'Birken-flop' IPO, Ozempic...for kidney failure, and Much More

StreetSmarts Morning Note

"The problem is not so much what people don’t know; it’s what they think they know that just ain’t so."

-Nassim Nicholas Taleb

"Tell me the difference between stupid and illegal, and I'll have my wife's brother arrested."

-Mark Baum (Steve Carell) in The Big Short

Table of Contents

A.M. Allocations: Summaries of important news and investing events

US Fed Meeting Minutes Released

Ozempic, Destroyer of Worlds

More like ‘Birken-Flop’

Inflation Update

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

US Fed Meeting Minutes Released

The Federal Reserve released the minutes from their September 19-20 meeting which showed its officials regarded the US economy’s outlook as uncertain

Most Federal Reserve officials anticipate one more rate hike, but the decision hinges on the pace of inflation cooling. The Fed kept the key lending rate steady recently due to uncertainties in economic responses and inflation's steady decrease.

Financial markets expect a pause in rate hikes at the upcoming Fed meeting, with a possible hike in December, dependent on upcoming economic data. There is ongoing uncertainty over the impact of the 11 rate hikes since March 2022 on the economy.

Ozempic, Destroyer of Worlds

Novo Nordisk's Ozempic (a GLP-1 drug for Type 2 diabetes patients and weight-loss) demonstrated efficacy against kidney failure in a clinical trial, leading to an early halt of the study due to its promising results.

The company’s ADRs (‘American Depository Receipts’, effectively foreign shares listed on a US market) jumped 6.3% in response to the positive trial outcome.

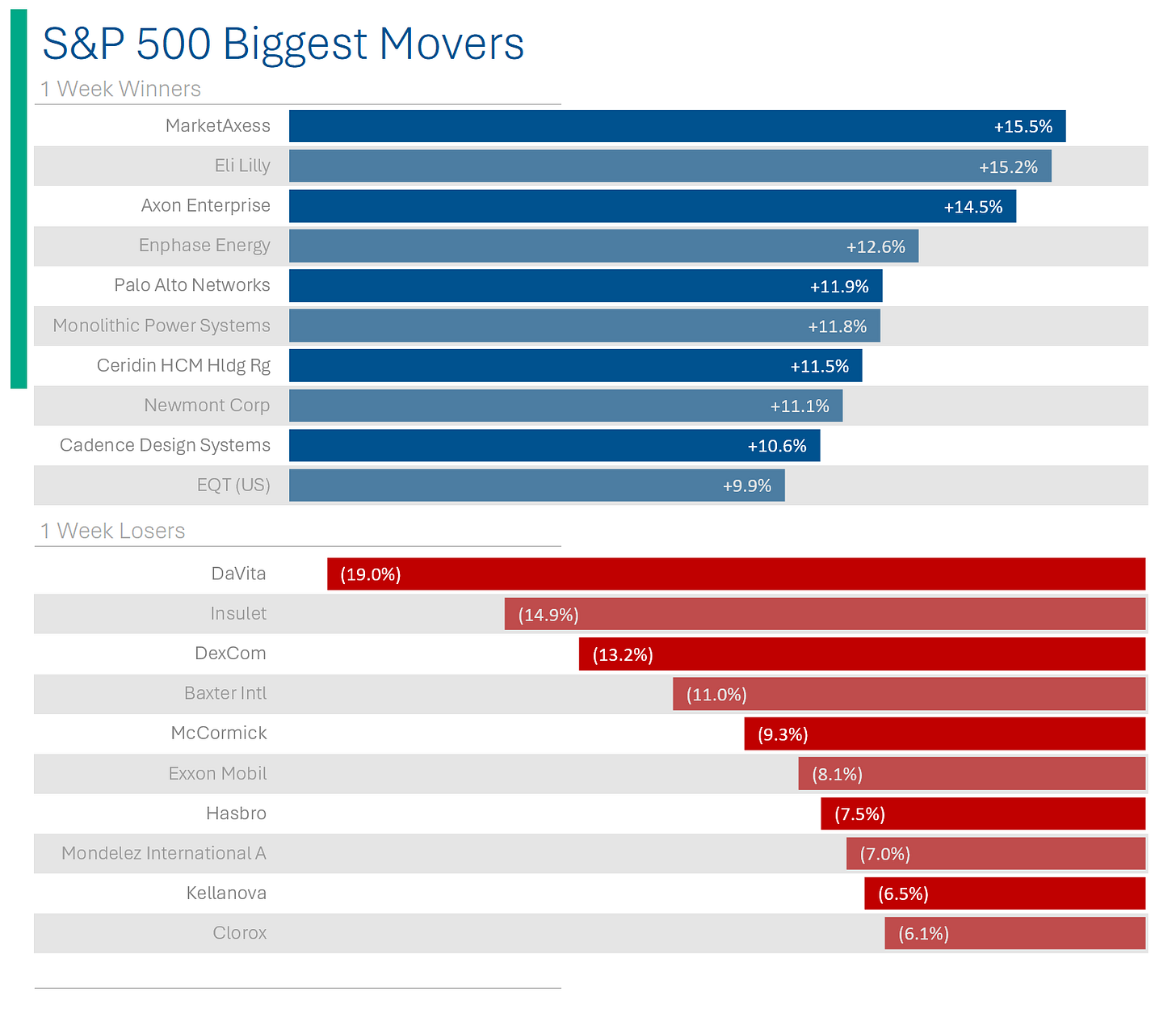

Fewer patients ending up with end-stage renal disease is bad for companies that run dialysis clinics (like, say, Fresenius and DaVita) and companies that make medical equipment and supplies for kidney failure (like DaVita, Baxter, Intuitive Surgical and Boston Scientific). Ouch!

Take-Aways: Diabetes, then weight-loss and now kidney disease, Ozempic is magical. Next up is hair-loss.

Also, I held a lot of DaVita shares back in 2016 and this is bringing up bad memories. Don’t ask.

More like ‘Birken-Flop’

Birkenstock's stock experienced a disappointing Wall Street debut, closing over 12% below its IPO price, signaling investors' wariness towards new listings.

The company's weak performance follows a trend of falling share prices post-IPO, as seen with Arm Holdings, Instacart, and Klaviyo, highlighting low investor demand.

Thomas Hayes of Great Hill Capital attributed this trend to overvaluations of these companies, especially in a down market where other bargain opportunities are available.

Take-Aways: In my newsletter yesterday I was pretty negative on the valuation (36x forward Price to Earnings vs. S&P 500 at 20x) and harbored some suspicions about Private Equity firm L Catterton manipulating the growth outlook, so it’s nice to be validated - or at least not embarrassed.

To me, this isn’t a failed IPO though, which may seem counter intuitive given the price drop, but let’s complicate it with an example. Facebook’s IPO was considered a failure because the price dropped substantially after the IPO and stayed below that level for over a year. But this was actually a good IPO: The people that wanted to sell some of their shares got to do so (Zuck, employees, VCs and Justin Timberlake) and did it at an inflated price. In this case, Birkenstock did have some of its investors sell shares (good for them), sure, but importantly they also raised $1.5bn from sale sales. If the IPO was priced perfectly (at $40.20), for the same number of shares they would have only raised $1.3 billion.

Anyway, I’m still not sure I like Birkenstock at the bargain basement valuation of 32x P/E.

Inflation Update

September’s PPI was released yesterday, increasing by +0.5% month-on-month, driven by a +3.3% rise in energy prices and marked a yearly increase of +2.2%.

September CPI is released later today: The market anticipates the report to show a slowing to +0.3% month-on-month after August’s 0.6% increase, attributed to high energy prices.

What are PPI and CPI?

The Producer Price Index (PPI) reflects the average change over time in the selling prices received by domestic producers for their output, providing a crucial measure of inflation from the perspective of sellers and manufacturers. This is what is known as a ‘leading indicator’ as it points to potential future inflation to come (ie - if products are more expensive to make, they will also have a more expensive sale price).

The Consumer Price Index (CPI) indicates the average change over time in the prices paid by consumers for goods and services, offering insight into cost of living and inflation as experienced by consumers in the economy.

Both are important gauges of inflation

Joke Of The Day

Why did the banker break up with his girlfriend? He lost interest.

Why are Irish bankers so successful? Because their capital’s always Dublin.

Hot Headlines

(CNBC) IRS says Microsoft owes an additional $29 billion in back taxes - rounding error.

(AP) Exxon Mobil doubles down on fossil fuels with $59.5 billion deal for Pioneer Natural as prices surge - 5min before they announced the deal: “We’re all about renewable energy.”

(CNN) House GOP picks Steve Scalise as speaker nominee, but unclear if he can get the votes to win gavel - hardcores in the GOP, like Marjorie Taylor Greene, are holding out for more right-wing Jordan.

(Mashable) Firefox will have a built-in ‘fake reviews detector’ — Amazon is in trouble - so all those 5-star rated Halloween decorations that broke immediately… were a lie?

(CNN) Star witness in Sam Bankman-Fried trial offers insider account of alleged criminal enterprise - the star witness is also his ex-girlfriend and certifiably crazy. Hope they aren’t counting on her too much.

(The Hill) Trump demands ‘full apology’ from Forbes after dropping off wealthiest Americans list - I don’t think he’ll get one.

(WSJ) High UAW Wages Shrink Detroit’s Room to Maneuver - report estimates that current employees average wage is $66 per hour, the highest in the world (Germany is at ~$62).

Trivia

Who is credited with popularizing the index fund?

Warren Buffett

Peter Lynch

John Bogle

George Soros

Mutual fund fees typically average between 0.5% to -1.0%. What is the current expense ratio of the Vanguard S&P 500 ETF (VOO)?

0.5%

0.3%

0.08%

0.03%

(answers at bottom)

Market Update

Trivia Answers

John Bogle. He was the founder and chief executive of The Vanguard Group, and preached investment over speculation, long-term patience over short-term action, and reducing broker fees as much as possible. Bogle is typically credited with creating the first index fund but he was technically a few years behind Rex Sinquefield in that regard.

0.03%. I guess if you manage +$8 trillion like Vanguard does you don’t really need high fees.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and Subscribe!