🔬 Are Wall Street Analysts Useless?

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble"

- Warren Buffett

“Cheese. It’s milk that you chew”

- Chandler Bing, Friends

The market couldn’t keep the rebound going with the S&P 500 -0.8% and Nasdaq -1.1%.

4 of 11 sectors closed higher led by defensive Utilities (+0.5%). Consumer Discretionary, Tech and Materials were the worst; all down -1.4%.

Notable companies:

Super Micro Computer (SMCI) [-20.1%]: Fiscal Q4 revenue largely in line, though EPS missed by over 20% due to softer GM performance; flagged competitive pricing for new strategic designs and supply constraints in liquid cooling; company downplayed concerns about Blackwell delays.

Walt Disney (DIS) [-4.5%]: Fiscal Q3 results ahead, EPS guidance raised; driven by Entertainment and Sports, lower tax rate; Experiences segment light, Q4 outlook lowered (now sees MSD decline); domestic demand moderation noted in Q3 could impact future quarters.

Shopify (SHOP) [+17.8%]: Q2 revenue and GMV (+22% vs consensus +19%), margins, and EPS all ahead; Q3 sales growth better than expected with guidance for low-to-mid twenties %, above Street expectations of 20%; highlighted share gains, increased Shopify Payments penetration, and pricing increases in subscription plans.

More below in ‘Market Movers’.

Street Stories

Are Wall Street Analysts Useless?

TLDR: Sorta.

On September 27th, 2021, 83% of Wall Street analysts covering Disney rated the stock a Buy. The average target price for the shares was $211, which represented an +18.6% premium to the share price of $178.

Fast forward a few years and Disney’s shares are worth $86. This begs the questions ‘are these people f***** stupid?’ ‘should you place value in Wall Street’s ratings?’

To test the value of Wall Street analysts I put together a little spreadsheet to see how well Buy Ratings and high Target Prices are in actually predicting a stock’s potential.

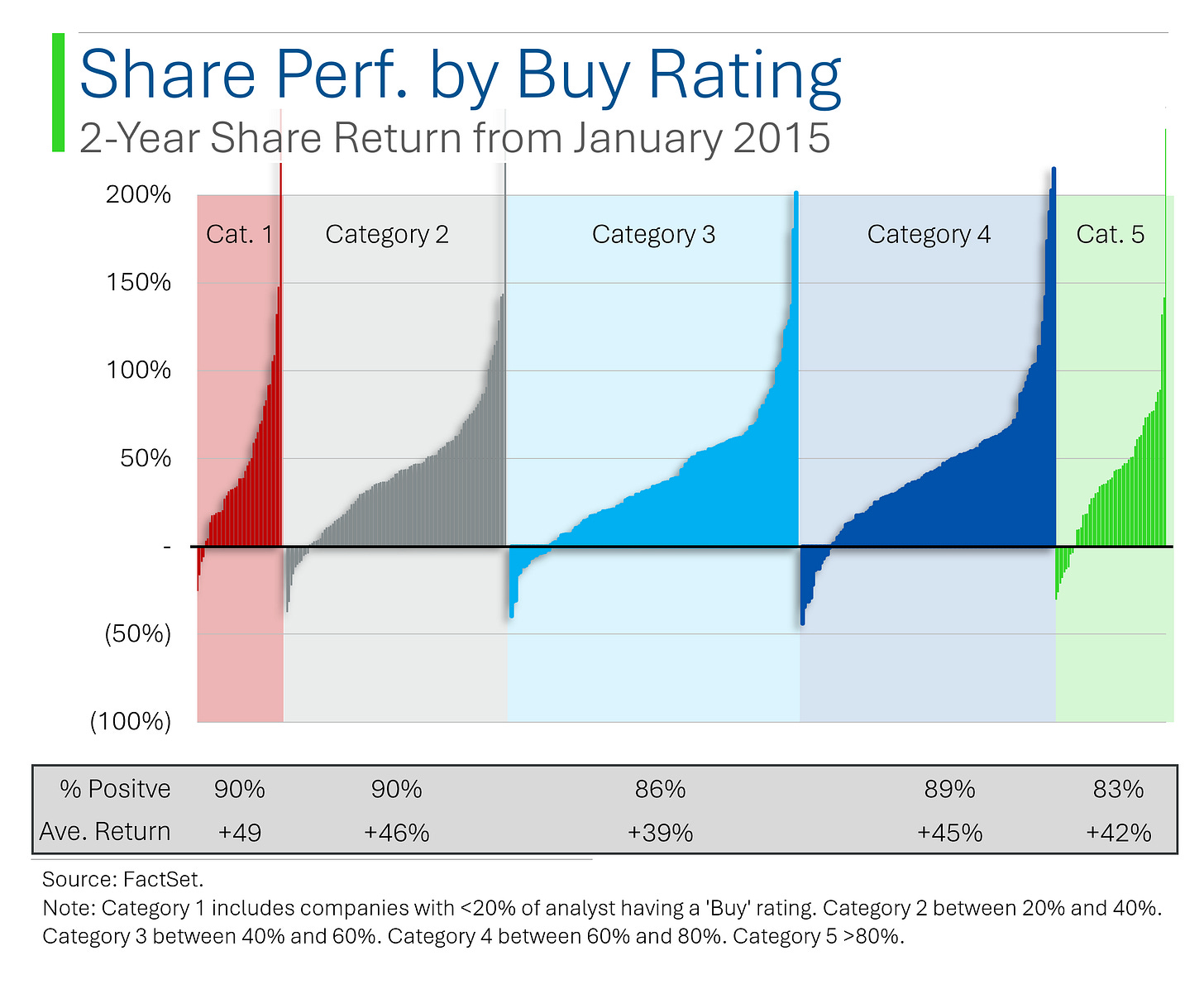

To start, I organized companies in the S&P 500 across different periods to see the impact Buy Ratings had on the shares. Companies with <20% of the Street having a Buy rating were in category 1. Companies with >80% having Buy Ratings were in Category 5. The rest you can figure out.

As you can see below, there is decent outperformance for Category 5 vs. Category 1. Makes sense; the dumpster fires that analysts aren’t afraid to hate on sucked, and the companies that had a halo around them crushed it.

What’s interesting is that companies with modest ratings (Cat. 2), solid ratings (Cat. 3) and good ratings (Cat. 4) don’t really seem differentiated across the years. Basically, stocks that are really loved/really hated tend to do great/terrible, but for stocks that are in the middle, Wall Street Analysts don’t really matter.

To add a bit of color to this, in the 2015 to 2017 period, stocks in the highest buy ratings group (Category 5) had the lowest percent of companies with a positive return (83%) and the second lowest (+42%) average return.

Your odds of hitting a homerun also don’t look particularly impressive.

While that might seem convincing, if we look at the period between 2021 and 2023 - you know, when the market sorta crashed - the result is totally different: Companies in the top category did extremely well.

Perhaps a conclusion you might draw from these observations is that Wall Street Analyst’s Buy ratings cluster around companies that are ‘high quality’. Maybe not the best growers, but solid compounders with deep moats and durability.

Moving on…

When looking at Target Prices, companies that Wall Street has super punchy target prices for (Category 5) where estimates are >+45% of the current share price easily outperformed every other category except for the 2017 to 2019 period.

The results pretty much hold down the line: Wall Street’s target price does seem to positively predict the performance of the stock.

To wrap this up, I’d say there’s a few (overly simplified) conclusions that might be drawn from this:

The percent of Buy Ratings only really matter for the extremes of super loved or super hated. For everything else it’s pretty minimal.

In times of big market pullbacks, companies with a super high percent of Buy Ratings performed very well. This may be sign that they are of high quality and very durable businesses.

The higher the target price, the better the stock will do. At least over a two year period. I won’t make you look at another chart, but I computed the Categories and their stock performance across the whole December 2015 to present period, and the top category (Cat. 5) finished 3rd. Buying the companies with the highest target price spread works in the short-term but you’ll need to readjust.

Ryan’s Thoughts: So, full disclosure: I worked on the buyside picking stocks for the better part of a decade, and chatting with Equity Research Analysts was one of the more helpful parts of the job. They know the companies better than anyone; even the folks buying the stocks. After all, they cover 10-20 companies and I had an investment universe of +150. It’s just math.

That said, there are a lot of… I’ll call them ‘external’ factors that limit their ability to accurately present price targets and buy ratings. Three are probably the most important:

1) To cover the stock well, usually means access to management. If you call Tesla the biggest short of all time (like JPM sorta did), then Elon isn’t going to talk to you (and also block you from their financing work). This doesn’t help you.

2) If you cover 12 stocks and have sell ratings on all of them, you probably aren’t generating a lot of attention to your calls. PM’s want to get calls from analysts banging the drum for their best ideas, not calls about how they shouldn’t buy stocks they don’t own. As a result you also probably aren’t drumming up much trading flow (how banks mostly get paid for research). This also doesn’t help you.

To conclude, Wall Street Analysts are great sources of information and insight but accept that often the ratings and target prices aren’t free of bias. In this industry it doesn’t pay to stand out too far. If you’re right when everyone else was wrong, you look like a hero! But that doesn’t nearly offset what happens when your wrong and everyone else is right (you get fired).

Take JP Morgan’s former chief market strategist Marko Kolanovic. He had the most bearish outlook for the market while most of the Street was clumped around ‘I don’t know’ territory. They didn’t look like geniuses, but, unlike Marko, they at least got to keep their jobs.

Joke Of The Day

When in doubt, mumble.

Hot Headlines

Reuters / Walt Disney warns theme park revenue to fall as profit slips. More signs of weakening consumer.

Yahoo Finance / Novo Nordisk CFO says Wegovy sales miss a 'blip'. Sales of Wegovy were still up +55% YoY and the company reported that the growth in weight-loss drugs is still very strong.

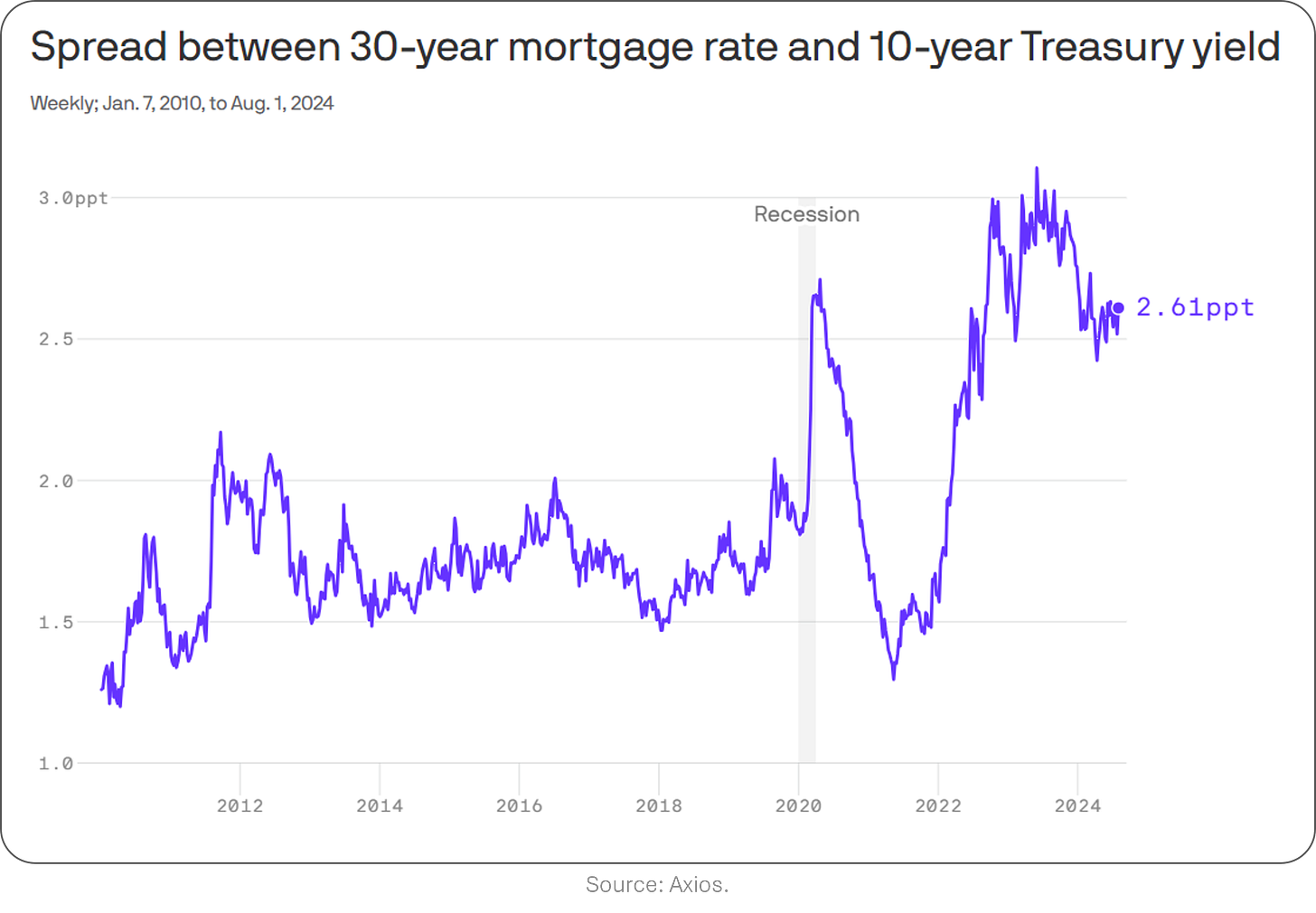

Axios / Even without Fed rate cuts, mortgages could continue to fall. Mortgages have historically priced at rates around +1.7% over the U.S. 10-Year treasury but currently sit at around +2.6%. If they revert to the mean, this could take mortgages rates from 6.6% to 5.5%. Which is huge.

Axios / Data shows that retail investors bought the dip during Monday's stock market plunge. Interactive Brokers data shows that retail investors weren’t scared out of the market but instead used the decline as a buying opportunity.

CNBC / A ‘soft landing’ is still on the table according to economists. In the face of rapidly decreasing sentiment around the US economy, many are highlighting that the general economic situation is still solid and that the Fed should be able to manage the final inflation push while not destroying the labor market.

Trivia

Today’s trivia is on Charlie Munger.

Charlie Munger got his law degree from Harvard. What was interesting about the way he got his degree?

A) He failed most of his tests and only passed because he was likeable.

B) He never completed an undergraduate degree.

C) He is highly dyslexic and couldn’t read the text books.

D) He never went to class.Charlie coined a term that he uses to describe the phenomenon wherein different biases layer and interlock with one another that ultimately can distort people’s perception of events and things, such as the stock market. This was called what?

A) Layered Biases Effect

B) Lollapalooza Effect

C) Three Stooges Effect

D) Sticky PerceptionsWhat famous book is based on the writings and speeches given by Charlie Munger?

A) Munger on Munger

B) Tap Dancing To Work

C) Snowball

D) Poor Charlie’s Almanack

(answers at bottom)

Market Movers

Winners!

Upstart Holdings (UPST) [+39.5%]: Q2 EPS and revenue beat expectations; Q3 guidance above consensus; H2 2024 revenue from fees raised; management highlighted tailwinds from expected lower interest rates; analysts see an inflection point noting a positive tone on credit, volumes, and funding.

Lumen Technologies (LUMN) [+32.6%]: Q2 revenue in line with earnings light; slight cut to FY revenue guide but raised FCF and capex guidance; analysts noted the report was mixed but focused on $5B Private Connectivity Fabric contract wins, sparking a 93%+ rally; multiple upgrades.

Fortinet (FTNT) [+25.3%]: Q2 EPS and revenue beat with improved gross margins; Q3 guidance ahead; FY24 EPS and revenue guidance raised; operating margin gains expected to boost FCF; software license growth at 26% Y/Y, driven by initial deployments of firewall solutions.

Shopify (SHOP) [+17.8%]: Q2 revenue and GMV (+22% vs consensus +19%), margins, and EPS all ahead; Q3 sales growth better than expected with guidance for low-to-mid twenties %, above Street expectations of 20%; highlighted share gains, increased Shopify Payments penetration, and pricing increases in subscription plans.

Cirrus Logic (CRUS) [+7.5%]: Fiscal Q1 results and September guidance ahead; takeaways highlighted strong iPhone 15 demand, iPhone 16 ramp, and content gains; discussion of PC opportunity; seasonality differences impact December outlook.

VF Corp (VFC) [+7.1%]: Fiscal Q1 revenue ahead, EPS not as bad as feared; sequential improvement across most brands, additional planned expense reductions, Vans reset traction, GM improvement expectations, and October Investor Day upcoming.

Reynolds Consumer Products (REYN) [+7.0%]: Q2 sales and EBITDA better; Hefty Waste & Storage and Presto were standouts; retail volume outperformance; slightly raised 2024 guidance due to better retail volume outlook and reduced non-retail drag.

IAC, Inc. (IAC) [+6.5%]: Q2 EBITDA and revenue beat; narrowed FY24 EBITDA range; raised Dotdash Meredith and Angi segments; analysts positive on DDM results, noting no slowdown post-Google AI Overviews, with positive ad volume and pricing.

Instacart (CART) [+2.8%]: Q2 EPS, EBITDA, and revenue beat expectations; guided Q3 EBITDA ahead of Street; sees HSD to LDD GTV growth y/y due to order growth rather than AOV growth; analysts positive on ad traction and retail media growth opportunity.

Losers!

Trex Co. (TREX) [-21.5%]: Q2 results in line, but Q3 revenue guide well below expectations; 2024 revenue guidance lowered by 7%; weakness in lower-priced product line and channel inventory reduction expected in 2H; noted incremental softening in mid-tier products; multiple downgrades.

Super Micro Computer (SMCI) [-20.1%]: Fiscal Q4 revenue largely in line, though EPS missed by over 20% due to softer GM performance; flagged competitive pricing for new strategic designs and supply constraints in liquid cooling; company downplayed concerns about Blackwell delays.

Lyft (LYFT) [-17.3%]: Q2 EBITDA and revenue beat, but bookings were light; Q3 EBITDA and bookings guidance below consensus, but FY guidance reaffirmed; analysts positive on rides strength in hotel/airport and social categories but concerned about long-term targets.

TripAdvisor (TRIP) [-16.6%]: Q2 EPS and EBITDA beat, but revenue missed and FCF was light; Q3 revenue growth guidance flat to slightly down y/y, below consensus; downgraded to neutral due to deteriorating core revenue growth and travel slowdown.

Airbnb (ABNB) [-13.4%]: Q2 EBITDA beat and revenue in line; Q3 revenue guidance below Street; noted moderation in Nights and Experiences Booked and shorter booking lead times globally; analysts see capped upside due to consumer trends and post-Covid normalization.

Charles River Laboratories (CRL) [-12.6%]: Q2 earnings and OM better with revenue in line; organic growth decline better than consensus; lowered FY24 EPS and revenue guidance; cited budget-focused biopharmaceutical clients; announced new $1B buyback.

Novo Nordisk (NVO) [-8.4%]: Wegovy sales missed by 14%, and Ozempic by 3%; flagged pricing pressure and supply constraints in obesity meds; noted strong demand and revised FY sales growth guidance upward.

Emerson Electric (EMR) [-7.7%]: FQ3 earnings better, but revenue missed; Intelligent Devices results below consensus; demand met expectations in process and hybrid markets; trimmed FY24 revenue growth guidance.

Rivian (RIVN) [-6.9%]: Q2 revenue in line, but EPS missed; production impacted by downtime from retooling upgrade; reaffirmed FY guidance including LT ~25% GM target; analysts positive on results and margin prospects.

Toast, Inc. (TOST) [-6.1%]: Q2 EPS missed, but revenue beat; gross payment volume up 265% Y/Y; GPV per location softer than expected; Q3 earnings guidance in line, while FY24 guidance raised; analysts flagged GPV per location deterioration.

Amgen (AMGN) [-5.1%]: Q2 EPS in line, revenue slightly ahead with 20% Y/Y growth in product sales; EPS fell Y/Y raising margin concerns; raised FY24 revenue guidance; Horizon acquisition boosted Tepezza, Kystexxa, and Uplizna, though Enbrel, Otezla, and Neulasta missed.

Walt Disney (DIS) [-4.5%]: Fiscal Q3 results ahead, EPS guidance raised; driven by Entertainment and Sports, lower tax rate; Experiences segment light, Q4 outlook lowered (now sees MSD decline); domestic demand moderation noted in Q3 could impact future quarters.

Market Update

Trivia Answers

B) While he’d been to two universities prior to Harvard, he had never completed an undergraduate degree.

B) Lollapalooza Effect.

D) Poor Charlie’s Almanack.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Peculiar analysis that most analysts would be scared to perform. Amazing job!

As a former analyst, I love to know other's opinions to find blind spots and bet against them.