🔬Barrels of Tension: The Most Relaxed Crisis in Oil History

"The most important thing to do if you find yourself in a hole is to stop digging."

- Warren Buffet

“Always forgive your enemies; nothing annoys them so much.”

- Oscar Wilde

US equities declined after last week's rally: Markets ended lower as tech and other sectors like autos, utilities, and homebuilders dropped, with stronger yields following the recent jobs report. Energy and pharma outperformed, while Nvidia had a positive session.

Rising yields and oil prices added market stress: Treasuries and stocks both sold off as the 10-year yield climbed, reflecting hawkish Fed repricing. Oil prices surged, raising inflation concerns, while the VIX jumped amid geopolitical risks and earnings season starting soon.

Key company and geopolitical updates were sparse today: Google was ordered to allow more competition in its app store, Chevron sold Alberta assets for $6.5B, and Boeing resumed talks with unions. Additionally, Denali, Pfizer, and Wynn were in focus for strategic moves, and Hurricane Milton poses a threat later this week.

Notable companies:

Duckhorn Portfolio (NAPA) [+102.8%]: Duckhorn is getting acquired by Butterfly Equity for $1.95B, which is a huge 106% premium to Friday’s closing price.

Amazon (AMZN) [-3.0%]: Amazon got downgraded to equal weight by Wells Fargo, citing limited margin expansion in the near term, though they remain optimistic about AWS and AI demand in the longer run.

Netflix (NFLX) [-2.5%]: Netflix was downgraded to underweight by Barclays over concerns about revenue growth challenges, although Piper Sandler upgraded the stock, pointing to potential in its ad-free business. Make up your mind Wall Street.

Street Stories

Barrels of Tension: The Most Relaxed Crisis in Oil History

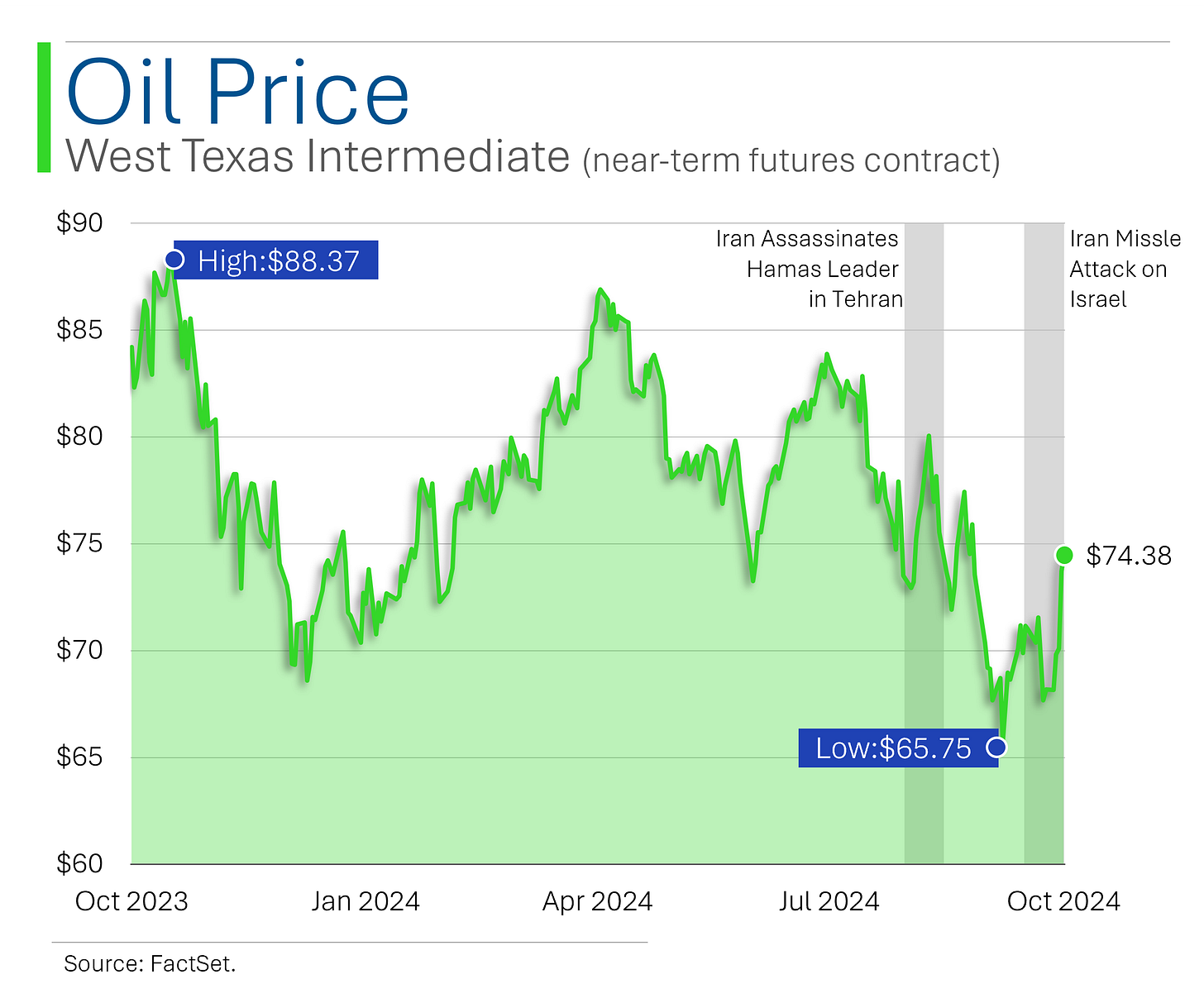

Oil prices have jumped $5 per barrel this week - quite the energetic performance - as fears mount that Israel might decide to pay Iran's energy infrastructure an unwelcomed visit.

Despite the high-stakes situation (with 4% of global supply at risk), the market's 8% weekly gain seems surprisingly modest, with Goldman Sachs predicting a $20 price hike and Swedish bank SEB warning of a potential surge to $200 in worst-case scenarios.

I mean, hell, oil is still 16% off of its 1 year high of $88 a barrel.

Part of this nuance is that the oil market is considerably short at the moment - with investors betting on falling prices due to next year's expected supply glut. Although recent developments (low inventories, market backwardation, China's stimulus, and OPEC cuts) suggest oil prices might have more potential than the skeptics think.

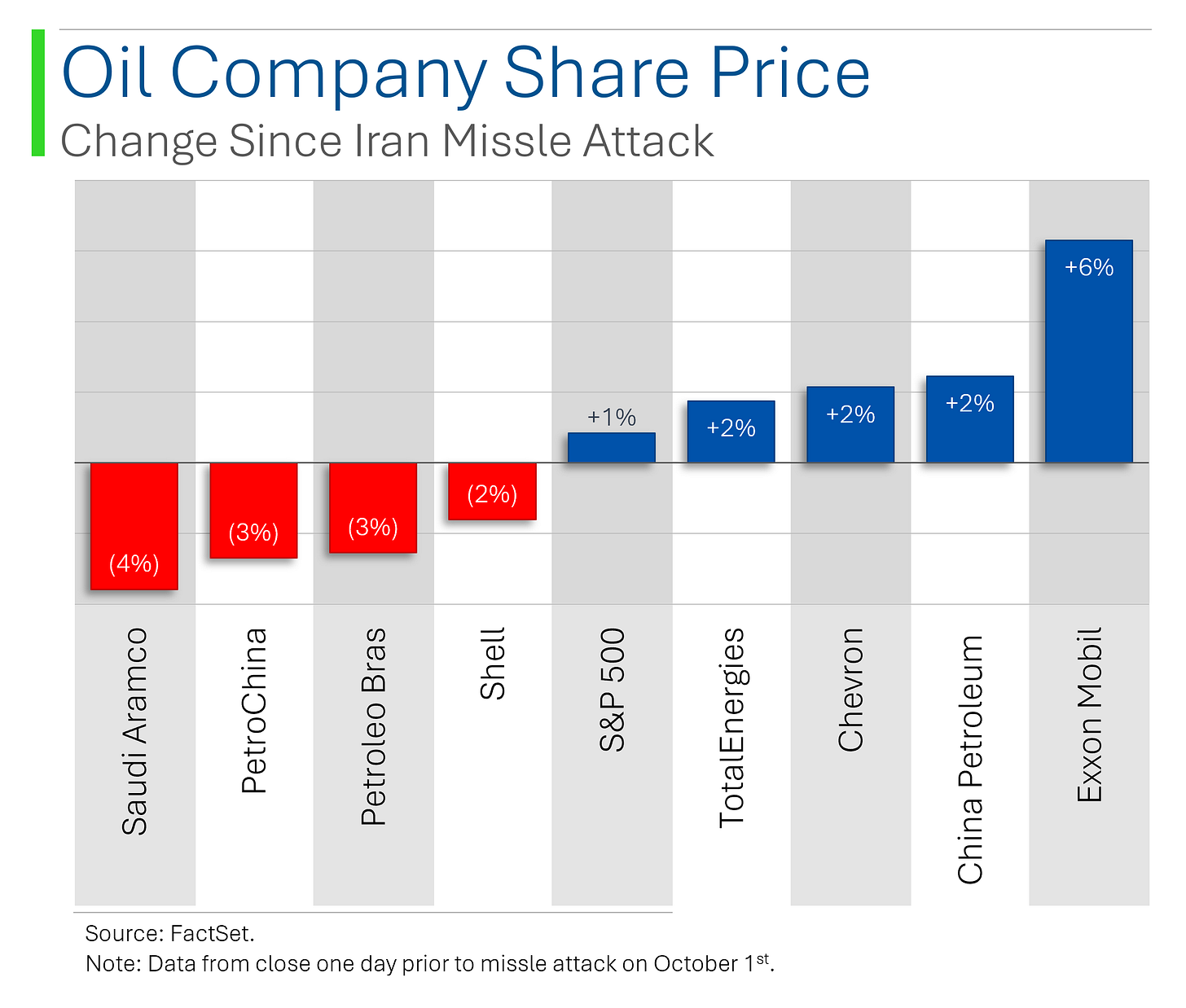

The stock market reaction has also been decidedly mixed over this as well…

The Golden Year: 2024 is Turning into a Shiny Record Breaker

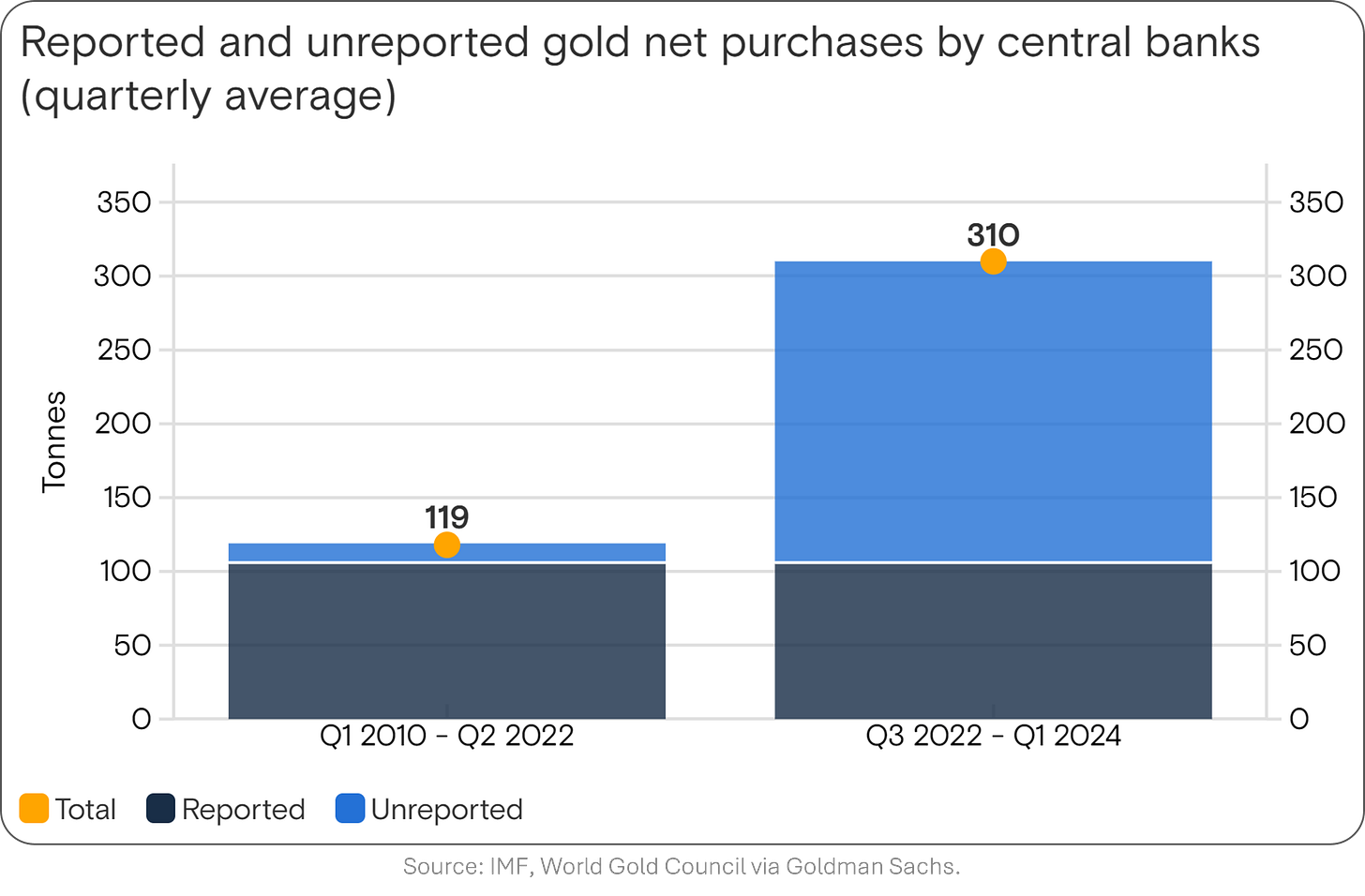

The price of gold has skyrocketed this year to near $2,700 per troy ounce, a 29% increase that would place it in the top three largest annual moves since 1980 if it can maintain these level until January.

The gain is also the highest it’s been by this point in the year year since 1986 (+32%), and even sits higher than what we saw in 2020 (+27%) and 2010 (+25%) - which if you recall, were some pretty scary times (that’s when gold does it’s best).

While gold’s usefulness as an inflation hedge may be waning, the main culprits behind the move include:

Central bank purchases: Since Russia’s 2022 invasion of Ukraine, central banks have tripled their gold purchases. Goldman Sachs expects this surge to continue, driven by concerns over US financial sanctions and rising sovereign debt.

Fed rate cuts: High interest rates typically make gold less attractive, but expected Fed rate cuts may draw Western investors back to the gold market after largely missing out on its recent rally.

Geopolitical shocks: Gold remains a key portfolio hedge against risks like tariffs, potential Fed independence threats, and concerns over debt sustainability.

Joke Of The Day

Three men die and go to hell. The devil, feeling generous, decided to grant each of them one wish.

The first one said “I wish I were alive again so I could have a second chance at redemption”, so the devil obliged.

The second man said “I wish I were alive again so I could live a lavish life”, which the devil also grants.

…The third man says “I wish my friends were back”.

Hot Headlines

Yahoo Finance / Costco’s gold bars fly off shelves as bullion prices smash records. So that’s all it took people to buy gold…Pretty decent spread through.

Yahoo Finance / Home insurers argue for a 42% average premium hike in North Carolina due to hurricane risk. Definitely not going to contribute to the next inflation print right?

Yahoo Finance / Hyundai has begun producing electric SUVs at its $7.6 billion plant in Georgia. #Nextstriketarget

Bloomberg / Hurricane Milton’s Category 5 winds intensify on path to Florida. I think the ex-New Yorkers are rethinking their decisions right about now…

Bloomberg / Rivian misstep triggered parts shortage hobbling its EV output. My buddy bought one of these and it's already been to the shop three times in under a year, lol.

Bloomberg / Lululemon founder’s $60 million house defaced after election sign for Conservatives went up. All I’m going to say is look into him.

CNBC / Google ordered to open Android app store in Epic Games trial. This could actually set a huge precedent for both them and Apple, only adding to their problems as the firms struggle to dominate in the AI space.

CNBC / Super Micro shares soar after server company says it’s shipping over 100k AI GPUs per quarter. Bullish for their supplier Nvidia, who sells about a million per quarter…

CNBC / 10-year Treasury yield rebounds back above 4%. Makes sense - good traders would have seen this already with the move up in gold.

Reuters / Israel marks Oct. 7 anniversary under shadow of escalating war. Memorials were held across the country, including the site of the music where 360 were killed.

Trivia

Today's trivia is all about Kamala Harris!

Which university did Kamala Harris attend for her undergraduate degree?

A) Yale University

B) Howard University

C) Stanford University

D) Princeton University

Which state did Kamala Harris represent as a U.S. Senator before becoming Vice President?

A) New York

B) California

C) Illinois

D) FloridaWhat was Kamala Harris' role before serving as a U.S. Senator?

A) Governor

B) Mayor

C) Attorney General

D) Supreme Court JudgeIn what city was Kamala Harris born?

A) Los Angeles

B) San Francisco

C) Washington, D.C.

D) OaklandWhich committee did Kamala Harris serve on while she was a U.S. Senator?

A) Senate Finance Committee

B) Senate Judiciary Committee

C) Senate Foreign Relations Committee

D) Senate Armed Services Committee

(answers at bottom)

Market Movers

Winners!

Duckhorn Portfolio (NAPA) [+102.8%]: Duckhorn is getting acquired by Butterfly Equity for $1.95B, which is a huge 106% premium to Friday’s closing price.

Super Micro Computer (SMCI) [+15.8%]: SMCI is shipping over 100K GPUs per quarter and has delivered 2K liquid cooled racks since June 2024, keeping things cool and steady.

Vista Outdoor (VSTO) [+10.5%]: Vista Outdoor is selling Revelyst to SVP for $1.13B and raised the Kinetic Group sale price to $2.23B—locking in some solid deals.

Hims & Hers Health (HIMS) [+10.1%]: Hims & Hers is getting added to the S&P SmallCap 600 on October 6, which is a nice boost for them.

Air Products (APD) [+9.5%]: Reports are swirling that Mantle Ridge has built a $1B stake in Air Products and might push for some shakeups.

Coty (COTY) [+4.1%]: Coty just got a buy upgrade from Jefferies thanks to its solid footing in the premium fragrance market, which makes up more than half of its business.

Barnes Group (B) [+2.7%]: Barnes is being acquired by APO in an all-cash deal that values the company at about $3.6B, though the premium is only around 5%.

Pfizer (PFE) [+2.2%]: Starboard Value has reportedly taken a $1B position in Pfizer and is pushing for a turnaround, enlisting the help of former top execs.

Losers!

Deckers Outdoor (DECK) [-4.8%]: Deckers saw a downgrade to neutral at Seaport Research as the Hoka and Ugg brands didn’t have the same back-to-school momentum this year, and other brands like Asics and Brooks are gaining ground.

Ciena (CIEN) [-4.7%]: Ciena got hit with a downgrade to neutral by JPMorgan, with restricted telecom spending and limited margin growth potential compared to competitors being the key issues.

Mobileye Global (MBLY) [-4.6%]: Mobileye was downgraded to underweight at JPMorgan due to concerns over its ADAS tech “SuperVision” being replaced by in-house solutions at key customer Zeekr.

Amazon (AMZN) [-3.0%]: Amazon got downgraded to equal weight by Wells Fargo, citing limited margin expansion in the near term, though they remain optimistic about AWS and AI demand in the longer run.

Netflix (NFLX) [-2.5%]: Netflix was downgraded to underweight by Barclays over concerns about revenue growth challenges, although Piper Sandler upgraded the stock, pointing to potential in its ad-free business.

Alphabet (GOOGL) [-2.4%]: A Federal judge ordered Google to allow rival app stores to compete with Google Play, opening up its mobile app business to more competition.

DuPont de Nemours (DD) [-1.8%]: DuPont got downgraded to underweight by Barclays after a strong rally this year, with expectations of underperformance and limited buyback support ahead.

Market Update

Trivia Answers

B) Howard University – Kamala Harris earned her undergraduate degree at Howard, a historically Black university in Washington, D.C.

B) California – She represented California as a U.S. Senator from 2017 to 2021.

C) Attorney General – She served as Attorney General of California from 2011 to 2017.

D) Oakland – Harris was born in Oakland, California, on October 20, 1964.

B) Senate Judiciary Committee – As a U.S. Senator, Kamala Harris served on the Senate Judiciary Committee, where she gained a reputation for her tough questioning.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.