🔬Bitcoin is Flying, Coal Usage is Falling, and Much More

"The best time to buy a stock is when the company’s problems are more apparent than real"

- Leon Cooperman

“Live every week like it’s Shark Week”

- Tracy Jordan, 30 Rock

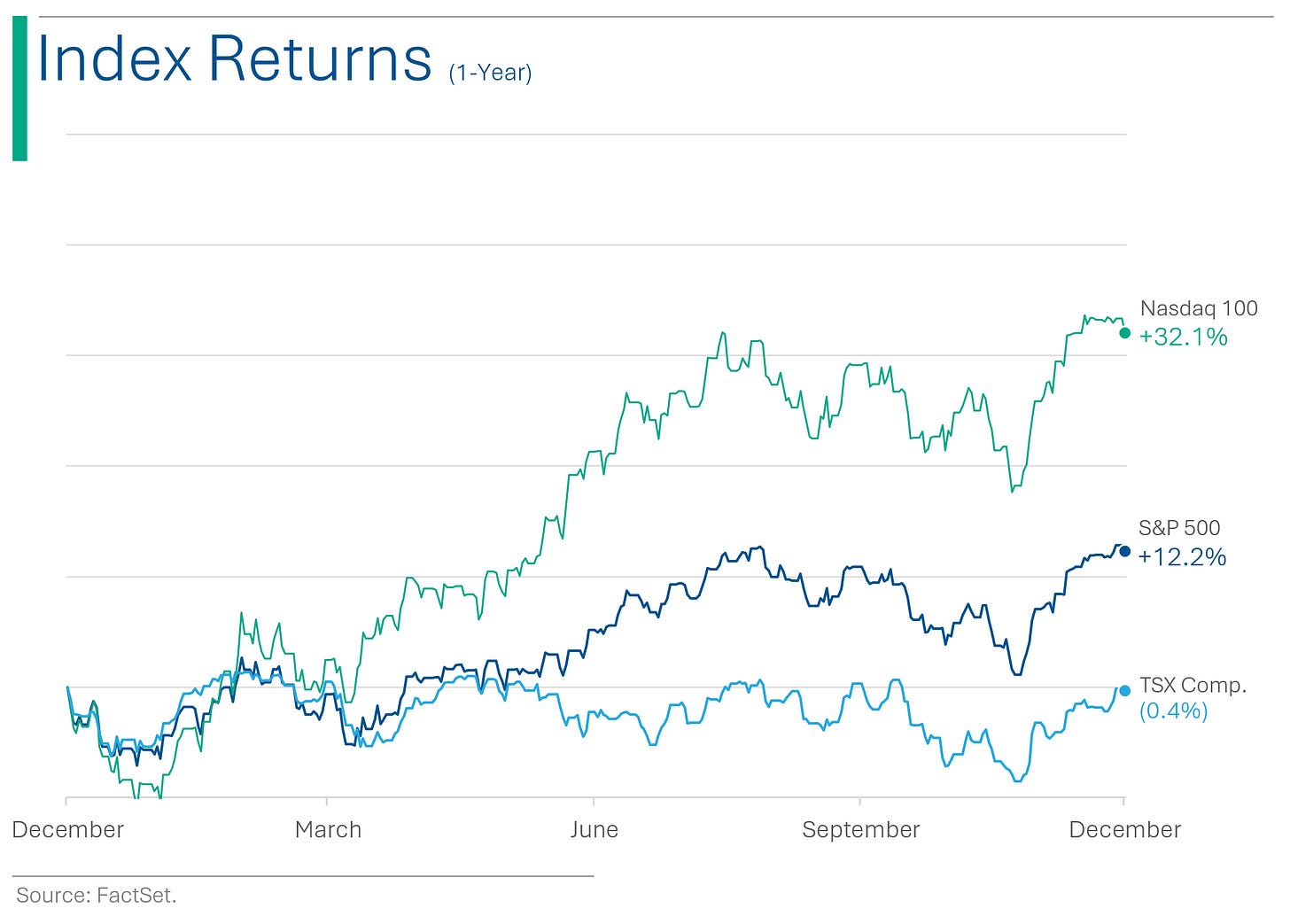

The big markets had a mixed day but only minor changes (S&P 500 -0.1%, Nasdaq +0.3%).

3 of 11 sectors closed in the green led by led by Tech (+0.8%) and Consumer Discretionary (+0.3%), while Energy (-1.7%) and Materials (-1.4%) had a rough one.

Apple closed up +2.1% and once again hit a market cap of $3 trillion. The move was partially the result of positive guidance coming out of Foxconn, which assembles iPhones.

Bitcoin futures were up +4.8%, following on the big rally on Monday.

WTI crude was all over the place but settled down -1.0%.

The Job Openings and Labor Turnover Survey (JOLTS) came in well below consensus to its lowest level since March 2021.

Moody’s lowered their China outlook to negative.

Street Stories

BITCOIN CONTINUES ITS RALLY - The last time Bitcoin broke $44 thousand was May 5th, 2022 - four days before the collapse of Terra and its UST stable coin kicked off the ‘Crypto Winter’. And unlike the multi-year winters of Westeros, crypto winters are apparently pretty short.

After hitting a peak price of $67,567 in November 2021, Bitcoin bottomed out a year later in November 2022 at $15,787. Fast forward another year and the king of the cryptos is on one hell of a tear: Over the last 12 months, Bitcoin is up 160% with no signs of slowing down. But, why?

As with all-things speculative, a good part of the reason the price is running is plain ole hype. However, there are some technical factors at play that, while maybe not fundamental to the intrinsic value of the coin, at least create a narrative for the rally to persist. These factors include:

Bitcoin ETFs - Currently there are more than a dozen ‘Bitcoin ETFs’ but these don’t actually own any Bitcoin. Rather, the regulation states that they are allowed to own futures contracts. It’s actually ridiculous since the regulation doesn’t fully trust the crypto exchanges but will allow ETF administrators to enter into derivative contracts…with people that transact over crypto exchanges. Ok, sure.

Anyway, regulation is moving forward and ETFs that actually own the underlying Bitcoin are coming very soon. Yesterday, BlackRock’s filings showed they had received the initial ‘seed investment’ for their pending ETF launch, and Bloomberg recently placed the the probability of SEC approval for a Bitcoin ETF in January at 90%. Currently there are 12 other known applications sitting with the SEC.

Why does this matter? Well, owning a Bitcoin ETF vs. a Bitcoin Futures ETF does make a pretty big difference. First off, there is tracking error. As you can see above, ProShares Futures ETF hasn’t exactly kept pace with the underlying coin. There are also additional fees and some price discrepancies tied to constantly trading and rebalancing futures contracts vs. just simply owning Bitcoin (and trying hard not to lose that piece of paper you wrote your password on). Moreover, most institutional investors are limited in their ability to own ETFs that trade in derivatives but are fine to own currency or commodity funds (which a Bitcoin ETF sorta is).

Currently, the largest Bitcoin futures ETF - the above noted Proshares one - has around $1.1 billion in AUM. The expectation is that once a proper spot ETF is available, billions of funds will flow into them, which obviously will have a significant impact on the price of Bitcoin. One estimate I found from Glassnode, estimates that up to $70 billion could flow into Bitcoin ETFs solely based on the SEC approval.(Perceived) Macro Tailwinds - As we’ve seen recently with meme-stocks and zero-profit Tech (see Monday’s note on ARK Innovations +55% YTD performance), the market is ‘Risk On’ at the moment and retail investors especially appear open to risky bets. Moreover, there is still a large contingent of people that consider Bitcoin a safe-haven asset, so the parallels to Gold - currently at an all-time high - shouldn’t be lost to anyone. Even the Federal Reserve has a semi-direct impact since much of crypto speculation is done with leverage. The ‘Peak Fed’ narrative is playing out everywhere, including the reduced (and expected to reduce further) borrowing costs that helps drive all this crypto speculation.

The ‘Halving’ - At every 110k interval of Bitcoin blocks mined (formerly 210k), an event known as the ‘halving’ takes place. At this point, the number of Bitcoin given as a reward for being mined, decreases by - you guessed it - one half. Historically this has been perceived as a bullish indicator since the supply growth of Bitcoin for trading is reduced. Currently, the next halving event is forecast to take place in April.

To conclude, while the price of Bitcoin may seem insane and driven by wild speculation (because it is), there are at least some partially rational drivers for crypto enthusiasts to get even more

crazybullish about.

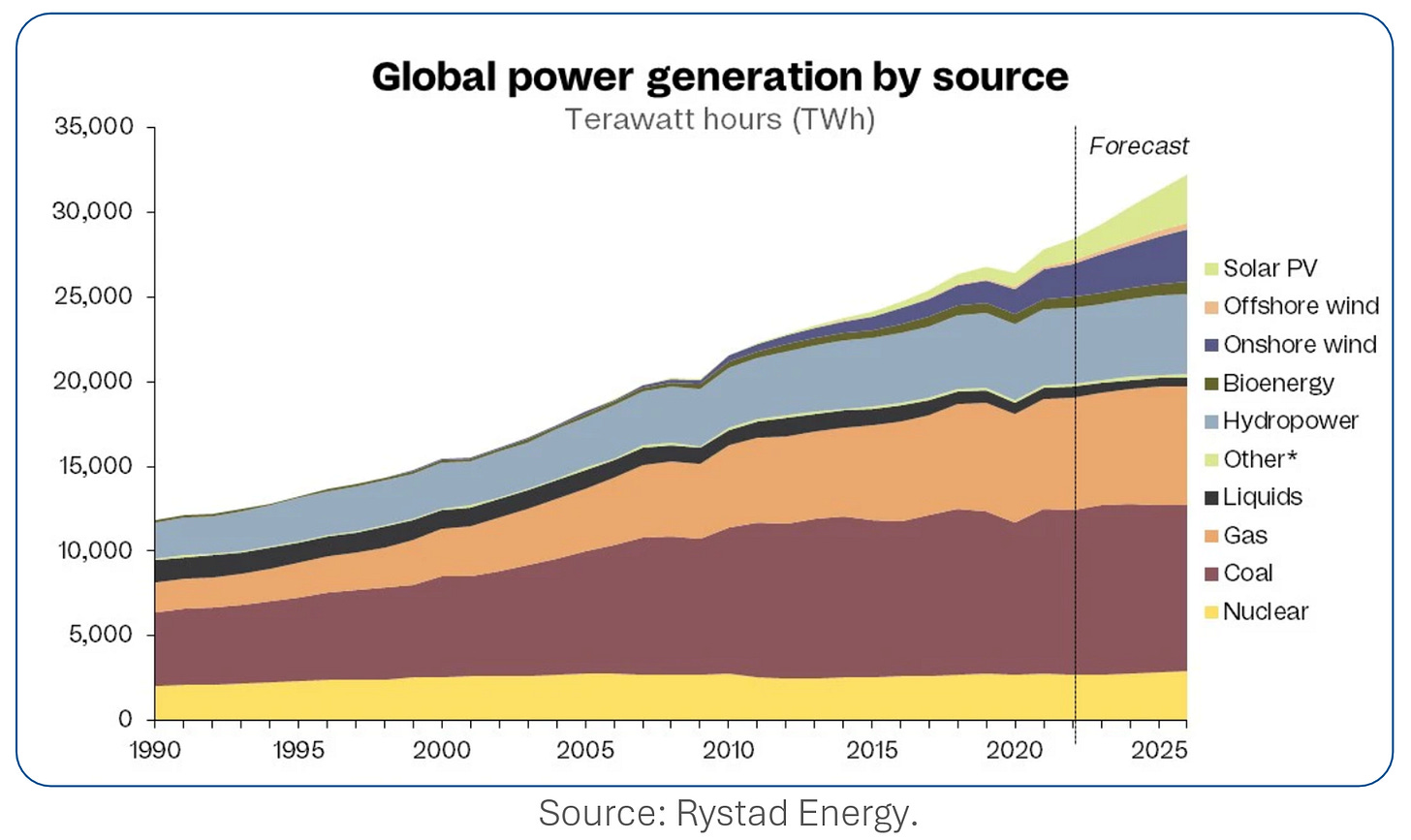

PEAK COAL - Global coal-based power production is set to peak in 2023 at about 10,373 terawatt-hours and is expected to slightly decline in 2024, marking the start of the renewable energy era in the power market, according to Rystad Energy. The decrease in coal usage, though minor, is significant in the context of global efforts to reduce emissions and combat climate change and energy analysts agree that the current trend indicates a stabilization and potential decline in coal usage for power generation. (Bloomberg has more)

M&A COME-BACK - John Weinberg, CEO of Evercore Inc., stated that companies are poised to resume deal-making activities, as evidenced by increased inquiries about potential deals at the Goldman Sachs financial services conference. Evercore is expanding and hiring overseas, and predicts a full-scale rebound in deal-making in the coming quarters, as businesses seek to rebuild confidence and avoid negative stock reactions to announcements. Hope so. Those poor bankers need to eat (wagyu beef and lobster) too. (Bloomberg has the story)

MORGAN STANLEY UPBEAT ON SOFT-LANDING - Bank of America CEO Brian Moynihan anticipates a slowdown in the US economy but remains optimistic about a soft landing rather than a recession, noting normalized consumer spending and reduced funds in customer accounts. He expressed caution regarding the Federal Reserve's interest rate hikes to combat inflation, emphasizing the need to avoid overcorrecting. (CNBC held the interview)

OZEMPIC COMPETITOR LAUNCHES AMIDST SUPPLY SHORTAGES - Eli Lilly's Zepbound, stepping up as the new kid on the block in the weight loss drug market, is now available at U.S. pharmacies, ready to fill the shoes (and prescriptions) left empty by supply-strapped rivals, like Wegovy and Ozempic. The drug, rebranded from its original diabetes treatment Mounjaro, has been added to Cigna's preferred drug list and offers a commercial savings program to make it more accessible. Ozempic has some real competition coming for its fat profits. (CNBC has more details)

Joke Of The Day

The market may be bad, but I slept like a baby last night. I woke up every hour and cried.

Mark Minervini pitches Upstart ($UPST) on CNBC but when asked what they do he pretends the audio isn’t working. (From last year but I only just heard of it.)

Hot Headlines

MarketWatch | Goldman warns stock-market rally is running out of gas with trend-following funds poised to slash exposure. Says systematic funds could dump more than $200 billion dollars in exposure to global stocks if the market suffers a pullback from recent highs. Momentum goes two-ways.

The Wrap | Nelson Peltz's fight for Disney Board seats gets new ally in investment firm Ancora Holdings. Vultures circling.

Punchbowl News | Treasury Secretary Janet Yellen says persistently high rates to create challenge for policymakers in deficit reduction. The United States spent $659 billion on bondholder payments in FY2023, nearly double FY2020’s total of $345 billion.

Axios | Elon Musk's aims to raise $1 billion for OpenAI competitor, X.ai. Per a new SEC filing, the company has raised about $135 million so far.

Bloomberg | Moody’s China outlook cut leaked on WeChat hours before announcement. Risky place to trade on non-public info.

Axios | Watchdog group Committee to Protect Journalists (CPJ) says at least 57 journalists killed in Israel-Hamas war.

Trivia

This week’s trivia is on famous investors.

Which investor is known for the 'Tiger Cubs', a group of hedge funds run by his former employees?

A) Julian Robertson

B) George Soros

C) Warren Buffett

D) Ray Dalio

Who is known for his contrarian investing approach and is the founder of Oaktree Capital Management?

A) Warren Buffett

B) Carl Icahn

C) Howard Marks

D) Ray Dalio

Which investor is known for founding the Vanguard Group and popularizing index funds?

A) Warren Buffett

B) Carl Icahn

C) John C. Bogle

D) George Soros

(answers at bottom)

Market Movers

Winners!

Gitlab (GTLB) [+11.4%] Q3 EPS and revenue exceeded expectations, with better-than-expected gross and operating margins. Billings beat estimates, leading to raised FY24 EPS and revenue guidance.

Robinhood Markets (HOOD) [+10.3%] Reported early November results showing a significant ~75% increase in notional crypto trading volumes compared to October 2023. Net deposits and Average Revenue Per Account (ARPA) also showed notable year-over-year improvements. Now it’s only down 85% since 2021 highs.

Losers!

Designer Brands (DBI) [-33.4%] Fiscal Q4 results fell short with revenue, gross margin, and EPS all missing targets. The company slashed its FY EPS guidance by nearly 60% at the midpoint.

America's Car-Mart (CRMT) [-18%] Reported a significant fiscal Q2 EPS miss on slightly softer revenue. Net charge-offs increased to 7.2%, and the allowance for credit loss rose to over 26%, attributed to ongoing inflation pressures. Getting run-over by weak consumer trends.

Five9 (FIVN) [-6.4%] Experienced a decline after Zoom (ZM) announced disinterest in acquiring the company. This follows a Bloomberg report suggesting renewed merger talks, originally proposed in 2021.

Albemarle (ALB) [-5.6%] Downgraded to underweight from neutral at Piper Sandler, driven by a notable deterioration in the global lithium market.

Market Update

Trivia Answers

A) Julian Robertson. The nickname derives from the name of his hedge fund, Tiger Management.

C) Howard Marks. Legend.

C) John C. Bogle. Still beloved by millions of (lazy) ‘Bogleheads’. jk.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.