🔬 ASML Gives Chip Investors the Scaries

"If you are going to panic, panic early"

- Barry Sternlicht

"Never interrupt your enemy when he is making a mistake."

- Napoleon Bonaparte

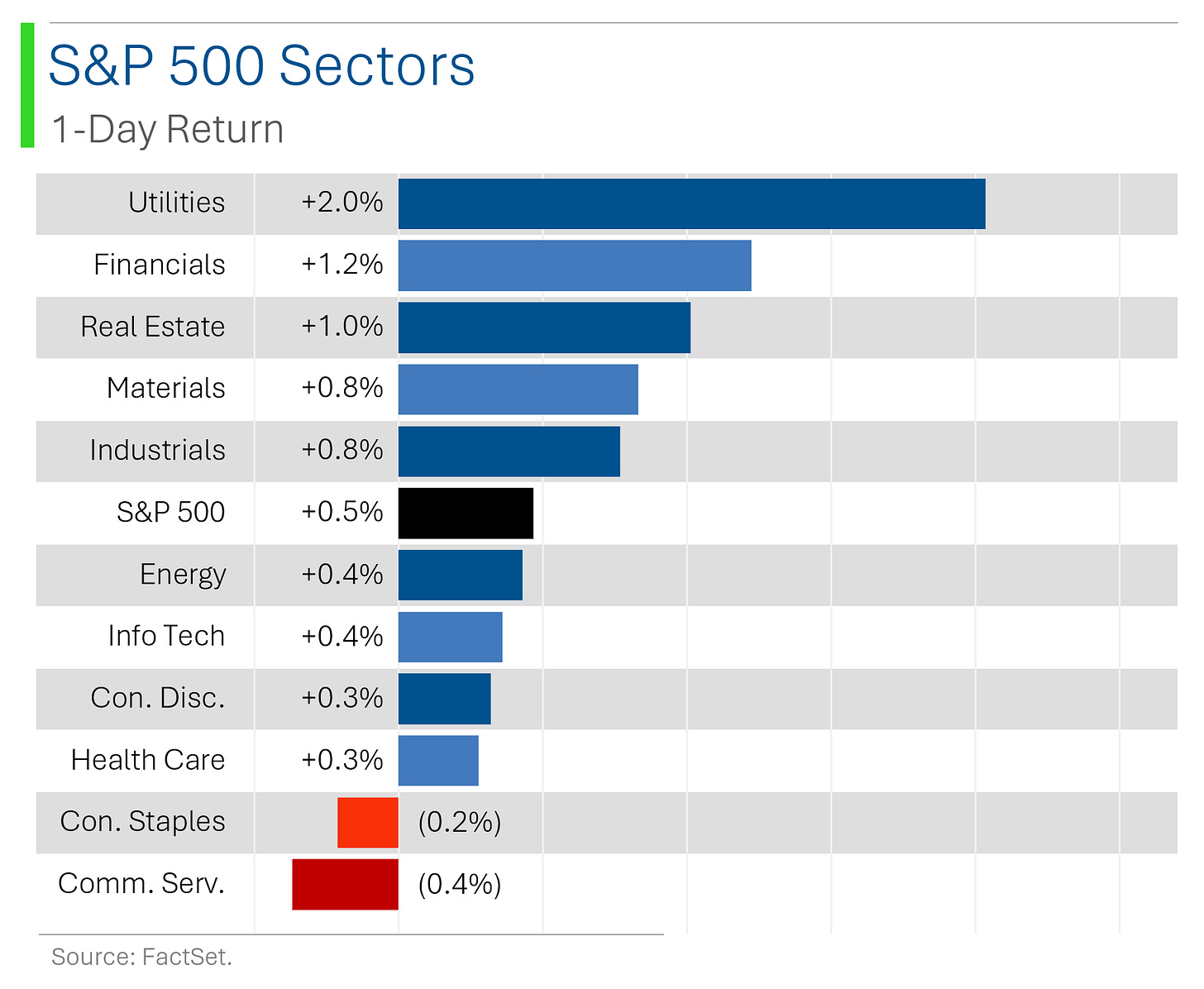

US Markets Recover with Broad Gains:

Equities finished higher Wednesday, though the S&P remained just shy of an all-time high. Airlines, banks, homebuilders, and credit cards outperformed, while big tech lagged except for Nvidia, and semiconductors showed mixed results with ASML weaker.

Financial Earnings Come in “Good Enough”:

Morgan Stanley, US Bancorp, and Synchrony Financial reported solid earnings, benefiting from favorable NII metrics and momentum. Abbott saw mixed results, missing on non-Covid revenue, while JB Hunt posted strong intermodal volumes despite freight challenges.

Economic Data Focused on Thursday Outlook:

Investors await key Thursday releases including retail sales, ECB's expected rate cut, and China’s property support updates. Treasuries firmed, mortgage indexes weakened sharply, and Bitcoin and gold both edged up, while WTI crude extended its decline from Tuesday’s drop.

Notable companies:

Novavax, Inc. (NVAX) [-19.4%]: FDA paused the company’s COVID-flu combo trials due to a reported case of motor neuropathy in a participant.

United Airlines (UAL) [+12.4%]: Q3 earnings and revenue beat, costs came in lower than expected, and they announced a $1.5B buyback.

Morgan Stanley (MS) [+6.5%]: Q3 results beat expectations, with investment banking fees up 56% and wealth management posting impressive asset growth.

More below in ‘Market Movers’.

Street Stories

ASML Gives Chip Investors the Scaries

In case you’ve been living under a rock for the last 18 months, we’ve been in something of an AI Bubble Boom. This hysteria optimism has played a key part in the Bull Market that’s been ripping since October 2022 and is pretty core to the ongoing hopes of the stock market. Ie: If things fell apart here, it would certainly have deep ramifications to broader investor sentiment.

Cue ASML’s fabulous Q3 earnings report Tuesday (which they accidentally released a day early on their website)…

The quarter itself was actually pretty decent: Revenue of €7.5 billion came in above consensus of €7.2 billion and topped their guidance for €6.7 to €7.3 billion. However, bookings for future sales came in at nearly half of what Wall Street was expecting and the firm’s Q4 guidance came in well below the Street’s bogey.

Selling ensued.

In fact, the 15.7% collapse Tuesday was the biggest in the 26 year history of the company, and it was followed by another 6.4% whammy yesterday.

For a reminder as to why this matters, ASML produces advanced photolithography machines essential for manufacturing the most cutting-edge semiconductor chips used by companies like TSMC, Samsung, and Intel. In fact, they are THE ONLY one in the world that can do this. As a result, they are a true bellwether for the state of the semiconductor market.

And bad news for them, is generally bad news for the chip industry.

The ‘glass half full’ side of this is that the company reported that AI-related server chip demand remains robust. However, this also means it is masking particularly sluggish demand across the rest of the chip industry, with notable weakness in automotive, mobile and PC markets.

At the company level, Wall Street’s estimate have been steadily coming down for a while but the collapse this week has been significant - and likely isn’t over, as lazy analysts get around to updating their increasingly less bullish models.

But you shouldn’t feel too bad for them, as the expectation is that the company will continue to be a growth machine well into the future.

Monopolies are cool like that…

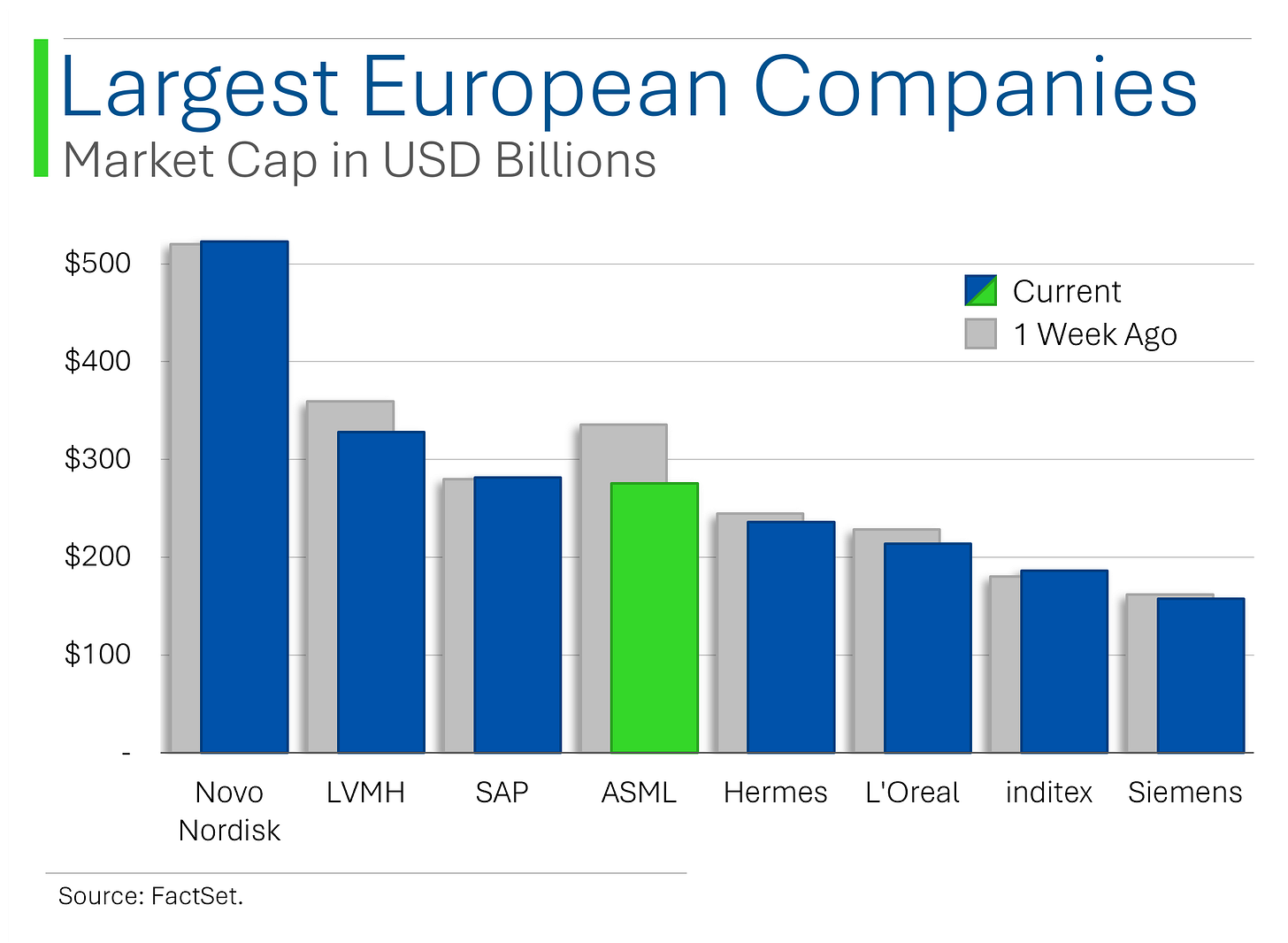

And lastly, ASML’s collapse is just the latest shake-up on Europe’s list of largest companies after LVMH’s boondoggle of a quarter Tuesday.

The share price bonfire also means that ASML now has the sad distinction of being Europe’s second largest tech company after a smug SAP dethroned them.

It’s always zee Germans…

Mortgage Rates Are Going Up Again

30-Year US mortgage rates jumped to 6.32% this week, giving homebuyers one more reason to groan as they face sky-high prices and scarce inventory, after teasing them with a dip to 6.08% two weeks ago.

Rates hit a 7.22% peak in May, then drifted lower thanks to the Fed’s first interest rate cut in years, with more cuts hinted for 2025 and beyond (because why fix things quickly?). Rising rates, driven by bond market jitters, have kept the housing market in a prolonged slump since 2022. Economists expect rates to hover around current levels for now, with Fannie Mae optimistically predicting they’ll dip to 5.7% by late next year - just in time for your 27th open house.

Slippery Slopes: Oil Prices Slide As Iran/Israel Expectations Improve

Oil has renewed its downward spiral this week as the threat of an all-out war between Israel and Iran appears to be waning. Israel reportedly told senior members of the Biden administration that it will limit any retaliatory attacks for Iran’s October 1st ballistic missile attack to strictly military targets.

The benchmark price is now down 8.2% since it’s recent peak following the attacks.

Joke Of The Day

I always tell new hires, don’t think of me as your boss, think of me as a friend who can fire you.

My resumé is just a list of things I hope no one ever asks me to do.

Hot Headlines

CNBC / Amazon to invest $500+ million to develop modular nuclear reactors to help power their AWS cloud-computing business as it grows it’s energy intensive AI business. Connect the nukes to the AI thingy? Sounds super.

Reuters / The prices paid for imports in the US fell by largest amount in 9 months. The September data showed that decreased energy costs were a significant contributor.

The Verge / The FTC adopts ‘click-to-cancel’ rule, requiring businesses to make cancelling a subscription as easy as signing-up. Please don’t unsubscribe. I’m free!

Politico / An estimated 10k North Koreans have been sent to fight for Russia in the Ukraine.

Pew Research / New survey suggests that 7 in 10 Americans are for a cellphone ban for students during class. Around a third agree with an all-day ban at schools.

The Verge / Amazon launches it’s first color Kindle eReader. The Kindle Colorsoft costs $279.99. Bout friggin time.

CNBC / GM to invest $625 million in joint venture to mine EV battery raw materials in the US.

Trivia

Today’s trivia is on Warren Buffett.

When Warren was just a kid in Washington, D.C., he was making more money than most of his teachers doing what?

A) Doing landscaping

B) Flipping houses

C) Day Trading

D) Delivering the Washington PostAfter graduating from the University of Nebraska in three years, Warren was rejected from Harvard. This ended up being one of the best things that ever happened to him as he then applied to this university where he learned from his future mentors Benjamin Graham and David Dodd.

A) Columbia

B) Princeton

C) Stanford

D) University of ChicagoWarren lives a famously modest life, including living in a house he bought for $31,500 in what year?

A) 1948

B) 1958

C) 1968

D) 1978

(answers at bottom)

Market Movers

Winners!

United Airlines (UAL) [+12.4%]: Q3 earnings and revenue beat, costs came in lower than expected, and they announced a $1.5B buyback.

Morgan Stanley (MS) [+6.5%]: Q3 results beat expectations, with investment banking fees up 56% and wealth management posting impressive asset growth.

Synchrony Financial (SYF) [+6.1%]: Q3 EPS and revenue beat while FY24 EPS guidance was raised, with loan growth and higher NII helping performance.

US Bancorp (USB) [+4.7%]: Q3 EPS came in strong with higher NII/NIM, stable credit trends, and plans to resume buybacks in 2025.

Cisco Systems (CSCO) [+4.3%]: Upgraded by Citi based on AI-related growth potential and rotation into networking from semiconductors.

J.B. Hunt (JBHT) [+3.2%]: Q3 earnings beat expectations, with strong intermodal volumes and positive margin trends in ICS.

Corteva (CTVA) [+2.9%]: Upgraded by Bank of America due to strong seed pricing, market share gains, and visibility into future royalties despite FTC investigation.

Losers!

Penguin Solutions (PENG) [-23.5%]: Reported weak FQ4 earnings with lower margins and softer guidance, though analysts remain more positive on FY25.

Novavax, Inc. (NVAX) [-19.4%]: FDA paused the company’s COVID-flu combo trials due to a reported case of motor neuropathy in a participant.

Stride (LRN) [-9.3%]: Fell after a short report raised concerns over ESSER fund expiration risks and allegations of charging for “ghost students.”

Interactive Brokers Group (IBKR) [-4.1%]: Q3 earnings missed estimates with revenue light, but management highlighted growth in customers, commissions, and borrowing.

Citizens Financial (CFG) [-2.5%]: Q3 EPS was in line, though NII and NIM came in lower, with some fees pushed into Q4; management projects a strong finish to the year.

Intel (INTC) [-1.5%]: China’s cybersecurity group flagged Intel products for review, while Qualcomm delayed acquisition decisions until after the U.S. election.

Market Update

Trivia Answers

D) Warren delivered the Washington Post.

A) Dodd and Graham taught at Columbia.

B) Warren bought the house in 1958.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.