🔬Are Emerging Markets Emerging?

Plus: Home Sales keep getting worse; CrowdStrike stops going down; and much more!

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

- Sir John Templeton

"Don't tell me what you think, tell me what you have in your portfolio."

- Nassim Nicholas Taleb

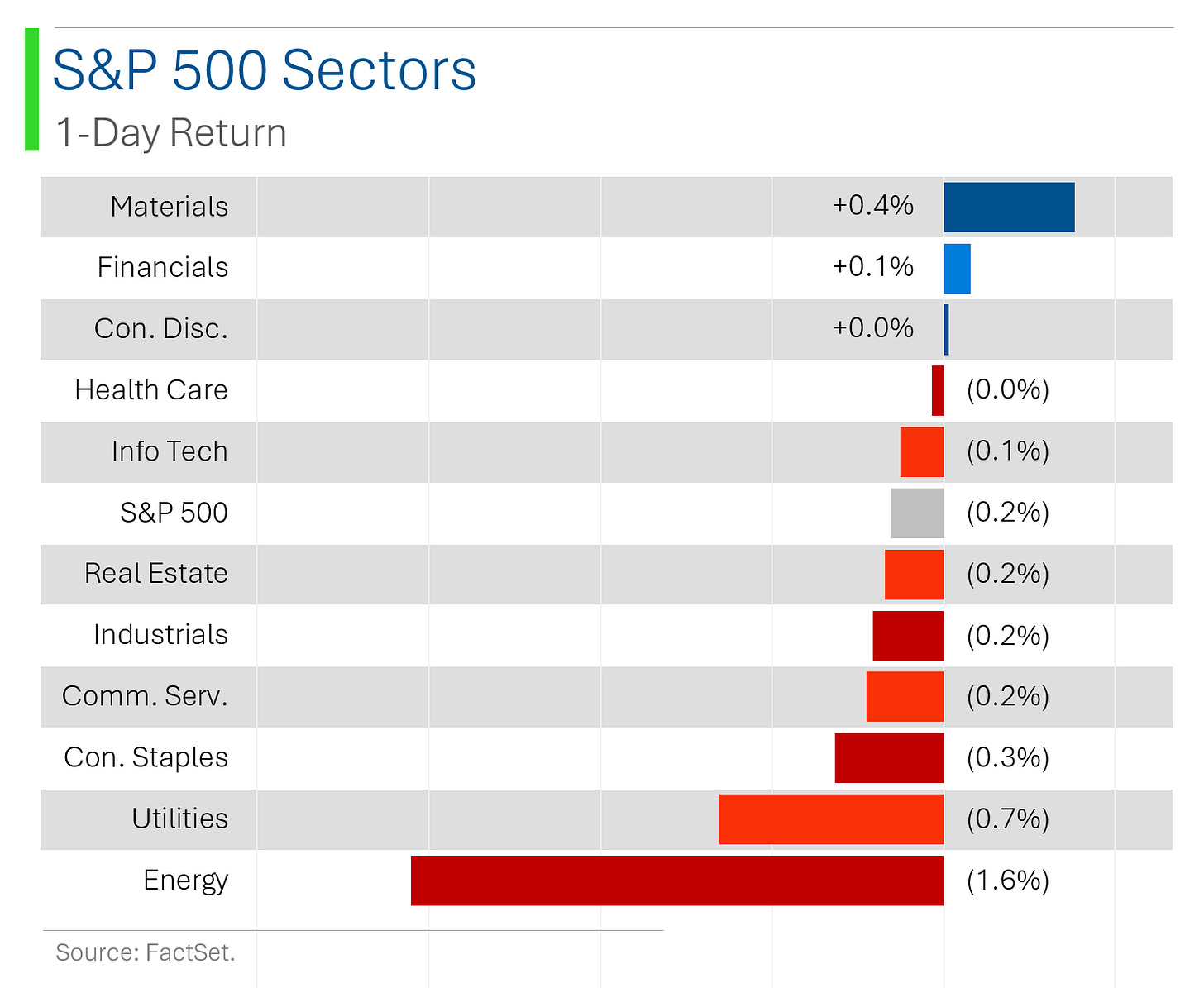

Soft day for the big US markets as yesterday’s rally streak ends at one, with the S&P 500 -0.2% and Nasdaq -0.1%. Small-cap rally continues with Russell 2000 +1.0%.

3 of 11 sectors closed higher with Materials (+0.4%) the only non-marginal one. Energy got hammered (-1.7%) with Crude Oil down -1.8% to near lowest levels of the summer.

Big day for Q2 reporting including:

Spotify Technology (SPOT) [+12.0%]: Q2 earnings and revenue in line; margins improved by lower marketing and personnel costs; traction in monetization; Q3 operating income and GM guidance ahead of Street.

United Parcel Service (UPS) [-12.1%]: Q2 revenue and EPS light; lowered FY operating margin guidance; returned to volume growth in US after nine quarters.

Tesla (TSLA) [-7.8% in pre-market]: Despite positive pre-announced deliveries, EPS missed ($0.52 vs. Street est. of $0.62) but revenue had a modest beat ($25.5b vs. est. $24.8b). Decent Q but expectations high after recent rally.

Alphabet (GOOG) [-2.2% pre-market]: Modest beats on EPS ($1.89 vs. est. $1.85) and Revs ($84.7 vs. $84.3b). CEO defended recent speculation that they are overdoing it with AI spending: ‘the risk of underinvesting is dramatically bigger than the risk of overinvesting for us here’.

More below in ‘Market Movers’

Street Stories

Are Emerging Markets Emerging?

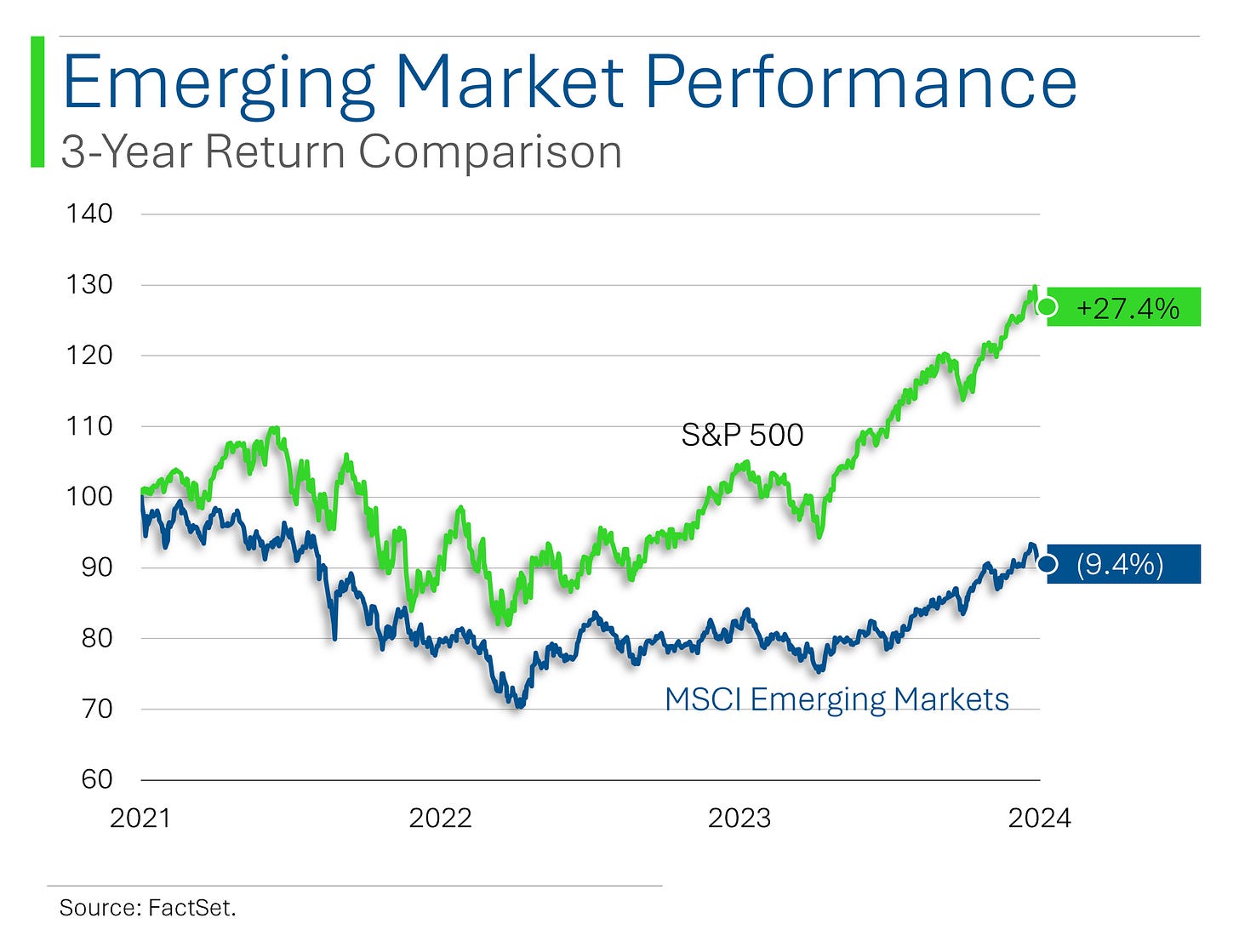

I haven’t talked too much about Emerging Markets (EM) in this newsletter - mostly because it’s been kinda s*** as an investment class. Most of that is because EM investing has basically meant betting on China, which has been in meltdown mode for the last few years.

Right now though, it looks like EM might be turning itself around - hokey pokey style.

One of the most recent indicators of this is that Invesco Asset Management published a massive survey of sovereign wealth funds in which 67% of respondents expect emerging markets to match or beat the performance of developed markets over the next three years.

Geopolitical risks are still seen as important considerations (83% see geo tensions as a major risk vs. 72% last year), and China is still not viewed in a positive investor lens, but generally the tone is upbeat.

Moreover, many of the biggest EM names are starting to generate real traction in the market. A rotation out of the US’s big winners - Big Tech most notably - can only add fuel to this as investors begin to broaden their horizons.

A global rate cutting environment and generally solid economic growth also kinda helps. As mentioned earlier this week, China’s PBOC cut short and long term interest rates by 0.10% to help bolster growth.

Looking at some of the core EM markets, Taiwan and India are having incredible years. China continues to lag, and there’s still a lot of risk from both Trump rhetoric and Democratic policy leaning towards extensive tariffs - notably in chips. While Brazil and South Korea have started to how some green shoots this summer.

It’s early days but the catalysts are a plenty.

Strike’s Over: CrowdStrike Shares Stabilize After Shutdown Saga

After dumping 23% of their share price - and $19.9 billion in market cap - it looks like the shares have finally cooled down. CRWD 0.00%↑ closed up +1.9% Tuesday in what seems like the end of the fallout from the single greatest cyber crash in history, having taken out an estimated 8.5 million computers.

And while investors weren’t too pleased, Wall Street analysts didn’t give them a pass either. Mean target price across the Street dropped from $403 prior to the crash to $382 - and that doesn’t include the roughly half of the Street that hasn’t updated their price targets yet. Yeesh…

Home Sales Continue Plunge

Record housing prices and elevated mortgage rates continue to plague the U.S. housing sector as sales drop for fourth straight month. June sales are just 1% off the October 2023 low - which was the weakest month since the aftermath of the housing crisis in 2010.

While mortgage rates are starting to retreat a bit on rate cut expectations and a sinking yield curve, current levels remain quite suffocating for individuals - many preferring the side-lines awaiting a more manageable rate now that rate cuts seem to (finally) be given the greenlight.

Joke Of The Day

My boss is going to fire the employee with the worst posture. I have a hunch, it might be me.

Hot Headlines

Bloomberg / Meta launches latest AI model (Llama 3.1) to compete with OpenAI and Google. Zuck also opened up about their open source strategy as a differentiator, allowing users to tailor models directly. Claims ‘closed models’ can lead to vendor lock-in users and a rise in State-sponsored espionage.

WSJ / GM delays EV projects in latest industry pullback. The move is the latest by the big automakers to delay EV expansion plans following weak domestic EV demand but strong interest in gasoline SUVs and trucks. Last week Ford cancelled plans for its Canadian EV plant; switching it to truck production.

Yahoo Finance / Cybersecurity firm Wiz turns down $23 billion Google deal, saying it’s aiming for an IPO. The company raised $1 billion earlier in the year at a $12 billion valuation - and it is only 4 years old! I gotta get my s*** together…

CBS News / FTC is investigating impact of surveillance pricing at JPMorgan, Mastercard and others. Basically they use people’s personal data to show different people different prices for the same products to maximize profitability. Brilliant! …but douchey.

Newsweek / Nike is in trouble. Can the Olympics save it? If you read my deep-dive ‘Swooshing Downhill’ you’d know my guess is ‘probably not’.

Trivia

Today’s trivia is on Investing 101.

What does 'short selling' in the stock market mean?

A) Selling stocks quickly

B) Selling stocks of companies that are highly volatile

C) Selling borrowed stocks with the aim to buy back later at a lower price

D) Selling stocks below a certain priceThe 'Rule of 72' in finance is used to:

A) Calculate a country's GDP

B) Estimate how long an investment will take to double

C) Determine interest rates

D) Predict stock market crashes'Quantitative Easing' refers to:

A) Lowering interest rates in order to stimulate GDP growth (‘Dovish Policy’)

B) A monetary policy where the central bank buys securities to increase money supply

C) A move by the Treasury to sell shorter duration bonds which typically pay a lower rate of interest

D) Making exams easier

(answers at bottom)

Market Movers

Winners!

Spotify Technology (SPOT) [+12.0%]: Q2 earnings and revenue in line; margins improved by lower marketing and personnel costs; traction in monetization; Q3 operating income and GM guidance ahead of Street; margin inflection offset weaker MAU performance.

Pentair (PNR) [+9.0%]: Q2 sales in line, EPS better on margin upside; lowered FY sales growth guidance but EPS at top of prior range; stronger margin expansion expected; low expectations from pool distributor warnings.

Inter Parfums (IPAR) [+8.9%]: Q2 sales slightly better, reiterated FY sales and EPS guidance; positive resilience/execution in tough macro environment; positive brand momentum/extensions.

Crown Holdings (CCK) [+8.9%]: Q2 EPS beat, revenue in line; Q3 EPS guidance in line, raised FY24 EPS guidance; beverage segment income up 21% in Q2; strong cash flows to resume buybacks.

MSCI Inc. (MSCI) [+7.9%]: Q2 EPS and revenue beat; FY24 guidance reaffirmed; Q2 subscription sales better in each segment; ESG/Climate research revenues in line; improved costs.

SAP (SAP) [+7.1%]: Q2 revenue in line, EBIT beat; positive on steady cloud Backlog growth (+28%); acceleration in Cloud ERP Suite revenue; increased FY25 EBIT guidance; cloud momentum noted amid software space disappointments.

Sherwin-Williams (SHW) [+6.9%]: Q2 earnings beat, revenue light; Paint Stores Group beat on sales and profit; growth in new residential; Performance Coatings strong in Industrial Wood and Coil; raised FY EPS guidance.

Zions Bancorporation (ZION) [+6.2%]: Q2 EPS ahead on lighter provisions, stronger NII; positive trends in deposits; better NII guidance.

GE Aerospace (GE) [+5.7%]: Q2 EPS and FCF beat, revenue missed; raised FY24 EPS guidance, FCF outlook ahead of expectations; steady defense sales, aftermarket services grew 14%; strong margins.

Danaher (DHR) [+5.3%]: Q2 earnings and revenue beat; shallower core growth decline; positive momentum in bioprocessing, strong Cepheid performance; reaffirmed FY core revenue guidance; 20M share buyback increase.

Solventum Corp. (SOLV) [+4.6%]: Bloomberg reported Trian has acquired a stake.

HCA Healthcare (HCA) [+4.6%]: Q2 earnings and revenue beat; raised FY24 EPS and revenue guidance; same-store growth +5.2%; high volumes consistent with prior quarter.

Philip Morris International (PM) [+2.2%]: Q2 EPS and revenue beat; strong smoke-free and combustible performance; raised FY24 guidance; growth across geographies, US nicotine pouch capacity restraints.

Losers!

United Parcel Service (UPS) [-12.1%]: Q2 revenue and EPS light; lowered FY operating margin guidance; Domestic Package a drag; returned to volume growth in US after nine quarters; announced buybacks resumption.

PACCAR (PCAR) [-11.0%]: Q2 EPS in line, Truck Parts and Other net sales and revenue missed; cut outlook for US & Canada market; missed margins; weak units delivered in Europe for third straight quarter.

A. O. Smith (AOS) [-9.4%]: Q2 EPS and revenue slightly below consensus; FY24 EPS $3.95-4.10 vs prior guidance $3.90-4.15; reaffirmed revenue outlook; NA sales up 9% y/y; international sales flat y/y.

NXP Semiconductors (NXPI) [-7.6%]: Q2 results in line, Q3 revenue guide (+4% q/q) below Street; softness in auto; flagged elevated expectations for 2H cyclical recovery; expects to resume sequential growth.

General Motors (GM) [-6.4%]: Q3 EPS and revenue beat; raised FY24 EPS and auto FCF guidance, lowered EBIT guidance; strong demand for gas-powered trucks and SUVs in US; slower EV sales contributed to EPS beat; 2H guidance implies slowdown.

Kimberly-Clark (KMB) [-5.7%]: Q2 EPS, operating income beat, but revenue light; organic growth missed across all segments; raised FY24 EPS growth forecast, left organic net sales growth unchanged; organic revenue growth weak despite pricing strength; lower quality EPS beat on taxes.

Polaris Inc. (PII) [-4.8%]: Q2 revenue and EPS below; all segments missed on sales and profits; lowered FY guidance; elevated interest rates, inflation, cautious dealer and consumer; reducing dealer inventory is key priority.

IQVIA Holdings (IQV) [-2.6%]: Q2 EPS and revenue beat driven by strong TAS performance; raised FY24 EPS and revenue guidance due to favorable FX conditions; lowered EBITDA guidance due to business mix; flagged competitive pricing pressures.

Comcast (CMCSA) [-2.6%]: Q2 earnings beat, revenue missed; noted difficulty in Studios and Theme Parks y/y; strength in Connectivity & Platforms and Media; Universal Pictures revenue down 27% y/y; Peacock subscribers up 38%; Broadband ARPU increased 3.6%.

Freeport-McMoRan (FCX) [-1.6%]: Q2 EPS and revenue beat; guides FY24 Capex $3.7B vs prior $3.6B; cut Q4 and FY24 copper and gold sales guidance.

Market Update

Trivia Answers

C) Short Selling is selling borrowed stocks with the aim to buy back later at a lower price.

B) The Rule of 72 is a way to estimate how long an investment will take to double. Just divide 72 by the expected annual return, and Bam!

B) Quantitative Easing is a monetary policy where the central bank buys securities to increase money supply.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.