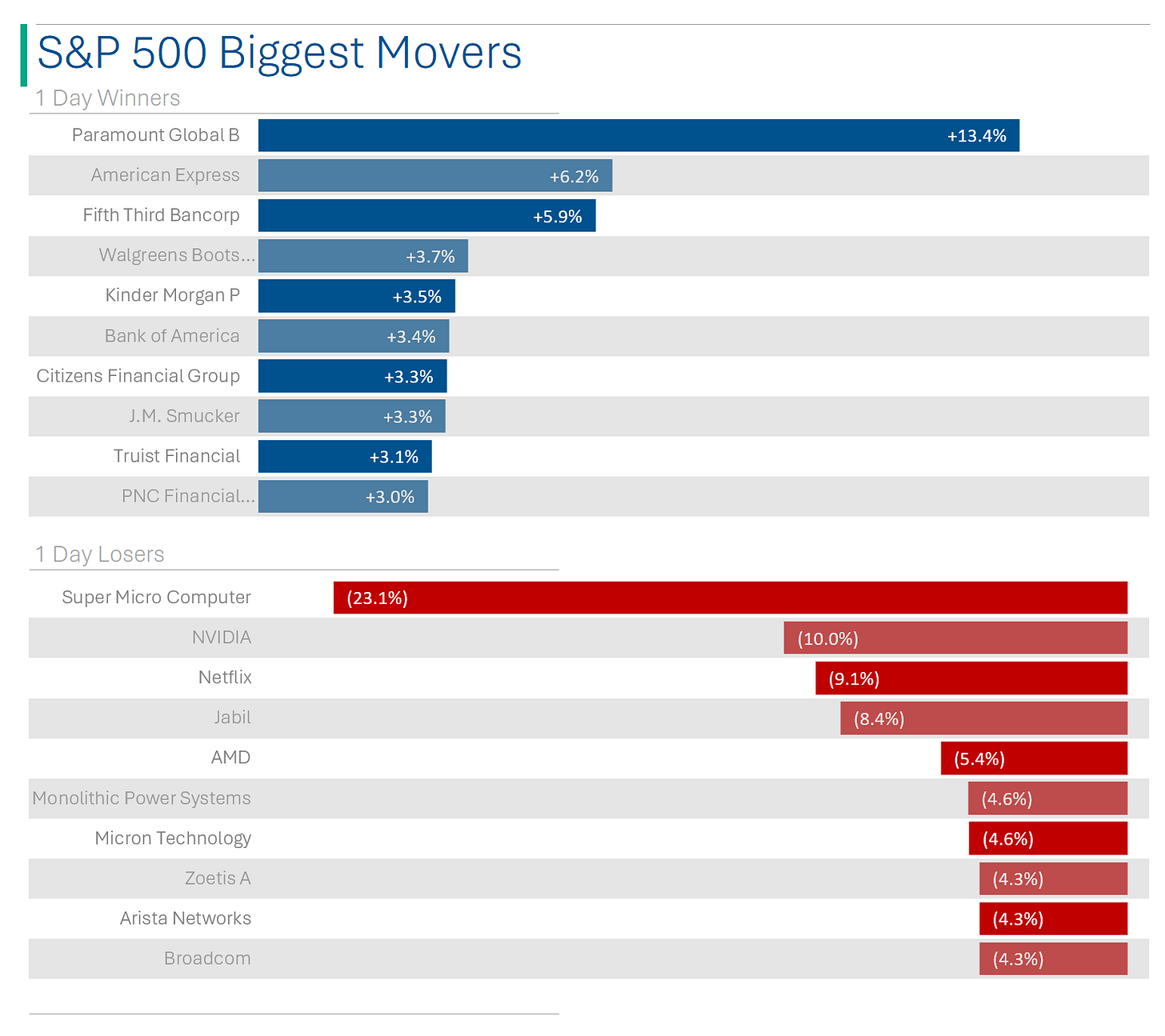

Market Movers

Winners!

Paramount Global (PARA) [+13.4%]: Sony and APO mulling joint bid to acquire, per New York Times.

American Express (AXP) [+6.2%]: Q1 diluted EPS beats, revenue meets expectations; non-interest revenue slightly below consensus. FY guidance reaffirmed, positive views on NII and lower rewards expenses.

Fifth Third (FITB) [+5.9%]: Q1 EPS, NII, and NIM exceed forecasts; margins also top consensus. FY24 outlook reaffirmed, slight guide down anticipated but not realized.

Losers!

Super Micro Computer (SMCI) [-23.1%]: Company to report FQ3 results on 30-Apr without issuing guidance, breaking from past practice.

Netflix (NFLX) [-9.1%]: Q1 earnings, revenue, and OM exceed forecasts; net adds surpass consensus, strong even in mature UCAN region. Q2 and FY revenue guidance falls short, mixed analyst views, concern over ending net adds and ARPU disclosure.

Jabil (JBL) [-8.4%]: CEO Kenneth Wilson on paid leave pending corporate policy investigation results; CFO Michael Dastoor steps in as Interim CEO.

Market Update

Trivia Answers

B) Pfizer was founded in 1849.

C) Pfizer’s mass production efforts quickly made it the world’s largest producer of Penicillin.

D) Pfizer launched Viagra in 1998.

B) Wyeth was Pfizer largest deal. The other companies are still publicly traded..

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.