"Time is your friend; impulse is your enemy."

- John Bogle

“Only the meek get pinched. The bold survive.”

- Ferris Bueller

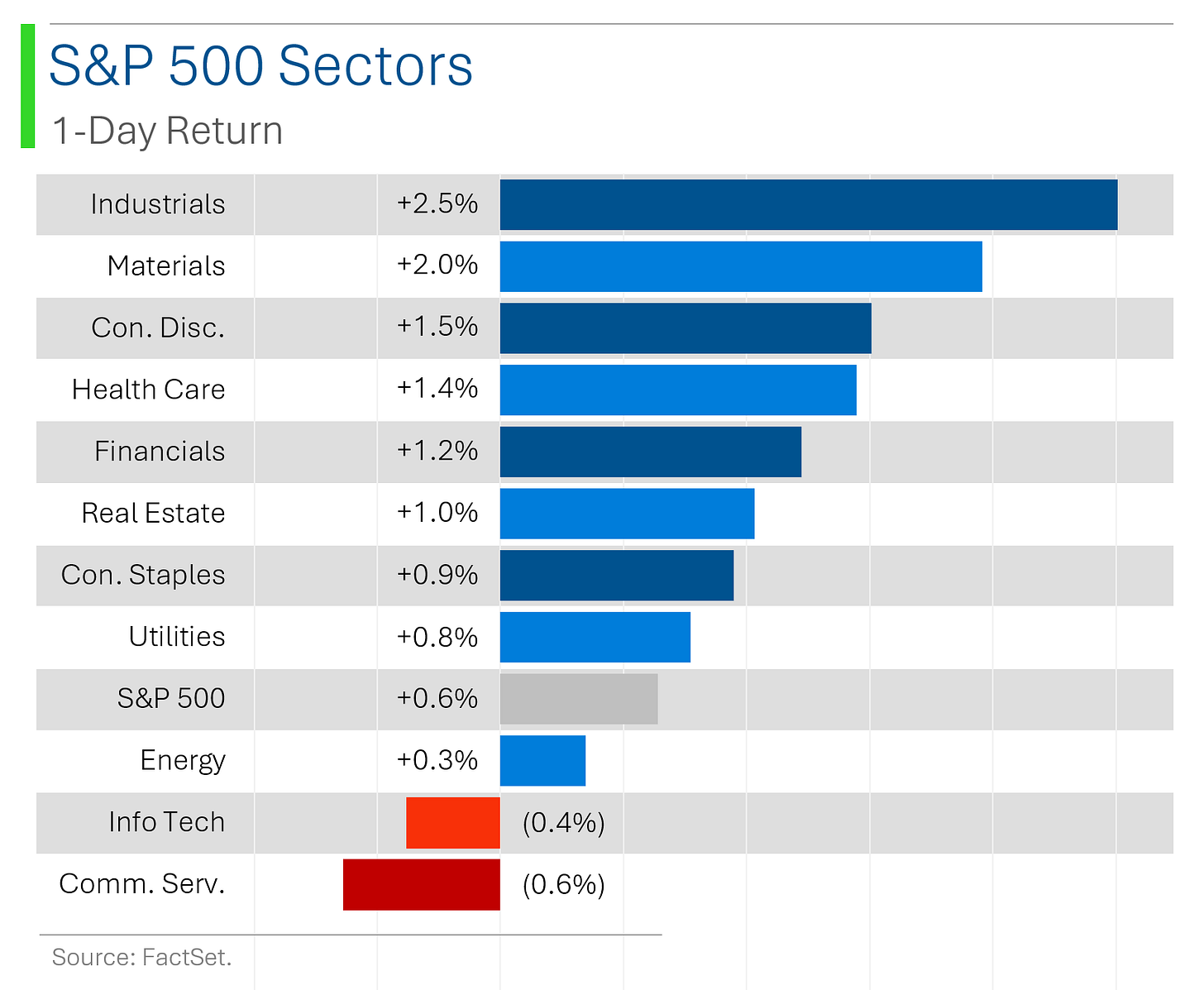

Strong day for the big US markets (S&P 500 +0.6%, Nasdaq +0.2%), but the big news was the small-cap rally, best expressed by the Russell 2000’s +3.50% day.

9 of 11 sectors closed higher led by catch-up trades in Industrials (+2.5%) and Materials (+2.0%). Tech (-0.4%) and techy Comm. Services (-0.6%) were the only losers as past winner loses their luster.

June Retail Sales came in better than forecast (flat vs. expectations for -0.2%) and the May figure was adjusted upwards.

Notable companies:

Shopify (SHOP) [+8.6%]: Upgraded to buy at BofA; firm believes company has achieved balanced growth and margin under new CEO.

Bank of America (BAC) [+5.4%]: Q2 EPS ahead with better fees (Equities trading and DCM bright spots) and operating efficiency; Q4 Net Interest Income guide better than expected.

Reddit (RDDT) [-3.5%]: Downgraded to hold from buy at Loo Capital; cited valuation concerns.

Street Stories

(Another) Great Small-Cap Rotation

In the short time I’ve been writing StreetSmarts we’ve had a few head fakes where Small-Cap outperformed the broader market (October 2023, February 2024) before quickly moving back to obscurity.

This time seems a bit different tho.

The narrow market leadership is up on a stick with stretched valuations; rate cut hype most impacts beleaguered Small-Cap; and even a bit of a relief rally (they have sucked after all) could be at play.

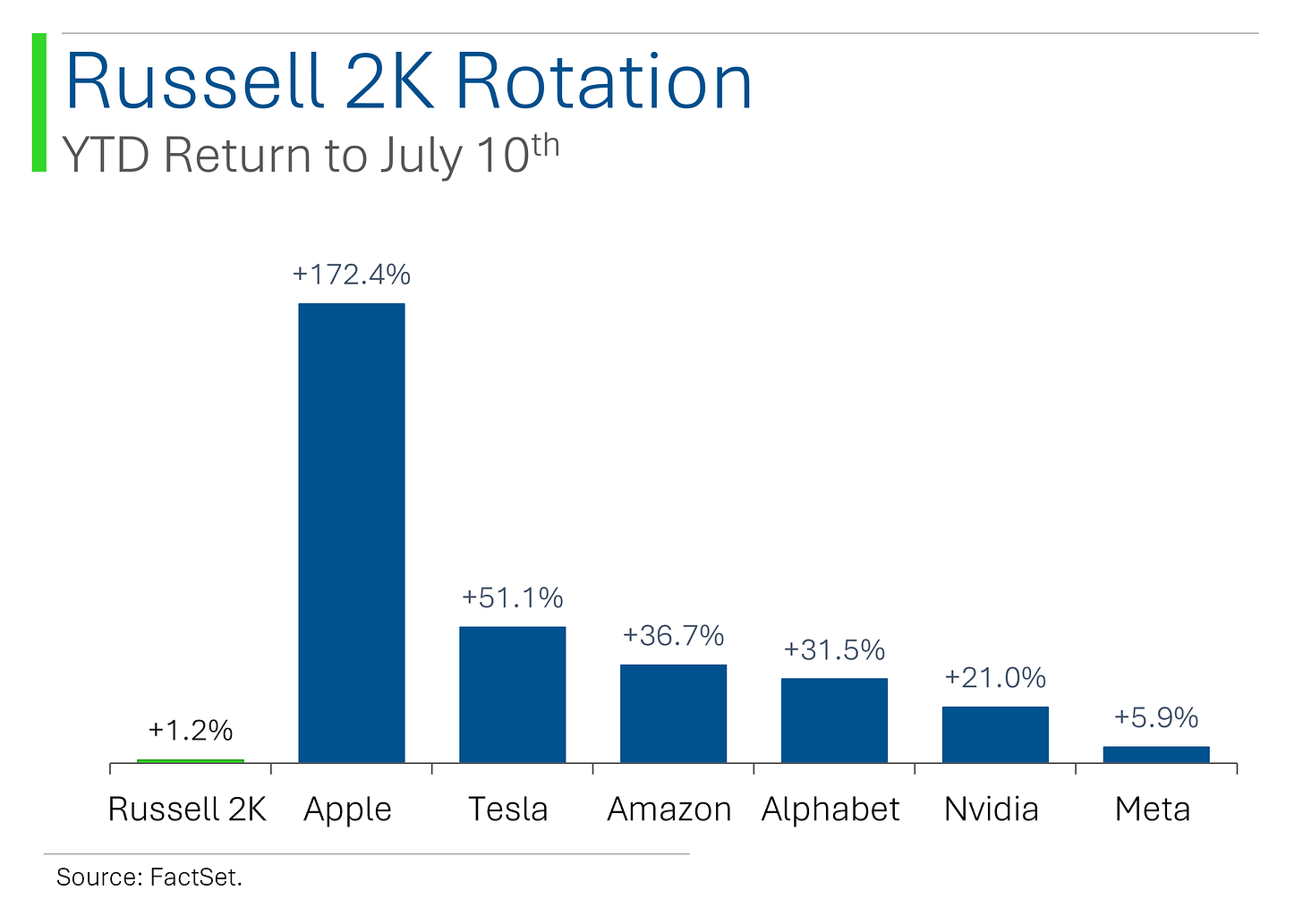

Since July 10th, the small-cap Russell 2000 is up +6.6%. Impressive no doubt, but the other side of that is that the big names that have crushed it this year are heavily underperforming.

When you factor in how bad the Russell has been this year - and how good the others have been - this is called a ‘rotation’.

There are fancy investing definitions for rotation, but the gist is that stuff that have been good starts to suck, and the stuff that’s sucked starts to be good.

And this suckiness isn’t anything new; the Russell has been sucking for a while now. Over the last five years, it’s generated less than half the return of the S&P 500.

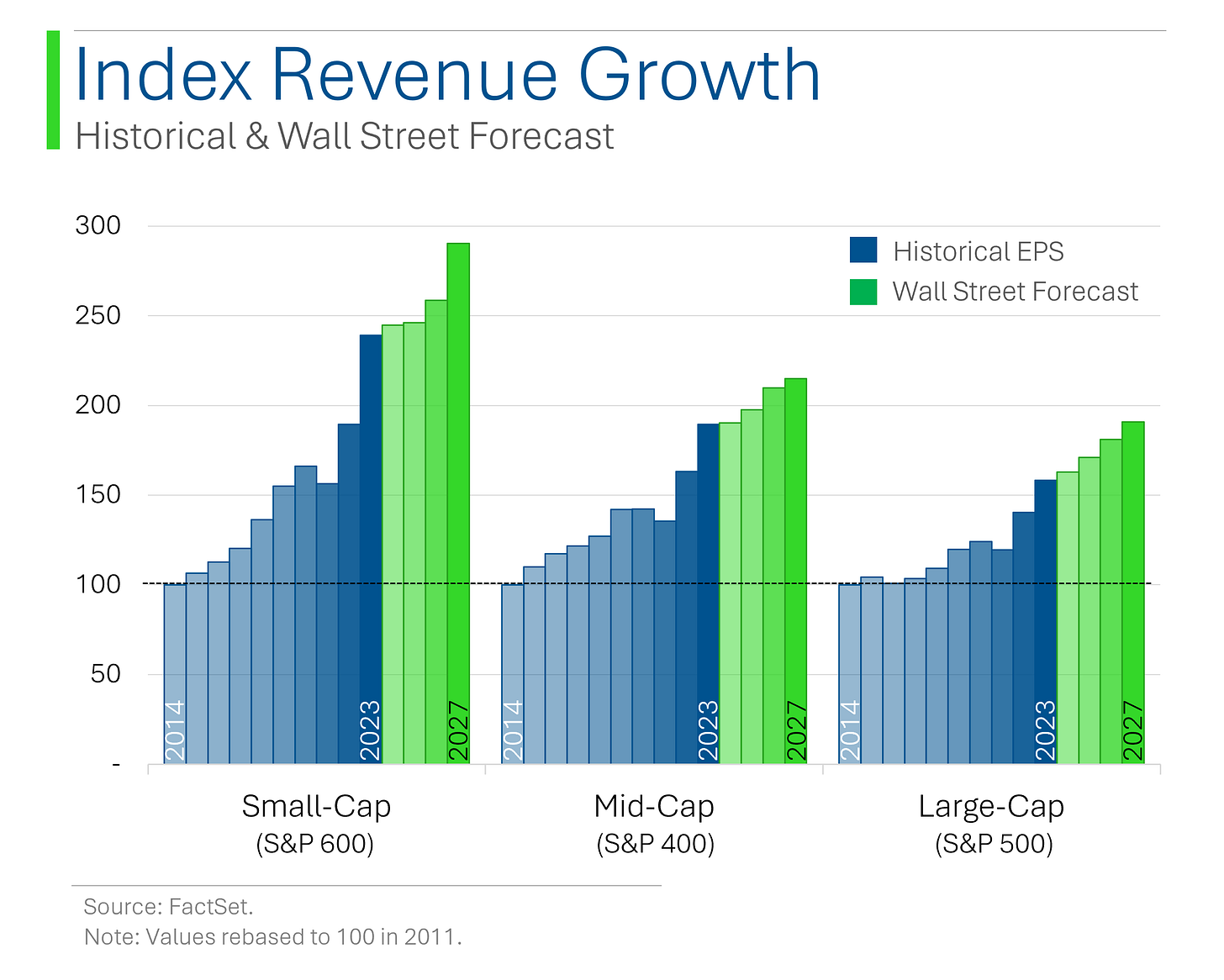

Now, I can’t get access to direct Russell data (it’s above my pay grade) but looking across the scope of the S&P indices, what stands out is that Small-Cap - in this case, the S&P 600 - has actually shown much stronger revenue growth than its big brother, the S&P 500.

Better growth, and weaker performance? That’s small-cap alright…

So how does an index exhibit better operational growth than another, yet still underperform it? That’s best seen by multiple dispersion.

See, Small-Cap used to trade at a similar multiple to Large-Cap but that parity has eroded. Now the S&P 500 trades at near record valuation levels (this century it’s only been higher during the weird Covid bubble) but the S&P 600 is well below peak.

We’ll see if it can hold on this time. Fingers crossed!

Rate Cut Redux

Enough has been made about Fed Chair J-Pow’s recent comments that sparked this rate cut euphoria taking place but I did want to hit on a couple data points which I think are interesting.

What got this going were consecutive dives in US inflation. While still sitting above its G7 peers, US inflation has dropped faster than everywhere else, save for the UK which has emerged from its technical recession in May but with an economy that is far from healthy.

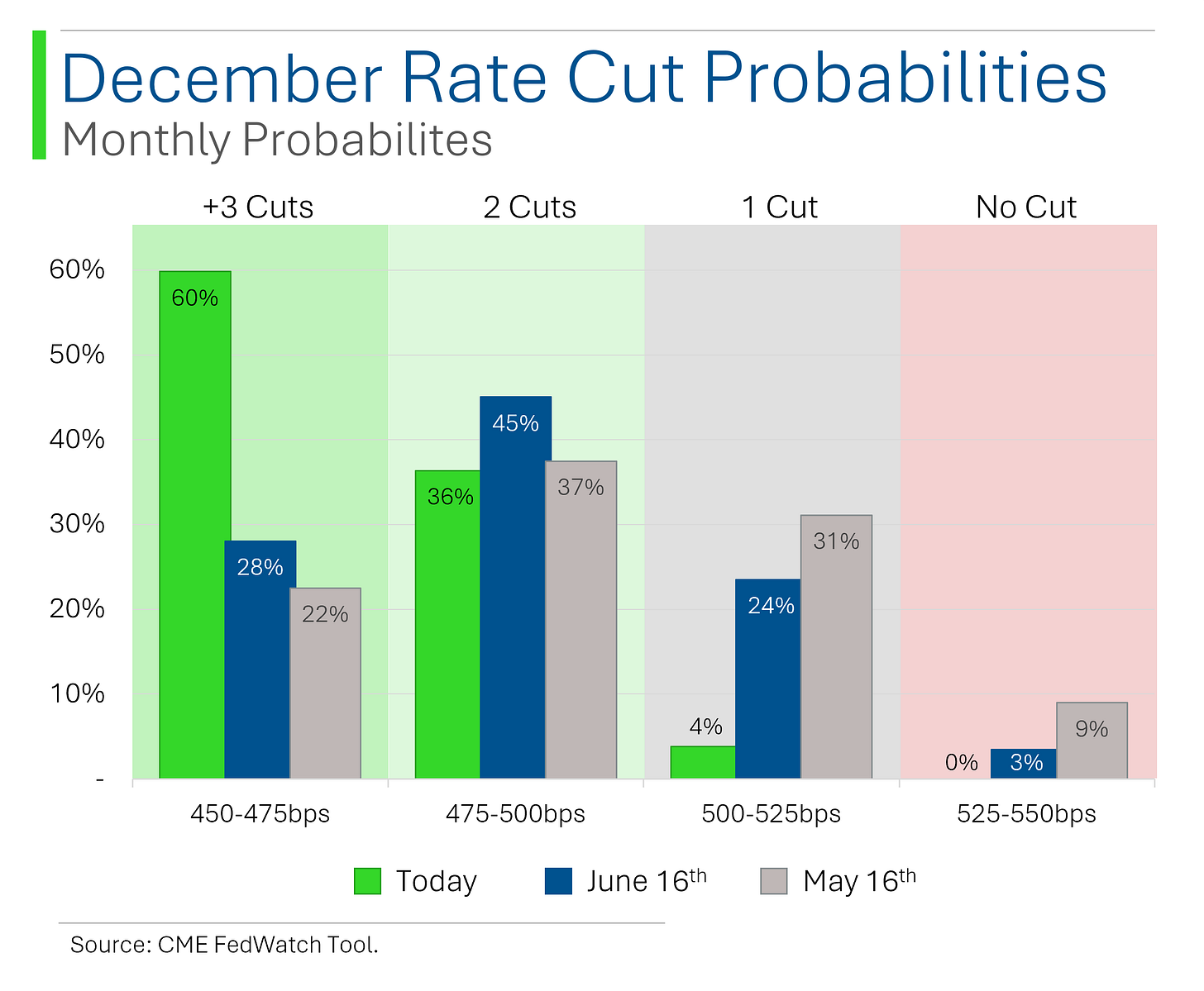

The rate cut odds have (again) become quite bullish. Recall that at the start of the year 3+ cuts were priced in; then it was barely one; and now it’s back up to +3.

The market currently sees a 96% chance of two or more cuts this year, up from only 59% in May.

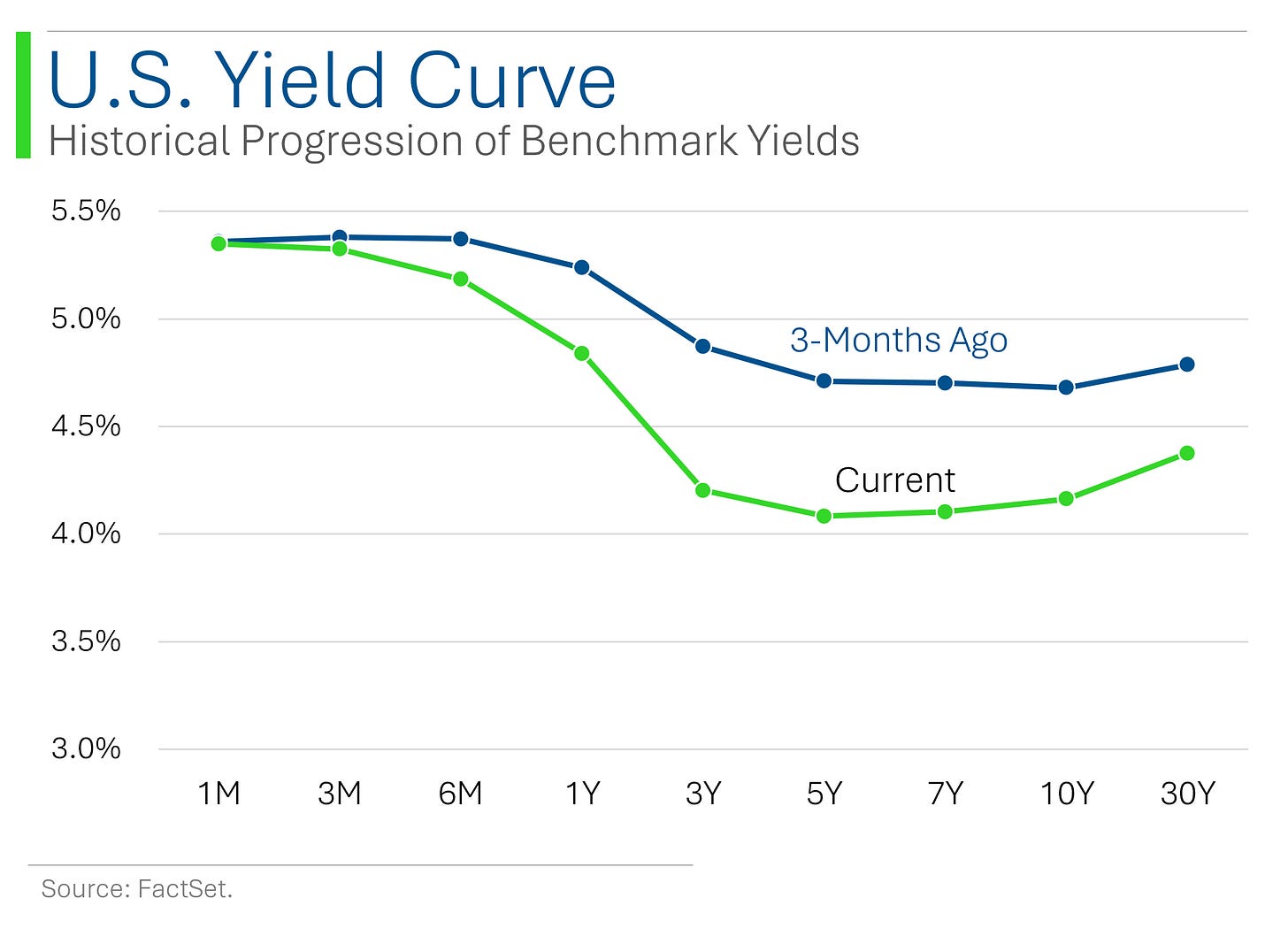

The US treasury yield curve has responded fairly significantly to this, with lower yields across the spectrum.

Joke Of The Day

So apparently RSVP'ing back to a wedding invite 'maybe next time' isn't the correct response…

Claustrophobic people are better at thinking out of the box.

Hot Headlines

WSJ / Elon Musk said to commit $45 million a month to pro-Trump Super PAC. The move follows other tech bros including Palantir Technologies co-founder Joe Lonsdale and the Winklevoss twins putting money into the America PAC.

Proof / Nvidia, Apple and Anthropic used thousands of YouTube video transcripts to train AI models. Proof’s investigation found that subtitles from 173,536 YouTube videos were siphoned from more than 48,000 channels, including heavyweights like MrBeast, PewDiePie and Marques Brownlee.

Yahoo Finance / Homebuilder sentiment falls to lowest level since December amid high mortgage rates.

CNBC / Oil falls on lingering demand concerns in China. IG International said the weaker Chinese economic data “cast some doubts on whether market participants are being overly optimistic” regarding China’s oil demand outlook. China GDP grew +4.7% in Q2 since last year but missed Wall Street estimates for +5.1%.

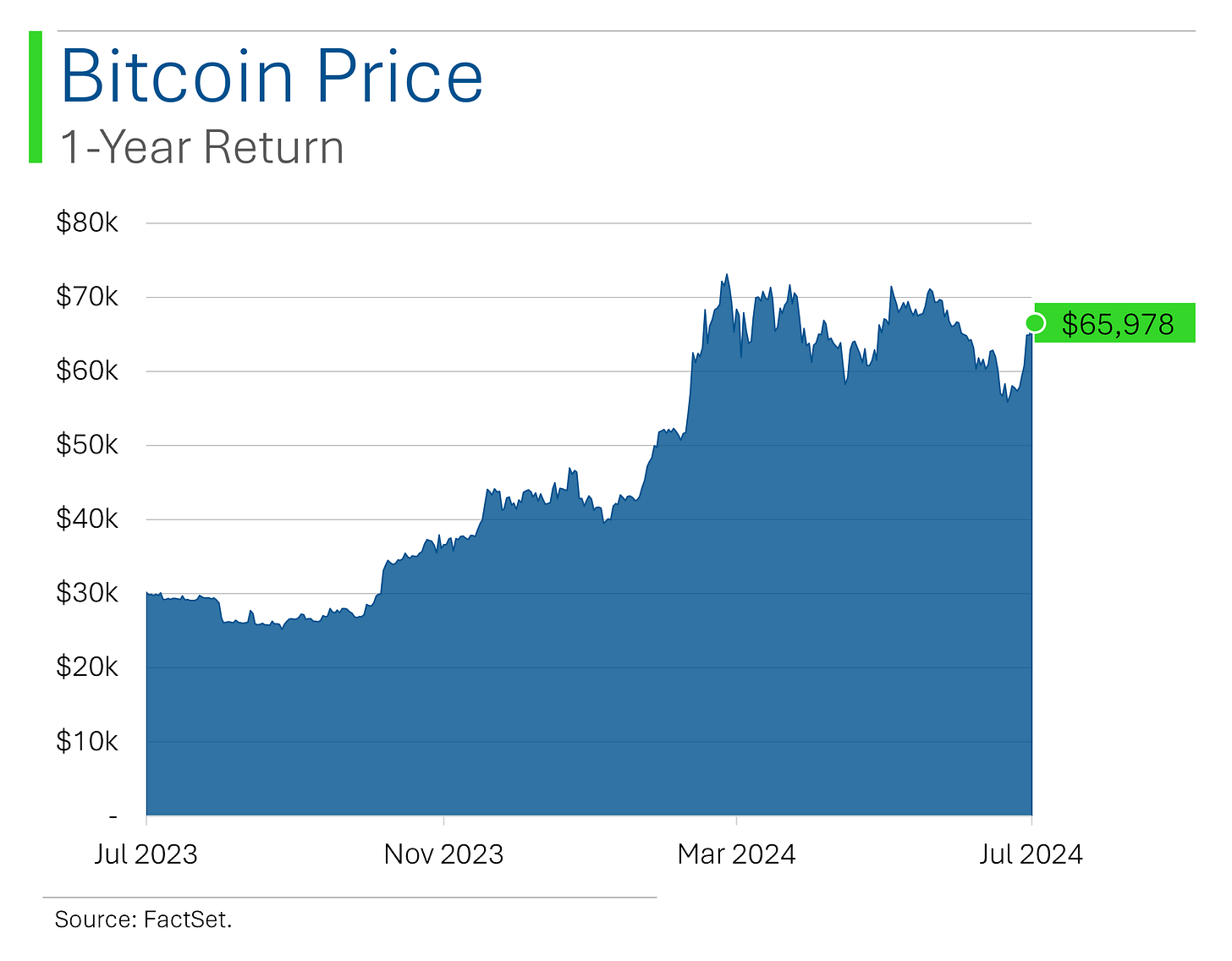

CNBC / Bitcoin takes flight after BlackRock CEO Larry Fink calls it ‘legitimate’. Low bar…

Trivia

Today’s trivia is on the first publicly traded company, the Dutch East India Company.

When was the Dutch East India Company (VOC) founded?

A) 1555

B) 1666

C) 1602

D) 1802

What was the main purpose of the Dutch East India Company?

A) Trade in spices and other goods from Asia

B) Colonize new lands

C) Spread Christianity

D) Develop new navigation techniques

At its peak, the VOC has 50k employees. How many ships did they have?

A) ~50B) ~100

C) ~150

D) ~300

What was the Dutch East India Company's highest recorded dividend payout in a single year?

A) 8%

B) 40%

C) 22%

D) 16%

(answers at bottom)

Market Movers

Winners!

Chegg (CHGG) [+17.4%]: Upgraded to equal weight from underweight at Morgan Stanley; valuation and FCF generation opportunity noted, despite need for lower sell-side estimates.

Shopify (SHOP) [+8.6%]: Upgraded to buy at BofA; firm believes company has achieved balanced growth and margin under new CEO.

Match Group (MTCH) [+7.5%]: Activist investor Starboard built over 6.5% position, pushing for sale if turnaround fails.

State Street (STT) [+7.5%]: Q2 earnings and revenue better; net interest income above consensus; fee income in line with strong FX results offsetting revenue headwind in Servicing.

UnitedHealth Group (UNH) [+6.5%]: Q2 EPS and revenue beat; reaffirmed FY24 EPS guidance; Optum revenue grew, margins down y/y; analysts noted complexity from Change breach and South America actions.

Bank of America (BAC) [+5.4%]: Q2 EPS ahead with better fees (Equities trading and DCM bright spots) and operating efficiency; Q4 net interest income guide better than expected.

EPAM Systems (EPAM) [+4.8%]: Upgraded to buy from hold at Jefferies; AI seen as a significant growth catalyst.

PNC Financial Services Group (PNC) [+4.7%]: Q2 earnings better with revenue in line; NII/NIM and fee income ahead of consensus; provision below forecasts; mixed FY24 guidance with slight a net interest income improvement.

Losers!

Charles Schwab (SCHW) [-10.2%]: Q2 earnings and revenue in line; net interest income light with net interest margin below consensus; asset-management and bank deposit fees slightly below forecasts; DARTs down sequentially; analysts noted soft June metrics and downtick in transactional cash balances.

Reddit (RDDT) [-3.5%]: Downgraded to hold from buy at Loop Capital; cited valuation concerns.

Market Update

Trivia Answers

C) The VOC was founded in 1602.

A) The company was formed to trade in spices and other goods from Asia.

C) At its peak, the company had ~150 ships.

B) The highest dividend payout was a whopping 40%.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.