🔬Bank Earnings Aren't Pretty, Canada's Population Trap, and Much More

"The first step towards getting somewhere is to decide you’re not going to stay where you are"

- J.P. Morgan

“Never try to teach a pig to sing. It wastes your time and annoys the pig”

- George Bernard Shaw

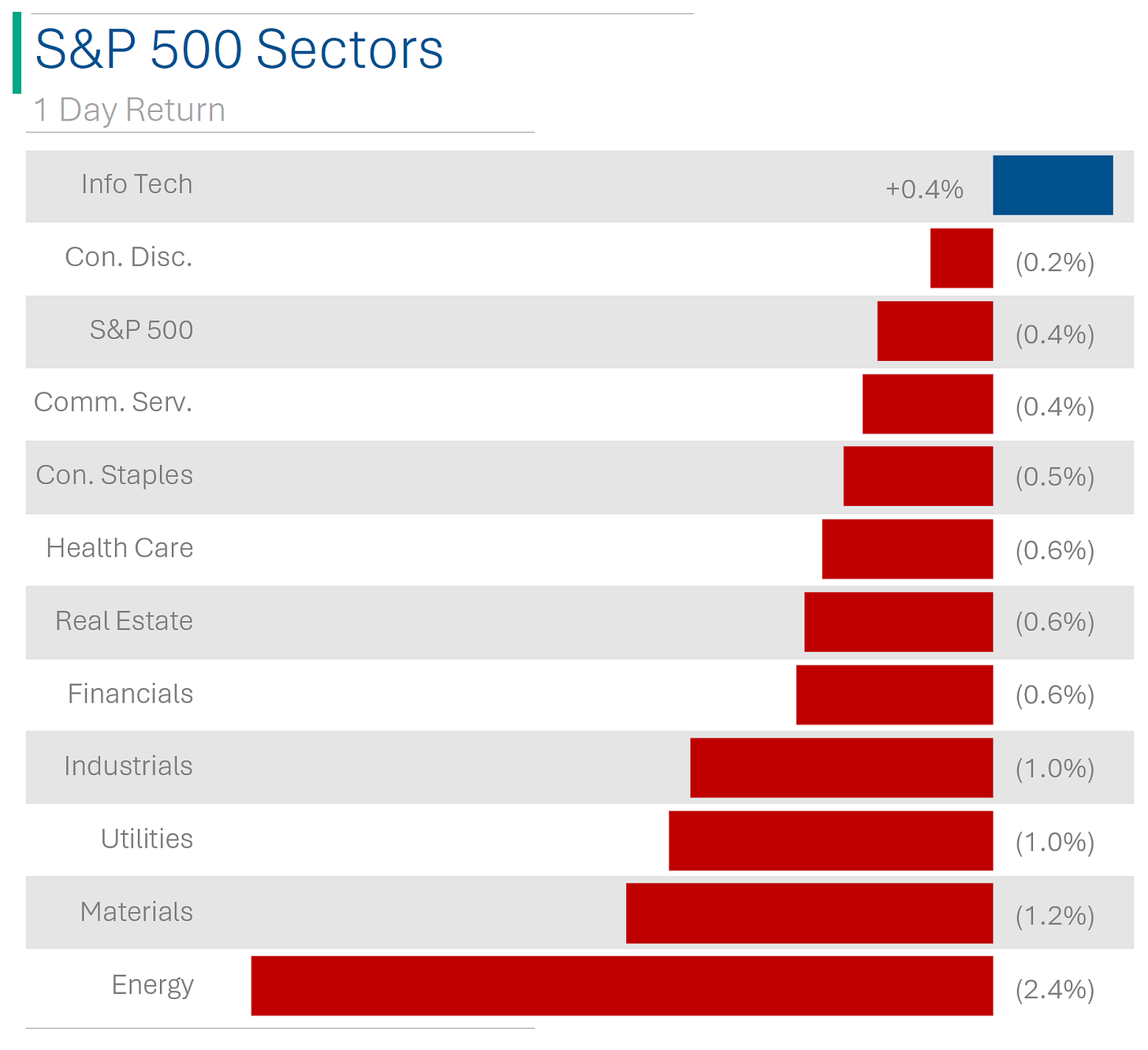

Weak start to the week for the big US markets after MLK Day, with the S&P 500 down -0.37% and Nasdaq down -0.19%.

10 of 11 sectors closed down with Info Tech (+0.4%) the only bright spot. Energy was worst (for the hundredth time this year) down 2.4%.

Mixed Fedspeak from Governors Waller (moderate) and Bostic (hawkish) pushed rates and USD higher.

Q4 2023 earnings kicked off at the end of last week and so far most of the big banks have reported with feeble results, particularly in investment banking where M&A and IPO deal flow has been tepid (more below).

Street Stories

Canada’s Population Trap

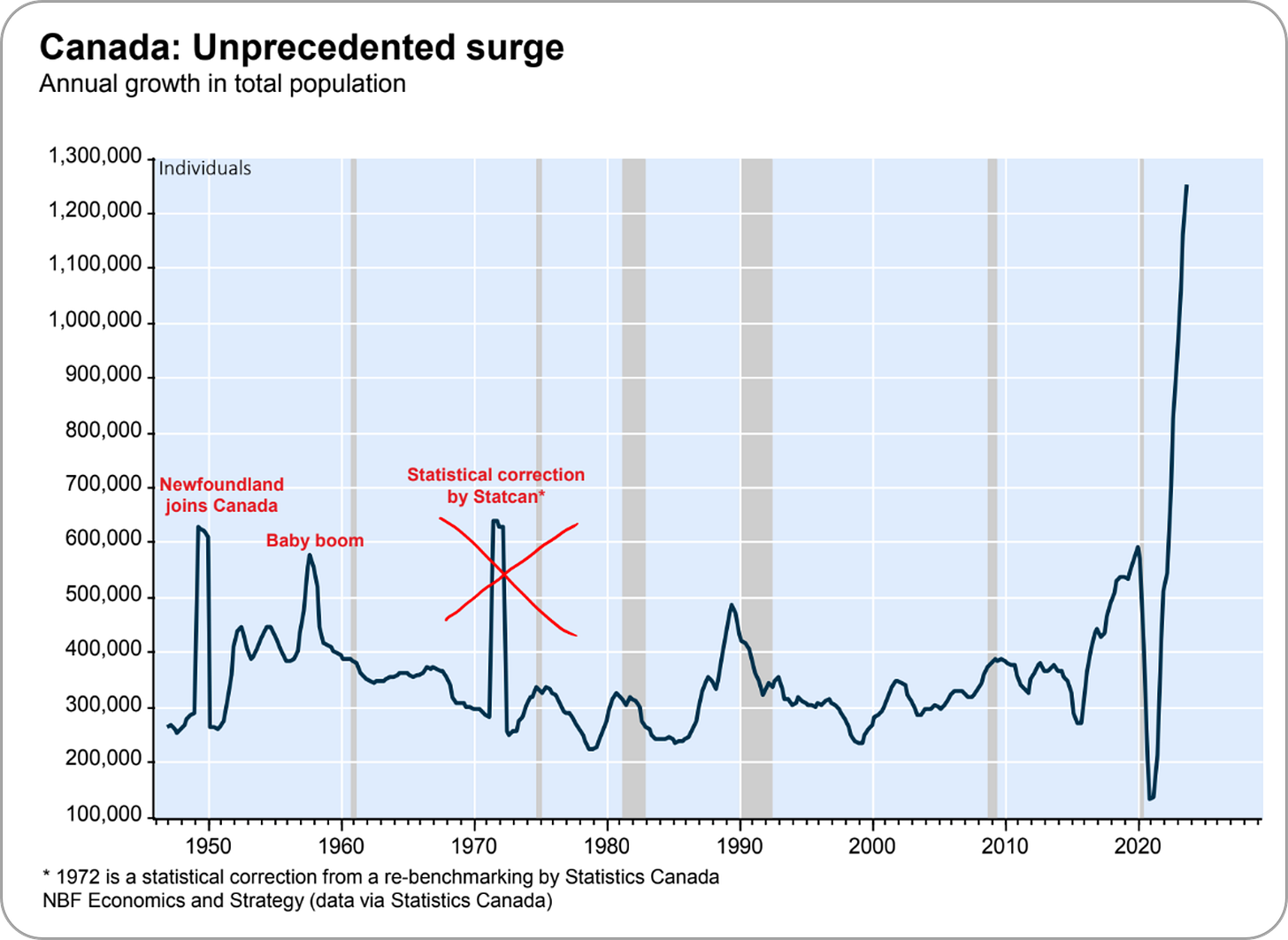

National Bank did an interesting piece (link) on the state of Canada’s immigration policy, calling the current situation a ‘Population Trap’ - a term meaning that the population is growing so fast that there is no possible way to improve the living standard. Following the pandemic, Canada’s population grew by 825k in 2022, followed by 1.2 million in 2023 - huge given Canada’s population of 38 million.

This impact is felt most in Canada’s housing situation where the deficit in supply has reached record levels, and new housing isn’t coming online fast enough to absorb the demand. Canada has around 4.2 people entering the working-age population for every new housing starts - well below the historical average of 1.8.

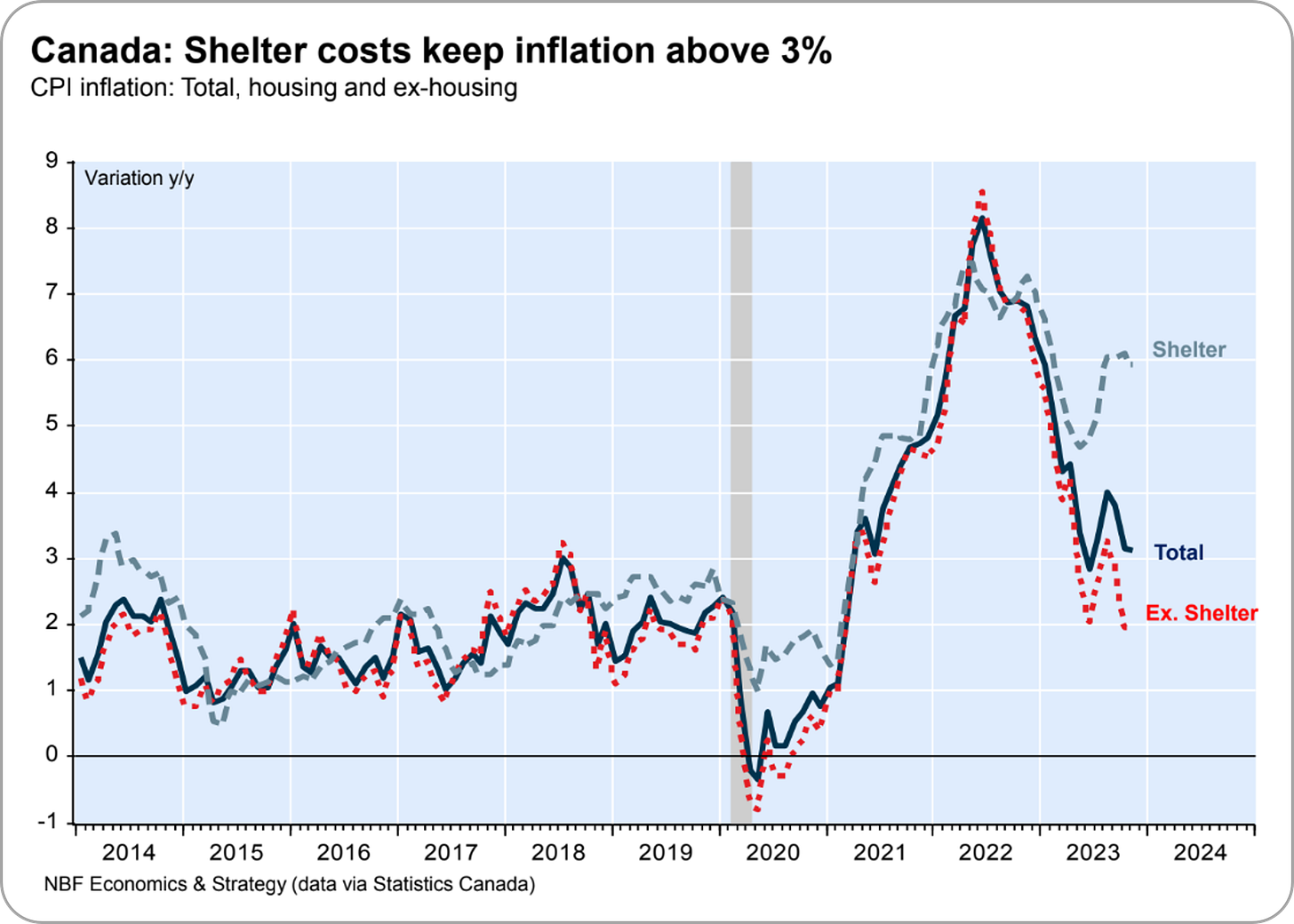

The supply shortfall is a leading contributor to inflation, as CPI would otherwise be in line with the 1-3% target level set by the Bank of Canada. Instead, housing inflation is still tracking around 6%, pulling the aggregate level up materially.

And while it is not the only factor, turbo charged population growth is a large contributor to the lack of progress in the Canadian standard of living, which has declined since the onset of the pandemic, and significantly behind the growth experienced by its neighbour to the south.

Bad Time for Banks

The big US banks led off Q4 reporting by posting generally weak results, with the average bank seeing a 5.5% Earnings Per Share miss. Goldman was the one bright spot, with beats on top and bottom line, but even then its $46.5 billion in Revenue was still its lowest since 2020.

A lack of deal flow to their respective investment banking divisions (M&A, IPOs) was a big contributor for the soft quarter for the banks, as 2023 was a pretty garbage year for deal activity.

Grounded Ambitions: JetBlue's Flight Plan for Spirit Hits Legal Turbulence

A federal judge grounded JetBlue's $3.8 billion deal to buy Spirit Airlines, citing worries it would skyrocket fares and nosedive competition. This decision represents a win for the U.S. Department of Justice's stance against airline consolidation and may impact other potential airline mergers, such as the $1 billion dollar Alaska Air deal for Hawaiian Airlines. Despite JetBlue's argument that the merger was essential to compete with larger airlines, both the court and antitrust enforcers were unconvinced, emphasizing the need to preserve low-cost travel options for consumers. Adding insult to injury, JetBlue is on the hook for a $470 million in break fees ($70 million to Spirit, $400 million to their shareholders). Ouchy

Break Fees: Common in M&A, break fees are signed as part of the merger agreement and outline situations to which one party will owe the other in the event that the transaction isn’t completed. On the side of the target company, there is often a break fee associated with a ‘no shop’ clause or if the company is acquired by a different firm.

On the side of the acquiror, there are often break fees associated with failure to secure financing or shareholder approval (required if issuing >20% of stock in the transaction). And also in regulatory intensive industries (like airlines), there are often break fees associated with approval from the regulator.

Conflicting Fedspeak: Waller's Moderation Meets Bostic's Hawk-Eye

Fed Governor Christopher Waller, a voting member, expressed optimism about inflation nearing the 2% Personal Consumption Expenditures (PCE) target. While he argued for moderation - specifically that because the labor market and economy are sound, that there is no reason to rush - his tone was perceived as accommodative to the narrative of US rate cuts soon, albeit not as aggressively as markets anticipate.

In contrast, Atlanta Fed President Raphael Bostic, a non-voter, struck a more hawkish tone, anticipating slower progress on inflation and projecting the Fed's 2% goal to be achieved by 2025.

Greenback's Grand Comeback: Geopolitics and Fed Fears Fuel Unexpected Currency Carnival

The Bloomberg US Dollar Spot Index experienced its largest rally in 10 months, driven by doubts about the extent of anticipated Federal Reserve rate cuts and increased demand for the safehaven currency due to geopolitical tensions. Concerns about overestimation of the Fed's rate cuts, escalating conflicts in the Red Sea, and China's economic struggles have made the dollar a preferred safe zone. (Yahoo has more)

Joke Of The Day

‘I have bad news and worse news …’ a financial adviser says to his client.

"Which would you like to hear first?"

"The bad news," the client says.

"All your money will be gone in 24 hours."

"Oh my gosh," the client says. "So what's the worse news then?"

"I should have made this call yesterday."

Hot Headlines

WSJ | Uber is closing an alcohol-delivery business it bought for over $1 billion three years ago. If they stop lighting money on fire, then they’ll stop being Uber.

Reuters | Hertz's dumping of 20k EVs to fan cost concerns and dampen used-car market. The sale, mostly consisting of Teslas, has been blamed on excessive EV repair costs and weak rental demand.

CNBC | Pentagon awards $2.5 billion in contracts to L3Harris, Lockheed Martin and Sierra Space TO BUILD MISSILES FOR SPACE. Wicked.

Bloomberg | Chevron still plans to ship cargo along Red Sea, CEO Says. Probably because he isn’t the guy driving the boat.

Axios | ABC News cancels New Hampshire debate after candidate Nikki Haley said she wouldn’t participate unless former President Donald Trump did. In ABC’s defense, did anyone really want a sixth DeSantis/Haley debate?

CNBC | IMF warns AI to hit almost 40% of jobs worldwide and worsen overall inequality. The IMF stated that in high-income nations, about 60% of jobs could , and roughly half of these may benefit from AI integration to boost productivity.

Trivia

This week’s trivia is on corporate firsts.

The first publicly traded company in the world was?

A) East India Company

B) Dutch East India Company

C) British South Africa Company

D) Hudson's Bay CompanyWho developed the first silicon-based integrated circuit?

A) Intel

B) Texas Instruments

C) Fairchild Semiconductor

D) Bell LabsThe first company to build a gasoline-powered automobile was?

A) Ford

B) Mercedes-Benz

C) Fiat

D) Peugeot

(answers at bottom)

Market Movers

Winners!

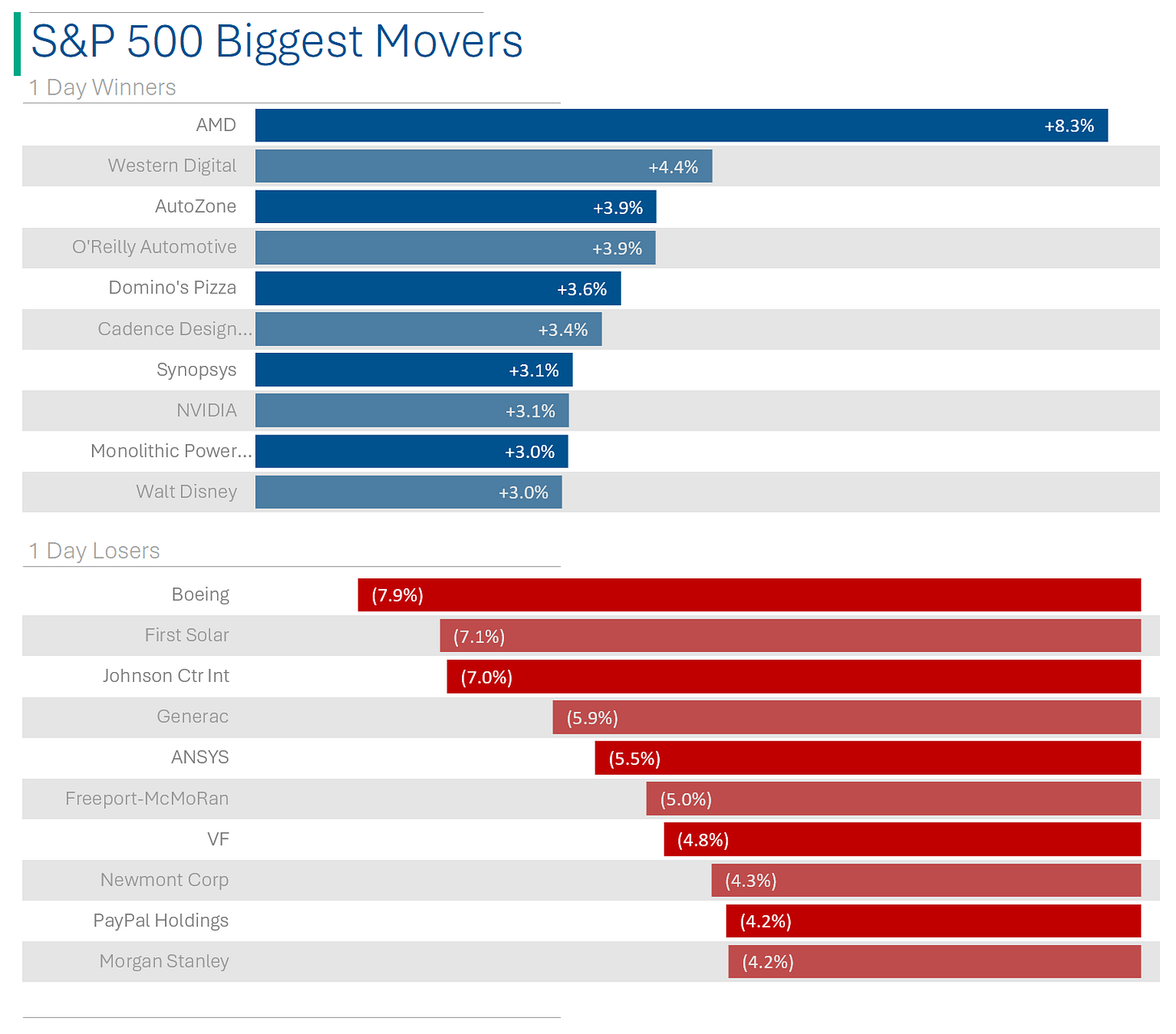

JetBlue Airways (JBLU) [+4.9%]: A district court judge blocked its acquisition of Spirit Airlines, ruling the deal violates the Clayton Act and permanently enjoined the proposed merger.

Synopsys (SNPS) [+3.1%]: Announced a $35bn cash and stock acquisition of Ansys, with an implied consideration of $390 per share, a 29% premium over Dec. 21, 2023 closing.

Losers!

Spirit Airlines (SAVE) [-47.1%]: See JetBlue above.

Boeing (BA) [-7.9%]: Downgraded to equal weight from overweight by Wells Fargo due to ongoing 737 scrutiny; concerns over FAA audit and potential production/delivery impacts.

ANSYS Inc (ANSS) [-5.5%]: See Synopsys above.

Morgan Stanley (MS) [-4.2%]: Q4 EPS missed estimates, while Revenue beat driven by wealth management; trading segments underperformed; compensation higher than anticipated.

Market Update

Trivia Answers

B) The Dutch East India Company was the first publicly traded company, having started trading 1602.

B) Texas Instruments created the first silicon-based integrated circuit. No more Germanium!

B) Mercedes-Benz launched the Benz Patent Motor Car in 1886. Ok, technically it wasn’t ‘Mercedes’ back then.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.