🔬 Airlines Get Pummelled, the Suez Canal is Important, and Much More

"It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong"

- David Einhorn

“If you see a bandwagon, it’s too late”

- James Goldsmith

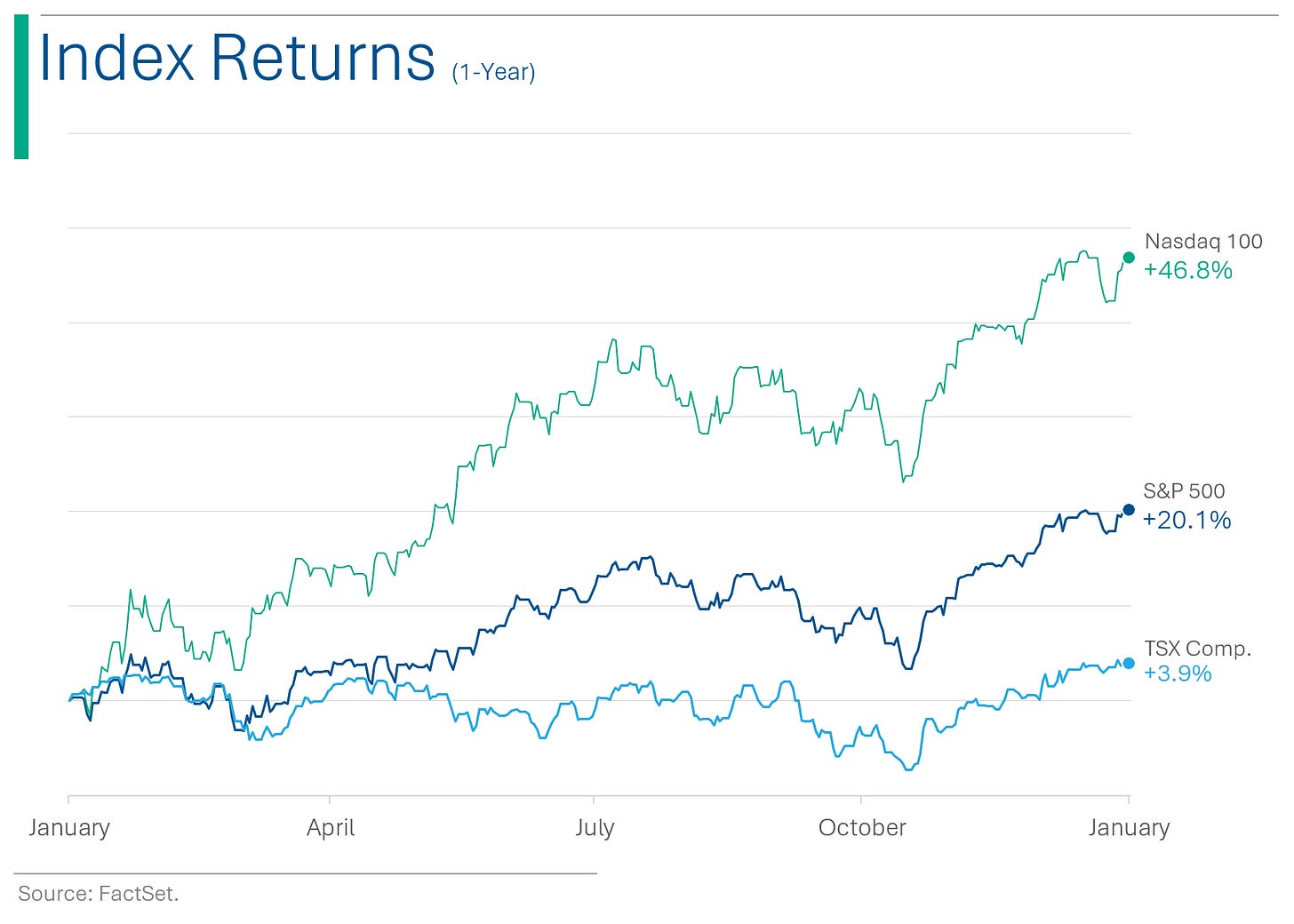

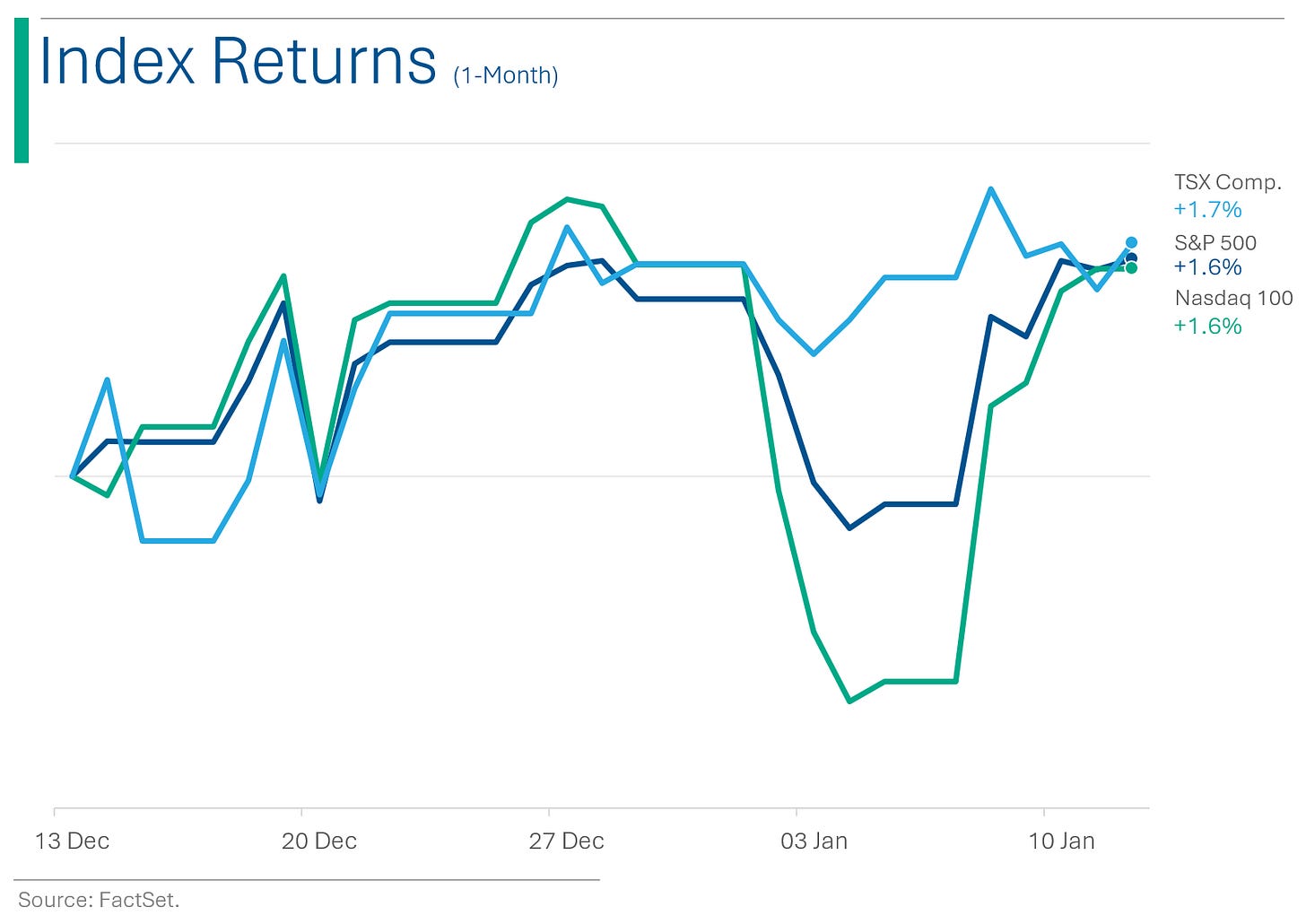

The big US markets traded up small on Friday (S&P 500 +0.08%, Nasdaq +0.02%) to finish the week nicely (S&P 500 +1.8%, Nasdaq +3.1%).

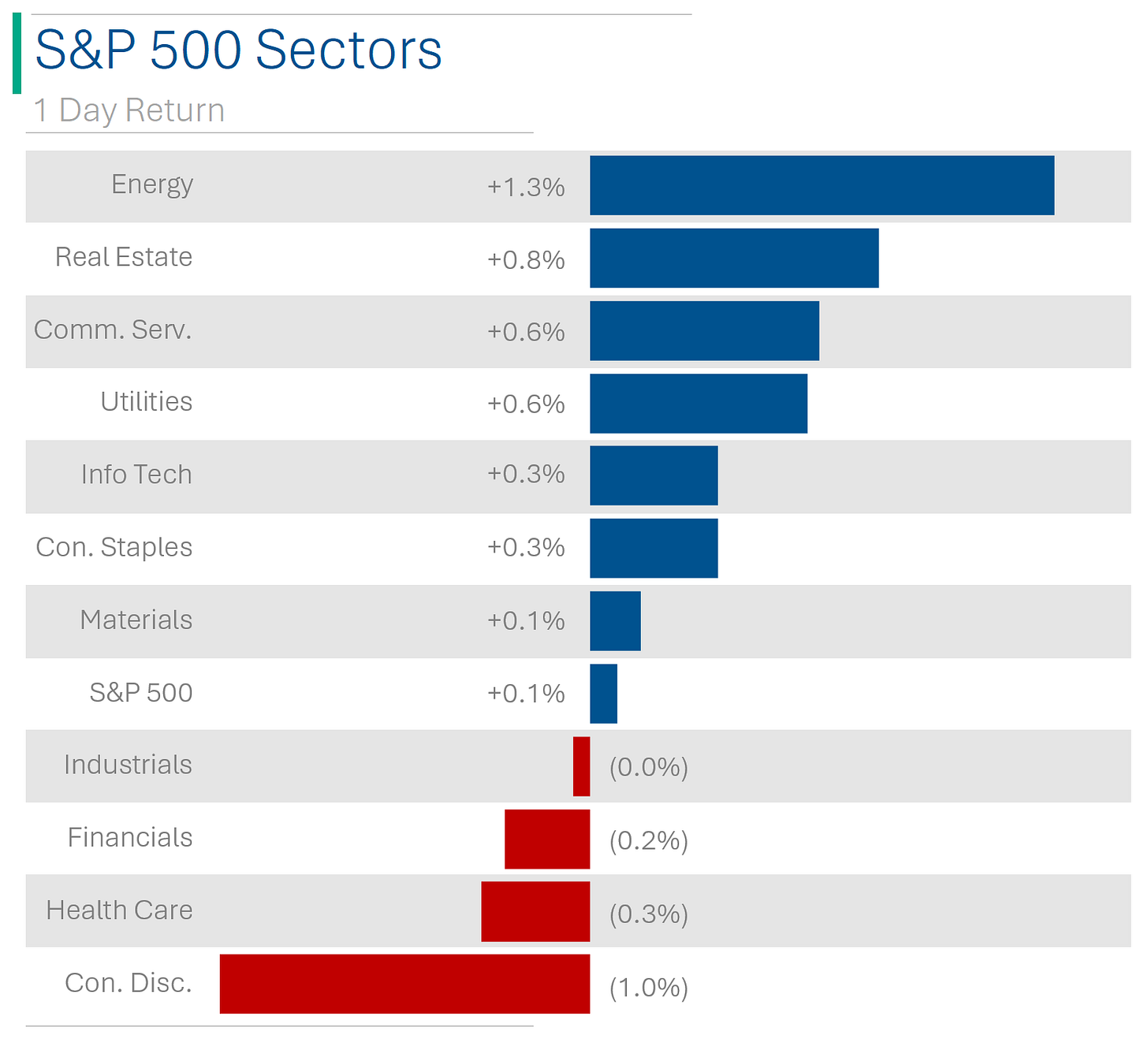

7 of 11 sectors closed up Friday, with Energy (+1.3%) finishing best after a bad start to the year. Consumer Discretionary (-1.0%) and Healthcare (-0.3%) finishing worst, after good starts to the year.

After a headfake on Thursday, Microsoft passed Apple to officially close the week as the largest company in world (market caps of $2.89 trillion and $2.87 trillion respectively).

Bank earnings kicked off with a miss from JP Morgan, large beats from Bank of America and Citigroup, while Wells Fargo was in-line.

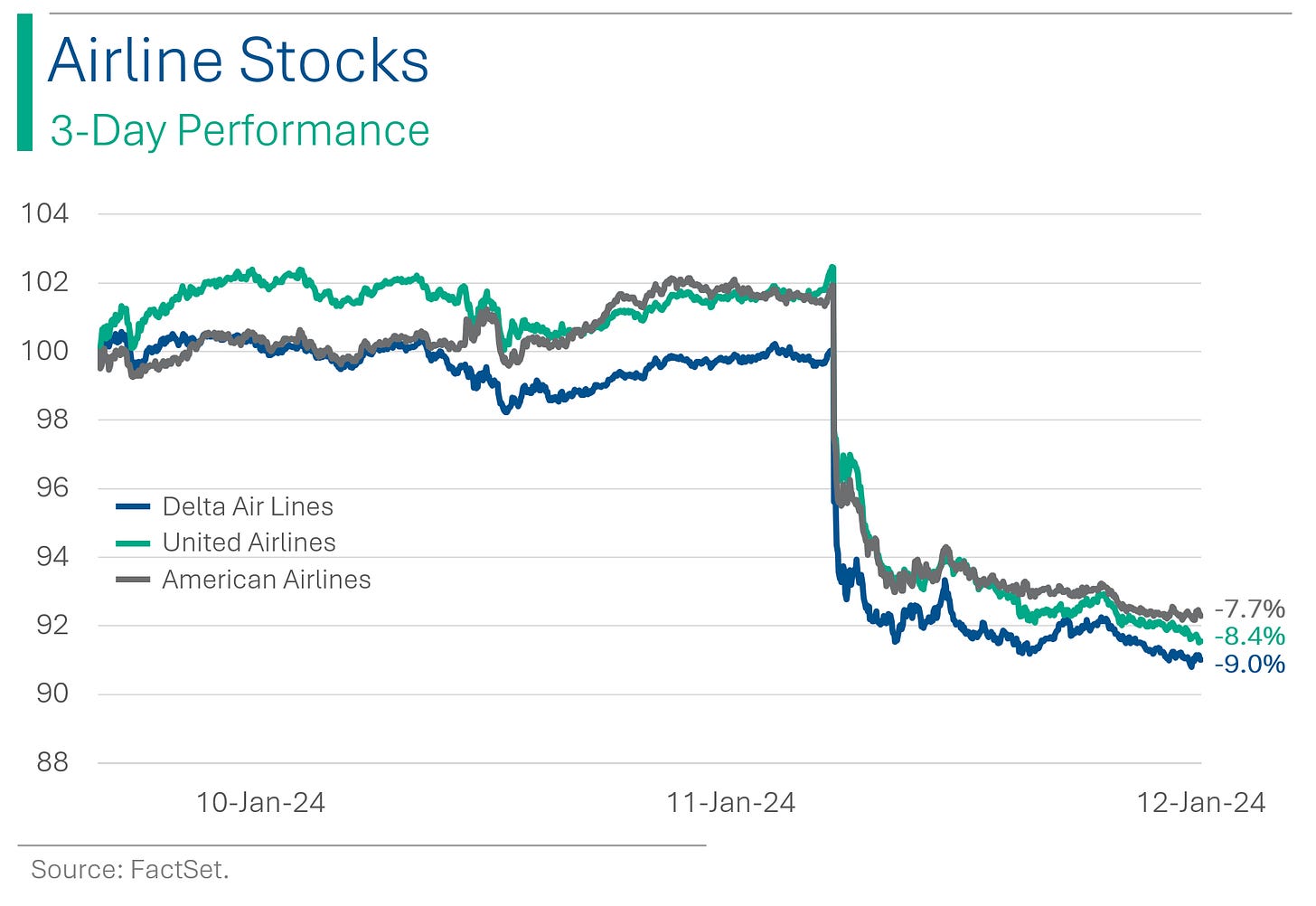

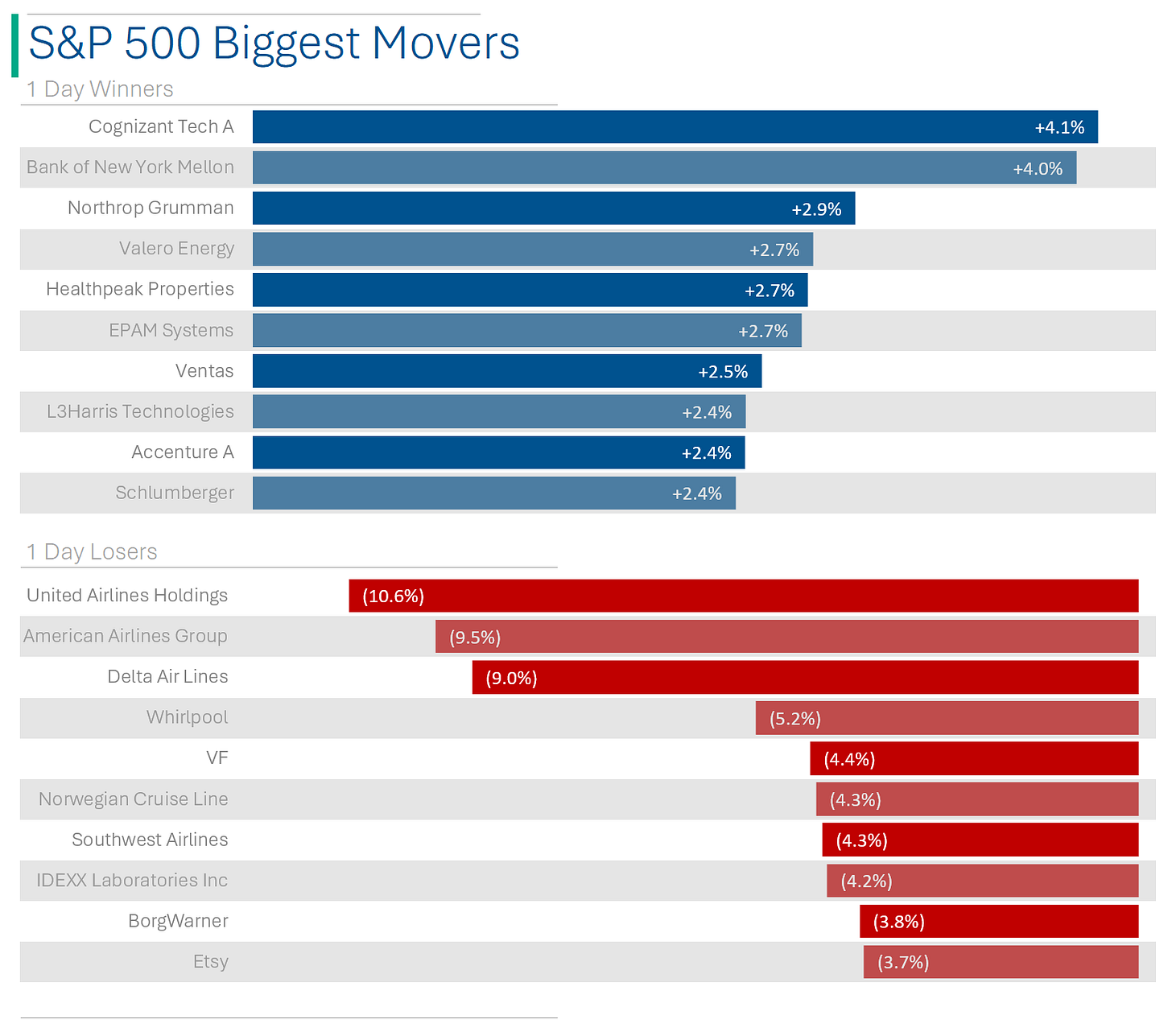

Delta Airlines posted a solid beat on Q4 earnings but fell 9% on weak 2024 guidance.

Street Stories

Bad Luck Boeing

While the MAX 9 door ‘plug’ incident was shocking, it wasn’t the first time in recent years the company has faced adversity. Recall back in 2019, the launch of the MAX 9’s predecessor - the MAX 8 - led to two separate crashes (in which 346 people died) linked to an autopilot issue. What’s clear is that, anything bad that happens to Boeing is good for Airbus.

Also, the FAA announced it will be extending the MAX 9 groundings (press release).

Recession Roulette: Economists Spin a More Optimistic Wheel for 2024

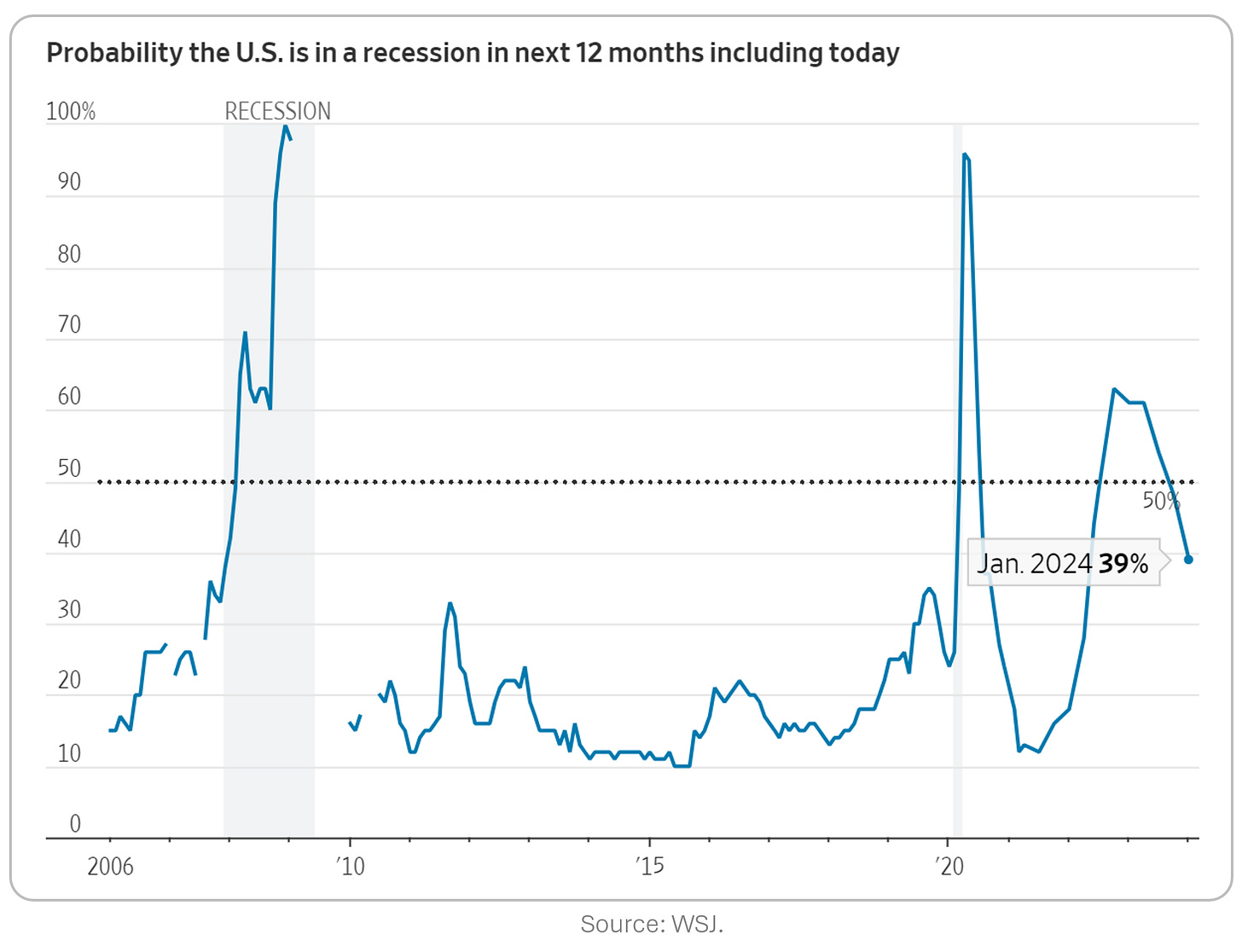

According to The Wall Street Journal's survey of economists, the probability of a recession in the next year has decreased to 39%, with expectations of modest economic growth at 1% in 2024, but the pace of job creation is predicted to slow significantly. Despite this slowdown, the unemployment rate is expected to rise only slightly to 4.3% by the end of the year, and inflation is projected to decrease to 2.3%. The Federal Reserve is anticipated to make one or two quarter-percentage point rate cuts by mid-2024, with markets and economists divided over the timing of these cuts. Good thing economists are never wrong. (Here’s the full story)

Airline Trouble

Delta Air Lines reported Q4 earnings on Friday. Quarterly profit was doubled with record revenue in 2023, driven by strong travel demand, especially for international flights. BUT, the company came across rather bearish on the travel industry in the coming year, coupled with a weak EPS guidance. As a result, the stock got hammered, and took it’s peer group with it. Just when I was getting used to airlines - which have underperformed the market massively since the pandemic started - not sucking anymore.

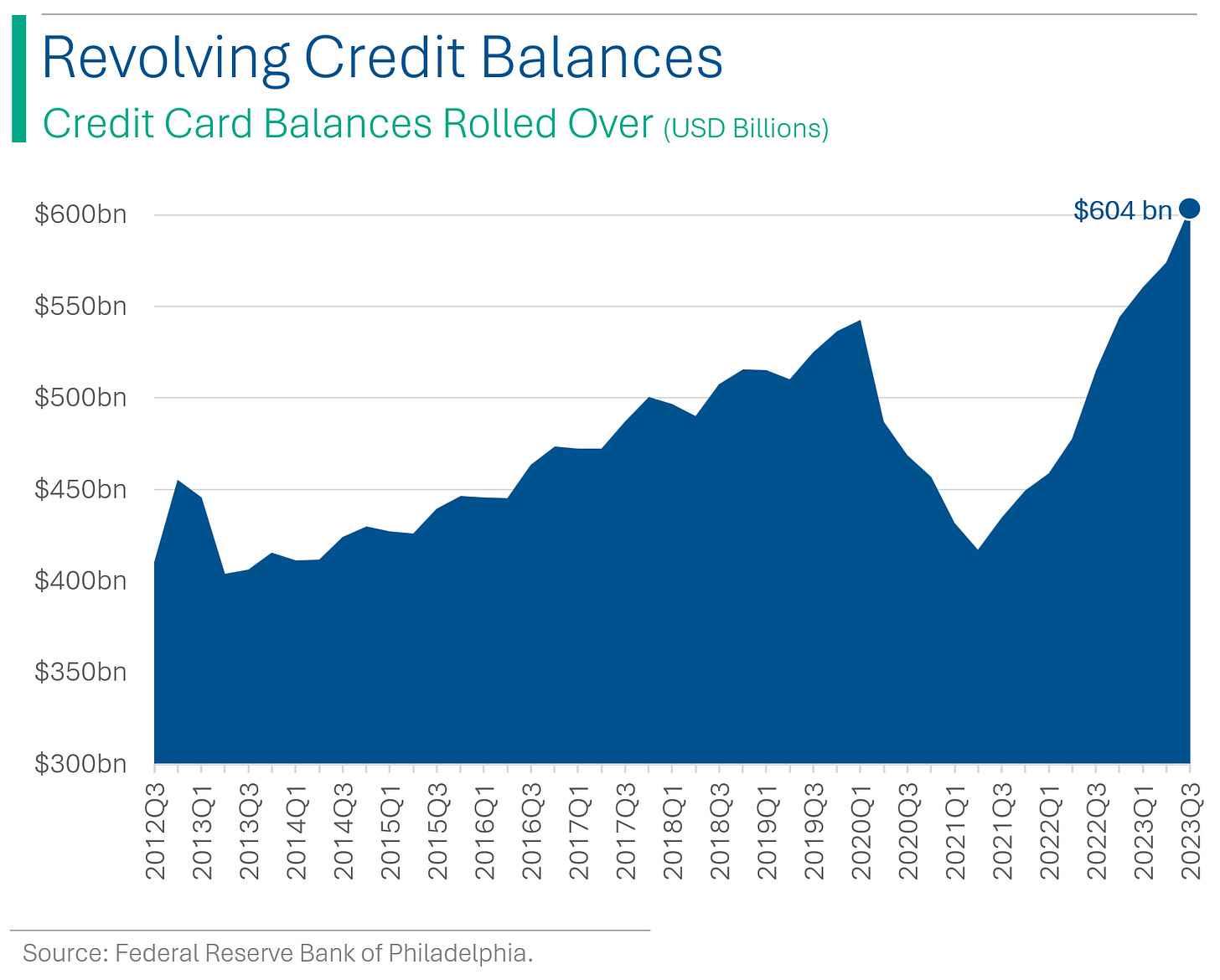

Plastic Problems: The Rising Tide of Credit Card Delinquencies

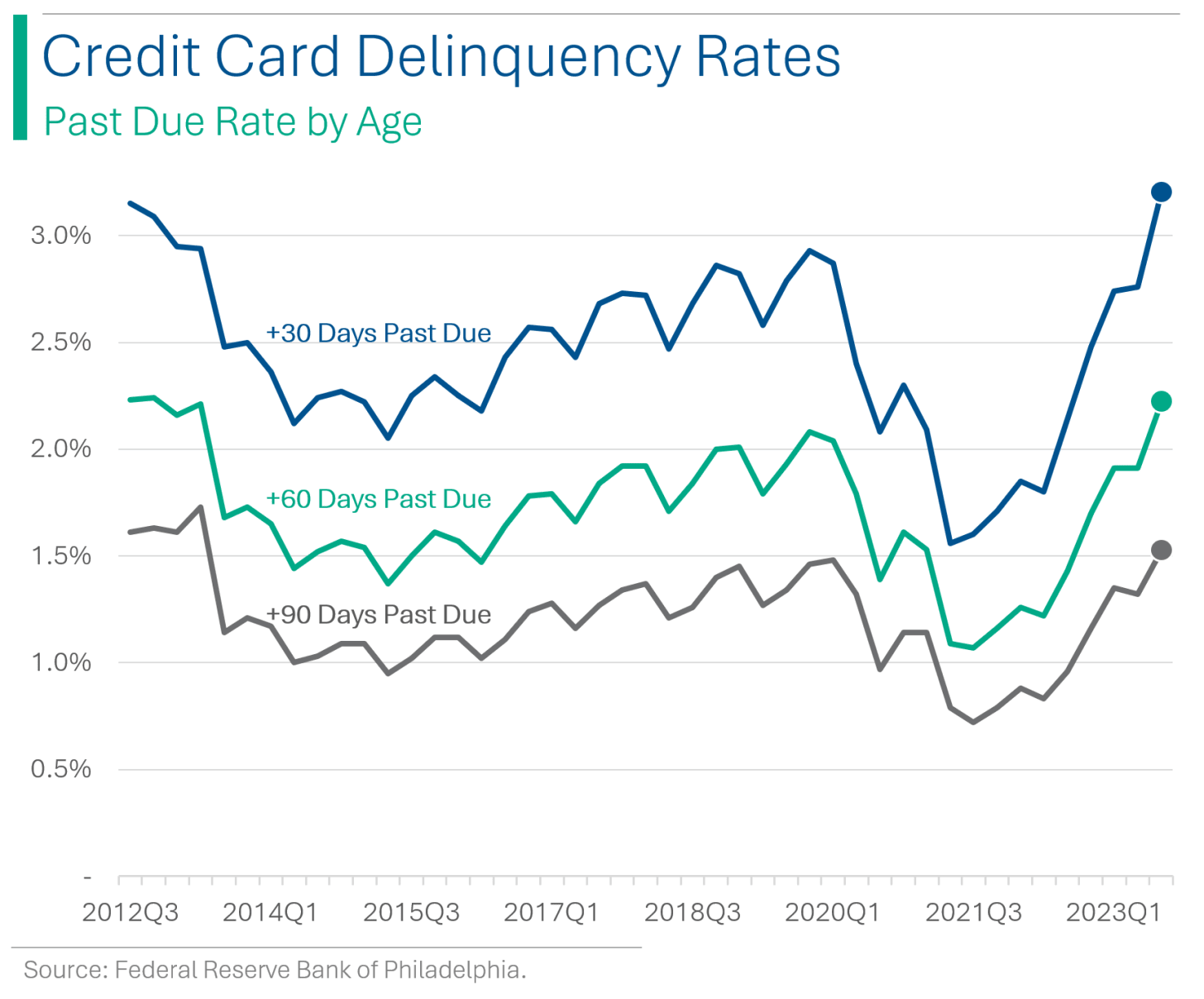

Credit-card delinquency rates in the U.S. have risen to the highest level in over a decade, with 3.2% of card balances more than 30 days past due, as reported by the Federal Reserve Bank of Philadelphia. In response to increasing signs of consumer financial strain, banks are reducing credit limits and granting fewer credit-line increases, while about 10% of cardholders are now only making the minimum payment, a figure not seen since 2019. Contrasting this, mortgage delinquencies have reached historic lows, indicating a more stable situation in housing loan repayments. I’m so confused. (The Philly Fed has some more interesting data on this this)

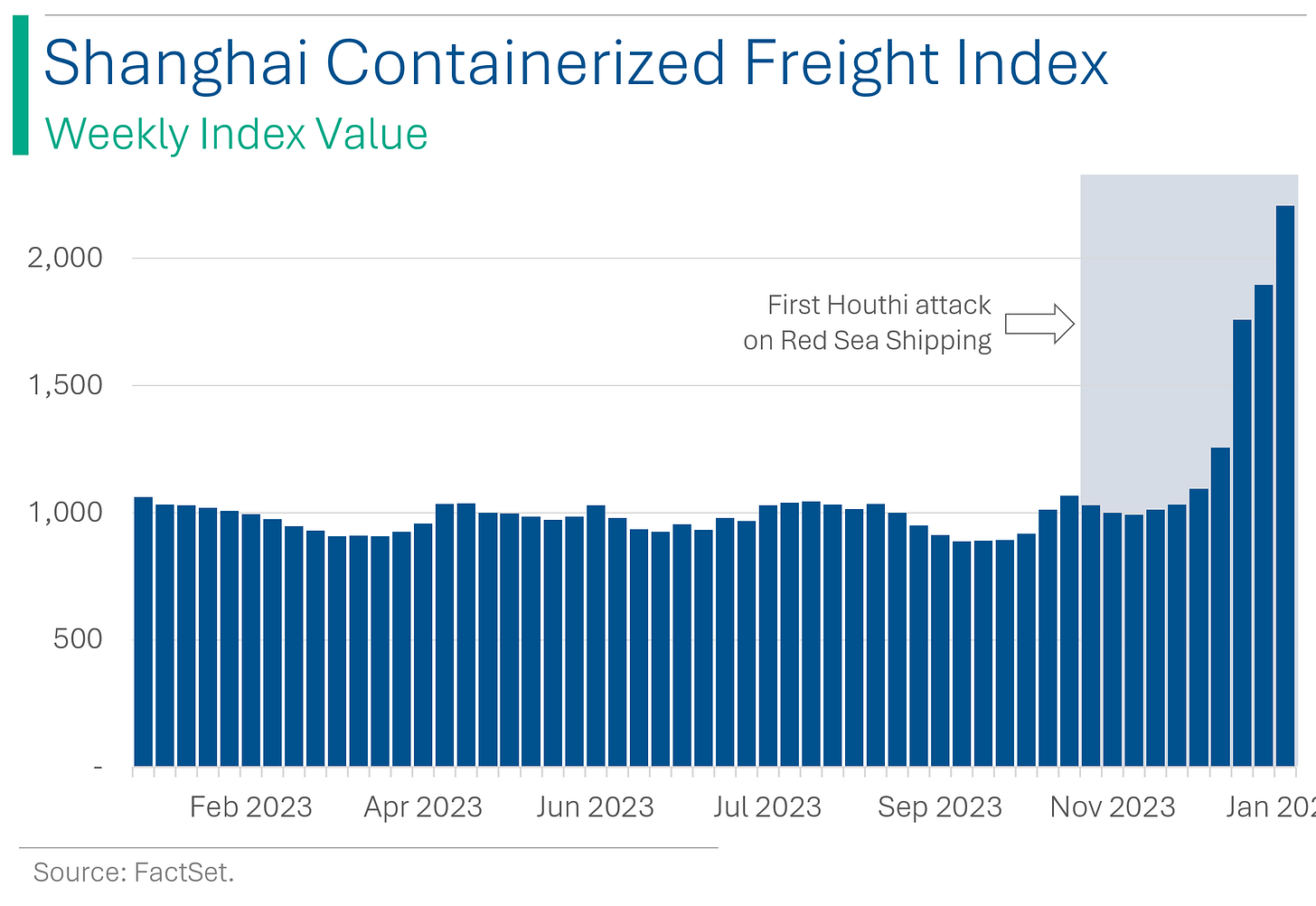

Red Sea Blues: Yemen Conflict Swells Shipping Costs

Container shipping rates have significantly increased due to U.S. and UK air strikes on Yemen, raising concerns about disruptions in the Red Sea, a crucial global trade route. The Shanghai Containerized Freight Index, a key indicator of shipping rates out of China, rose by 16% in a week. Moreover, automaker Stellantis announced that it has resorted to airfreight to cope with disruptions, while Tesla has been forced to pause most production at its Germany plant due to a lack of parts. Industry experts warn that prolonged conflict could lead to further disruptions in global shipping and a potential rise in global inflation. (Reuters and the WSJ have more)

Joke Of The Day

How do you find a good small-cap fund manager?

Find a good large-cap fund manager, and wait.

Hot Headlines

Barron’s | U.K. police arrest six members of Palestine Action in plot to disrupt London Stock Exchange. London police said the activists intended on ‘causing damage in an effort to prevent the building opening for trading’. No one told these geniuses that the LSE is electronic and that no actual trading takes place there.

Reuters | Asia stocks stumble following China skipping on rate cut. Chinese economic data has been getting worse and a cut was expected to help support the economy,

NY Post | ESPN and the NFL in advanced talks on agreement that could give the league a stake in TV giant. Deal terms apparently include that Disney-owned ESPN would take over NFL Media (which owns the NFL Network) and that the league would receive an ownership stake in ESPN.

The Verge | The Best of CES 2024. The undoubted winner of was Samsung’s robot Ballie.

Trivia

This week’s trivia is on company firsts.

The first company to achieve a billion-dollar market value was?

A) General Electric

B) U.S. Steel

C) Apple

D) MicrosoftThe first company to produce a digital camera was?

A) Sony

B) Kodak

C) Nikon

D) CanonWho launched the first commercial satellite?

A) NASA

B) Soviet Union

C) SpaceX

D) AT&T

(answers at bottom)

Market Movers

Winners!

Cameco (CCJ) [+7.0%]: Uranium miners, including Cameco, are experiencing a surge after reports that Kazakhstan's Kazatomprom, the leading uranium miner globally, will likely fall short of its production goals for the next two years.

Bank of New York Mellon (BK) [+4.0%]: Q4 earnings per share (EPS) and revenue exceeded expectations, excluding one-time charges. Quarterly revenue increased by 10%, with net interest revenue boosted by higher interest rates.

Losers!

Delta Air Lines (DAL) [-9.0%]: Q4 earnings and revenue were better than expected. Q1 guidance is within consensus, but the full-year forecast falls short of initial Investor Day targets.

Tesla (TSLA) [-3.7%]: Bloomberg reported Tesla's price reduction for China-produced Model 3 sedans and Model Y SUVs. Reuters added that Tesla is suspending most of its Berlin production due to Red Sea transport disruptions, following news of Hertz reducing its EV fleet.

Market Update

Trivia Answers

B) U.S. Steel was the first billion dollar company.

B) Kodak made the first digital camera.

D) AT&T launched the first commercial satellite.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.