🔬Argentina's Dollar Dream, Microsoft Always Wins, and Much More

“Nothing like price to change sentiment”

- Helene Meisler

“If you don’t know who you are, this is an expensive place to find out.”

- George Goodman

Table of Contents

🗣️ Market Chatter

🔥 Hot Headlines

🤭 Joke Of The Day

🔬 A.M. Allocations: Buck-Wild: Argentina’s Dollarization Dreams

🙋♂️ Trivia

📈 Market Movers

📊 Market Update

Market Chatter

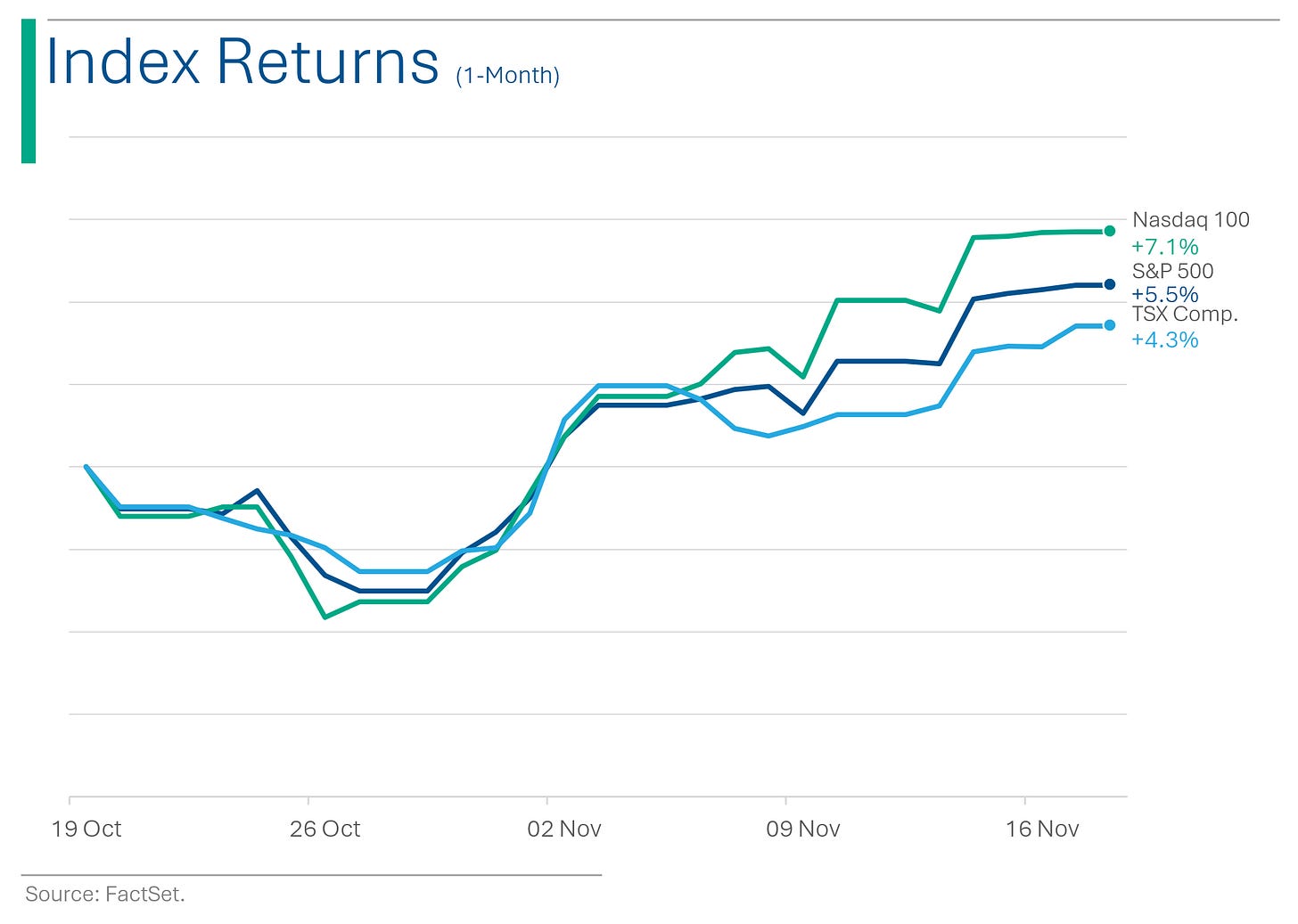

US markets were up (S&P 500 +0.7%, Nasdaq +1.1%) on a very quiet day of trading, closing out near highs of the day.

S&P closed out at its highest level since August and near to its YTD high.

The Dollar Index was down 0.5% with Yen strength the main headline.

Oil was up 2.4%, erasing last week’s 1.7% decline.

Bitcoin futures up 2.7% and closing in on highs since Crypto Winter kicked-off in Q1 2022.

Bayer was down 17.5% after its blood thinner clinical trial failed.

Microsoft was up 2.1% after it announced it hired recently fired OpenAI CEO Sam Altman.

Hot Headlines

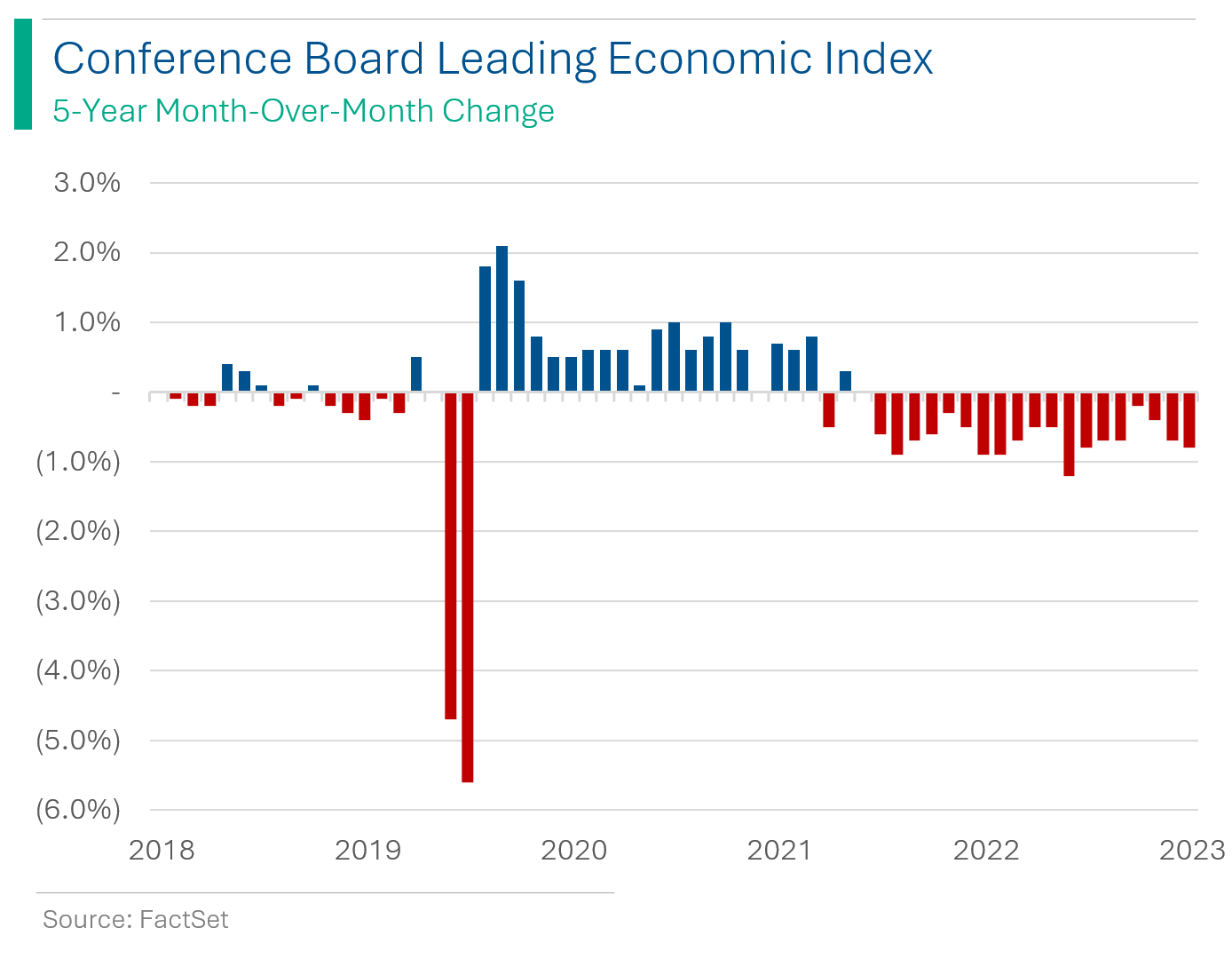

RECESSION INDICATOR WORSENS - The Conference Board's Leading Economic Index (LEI) for the U.S. declined in October, indicating potential recession in the near term, driven by worsening consumer expectations, high inflation, and interest rates. (More from PRN Newswire)

GM’S AUTONOMOUS DRIVING CEO LEAVES - Kyle Vogt, head of General Motors' self-driving car unit Cruise, resigned following regulatory action due to a series of accidents, including a serious collision involving a pedestrian. Despite these setbacks and significant financial losses, GM reaffirmed its commitment to Cruise and its autonomous vehicle technology. The company is putting in greater controls over the unit and appointed new co-presidents but no successor to Vogt as of yet. Did anyone really think GM was going to be a leader in autonomous driving? Honestly. (CNN has more)

FED PRES. BARKIN STILL HAWKISH - Richmond Fed President Thomas Barkin stated that although the U.S. economy is growing and inflation appears to be slowing, the Federal Reserve's work on controlling inflation is not yet complete. Barkin, who will be a voting member of the Federal Open Market Committee in 2024, emphasized the need for ongoing high interest rates until inflation consistently approaches the Fed's 2% target. Why do they keep letting these people talk? (More from MarketWatch)

WORLD’S LARGEST CRYPTO EXCHANGE SUED - In furtherance to the convention that every crypto exchange is a corrupt ponzi scheme, the U.S. Justice Department is reportedly seeking over $4 billion from Binance in what it calls their ‘elaborate scheme to evade U.S. federal securities laws’. Zing. The resolution to a long-standing investigation includes the potential criminal charges against founder Changpeng Zhao. Binance, under scrutiny since 2018 for issues like anti-money laundering compliance, faces multiple legal challenges in the U.S., including lawsuits from the SEC and CFTC. No word yet if the DOJ will accept restitution in bitcoin. (Reuters has more)

OPENAI DRAMA CONTINUES - Over 700 OpenAI employees have signed a letter demanding the resignation of the company's board following the removal of former CEO Sam Altman or they’ll quit and join Sam at Microsoft. The employees are advocating for the appointment of new independent directors and the reinstatement of Altman and ex-president Greg Brockman. OpenAI chief scientist Ilya Sutskever, a key figure in the board's decision to oust Altman, has expressed regret over his role in the matter (and will probably be fired in hours). Big winner in this is Microsoft who went from being OpenAI’s largest shareholder to effectively stealing its top minds, including Altman and former Brockman. (Axios has more)

(CNN) World’s ‘most sought-after’ whisky sells for $2.7 million. Only 40 were bottled of this 1926 Macallan. I’ll pass. I’m more of an Islay guy.

(Bloomberg) Heads are rolling as Citigroup cuts over 300 senior manager roles as latest restructuring heats up. I worked at Credit Suisse so I can’t throw stones.

(Reuters) Live Nation issued subpoena regarding ticketing, fees by US Senate panel. THROW. THEM. IN. JAIL.

(Reuters) US SEC sues Kraken crypto exchange over failure to register (re: All crypto exchanges are frauds).

(Business Insider) Retool survey finds more than half of tech workers think AI is overrated. I DISAGREE.

(Vancouver Sun) Man wanted in the US and Canada in $300 million Ponzi Scheme disappears to Asia.

Joke Of The Day

A young stockbroker had just parked his BMW. As he opened the door, a car zoomed past ripping the door from his car. A police officer happened to be walking past, and quickly ran over to the driver. “Are you alright?”, he asked. The stock broker whined, “My Beemer! Look what he did to my Beemer!” Disgusted the officer growled, “You greedy Wall Street types are all alike. Just worried about your damn status symbols. You’re so busy whining about your damn BMW that you haven’t even noticed that your whole arm was ripped off by the crash.” The stock broker looked down at bleeding shreds of flesh hanging where his left arm once was and screamed, “Oh my God! Oh my God! My Rolex!”

A.M. Allocations

Buck-Wild: Argentina’s Dollarization Dreams

Argentina’s newly elected anarcho-capitalist President, Javier Milei, plans to replace the national peso with the U.S. dollar to combat the country's severe inflation, one of the highest globally at 143%. Sounds nice, but Milei's dollarization proposal faces significant challenges, including obtaining support from a divided congress and navigating legal hurdles, as the Argentine Supreme Court considers the move unconstitutional.

Economic analysts are also skeptical about Argentina's ability to implement dollarization due to its lack of access to global debt markets and the need for substantial funds to convert the monetary base into dollars.

Milei also aims to overhaul the government, reduce spending, open the economy to global markets, and privatize state-run companies, including oil firm YPF, sparking rallies in Argentine assets in New York.

Explainer: Adopting the USD as a national currency helps stabilize economies by reducing inflation and bringing it under control, as it prevents governments from printing money excessively, which is often a key factor in driving inflation.

Dollarization can also attract foreign investment and enhance economic credibility, as using a stable and internationally recognized currency like the USD lowers interest rates and creates a more predictable financial environment, crucial for long-term economic planning and growth.

My Thoughts: Fully adopting the Greenback does have a nice track record with reducing rampant inflation. However, while I’m no economist, it sounds pretty damn tricky, and it’s not like these folks have a great track record with financial management. Comparisons are being drawn with Ecuador and El Salvador, which have previously dollarized, but Argentina has a different economic structure. The limitations that dollarization may impose on Argentina’s monetary policy - such as the ability to run budget deficits in times of need, and shock of absorbing these massive changes - could pose real risks to their economic system.

The biggest thing that sticks out to me is their size: Argentina’s economy - while shaky - is massive compared to the other dollar adopters so the level of sophistication and integration is likely exponentially more complex.

Time will tell if President Milei garners sufficient support to drop the peso for the dollar. And while I don’t think it will end up being nearly as trouble-free as the President claims, if they can pull it off it could add some much needed stability to a country that was once one of the 10 richest in the world but now has roughly the same purchasing power as Libya.

Trivia

Some general investing terminology today!

What does 'Alpha' represent in investing?

A) The market return

B) The average stock return

C) Excess return of an investment relative to the return of a benchmark index

D) The dividend payout ratio

What does a 'Duration' measure in bond investing?

A) The bond’s time to maturityB) The bond's yield to maturity

C) The weighted average time to receive cash flows

D) The bond's default risk

The 'Capital Asset Pricing Model (CAPM)' is used to:

A) Determine the optimal capital structure

B) Calculate the expected return of an asset

C) Measure the liquidity of a market

D) Estimate the default risk of a bond

(answers at bottom)

Market Movers

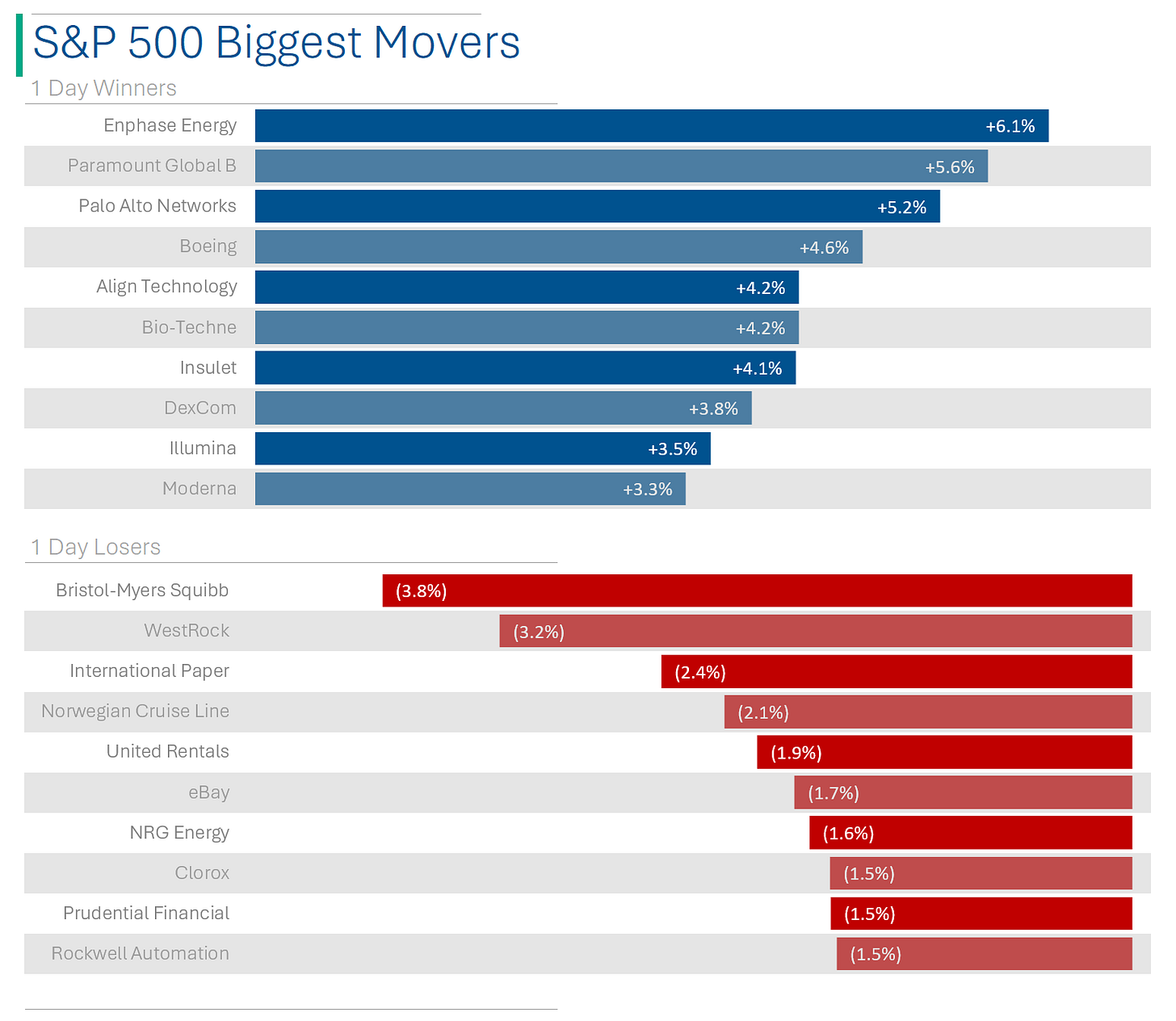

Winners!

GoodRx Holdings (GDRX) [+10.1%]: Interim CEO Scott Wagner bought 131k shares.

Iovance Biotherapeutics (IOVA) [+8.7%]: Goldman Sachs initiated a buy rating, highlighting their leading tumor-infiltrating lymphocyte therapies for solid tumors and potential in melanoma (these are good things).

Penn Entertainment (PENN) [+6.8%]: Upgraded to buy from neutral at BofA Securities, noting promising trends for ESPN Bet and promotional discipline.

Losers!

Bayer AG (BAYRY) [-17.5%]: Trial of blood-thinner asundexian halted due to lack of efficacy, a setback given its potential as a blockbuster and Xarelto successor; also faced a ~$1.56B US jury award related to Roundup weedkiller.

Chegg (CHGG) [-6.2%]: Downgraded to underweight from equal-weight at Morgan Stanley, with concerns over declining web traffic and app downloads in October.

Market Update

Trivia Answers

C) Alpha is the excess return of an investment relative to the return of a benchmark index.

C) Duration is the weighted average time to receive cash flows.

B) CAPM is used to calculate the expected return of an asset.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.