🔬Are The 7 Still Magnificent?

Plus: Roaring Kitty's humongous GameStop position reignites Meme-rally; and much more!

"I like to think of the investment world as divided into two groups: those who don't know where the market is headed and those who don't know they don't know"

- Jeremy Grantham

"A plan without action is not a plan. It’s a speech"

- T. Boone Pickens

Modestly positive day for the big US markets after a run of poor performance, with the S&P 500 +0.1% and Nasdaq +0.6%.

4 of 11 sectors closed higher, led by Tech (+1.0) while Energy tumbled -2.6%, after oil dropped 3.6% following the OPEC+ meeting that announced a tapering of their

market manipulationproduction cuts starting later this year.May ISM Manufacturing came in well below estimates with a print of 48.7 vs. Wall Street’s bogey of 49.7.

Notable companies:

GameStop (GME) [+21.0%]: Meme-stock influencer Keith "Roaring Kitty" Gill posted a screenshot implying he holds 5M shares and 120k in call options.

Stericycle (SRCL) [+14.6%]: To be acquired by Waste Management for ~$7.2B in cash ($62 per share) representing a ~20% premium.

Spotify Technology (SPOT) [+5.6%]: Raised US subscription prices; individual plan to $11.99, duo to $16.99, family to $19.99.

More below in ‘Market Movers’

Street Stories

Are The 7 Still Magnificent?

The biggest story of last year - at least until the AI hype - was the dominating performance of seven of the biggest companies in the world. Mega-caps with growth stories like start-ups, they pulled market sentiment upwards and buoyed the stock market in 2023 to one of its best years on record.

So what happened?

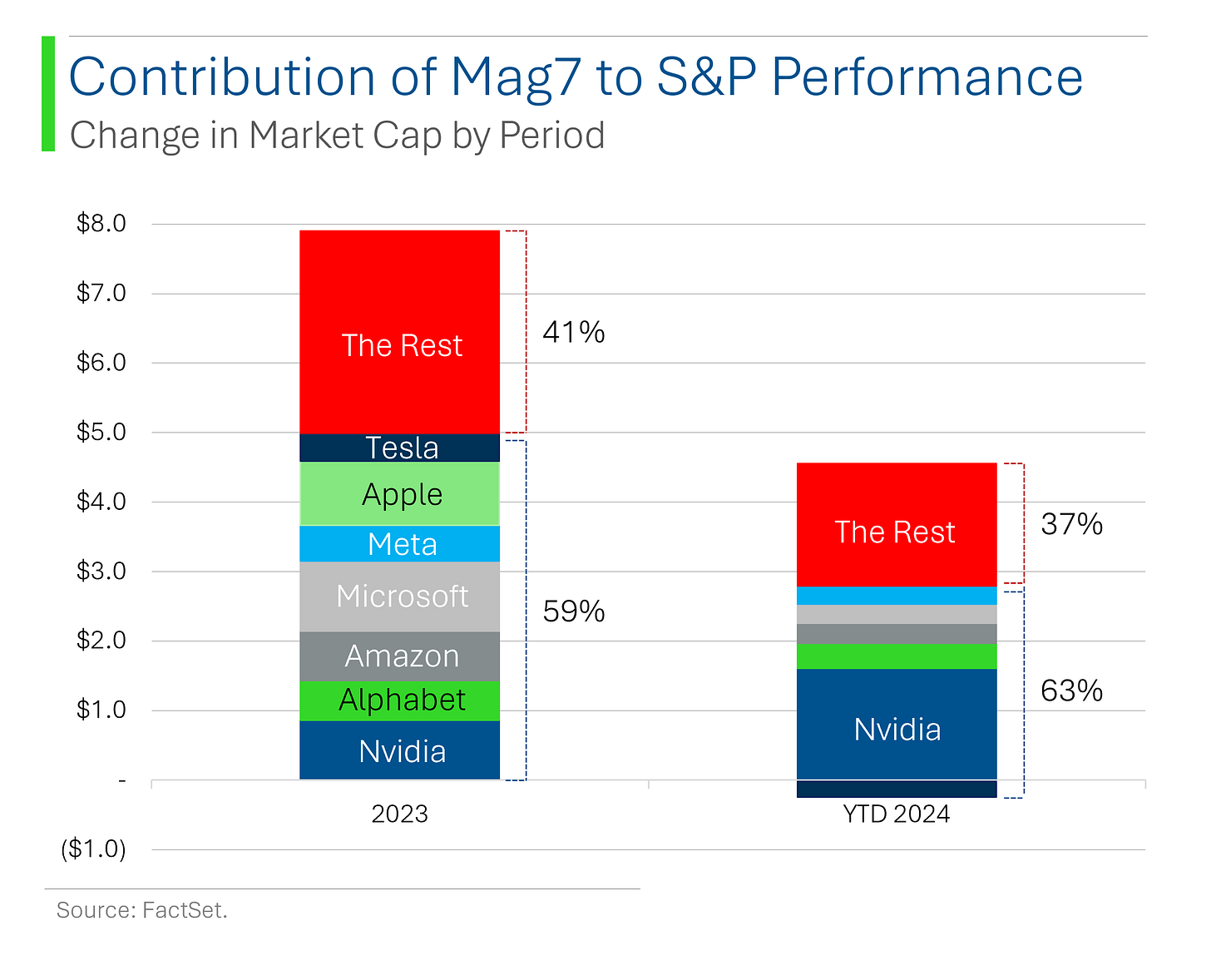

Last year, the average member of the Mag7 was up +111% and considering that they started the year consisting of ~21% of the S&P 500, you can tell that they had a pretty significant impact on the the index rising +24% last year.

And while infrequently talked about, they have actually performed pretty well on the whole this year. Four of the seven (Nvidia, Meta, Alphabet and Amazon) are up far more than the S&P, which up +11% for the year. Microsoft is close to +10%, Apple has turned it around and is now positive (+1% for the year). And Tesla… well, maybe we won’t get into that.

What’s interesting is that as a group, they have again contributed more to the index’s performance this year than the other 493 stocks in the S&P 500 combined. Moreover, their contribution is higher this year than last year when they were all the rage (63% of return vs. 59% in 2023).

That said, 63% of Mag7 performance is attributable to Nvidia, so hold back on the medal ceremony.

The Mag7 now represent ~32% of the entire combined market cap of the S&P 500, a record for the group and +50% over the start of 2023 (21%).

Lastly, it’s become clear in the last few months that some of members of the group have stronger prospects than others. Over the course of 2024, Nvidia has seen Wall Street estimates for its 2024 revenue grow by 28%. For Tesla, it’s gone the other way, with the Street now seeing 2024 sales coming in 11% lower than at the turn of the calendar.

For the rest, the hype may have waned but the growth stories look relatively in tact (ok, Apple is a bit shaky). They may not be the rocket ships they were in 2023 but not a hell of a bad place to keep your money.

GameStop’s Fat Cat is Back (again)

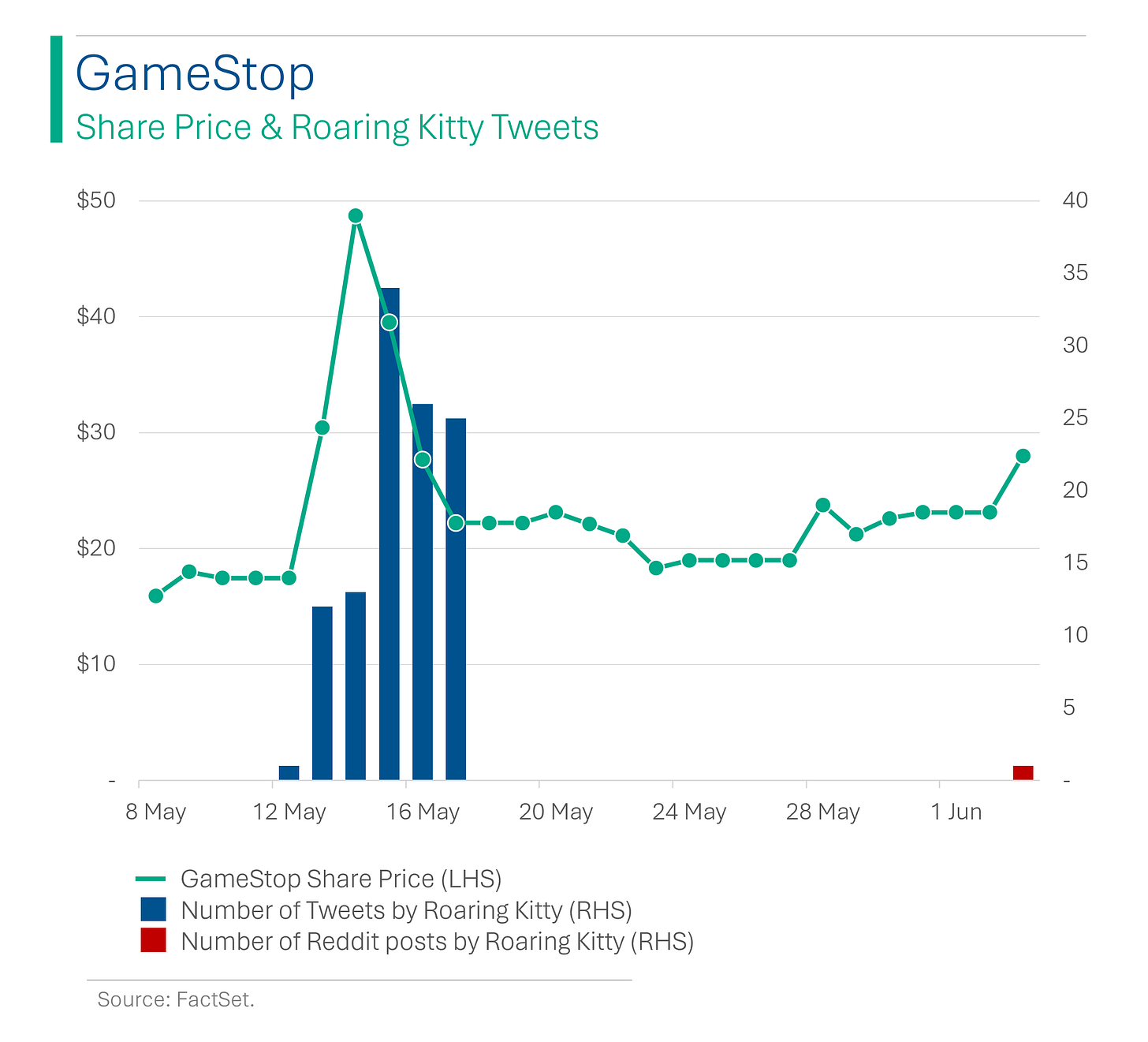

On May 12th, investor Keith Gill aka Roaring Kitty aka DeepF***ingValue started what would ultimately be a series of 111 tweets over the course of 6 days and the May Meme-stock rally was born.

He then proceeded to disappear for weeks. The stock went down. Then he came out of the blue with his first Reddit post in 3 years to reveal a massive position in GME, including 5 million shares and 120k in call options. The stock went up.

When I created the above, GameStop shares were at $31 - up 34% on the day (they ended up trading down a bit afterwards). At $31 a share, Keith Gill’s GameStop position would be worth $287 million at the time of his options expiry.

Ya, the guy who put $50k into GameStonk would be worth more than a quarter of a billion dollars.

Moreover, if he folded those options profits in GameStop shares, he would be in control of ~3% of the company.

That would make Keith Gill, a blue collar guy from a suburb of Boston; with no investment fund; no trust fund; just a few bucks in an E*TRADE account, the fourth largest shareholder of a $7 billion company, behind only it’s CEO (RC Ventures in the above) and index funds BlackRock and Vanguard.

I mean, that’s great and all. But like…

(Last month I did a bit of a primer on why it will be different this time with GameStop, mostly due to the lack of elevated short-interest. Check it out!)

Joke Of The Day

Just saw an advert in the local newspaper which read: “Accountant Needed: $55,000 – $60,000”. So I rang them and said, “-$5,000”.🫡

Hot Headlines

Reuters / Scandal! Japanese automakers investigated for potential falsifying of safety certifications. The transport ministry ordered Toyota, Mazda and Yamaha to suspend shipments of some vehicles, while irregularities were also found at Honda, Suzuki and Yamaha.

CNBC / Spirit Airlines’ finance chief to join beleaguered car rental firm Hertz. The transition at Spirit comes while the carrier has been incinerating money despite booming travel demand, raising questions about its ability to manage debt that is due to mature in 2025 and 2026. Not exactly going from strength to strength.

Bloomberg / Citron’s Andrew Left - burned in 2021 Meme Mania - is short GameStop again. “When I saw it, I shorted it,” Left said referring to Roaring Kitty’s latest Reddit post unveiling a 5m share position.

Reuters / Ackman's Pershing Square raises $1.05 billion by selling 10% stake ahead of potential IPO. The hedgefund claims it will use the money to accelerate growth in AUM and launch new funds. I still think he’s the biggest weenie on Wall Street but can’t wait to see the S1.

Reuters / Fashion firm Shein is reportedly preparing to file £50 billion IPO prospectus in London. Valued at $66 billion in a fundraising last year, the firm has been engaged with the London-based teams of financial and legal advisors, after US regulatory scrutiny pushed them into the hands of the Brits. You know, after that whole ‘forced labor’ thingy.

Trivia

This week’s trivia is on famous investors.

Who is known as the "Oracle of Omaha"?

A) Carl Icahn

B) Warren Buffett

C) George Soros

D) Peter LynchWhich famous investor is known for his $1 billion profit on a single trade betting against the British Pound in 1992?

A) Warren Buffett

B) Carl Icahn

C) George Soros

D) Ray DalioWhat is the main investment strategy of Ray Dalio's Bridgewater Associates?

A) Value Investing

B) Growth Investing

C) Risk Parity

D) Index Fund InvestingMarch 27, 1980 is known as this day following the attempt by the Hunt Brothers (Nelson, William, and Lamar) to corner the market for the commodity.

A) Gold Monday

B) Silver Thursday

C) Copper Wednesday

D) Iron Thursday

(answers at bottom)

Market Movers

Winners!

MarineMax (HZO) [+27%]: Bloomberg reported OneWater Marine (ONEW) made a $40 per share cash offer; deal could be announced this month.

Coherent (COHR) [+23%]: Announced Jim Anderson as CEO.

GameStop (GME) [+21%]: Meme-stock influencer Keith "Roaring Kitty" Gill posted a screenshot implying he holds 5M shares, valued at ~$116M.

Stericycle (SRCL) [+14.6%]: To be acquired by Waste Management for ~$7.2B; $62/sh cash represents a ~20% premium; expected to close in Q4'24.

Paramount Global (PARA) [+7.5%]: Skydance's revised offer includes $15/sh for nonvoting shareholders.

Spotify Technology (SPOT) [+5.6%]: Raised US subscription prices; individual plan to $11.99, duo to $16.99, family to $19.99.

NVIDIA (NVDA) [+4.9%]: CEO Jensen Huang announced "Rubin" chips for data centers in 2026 at Computex 2024.

Autodesk (ADSK) [+4.6%]: Audit committee investigation results; Q1 EPS ~$1.87 vs FactSet $1.74; Q2 EPS guidance beat; no restatement of financials.

Magnite (MGNI) [+3%]: Upgraded to buy from neutral at Cannonball Research; upside from Netflix partnership.

Becton Dickinson (BDX) [+3%]: To acquire EW Critical Care Product Group for $4.2B; expected to close this year.

Best Buy Co. (BBY) [+2.5%]: Upgraded to buy from sell at Citi; noted tech replacement cycle and AI demand.

Losers!

Lattice Semiconductor (LSCC) [-15.5%]: President, CEO Jim Anderson stepping down; will assume CEO role at COHR.

Science Applications International (SAIC) [-11.8%]: Q1 earnings and revenue in line; increased internal investment; reaffirmed FY guidance; expects Q2 to be flat q/q.

Hertz Global (HTZ) [-5.3%]: COO Justin Keppy to resign; Scott M. Haralson appointed CFO.

Cava Group (CAVA) [-5.0%]: Downgraded to neutral from overweight at JP Morgan; positive on traffic and margin trends but cited valuation post-IPO.

Waste Management (WM) [-4.5%]: To acquire Stericycle for ~$7.2B; $62/sh cash represents a ~20% premium; expects $125M in annual run-rate synergies; close expected Q4'24; suspending share repurchases.

Boston Beer (SAM) [-3.2%]: Suntory spokesperson denies discussions to acquire company.

Target (TGT) [-2.0%]: Initiated underperform at BNP Paribas Exane; cited increasing competition; expects struggle to hit OM target; removed from US Conviction List at Goldman Sachs.

Market Update

Trivia Answers

B) Warren Buffett is the Oracle of Omaha.

C) George Soros made the famous ‘Breaking the Bank of England’ trade.

C) Bridgewater is known for its Risk Parity or ‘Market-Neutral’ strategy.

B) Silver Thursday. In the end the move failed and cost the brother’s most of their $5 billion fortune. Tiffany’s even took out a full-page ad in the New York Times condemning them for jacking up the price of this key jewelry input.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Interesting thoughts. I think it’s great to see the Mag 7 breaking apart a bit and the indexes staying strong. It’s a sign of a healthy market.