🔬Batteries Included: A Snapshot of the EV Market

Plus: Nvidia's back in the triple trillion club; and much more!

“Make the most of yourself by fanning the tiny, inner sparks of possibility into flames of achievement.”

- Golda Meir, fourth Prime Minister of Israel

“Here’s something to think about: How come you never see a headline like ‘Psychic Wins Lottery’?”

- Jay Leno

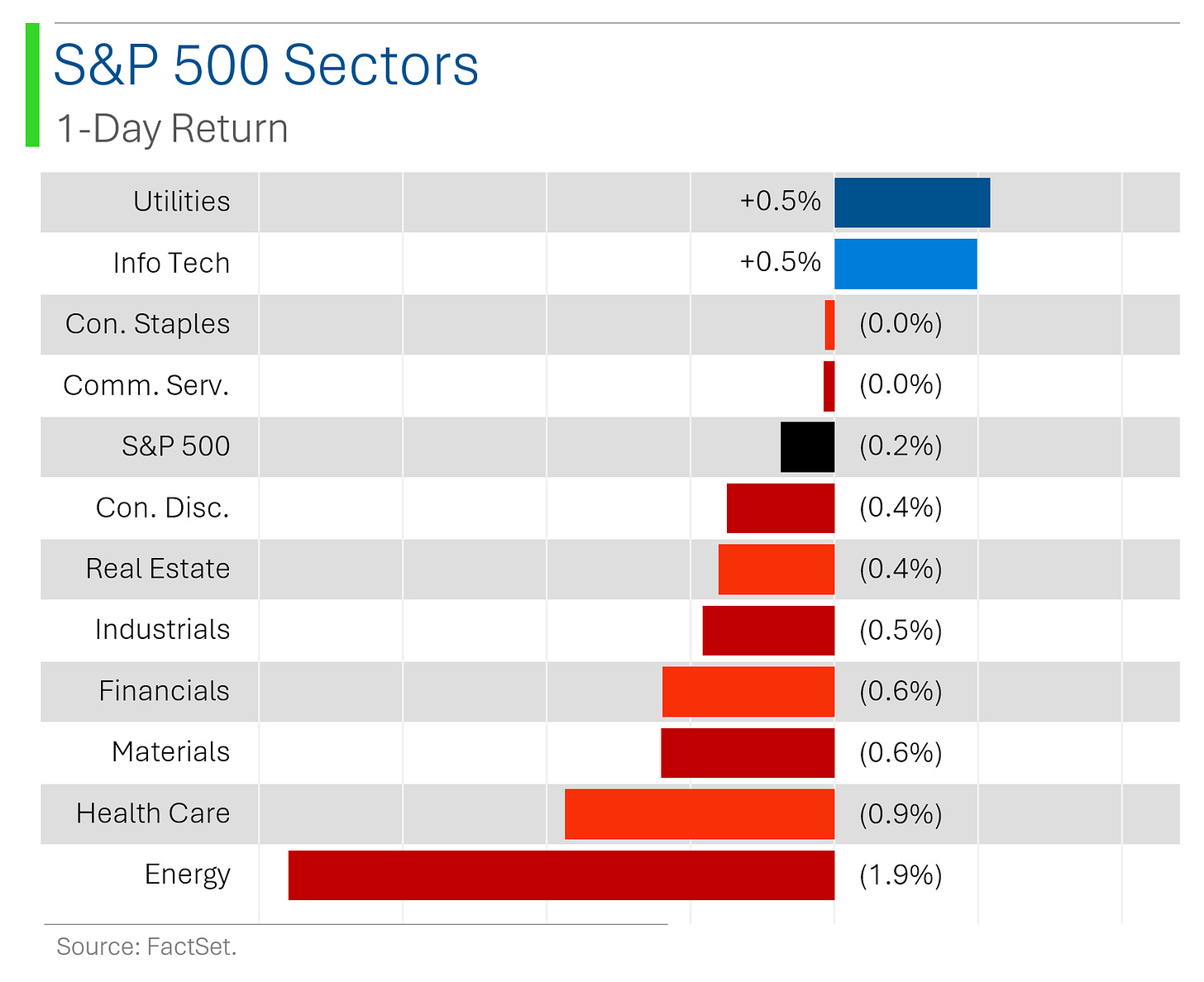

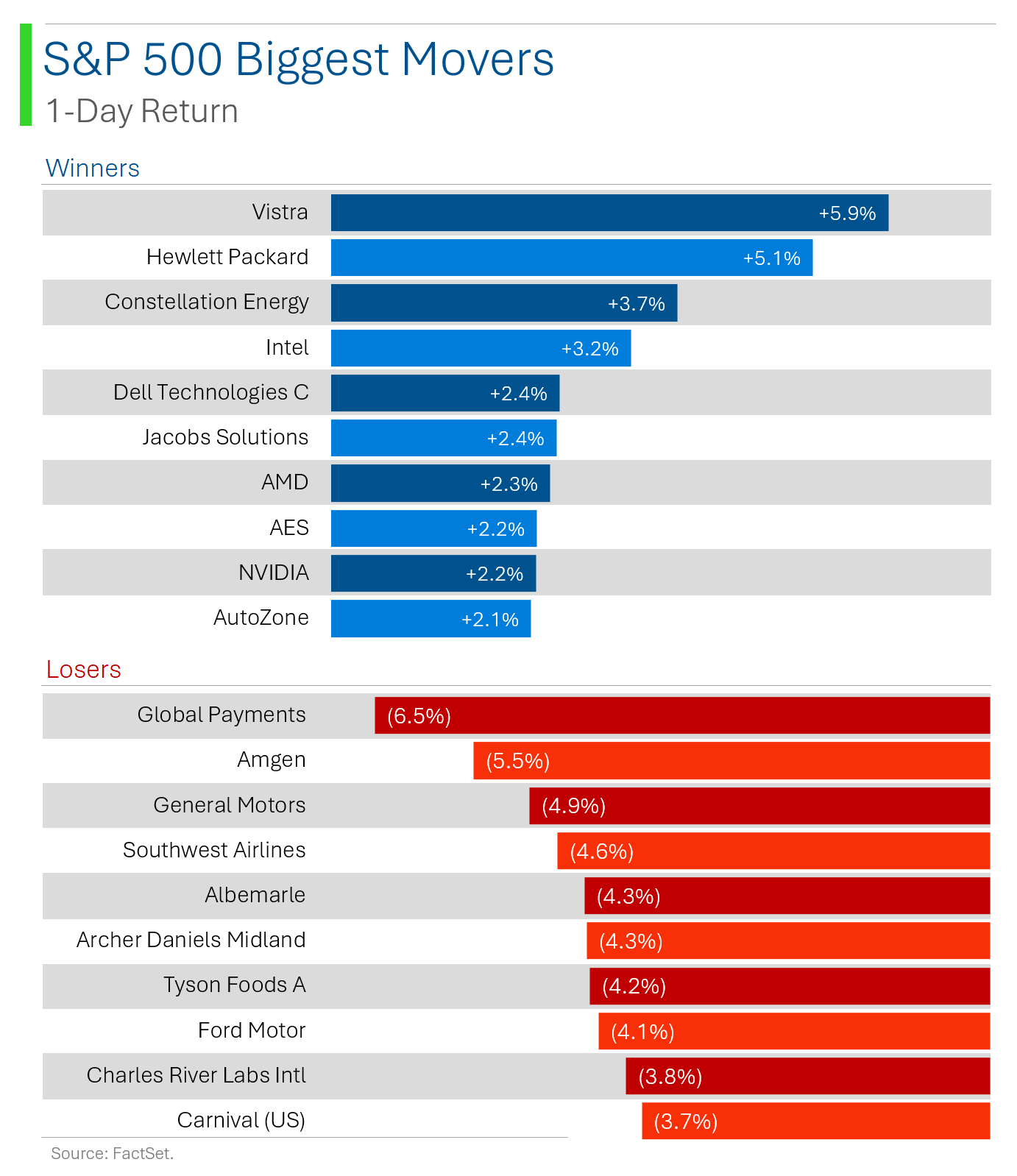

US Markets Mixed Performance: Equities were mostly lower, with underperformance in homebuilders, energy, biotech (Amgen), and Chinese tech, while big tech was mixed but held up by Meta and Nvidia. Outperformers included larger-cap semiconductors, airlines, utilities, and casinos, with a steepening treasury curve and a dollar gain of 0.5%.

Market Pullback Drivers: The decline is attributed to overbought conditions, skepticism over China's stimulus, and geopolitical tensions, with concerns about high valuations and reduced buyback support. Investors are waiting for the upcoming Non-Farm Payroll (NFP) report and Q3 earnings season.

Corporate and Economic Updates: Meta's Connect event introduced a new AI chatbot and smart glasses features. Economic data included a slight decline in August new home sales, while SAP faced a DoJ investigation, and Boeing continued to make strike-related headlines.

Notable companies:

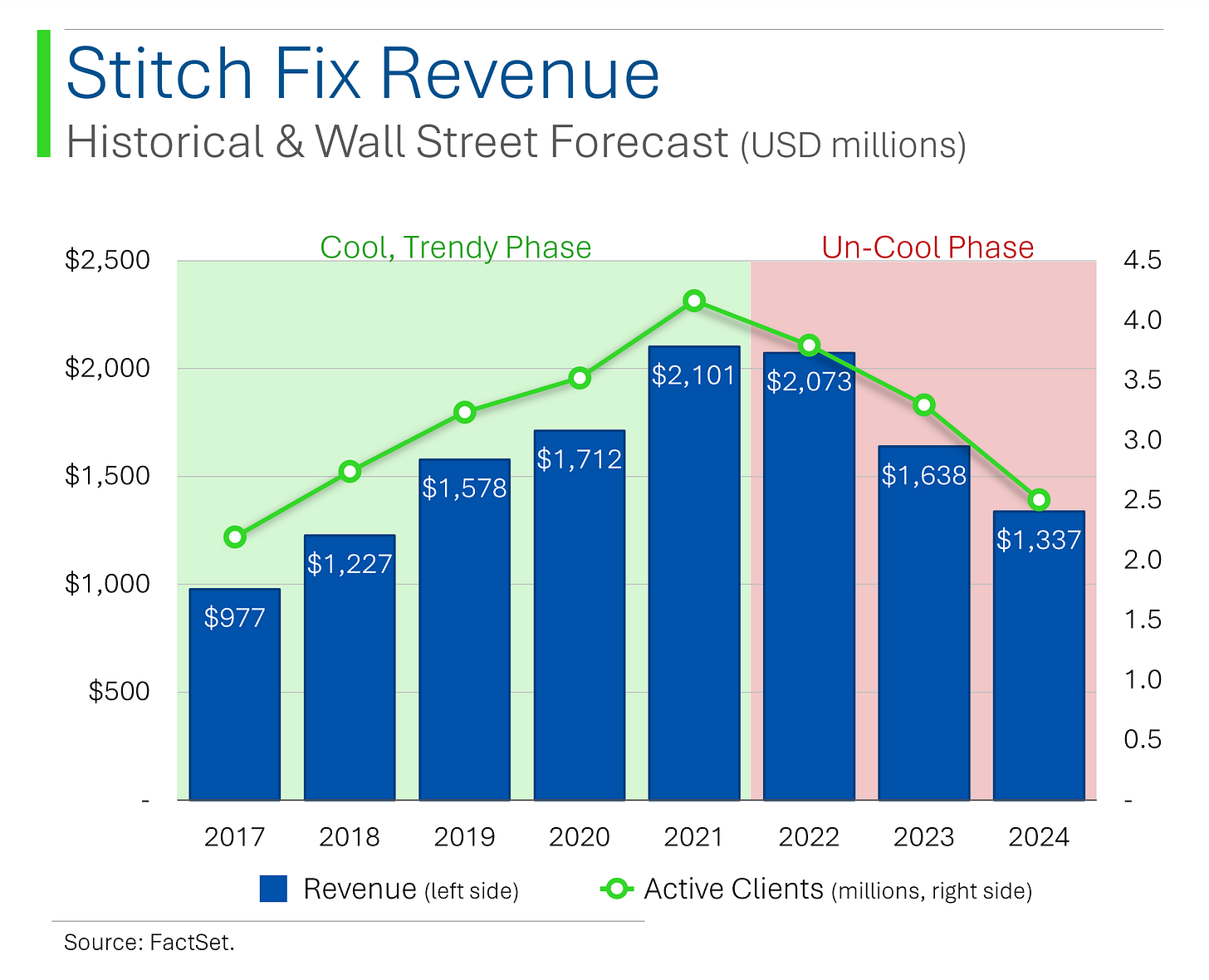

Stitch Fix (SFIX) [-39.5%]: FQ4 EBITDA beat, but clients are down, FY25 guidance missed expectations, and they’re aiming for a growth comeback by FY26, though analysts are cautious about the long path ahead.

Rivian (RIVN) [-6.8%]: Morgan Stanley downgraded them, pointing to rising US auto inventories, consumer credit issues, and challenges in building a competitive computer platform.

Amgen (AMGN) [-5.5%]: Phase 3 results for their atopic dermatitis drug were lukewarm, with analysts flagging weaker efficacy compared to Sanofi’s Dupixent.

More below in ‘Market Movers’.

Street Stories

Batteries Included…Hopefully

The global EV market is racing ahead, with 17 million sales projected for 2024, making up nearly 20% of total car sales.

But, it’s not all smooth driving… Especially for the US.

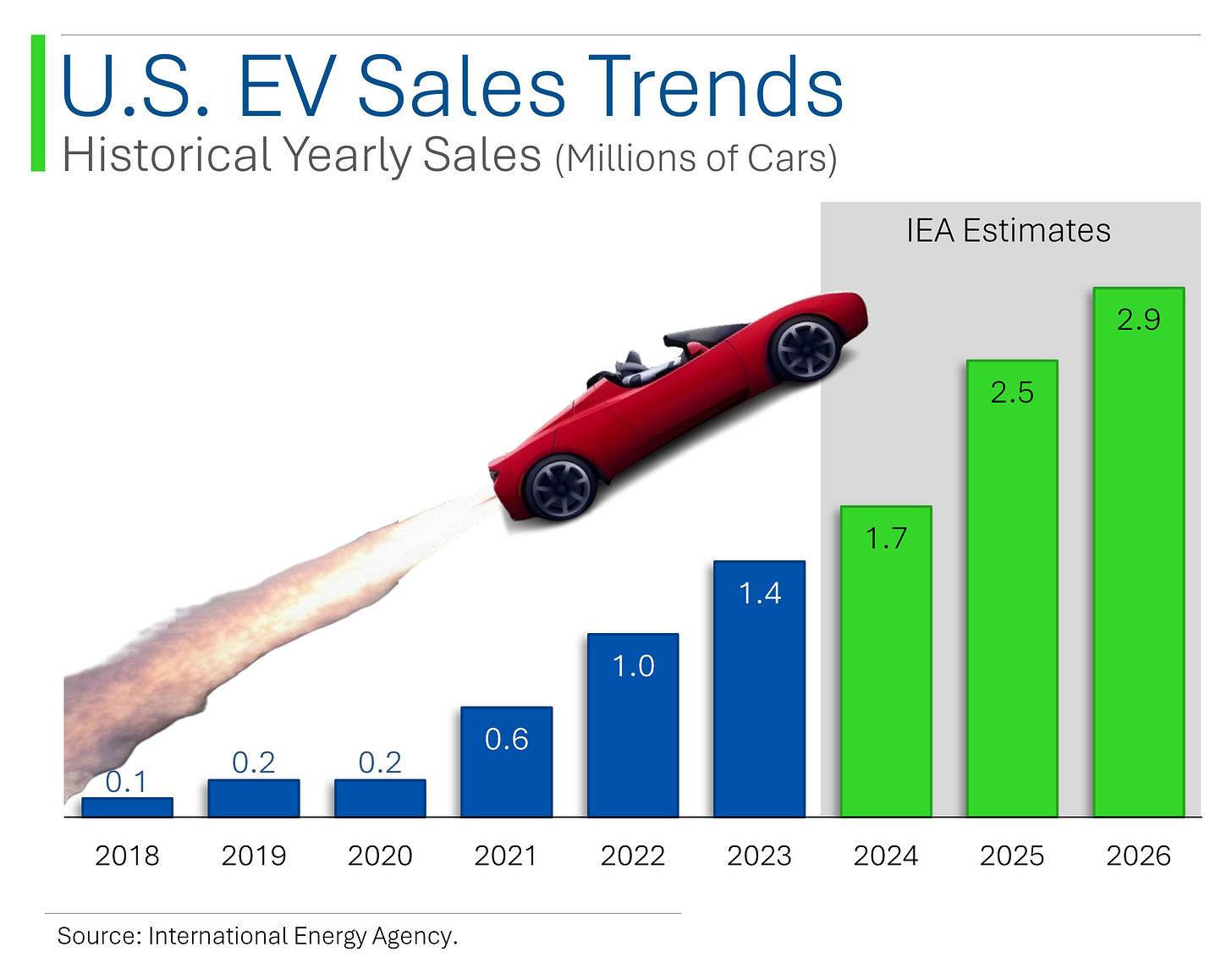

2024 has been the year of tariffs, tech bans, and geopolitical tensions, which are all having huge effects on the American and global EV markets. That said, in 2024, U.S. EV sales are projected to grow by 21%, reaching 1.7 million units, up from 1.4 million in 2023.

And as you can see below, this follows a trend of rapid growth, with EV sales increasing by an average of 40% annually since 2020.

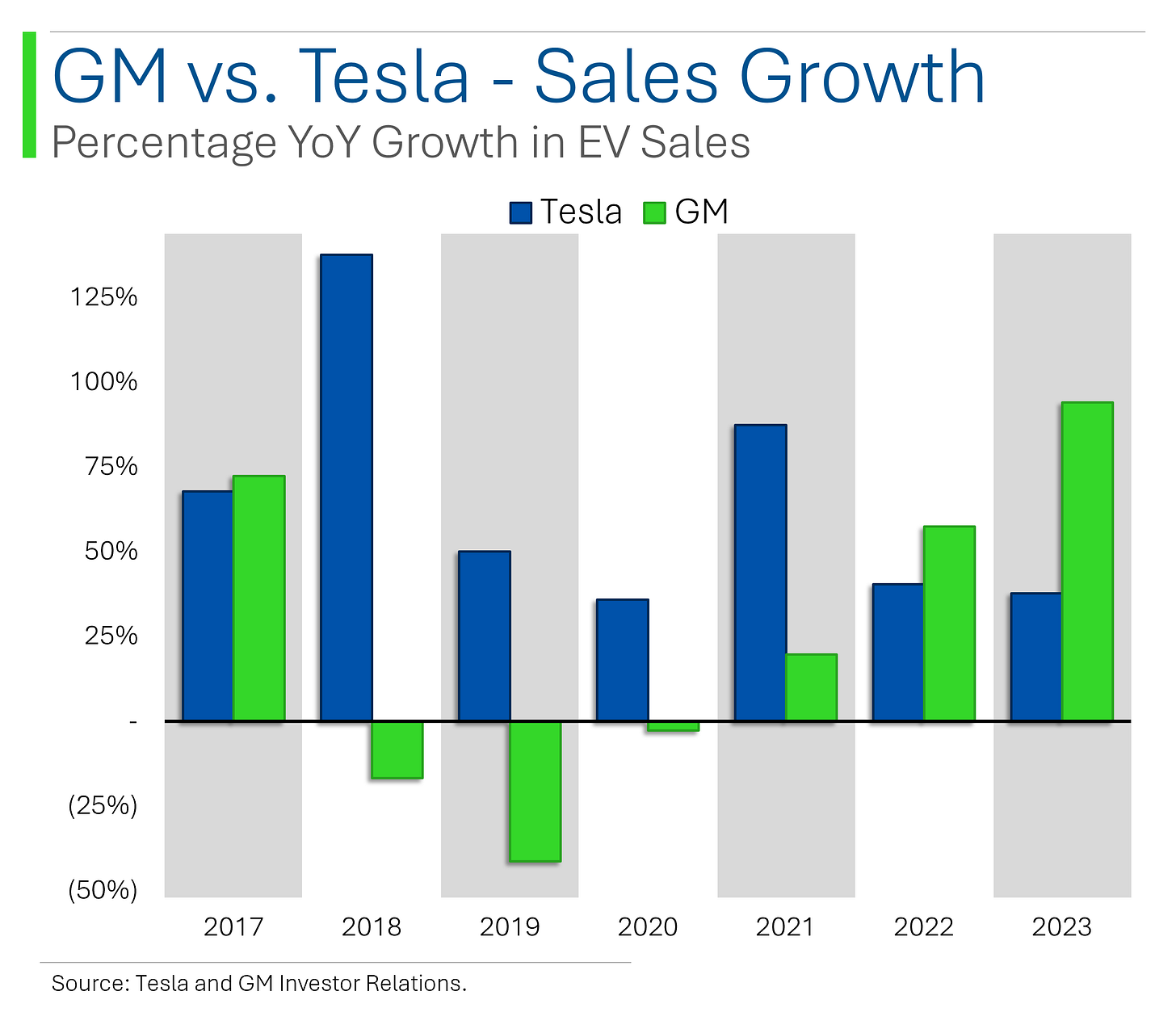

While Tesla leads, GM and Ford are steadily closing the gap, thanks to the fact that everyone’s electric cars have finally started to look less stupid…

The major shift that the US market will have to get over is the newly instituted 102.5% tariffs on Chinese EVs which has sparked fears of retaliatory measures on the part of China as well as an overall more costly end product for consumers.

I can’t imagine this will get better with Trump in the Oval Office.

Zeroing in on domestic car-makers, GM is finally gaining momentum in 2024, selling 21,000 EVs in just July and August, putting it in a close race with Ford and Hyundai.

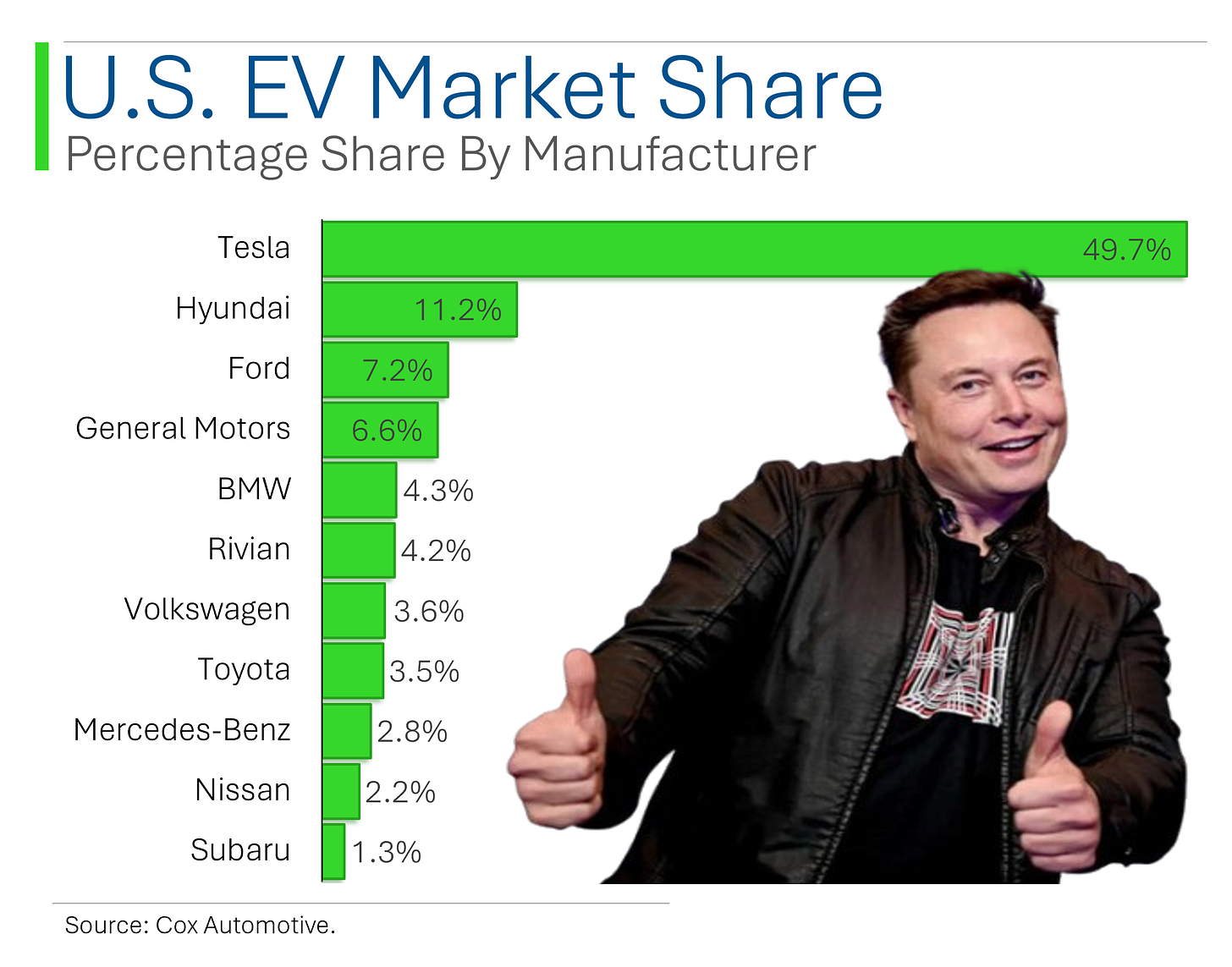

But as we all know, Tesla still dominates, with 164,000 vehicles sold in Q2 alone, more than its closest competitors combined.

These trends towards EVs have been driven by a multitude of factors, including:

Federal and state-level subsidies have made EVs more affordable.

Advancements in battery technology have improved range and lowered costs.

The rollout of charging infrastructure has also helped boost consumer confidence in EV adoption and lowered “range anxiety”.

Automakers have started offering a broader lineup of EV models, catering to both budget-conscious buyers and luxury-seekers.

And as you can see below, this has helped other automakers garner a much more material share of the market compared to just 5 years ago.

The EV market is booming, but the landscape is complex: Tariffs, tech bans, and a race to build charging infrastructure make 2024 a pivotal year.

I’m still not ready to buy one yet though.

Afterall, I had one of these bad boys as a kid and nothing will compare.

More like ‘Stitch Broken’

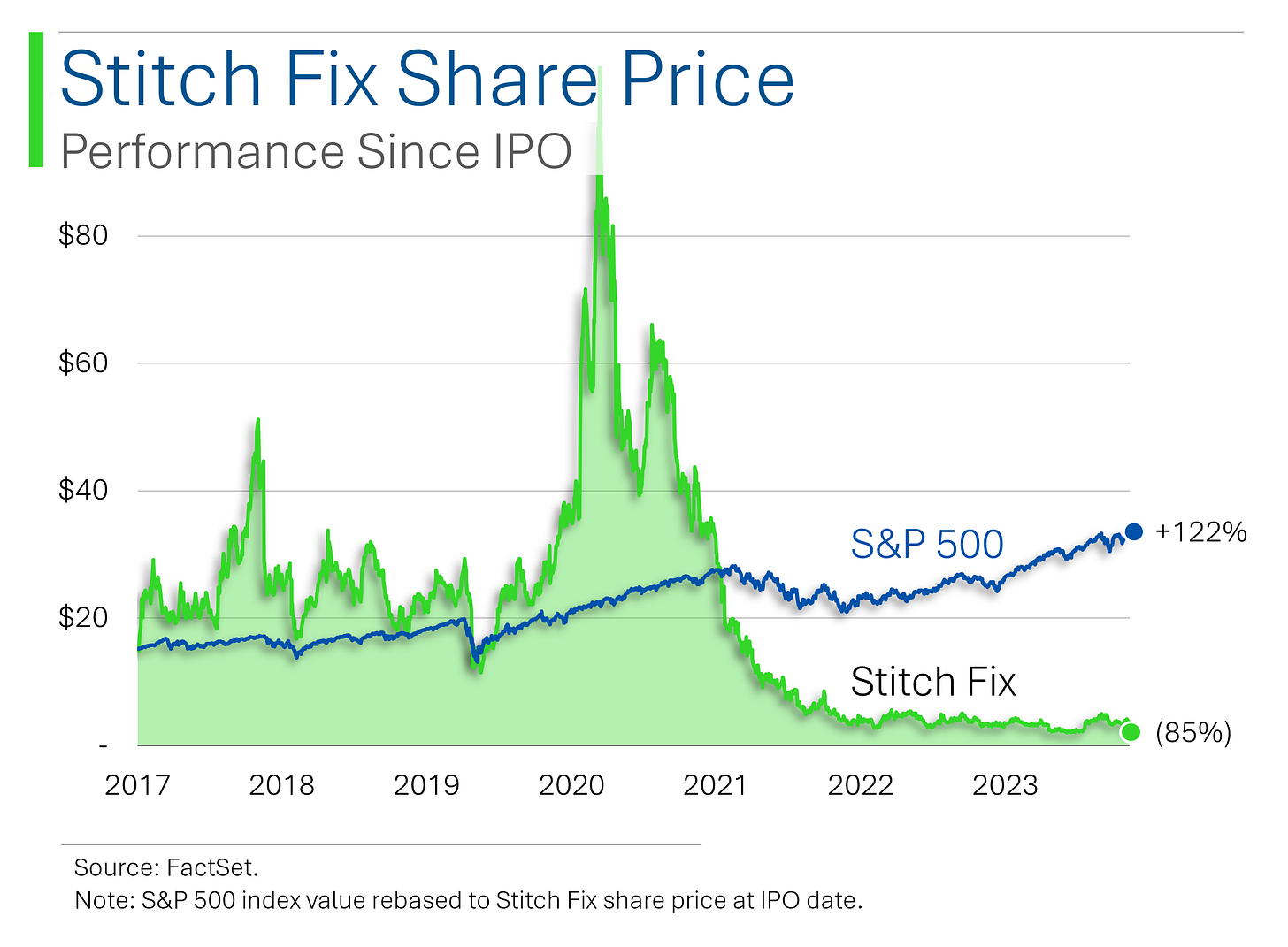

Former techy unicorn Stitch Fix continued its plunge into irrelevance after flopping another quarter yesterday, power-bombing the shares down 39.5%. In a rare feat, the company actually beat on EBITDA, but guidance was less than optimistic. 2024 Revenue also continued it’s downward slide, while users continued their exodus from the platform.

As a result, the shares are now down 85.0% since their IPO - or an even more impressive 97.9% since their pandemic peak of $106 a share.

The Triple Trillion Tripod

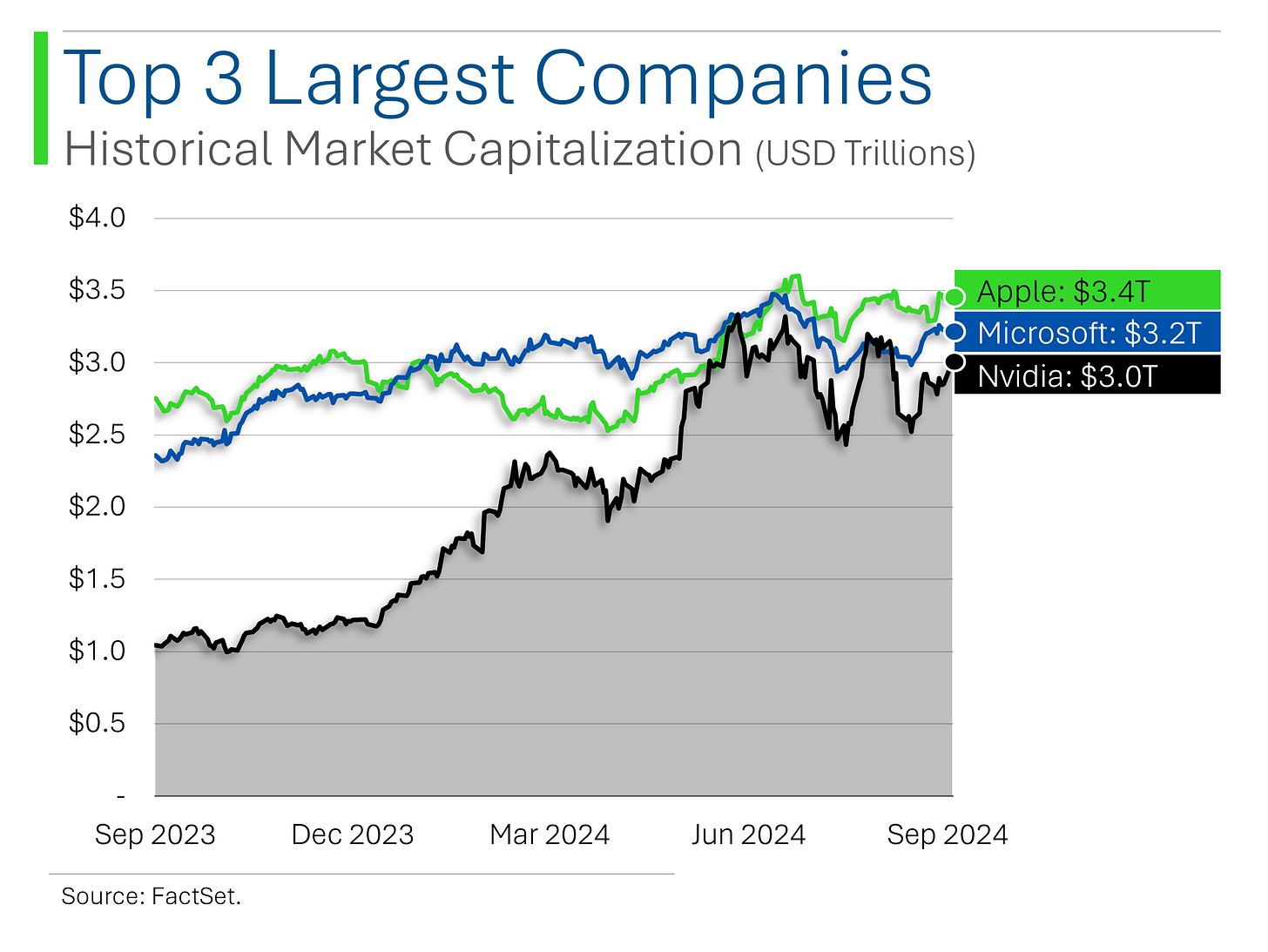

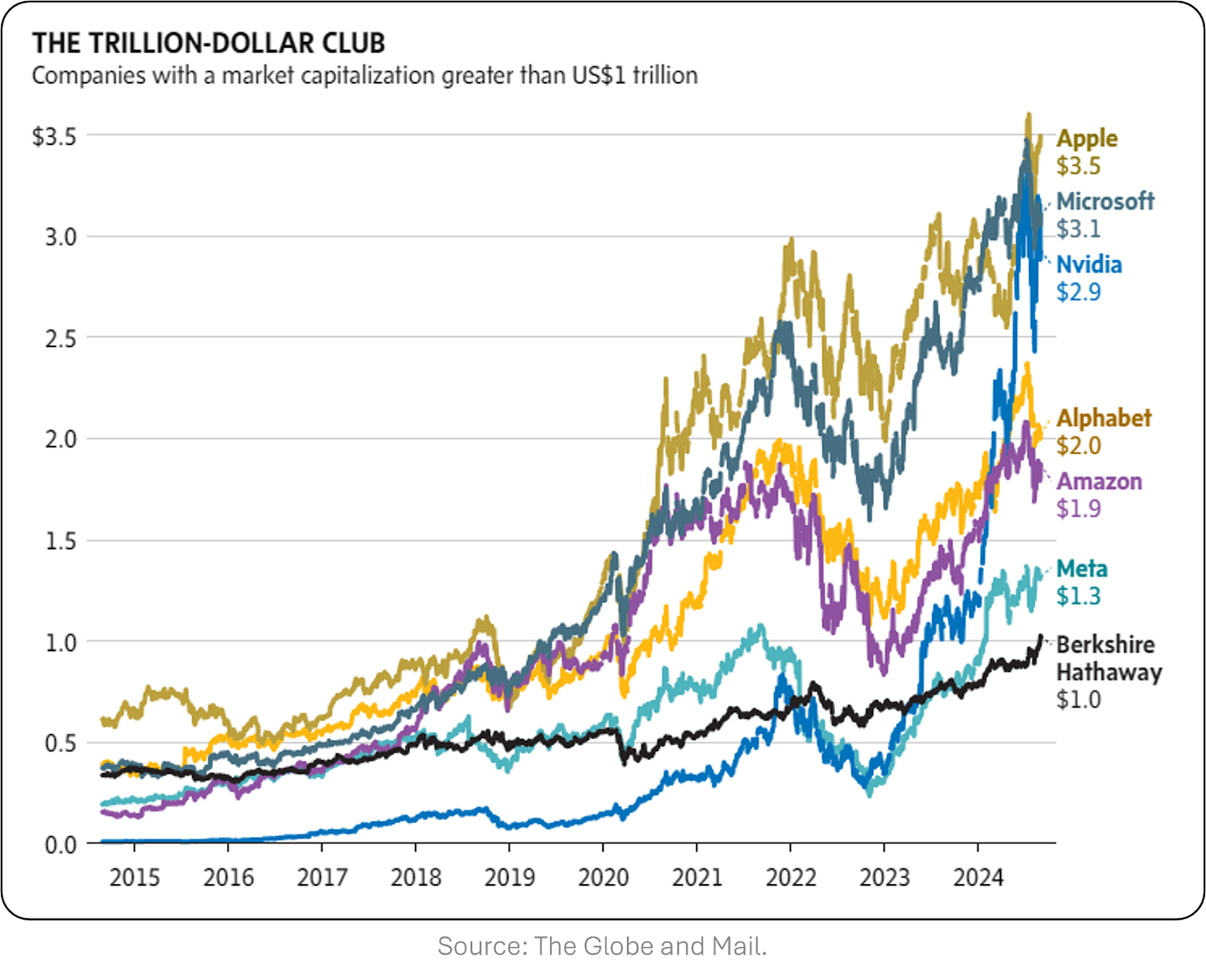

Nvidia popped up +2.2% yesterday - actually a pretty mild day for them - which means its market capitalization is back above $3 trillion again. As a result, the three biggest public companies in the world are now all back in the Triple Trillion Club (which I totally just made up).

Since breaking into the ‘TTC’ back in June, Nvidia has actually washed out 5x so here’s to hoping this time it sticks…

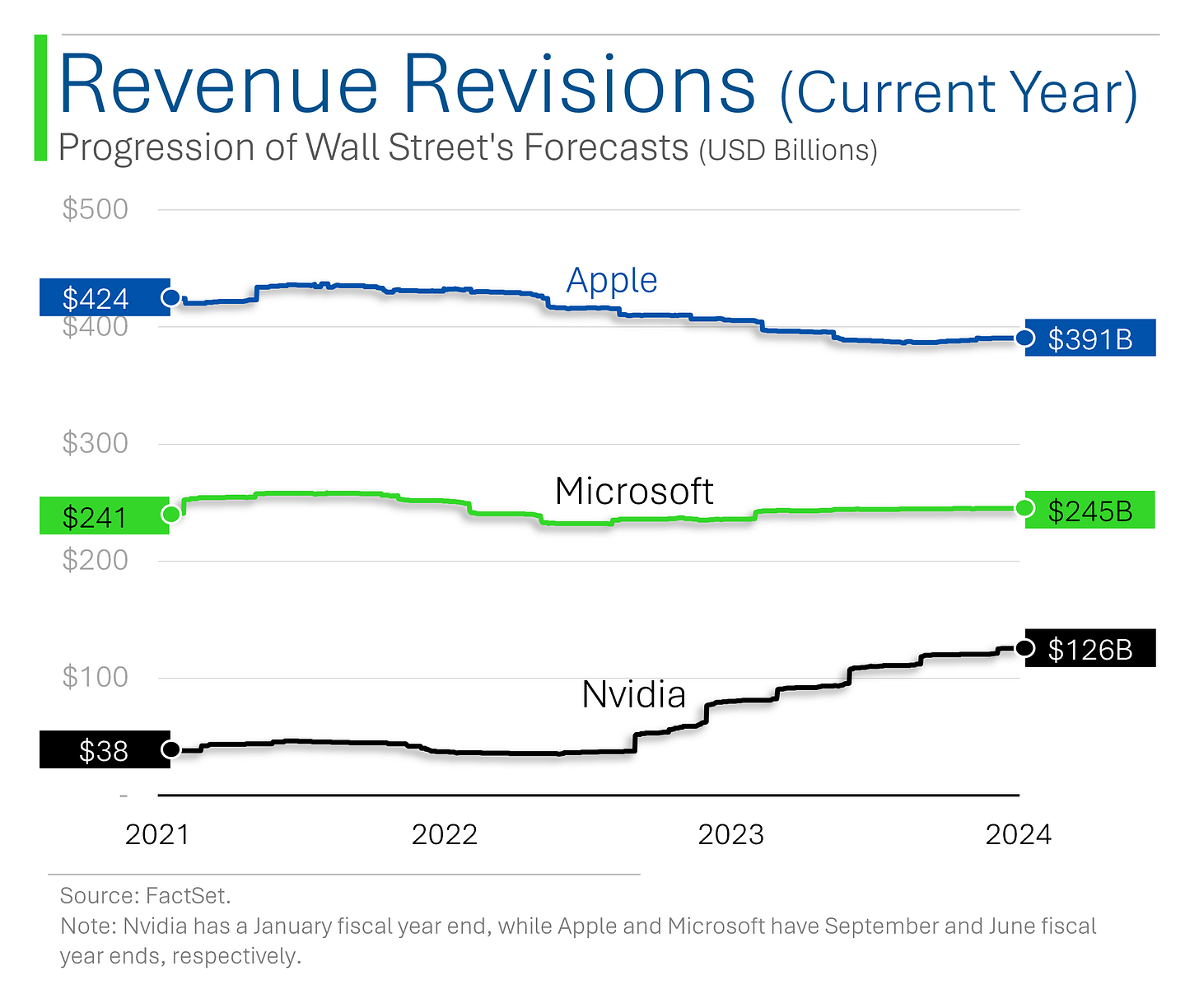

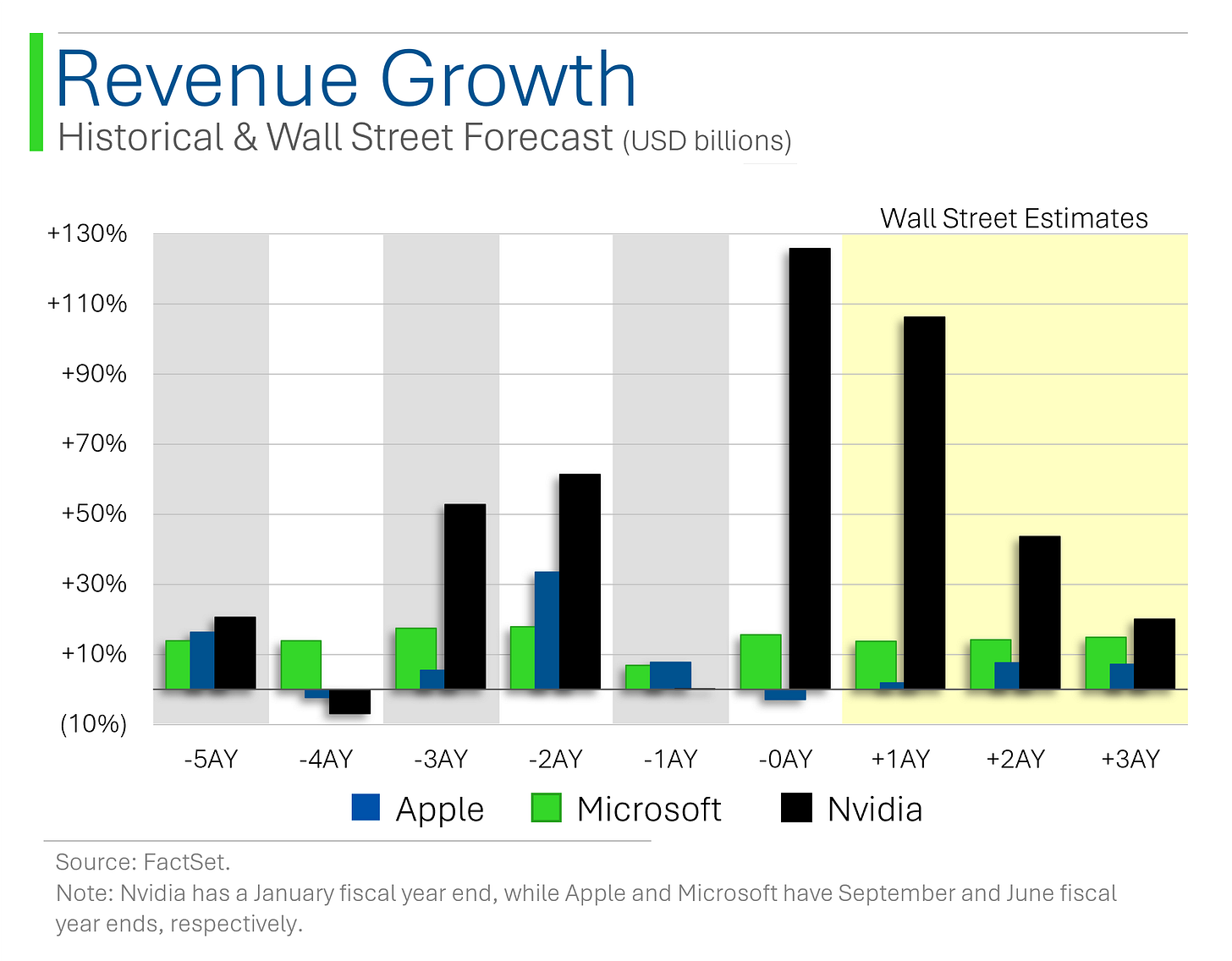

And while Nvidia’s revenue may not be anywhere as large as its big brother’s Apple and Microsoft, Wall Street has continued to grow more bullish on their prospects.

For example, Wall Street estimated their current year Revenue (FY2025) at only $38 billion a few years back, now that figure is sitting at $126 billion (+230%). Meanwhile estimates for Apple (-8%) and Microsoft (+2%) haven’t been as hyped.

So while their revenue may be smaller, it’s expected to grow a lot faster. But with Wall Street forecasting another +106% in growth this year, the bar is set EXTREMELY high.

Joke Of The Day

"I don't have a microwave, but I do have a clock that occasionally cooks s***."

Hot Headlines

CNBC / House passes bill to avert a shutdown before the election, sending it to the Senate. In a 341-82 vote, the House passed a temporary funding bill to keep the government afloat until Dec. 20, just in time for another showdown right before the holidays.

CNBC / Meta unveils $299 Quest 3S VR headset and Orion AR glasses prototype. Meta's new headset is designed to undercut its predecessor and rival Apple's $3,499 Vision Pro. Reportedly, it can handle multitasking and aims to position itself as a full computing device. That way, you never need to take it off and Meta’s ad revenue can go up in tandem…

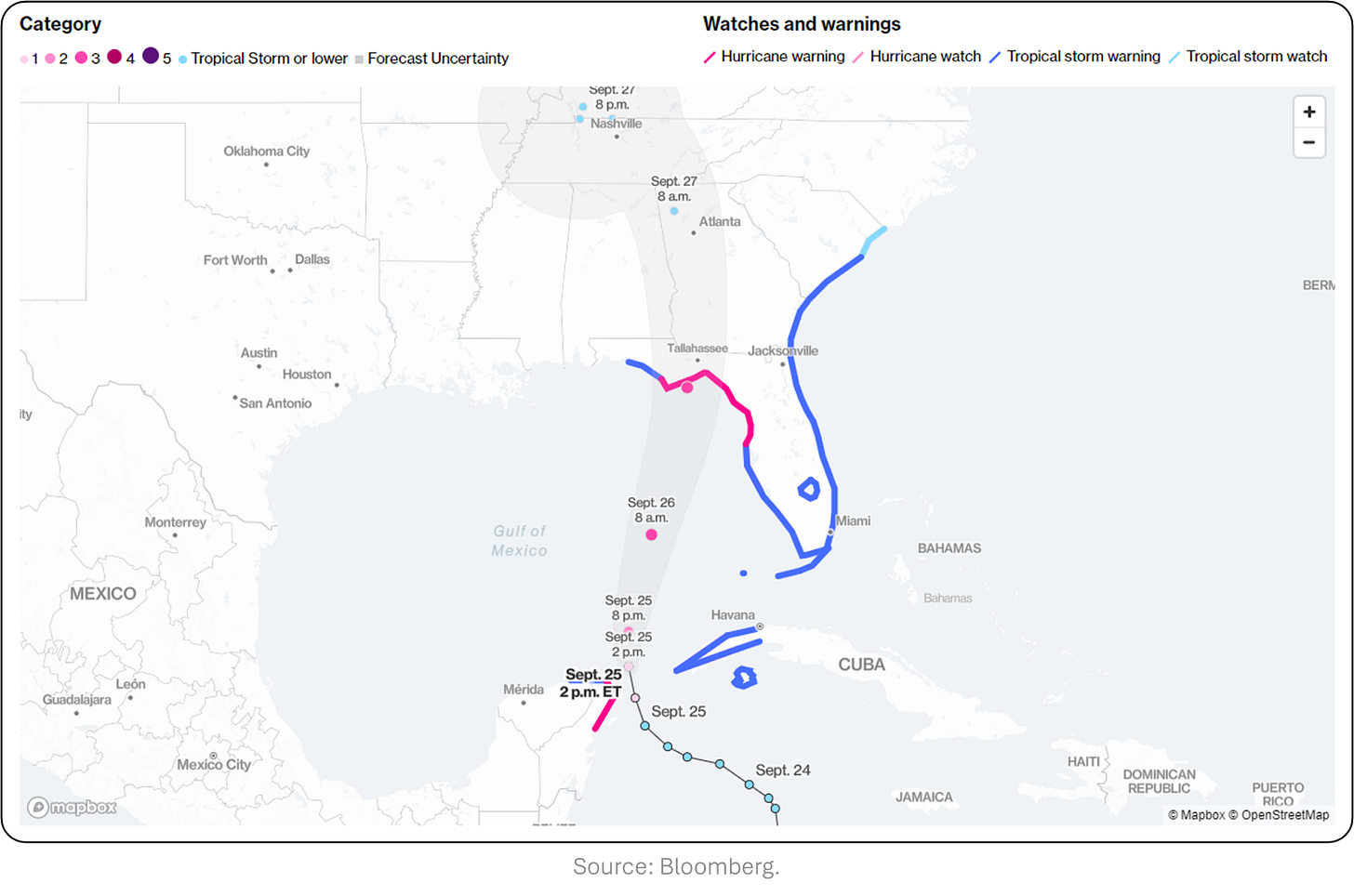

Bloomberg / Tracking Helene’s latest path. The hurricane is moving past Cancun and is heading toward Florida's Panhandle with winds reaching 85 mph. Furthermore, forecasts suggest the storm will strengthen into a Category 3 with 120 mph winds and that up to 20 inches of rain could hit parts of Florida.

Yahoo Finance / Some 7-Eleven owners in Japan fed up with strategy, welcome foreign bid. Franchise owners are citing failures like the botched 7pay system alongside a culture that doesn’t take into account their opinions on overall retailer direction. Furthermore, while some are wary of foreign ownership, most welcome Couche-Tard’s $38.5 billion bid…it's really fantastic that franchise-owners are top mind and that their opinion matters here, right?

The Globe and Mail / The $1-trillion club: Berkshire Hathaway finally joins exclusive group. Historically avoiding tech, Buffett’s late pivot to Apple and Amazon paid off, pushing Berkshire into rarefied air. To grasp the scale: $1 trillion equals 60% of Canada’s GDP. Good job Warren, it’s about time!

Yahoo Finance / Wall Street just got another sign that dealmaking is on its way back. Jefferies reported a 47% year-over-year surge in investment banking fees while other big players like JPMorgan and Citigroup also expect a boost in investment banking, despite mixed trading results. The real question though: Have you seen your bonus go up?

Trivia

Today's trivia is all about electric cars - time to see how well you're really plugged in (sorry, had to)!

Which company, founded in 1995, created the world's first commercially available electric vehicle with a range of over 300 miles per charge?

A) Tesla

B) GM

C) Nissan

D) AC PropulsionWhich country had the highest percentage of electric cars in its total vehicle fleet by 2023?

A) Norway

B) China

C) Netherlands

D) GermanyWhat is the name of the lesser-known, high-energy battery material considered a potential alternative to lithium-ion in future EV batteries?

A) Solid-state electrolyte

B) Sodium-ion

C) Aluminium-ion

D) GrapheneWhich EV manufacturer broke the record for the world’s fastest quarter-mile run in an electric car in 2021?

A) Rimac

B) Lucid Motors

C) Tesla

D) PorscheWhich of the following car brands released the first mass-produced electric vehicle back in the 1990s, only to controversially pull them off the market?

A) Toyota

B) Ford

C) General Motors

D) Chrysler

(answers at bottom)

Market Movers

Winners!

Progress Software (PRGS) [+11.9%]: Q3 earnings, revenue, and margins beat expectations, showing strong demand across products like OpenEdge, and they raised FY24 guidance while suspending dividends post-ShareFile deal to focus on M&A and buybacks.

Masimo (MASI) [+6.0%]: The Chairman and CEO is stepping down, but the company reaffirmed Q3 guidance and is still reviewing its audio and healthcare businesses.

Hewlett Packard Enterprise (HPE) [+5.1%]: Barclays upgraded them, expecting growth in server revenues, better storage results, and a boost from the Juniper deal.

Flutter Entertainment (FLUT) [+5.1%]: At their investor day, they announced plans for a $5B share buyback and forecasted big margin growth by 2027.

DoorDash (DASH) [+1.6%]: KeyBanc upgraded them, pointing to survey results that show growing market share and projecting strong order volume and EBITDA growth by 2026.

Losers!

Stitch Fix (SFIX) [-39.5%]: FQ4 EBITDA beat, but clients are down, FY25 guidance missed expectations, and they’re aiming for a growth comeback by FY26, though analysts are cautious about the long path ahead.

Rivian (RIVN) [-6.8%]: Morgan Stanley downgraded them, pointing to rising US auto inventories, consumer credit issues, and challenges in building a competitive compute platform.

Amgen (AMGN) [-5.5%]: Phase 3 results for their atopic dermatitis drug were lukewarm, with analysts flagging weaker efficacy compared to Sanofi’s Dupixent.

KB Home (KBH) [-5.4%]: Q3 orders and margins missed, noting some slowdown in the summer but improvement into September; FY25 guidance was positive, but the stock had already been outperforming.

General Motors (GM) [-4.9%]: Morgan Stanley downgraded GM due to expectations of losing market share, EV challenges, and pricing pressures in the US auto industry.

Tyson Foods (TSN) [-4.2%]: Piper Sandler downgraded them over concerns about rising cattle costs and the potential hit to margins from falling beef prices.

Trip.com Group (TCOM) [-3.7%]: Bloomberg reported Prosus NV sold its entire remaining stake in the company, offloading 14.5M shares in a block trade.

AAR Corp (AIR) [-3.5%]: Shares dropped after a report showed the company is still working with the DoJ and SEC on a probe into potentially illegal conduct involving a former employee.

SAP (SAP) [-3.3%]: Bloomberg reported the DoJ has been investigating SAP and reseller Carahsoft for potentially conspiring to fix prices on government sales since 2022.

Market Update

Trivia Answers

D) AC Propulsion – AC Propulsion, founded in 1995, created the tzero, the first electric vehicle to surpass 300 miles per charge.

A) Norway – By 2023, over 80% of Norway's total car sales were electric, the highest in the world.

B) Sodium-ion – Sodium-ion batteries are being explored as a potential alternative to lithium-ion due to cost and material availability.

A) Rimac – Rimac’s Nevera set the quarter-mile record for EVs in 2021, clocking in at just 8.6 seconds.

C) General Motors – GM’s EV1, released in the late 1990s, was one of the first modern electric cars but was controversially discontinued and largely destroyed.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.