🔬 Are Valuations Getting Stupid?

Plus: The best at beating Wall Street estimates; PMIs are good enough; and much more!

“The best time to plant a tree was 20 years ago. The second-best time is now.”

-Chinese proverb

“If you think nobody cares if you’re alive, try missing a couple of car payments.”

-Earl Wilson

Soft end to another positive week for the big US markets, with the S&P 500 and Nasdaq both down 0.2%. The S&P finished up +0.6% for the week making in 8 out of the last 9 weeks in the win column.

8 of 11 sectors closed higher for the week, with Energy (+2.5%) and Consumer Discretionary (+1.9%) doing the best - shout out to increasing oil prices and a modest CPI print last week. Utilities (-0.8%) and Tech (-0.7%) did the worst.

Notable companies on Friday:

Sarepta Therapeutics (SRPT) [+30.1%] Received expanded US FDA approval for muscular dystrophy treatment.

Nike (NKE) [+1.7%] Upgraded to outperform from perform at Oppenheimer, citing derisked near-term and management's progress on innovation and brand-building.

Palantir Technologies (PLTR) [-6.7%] Downgraded to sell from neutral at equity research shop MCH; cited valuation concerns, market's aversion to high multiples, and earnings falling short of AI expectations.

More below in ‘Market Movers’.

Street Stories

Are Valuations Getting Stupid?

To start: Yes, probably.

If we ignore the ‘Everything Bubble’ that hit the stock market during the pandemic, the stock market trades at close to its highest valuation ever. At 21x forward P/E the market currently sits at a 33% premium to it’s 20 year average.

Ie: Not cheap.

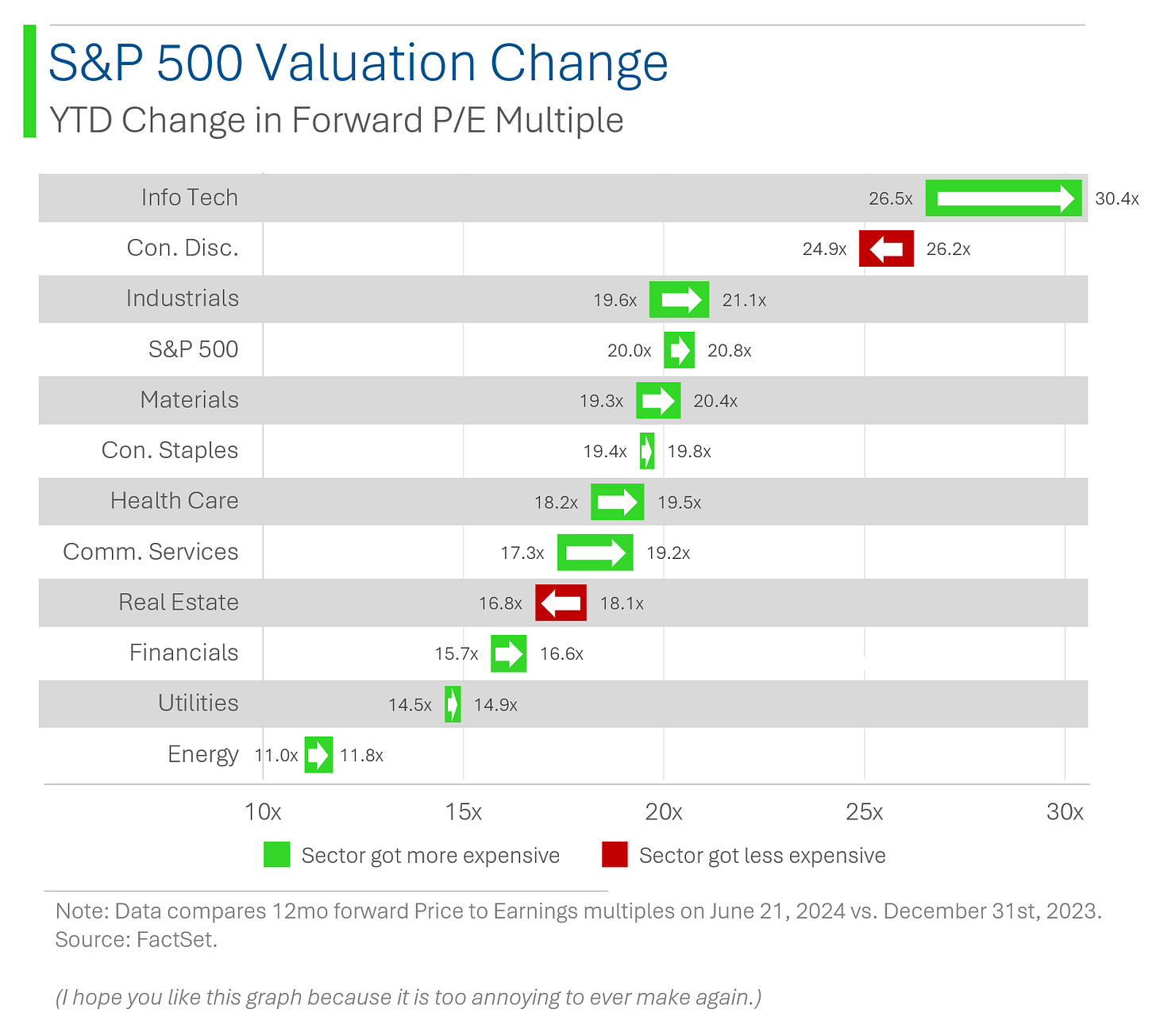

So far in the first half of the year, valuations increased in 9 out of the 11 sectors, with only Consumer Discretionary and Real Estate taking a step backwards. The former mostly due to worries over the inflation-stretched consumer, and the latter as hopes for aggressive rate cuts by the Fed evaporated.

On the whole, the average sector multiple ticked up by 4.6% this year.

Generally speaking, higher growth sectors tend to have the highest multiples, but there are some exceptions such as Health Care and Communication Services which trade below the S&P 500 average yet are forecast to growth at a higher rate.

To me, the big question is how good are the growth prospects in the future: Are we expecting record high corporate growth to warrant the record high valuations?

Turns out, ‘not really’. Aggregate Wall Street growth estimates for the S&P are in the 5-6% range for the next few years.

Solid, but this isn’t exactly predicting the next renaissance.

Purchasing Managers’ Index: Slightly More Upbeat

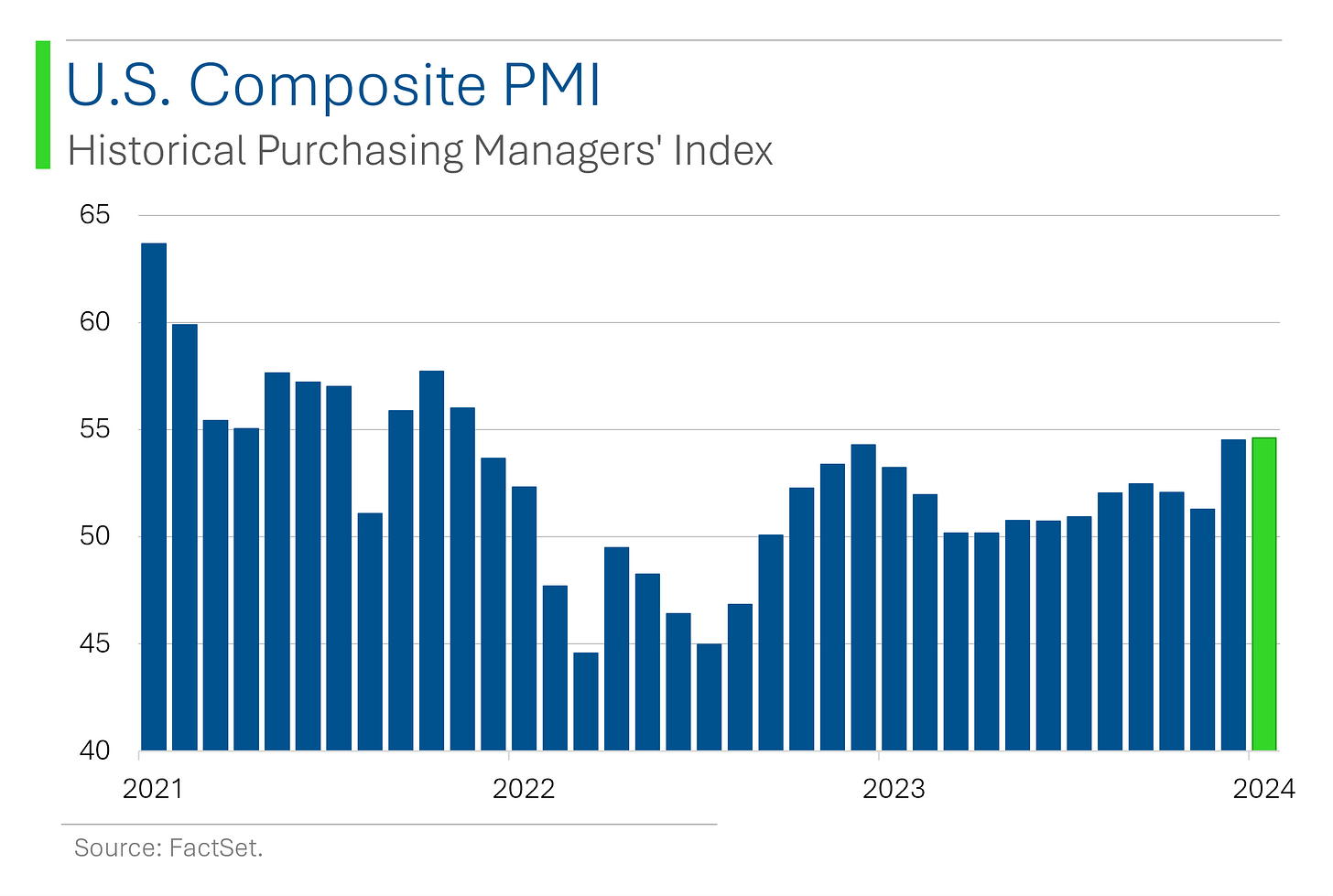

In June, the US S&P Global Composite PMI rose to 54.6, up from a revised 54.5 in May and indicating continued robust expansion in the private sector, with manufacturing and services PMI readings also surpassing analysts' expectations.

S&P Chief Business Economist Chris Williamson highlighted that economic growth reached a two-year high and noted that selling price inflation cooled, aligning with the Fed's 2% target. 🤘🤓

Street Beat Down

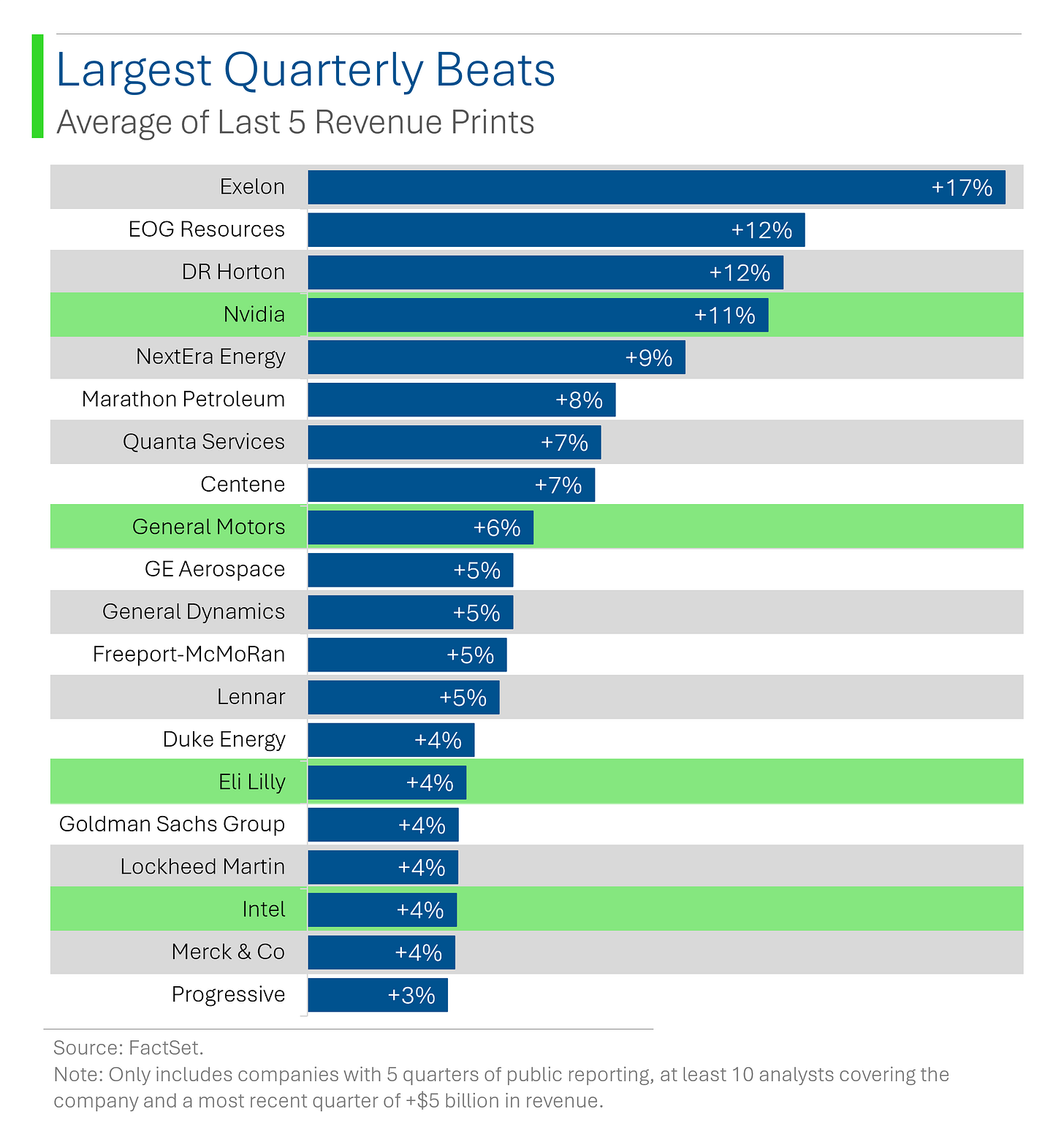

Sure, most quarters that ‘beat’ Wall Street estimates are more of a success for management’s managing of expectations than operations. But for some companies - they really knock the ball outta the park every three months.

Nvidia’s double-digit streak over the last five quarters definitely stands out. Eli Lily’s run is also notable as the insulin King started taking on its main rival Novo Nordisk for the weight-loss market.

And I think most of us are pretty surprised that GM and Intel are on this list also. Worth noting a ‘Beat’ doesn’t necessarily mean they had a great quarter; it could also just mean that the quarter was less of a disaster than everyone was expecting.

Less of a bullish indicator.

Utility Southern has been a stand out for all the wrong reasons. Tesla and the logistics companies UPS and FedEx also haven’t exactly been heroes either.

Streak-wise, Danaher continues to be the King (at this point it’s a bit of a running joke how they ‘inform’ the Street of where expectations sit #shady). Visa and Mastercard essentially have things on autopilot at this point also.

Interestingly Nvidia is in the number two spot with a streak that goes back over 5 years now (ie: 4 years before anyone ever heard of them).

Joke Of The Day

“The trick is to stop thinking of it as ‘your’ money.” – IRS auditor

Hot Headlines

WSJ / The rise of Chinese EVs is dividing the West’s response to defend domestic automakers. Last month the Biden administration raised total import tariffs to 102.5% on Chinese EVs, whereas the EU has taken more modest steps, bringing the total figure to only 27.4%.

NY Times / How pharmacy benefit managers secretly inflate prescription drug costs. A great look into the shady and opaque industry that costs consumers, employers and the government billions in extra drug costs.

Reuters / TikTok says U.S. hopes hinge on U.S. Court of Appeals hearing in September to void the pending ban on the App. Chinese parent company ByteDance argues divestiture is not possible technologically, commercially or legally, and claims the U.S. government refused to engage in any serious settlement talks after 2022.

Bloomberg / WHO warns fake Ozempic is circulating in Europe and Americas. Was wondering why I was lactating…

WSJ / The summer of finance bros and the origin of ‘Man in Finance’.

Trivia

This week’s trivia is on the history of semiconductors aka chips.

Which company, founded by Jack Kilby, is credited with inventing the handheld calculator using integrated circuits?

A) IBM

B) Texas Instruments

C) Intel

D) Fairchild Semiconductor

AMD, a major competitor in the microchip industry, stands for:

A) Advanced Micro Devices

B) Accelerated Modular Dynamics

C) Analytical Machine Designs

D) Automated Microchip Development

TSMC, one of the largest semiconductor manufacturers in the world, is based in which country?

A) United States

B) South Korea

C) Taiwan

D) Japan

(answers at bottom)

Market Movers

Winners!

Sarepta Therapeutics (SRPT) [+30.1%] Received expanded US FDA approval for muscular dystrophy treatment.

Asana, Inc. (ASAN) [+15.3%] Announced $150M buyback and reiterated Q2 and FY25 guidance.

Ryan Specialty Holdings (RYAN) [+7.7%] To join S&P MidCap 400, effective 28-June.

FactSet Research Systems (FDS) [+3.8%] FQ3 EPS and EBITDA beat, revenue in line; raised FY24 EPS guidance despite slightly lower organic revenue growth; analysts positive on margin tailwinds.

Nike (NKE) [+1.7%] Upgraded to outperform from perform at Oppenheimer, citing derisked near-term and management's progress on innovation and brand-building.

Losers!

Smith & Wesson Brands (SWBI) [-12.9%] Fiscal Q4 revenue and EBITDA ahead, expecting healthy FY25 demand for firearms; scrutiny over Q1 outlook with units and dollars down 10%, plus capacity buildout and promotions.

Palantir Technologies (PLTR) [-6.7%] Downgraded to sell from neutral at equity research shop MCH; cited valuation concerns, market's aversion to high multiples, and earnings falling short of AI expectations.

CME Group, Inc. (CME) [-2%] Downgraded to underweight from neutral at JPMorgan, citing competition from FMX Exchange.

Market Update

Trivia Answers

Kilby founded Texas Instruments.

AMD stands for Advanced Micro Devices.

Taiwan. Yep, that’s what the ‘T’ stands for.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Ridiculously so ,,, but the money needs to go somewhere that governments are giving away

Great piece as always! I'm starting to wonder if there's been a material change in valuations where they will be higher than we've been accustomed to. Kind of like inflation staying higher for longer. As the government debases our currency more rapidly than ever it would make sense than valuations of companies run above average compared to the past. These Big Tech companies also have a lot of cash on their balance sheets and they generate a lot of revenue, so the valuations aren't as frothy as in the dot com bubble when those stocks were dogcrap.