🔬Bill Ackman's Reboot

Plus: Oil is a disaster (and I'm ok with that); Boeing is also a disaster (ditto); and much more!

"The man who moves a mountain begins by carrying away small stones."

- Confucius

"Learn how to take a punch or you should not be doing this job."

- Bill Ackman

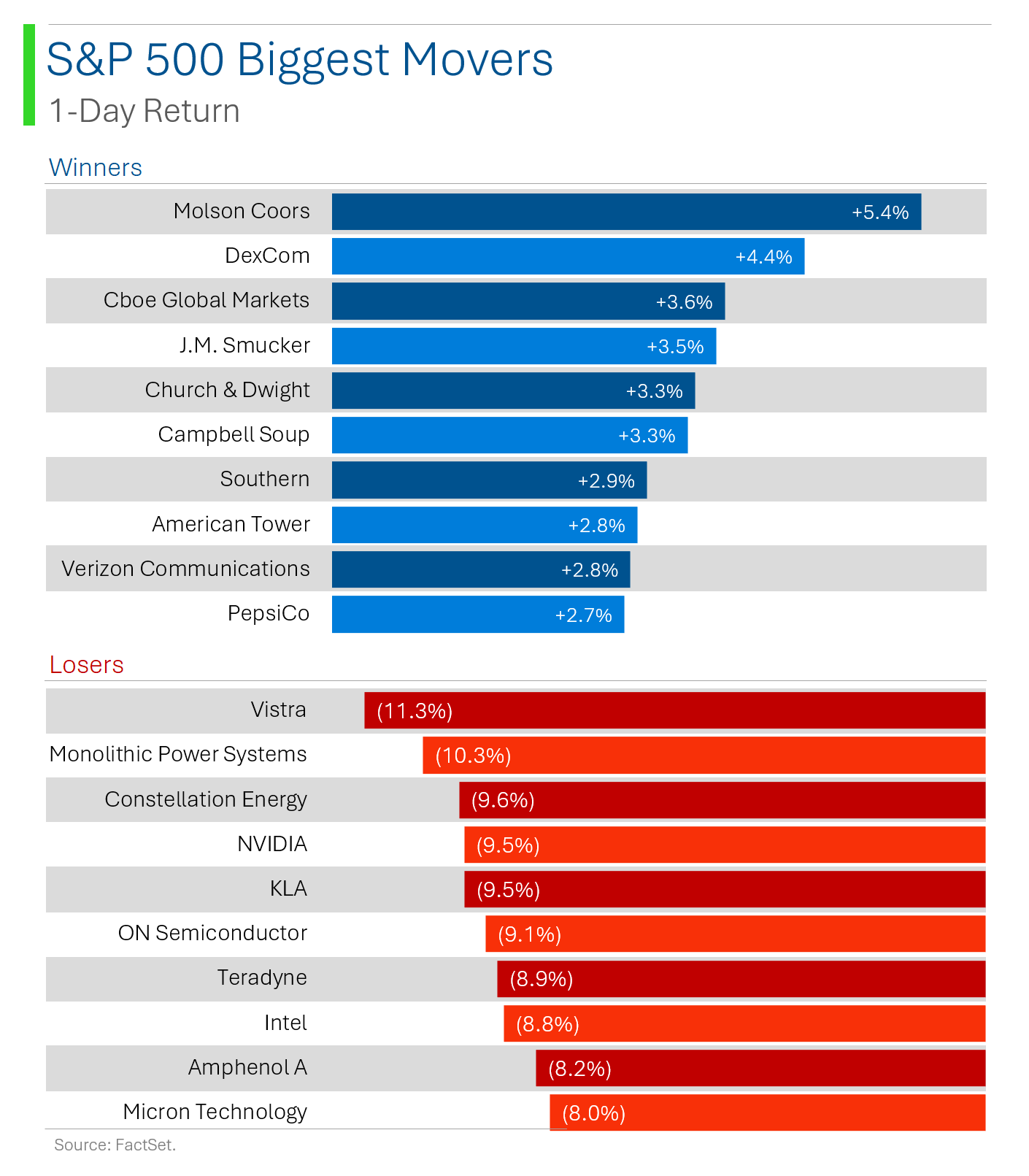

Brutal day for the big US markets with the S&P 500 -2.1% and Nasdaq -3.3%, as the September Effect and weak ISM data soured the market’s mood. Even Small-Caps couldn’t escape the carnage as the Russell 2K fell 3.1%.

Only 2 of 11 sectors finished higher (Staples +0.8%; Real Estate +0.3%), while Tech (-4.4%) imploded - mostly due to Semiconductor weakness of which Nvidia was the poster child.

The PHLX Semiconductor Sector ETF ($SOX) had it’s worst day since March 2020 (you know, the pandemic) finishing down a massive 7.8%.

WTI Crude Oil also fell 4.3% on China demand worries and expectations for OPEC+ to start backing off production cuts.

Notable companies:

Southwest Airlines (LUV) [+2.3%] Reuters reported that Elliott Management's stake crossed the 10% threshold, allowing it to call a special meeting.

Boeing (BA) [-7.3%] was downgraded to underweight from equal weight at Wells Fargo, which noted free cash flow per share peaking by 2027 due to development costs and further dilution from an equity raise.

United States Steel (X) [-6.1%] saw reports from the NY Times that Kamala Harris opposed Nippon Steel's proposed takeover of the company at a campaign rally.

More below in ‘Market Movers’.

Street Stories

Bill Ackman’s Reboot

One of the most controversial hedge funders, Bill Ackman, is back on the IPO scene, trying to resurrect the Pershing Square IPO after his first attempt was a comical flop.

Ackman initially aimed for a modest $25 billion IPO on the New York Stock Exchange, but investor interest was so low that he slashed the target to just $2 billion before ultimately pulling the plug.

Obviously I was devastated to hear the news…

Now, Ackman’s looking to sweeten the deal with some enticing new incentives, like a rumored promise to buy into his actual asset management company and offering early investors the right to buy additional shares at a fixed price through warrants.

This setup resembles a SPAC (special purpose acquisition company), where shares and warrants are bundled together before trading separately.

That said, I think the SPAC train might have left the station for Willy…

Meanwhile, the situation is also impacting Pershing Square Holdings, Ackman’s London-listed investment vehicle. UK investors were hoping for a fee reduction linked to the Pershing Square USA IPO, but with the relaunch still in flux, those hopes are dimming.

Additionally, Ackman’s plan to reduce his position in Universal Music by selling some of it to the US vehicle might no longer be viable. He is their largest shareholder, owning 6% of Universal, and it’s his largest position at 22% of the $12 billion fund… So it didn’t help when shares tanked at the end of July after a garbage Q2.

Despite these challenges, Pershing Square Holdings has performed well overall, with shares up almost 30% over the past year, even after the Universal Music setback. And - as much as I hate to admit it - the douche guy is actually a pretty solid investor.

However, with reduced options for maneuvering and the ongoing uncertainty, the future of Ackman’s investment vehicles is far from clear.

It’s times like these where it's important to remember the old adage: You’re only as good as your last deal.

Slippery Slope: Oil Dives as China and OPEC Steal the Show

Weakness out of China has been weighing on the oil price for some time now but the tapering off of OPEC+ production cuts turned things into a bit of a rout yesterday, with Brent Crude crashing 4.9% and taking the price negative on the year.

OPEC+ is expected to add back 180k of daily barrels to the supply chain in the coming weeks, part of the 3.6m daily supply they pulled from the market to manipulate stabilize price levels. Pricks.

Boeing’s Labor Turbulence

Things at Boeing seem to just keep getting worse, and now 32k workers are ready to go on strike. With a contract deadline looming on September 12, the chances of avoiding a walkout look slim.

Union Head Jon Holden says they’re miles apart on wages, healthcare, and retirement (sorta important things). Meanwhile, Boeing’s new CEO Kelly Ortberg is trying to patch things up but reportedly hasn’t had much luck.

Furthermore, with all the bad press, malfunctions and astronauts stuck in space, their share price has fallen almost 39% this year (so far)…

This potential strike isn’t a non-material blip with the company dealing with delayed deliveries, a 777X program that’s billions over budget, and $33.3 billion in losses over the last five years. If the workers walk, it could grind production to a halt and harm their bottom line even more.

I almost feel bad for Boeing. Psyche!

Joke Of The Day

Three econometricians went out hunting and came across a large deer. The first econometrician fired but missed by a meter to the left. The second econometrician fired but missed by a meter to the right. The third econometrician didn’t fire but shouted in triumph, “We got it! We got it!”

Hot Headlines

Yahoo Finance / Costco’s first membership price hike in 7 years just went into effect. The price hike affects 52 million members and comes with a promise of higher rewards for Executive members. Costco’s also cracking down on membership moochers with stricter ID checks - so you might need to stop using your parent’s membership.

Yahoo Finance / America’s massive hotel strike just got even bigger. Hotel workers in Baltimore have joined a massive nationwide strike with 10,200 workers walking off the job across nine U.S. cities. As the hotel industry basks in post-pandemic profits, the workers are making it clear: they want their fair share, and they’re willing to disrupt your vacation to get it.

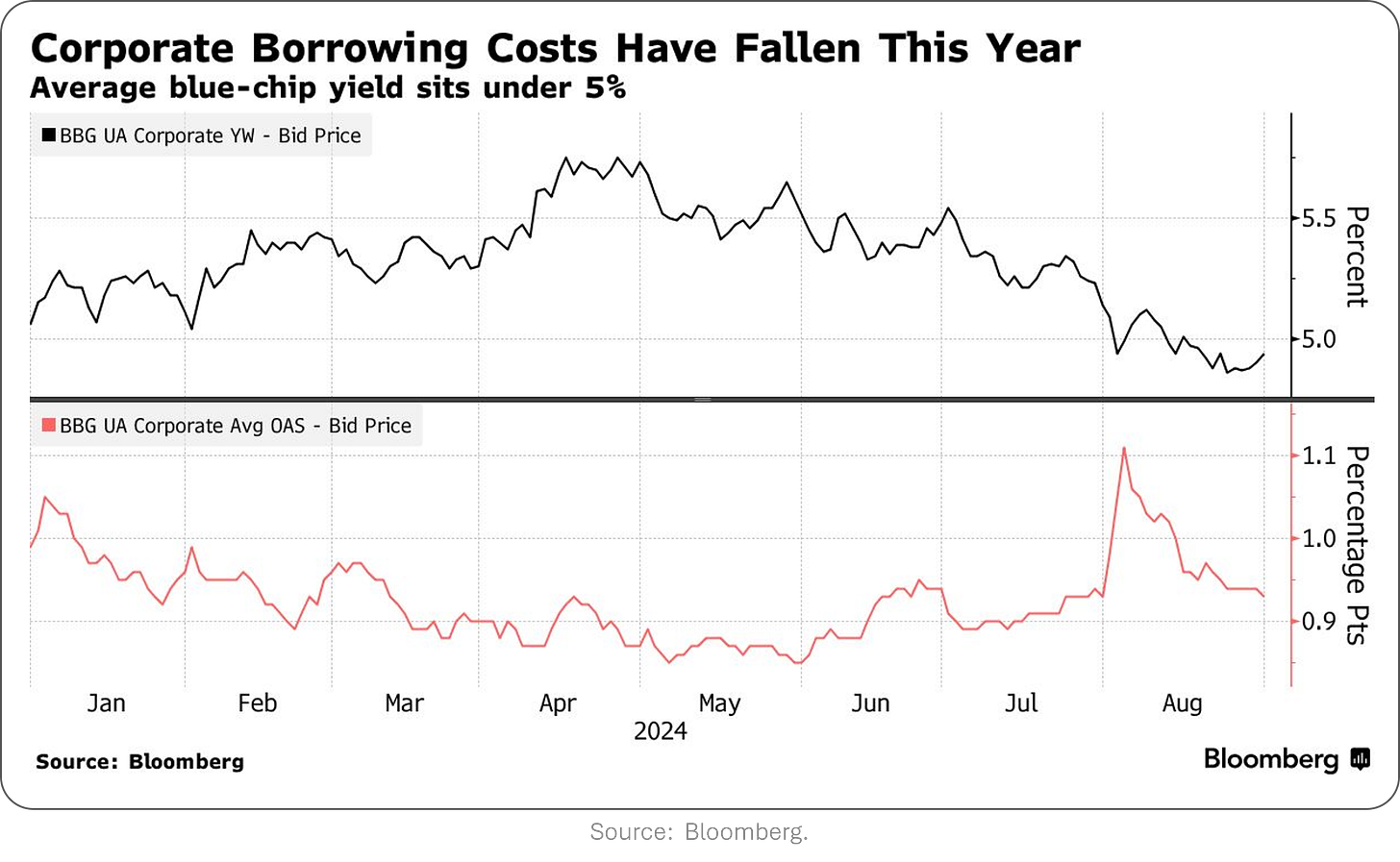

Bloomberg / Investors pile into bond market in busiest day EVER. September’s bond issuance is expected to hit around $125 billion, with a record breaking 29 blue-chip firms rushing to raise capital while borrowing costs sit below 5%.

Bloomberg / New Argentine currency launched to offset Milei’s shock therapy. Governor Ricardo Quintela is trying a bold experiment by launching a new currency called the "chacho" to combat the financial pain from President Milei’s economic reforms. While many within the province are on board with this plan, Milei does not seem like an individual that takes insubordination or differing views well…

Bloomberg / Coors beer maker joins Ford, Lowe’s and others in diversity retreat. The brewer announced it will no longer tie executive pay to diversity goals or engage with the Human Rights Campaign’s rankings. And so the pendulum swings.

CNBC / NFL season expected to spur record $35 billion in legal sports wagers. As 38 states have now legalized sports betting, companies like DraftKings and FanDuel are rolling out new features to capture the action. Furthermore, this represents a 30% increase from last season…looks like we’ve completely embraced the degeneracy.

Trivia

Today's Trivia is on Hedge Funds!

Which hedge fund, known for its aggressive short-selling strategy, was famously involved in the Herbalife controversy, claiming the company was a pyramid scheme?

A) Pershing Square Capital Management

B) Bridgewater Associates

C) Citadel LLC

D) Renaissance Technologies

What is the name of the hedge fund that collapsed in 1998, leading to a $3.6 billion bailout coordinated by the Federal Reserve due to its massive leverage and positions in derivatives?

A) Long-Term Capital Management (LTCM)

B) Citadel

C) Fortress

D) Lehman Brothers

Which hedge fund employed a "quantitative" strategy to generate returns, becoming one of the most successful and secretive hedge funds in history?

A) Tiger Global Management

B) SAC Capital Advisors

C) Renaissance Technologies

D) Elliott Management Corporation

Which hedge fund is known for its activist investment strategy, often buying significant stakes in companies to push for changes in management, operations, or strategy?

A) Third Point LLC

B) Man Group

C) Two Sigma Investments

D) Soros Fund Management

(answers at bottom)

Market Movers

Winners!

Vaxcyte (PCVX) [+36.4%] announced positive topline results from its phase 1/2 study of VAX-31 and plans to initiate a pivotal phase 3 study by mid-2025.

Shoals Technologies (SHLS) [+15.6%] received a favorable legal ruling from the US International Trade Commission in its patent infringement complaint against Voltage.

Polestar Automotive (PSNY) [+12.3%] appointed Jean-Francois Mady as CFO, effective 21-Oct.

Southwest Airlines (LUV) [+2.3%] Reuters reported that Elliott Management's stake crossed the 10% threshold, allowing it to call a special meeting.

Unity Software (U) [+2.0%] was upgraded to overweight from equal weight at Morgan Stanley, citing valuation and increased confidence in its Create game engine and derisked growth expectations.

Losers!

Dyne Therapeutics (DYN) [-30.7%] announced data for DYNE-251 for Duchenne muscular dystrophy, including several adverse events, and revealed the stepping down of its COO, CMO, and chief business officer, noting the stock is up nearly 250% YTD.

Intel (INTC) [-8.8%] was reported by Reuters to be planning a presentation to its board later this month proposing to split off unnecessary businesses and overhaul capital spending, with a potential sale of the Altera unit.

Boeing (BA) [-7.3%] was downgraded to underweight from equal weight at Wells Fargo, which noted free cash flow per share peaking by 2027 due to development costs and further dilution from an equity raise.

United States Steel (X) [-6.1%] saw reports from the NY Times that Kamala Harris opposed Nippon Steel's proposed takeover of the company at a campaign rally.

Caleres (CAL) [-5.2%] was downgraded to hold from buy at Loop Capital Markets, which cited valuation concerns following a 25% rally and potential headwinds from the election news cycle and a shortened holiday shopping season.

Xylem (XYL) [-5.0%] was downgraded to hold from buy at TD Cowen, with concerns about decelerating revenues, margins, and a high valuation multiple.

Acadia Healthcare (ACHC) [-4.5%] saw a NY Times article revealing an investigation into its psychiatric hospitals, alleging illegal detainment practices in 12 of 19 states, which ACHC defended as driven by medical necessity.

CME Group (CME) [-1.4%] was downgraded to underperform from neutral at Bank of America, citing competition from BGC Partners, CBOE, and ICE, along with headwinds amid expected rate cuts and strong markets.

Market Update

Trivia Answers

Pershing Square Capital Management is known for its aggressive short-selling strategy, particularly in the Herbalife controversy, where it claimed the company was a pyramid scheme.

Long-Term Capital Management (LTCM) collapsed in 1998, leading to a $3.6 billion bailout coordinated by the Federal Reserve due to its massive leverage and positions in derivatives.

Renaissance Technologies employed a "quantitative" strategy, making it one of the most successful and secretive hedge funds in history.

Third Point LLC is known for its activist investment strategy, often buying significant stakes in companies to push for changes in management, operations, or strategy.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.