🔬Atlas Carried The World On His Back

Plus: Wingstop's secret recipe; and much more

"Action is the foundational key to all success."

-Pablo Picasso

"Success is walking from failure to failure with no loss of enthusiasm."

-Winston Churchill

Mixed day for the big US markets with the S&P 500 flat and Nasdaq +0.2%. Small-Cap still in favor as the Russell 2000 was +0.7%.

7 of 11 sectors finished higher, led by Energy (+1.3%) and Financials (+0.8%) but Tech (-0.7%) pulled the market down following a poor response to Nvidia’s Q2 release.

Notable companies:

Nvidia (NVDA) [-6.4%]: Q2 earnings beat with strong Q3 guidance, but some concerns emerged over margin compression and growing operating expenses, though overall sentiment remains positive due to strong demand for Gen-AI.

Dollar General (DG) [-32.2%]: Q2 earnings missed across the board, with management cutting FY25 guidance and noting that its core customer is financially strained; analysts highlighted that the reduced guidance may still not fully reflect risks, including ocean freight and tariff concerns.

Birkenstock (BIRK) [-16.1%]: Fiscal Q3 revenue slightly missed while EBITDA beat; FY guidance confirmed, though some concerns arose over softer DTC revenue performance despite double-digit growth across all segments.

More below in ‘Market Movers’.

Shorter note today ahead of the long weekend.

Street Stories

Talk About Reigning Champ.

Earlier this week, Nvidia dropped their Q2 earnings, and while they technically beat expectations, $30.04 billion in revenue and $0.68 EPS, Nvidia's stock still shed 6.4% in yesterday’s trading. So, what’s the deal?

First off, yes, Nvidia is still the king…Furthermore, its holding the market on its back as we all wait for JPow’s rate cuts.

Data Center revenue skyrocketed to $26.27 billion (representing a 154% year-over-year increase, by the way).

Their AI chips are in high demand, powering everything from generative AI to enterprise-level computing. But here’s the catch: that growth curve is starting to show some cracks. Sequential growth slowed to 16%, and there’s a potential Blackwell GPU delay looming.

Now, let’s talk margins.

Specifically, the not-so-rosy picture they’re painting. Nvidia’s gross margin dropped by 320 basis points quarter-over-quarter. That’s a fancy way of saying their profitability is taking a hit, which is raising some eyebrows, especially in a market that’s starting to wonder if Nvidia’s price tag is just a bit too steep.

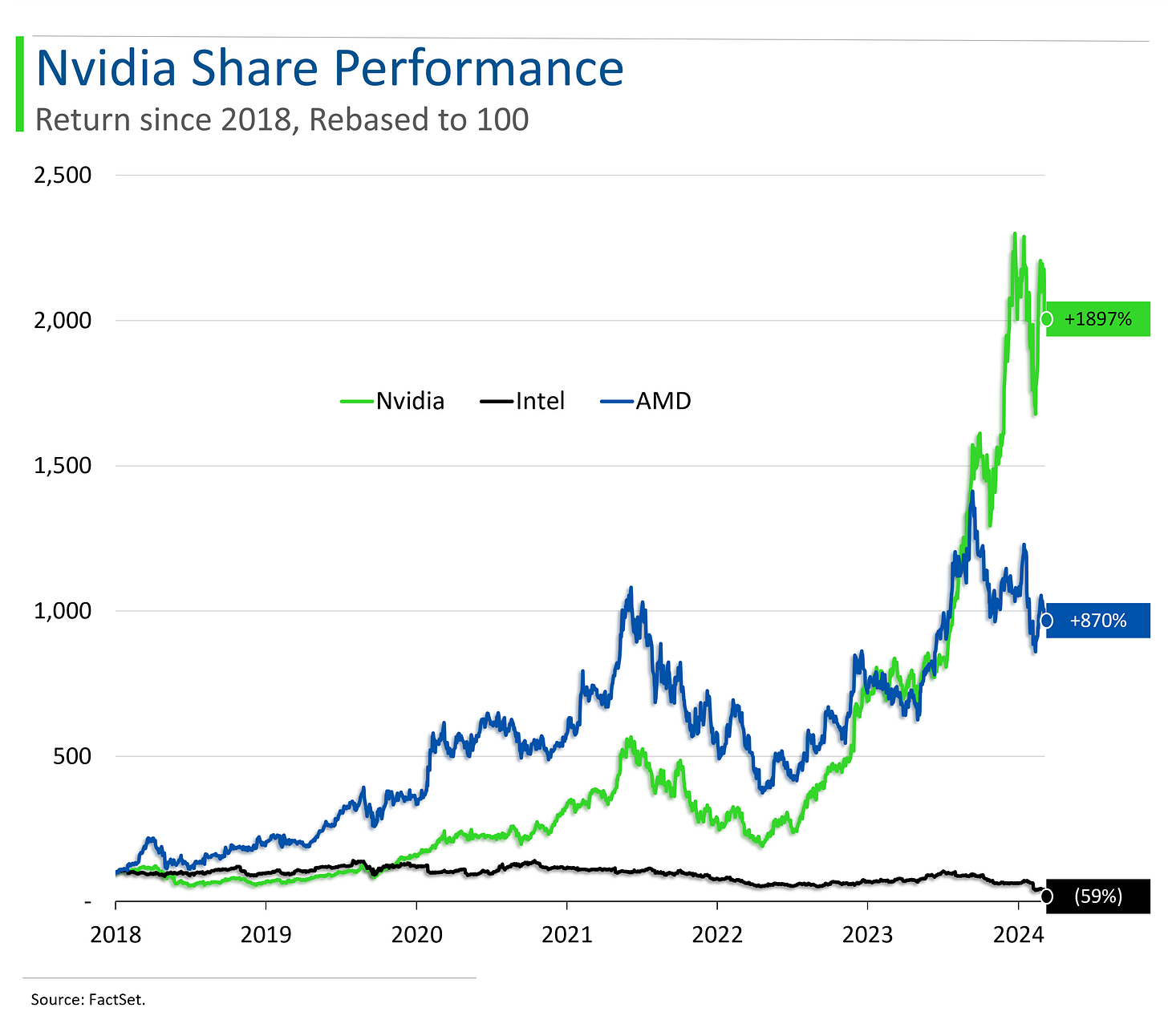

That said, look at them in comparison to the competition: If price is what you pay, and value is what you get…Nvidia deserves the lead.

On the flip side, Nvidia’s cash flow is still a thing of beauty.

Their operational cash flow hit $14.5 billion this quarter, with free cash flow not far behind at $13.5 billion. But, it is worth nothing that both these figures are down sequentially, thanks to higher cash taxes.

Nvidia’s response? A massive $50 billion stock buyback program, which, while flashy, might not be the wisest move in a sector known for its cyclical nature.

Valuation is where things get a little dicey…

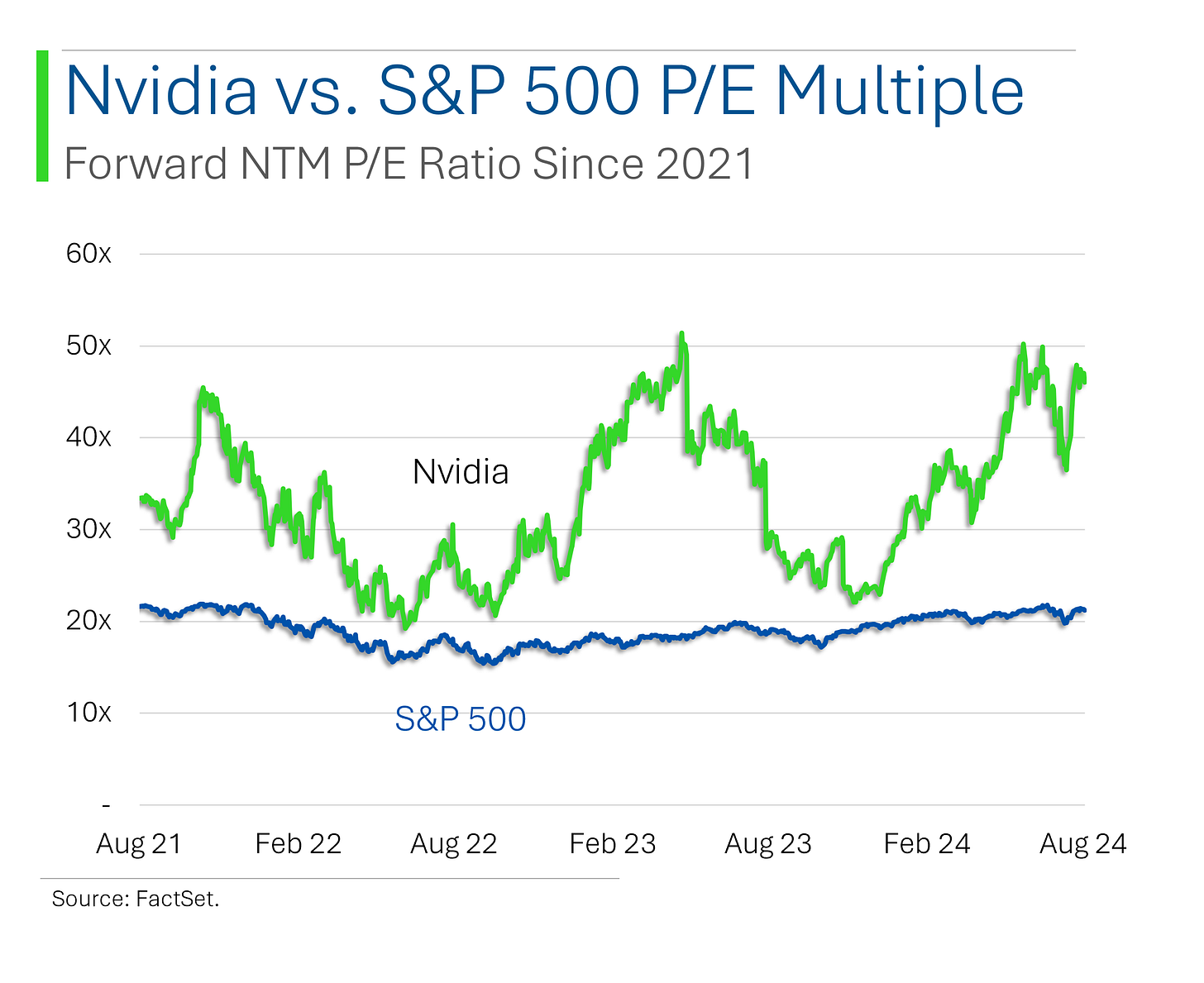

Nvidia is trading at a NTM P/E of ~46x now, that’s high, even for a company as dominant as Nvidia.

Compare that with the broader market’s 21x, and you start to wonder if the market isn’t pricing in a bit too much future success. Sure, their AI ecosystem is powerful, but with competitors like AMD ramping up and cloud giants building their own in-house chips, can Nvidia maintain this edge?

To wrap things up, Nvidia is still a beast, but the market’s lofty expectations mean that even a slight miss, or in this case a narrower beat, can send the stock tumbling.

If you’re holding Nvidia, you’re probably in it for the long haul, but don’t be surprised if the road gets a bit bumpier from here on out.

Not Just Wing-ing It.

Wingstop is bucking the trend of consumer pullback seen by fast-food giants like McDonald’s and Starbucks. The key? Chicken wings, a staple for live sports events. As people continue to indulge in social gatherings, Wingstop's offerings remain a go-to choice, even in tighter economic times.

CEO Michael Skipworth credits targeted advertising during live sports for boosting brand awareness.

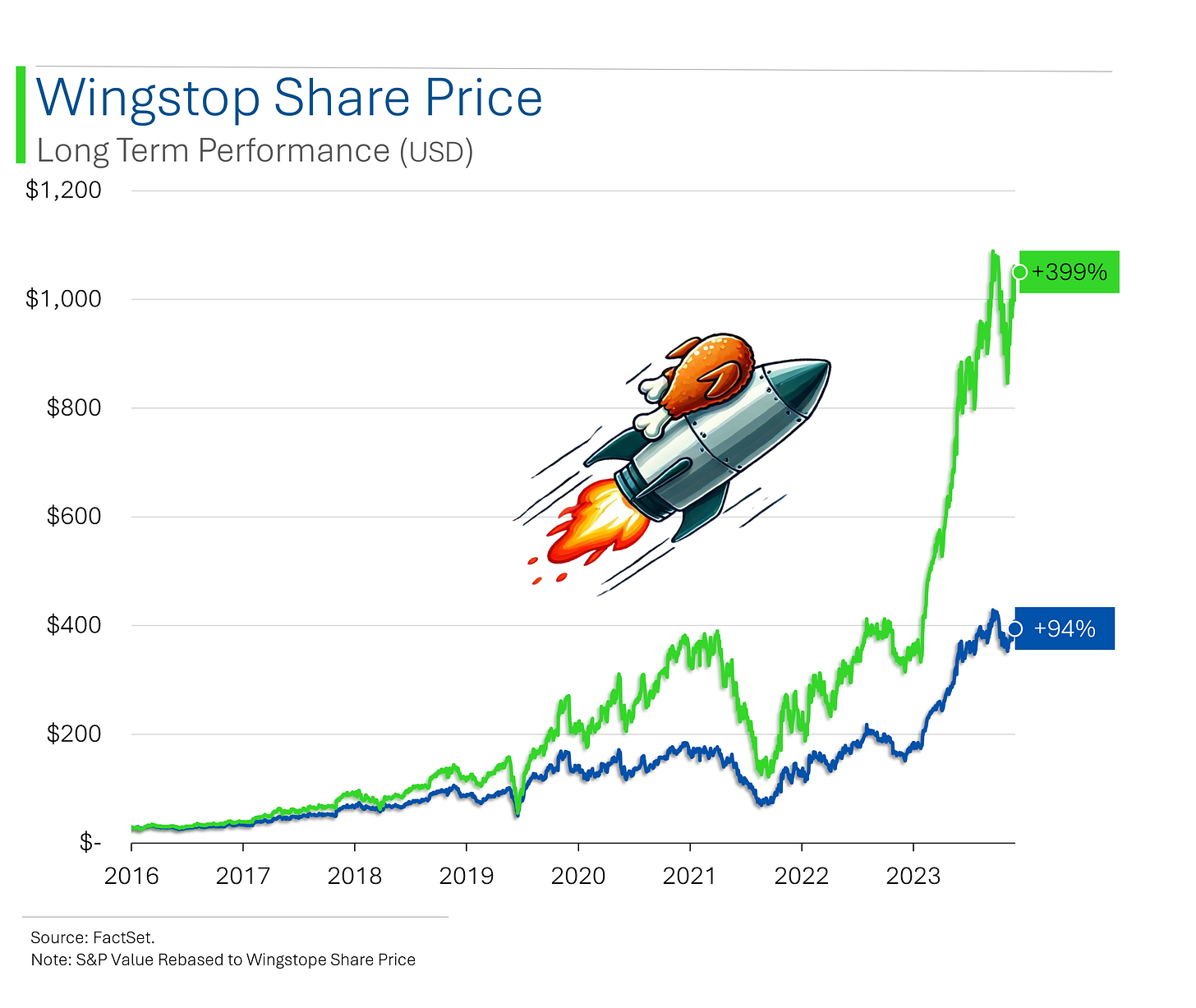

Furthermore, they’ve also been disciplined with pricing, raising prices by just 15% since 2019, compared to the 30-40% hikes by competitors. This strategy is paying off as domestic same-store sales jumped 28.7% in Q4 2024. Just take a look, their strategy is clearly working.

Wingstop's stock reflects its success, soaring over 50% year-to-date, now trading around $400 per share, up from its $30 IPO price in 2015.

(I can also attest that their product is delicious)

Joke Of The Day

Successful investing is having everyone agree with you…later.

Trivia

Today’s trivia is on one of the world’s most controversial hedge funders, Bill Ackman.

Bill Ackman is the founder and CEO of which hedge fund, known for its activist investment strategies?

A) Bridgewater Associates

B) Pershing Square Capital Management

C) Elliott Management

D) Third Point LLCIn 2012, Bill Ackman launched a high-profile short-selling campaign against which company, calling it a "pyramid scheme"?

A) Herbalife

B) Valeant Pharmaceuticals

C) Tesla

D) J.C. PenneyWhich Canadian pharmaceutical company was part of a notorious investment by Bill Ackman, leading to significant losses and controversy?

A) Sun Pharma

B) Valeant Pharmaceuticals

C) Apotex

D) SandozBill Ackman made headlines in 2020 for a highly profitable hedge on corporate credit during the onset of the COVID-19 pandemic. How much profit did Pershing Square reportedly make from this bet?

A) $500 million

B) $1 billion

C) $2.6 billion

D) $4 billionIn 2021, Bill Ackman launched the largest-ever special purpose acquisition company (SPAC). What was the name of this SPAC?

A) Tontine Holdings

B) Fortress Value Acquisition

C) Churchill Capital

D) Starboard Value Acquisition

(answers at bottom)

Market Movers

Winners!

Affirm Holdings (AFRM) [+31.9%]: Q4 revenue and operating income beat expectations, with FY25 GMV guidance ahead of estimates and analysts highlighting earlier-than-expected profitability and strong customer engagement.

Nutanix (NTNX) [+20.3%]: FQ4 earnings beat expectations with in-line guidance for FQ1 and FY25; analysts positive on partnerships and renewal activity, with VMware replacement opportunities noted.

Best Buy Co. (BBY) [+14.1%]: Q2 earnings beat with better-than-expected comp decline; FY256 guidance raised, with management citing stabilization in the industry and potential upside from Apple upgrades and AI hardware.

The Cooper Cos. (COO) [+11.8%]: Q3 earnings beat with strong momentum in the contact lens industry; Q4 and FY24 guidance ahead of consensus, with analysts noting increased leverage and free cash flow improvement.

EnLink Midstream (ENLC) [+9.4%]: OKE to acquire GIP's interest in the company for $3.3B in cash at a 13% premium to yesterday's close.

Veeva Systems (VEEV) [+8.9%]: Q2 revenue beat and raised FY guidance, with analysts noting strong deal momentum and improved pipeline visibility in Vault CRM.

CrowdStrike (CRWD) [+2.8%]: Q2 earnings beat, but FY25 guidance cut due to impact from a July outage; analysts see a derisked outlook despite concerns over incentive impacts.

Guess? (GES) [+1.4%]: Q2 earnings slightly missed, with revenue slightly ahead; Q3 EPS guidance missed, and FY25 guidance lowered, with cautious consumer spending affecting traffic and conversion rates.

Losers!

Dollar General (DG) [-32.2%]: Q2 earnings missed across the board, with management cutting FY25 guidance and noting that its core customer is financially strained; analysts highlighted that the reduced guidance may still not fully reflect risks, including ocean freight and tariff concerns.

Okta, Inc. (OKTA) [-17.7%]: Q2 earnings beat with raised FY25 revenue outlook, but concerns over growth deceleration and softer Q3 guidance persist, with the company citing a challenging macro environment.

Birkenstock (BIRK) [-16.1%]: Fiscal Q3 revenue slightly missed while EBITDA beat; FY guidance confirmed, though some concerns arose over softer DTC revenue performance despite double-digit growth across all segments.

Pure Storage (PSTG) [-15.8%]: Q2 earnings beat, but the company only reiterated FY25 guidance and lowered TCV bookings guidance, disappointing some who expected a hyperscaler win; stock hit by downside implications for 2H estimates.

NetApp (NTAP) [-9.6%]: FQ1 earnings beat with strong product sales growth, but concerns over gross margins and tough comparisons linger, even as FY25 guidance was raised and CFO retirement announced.

Ollie's Bargain Outlet Holdings (OLLI) [-7.6%]: Q2 earnings in line with better comps, revenue, and EBITDA, but gross margin missed by ~100 bp; FY guidance raised, though the stock remains up 24% YTD.

Cava Group (CAVA) [-6.4%]: Downgraded to equal-weight from overweight at Morgan Stanley due to valuation concerns.

Nvidia (NVDA) [-6.4%]: Q2 earnings beat with strong Q3 guidance, but some concerns emerged over margin compression and growing operating expenses, though overall sentiment remains positive due to strong demand for Gen-AI.

Topgolf Callaway Brands (MODG) [-5%]: Downgraded to hold from buy at Jefferies, citing unmaterialized synergies between Topgolf and Callaway and concerns over earnings quality and rising debt.

American Eagle Outfitters (AEO) [-4.2%]: Q2 earnings slightly better with mixed guidance; Q3 operating income guidance light, and the high end of FY revenue growth outlook was lowered.

Victoria's Secret (VSCO) [-3.7%]: Q2 earnings beat with strong international performance, though weaker results in direct and US/Canada; FY24 guidance raised with some concerns over gross margins.

Market Update

Trivia Answers

Pershing Square Capital Management is the hedge fund founded and led by Bill Ackman, known for its activist investment strategies.

In 2012, Bill Ackman launched a short-selling campaign against Herbalife, labeling it a "pyramid scheme."

Valeant Pharmaceuticals was the Canadian company involved in a controversial investment by Bill Ackman that led to significant losses.

Bill Ackman's Pershing Square made $2.6 billion from a hedge on corporate credit during the early days of the COVID-19 pandemic.

The largest-ever SPAC launched by Bill Ackman in 2021 was named Tontine Holdings.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Can't believe the WingStop performance. I tried the wings recently at a new location in T.O - they were not good in the least! However, the place was pretty busy with young people...

Would be interested to see any of the daily notes that have previously looked at aggregate balance sheet strength of corporate USA.