🔬Activist Investors Circle Disney, Oil Inventories Keep Surging, and Much More

"The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions."

- Seth Klarman

“Money is the best deodorant”

- Elizabeth Taylor

Table of Contents

🔥 Hot Headlines

🤭 Joke Of The Day

📈 Market Movers

🙋♂️ Trivia

📊 Market Update

Hot Headlines

OIL INVENTORY BUILD-UP - U.S. crude oil inventories unexpectedly rose by 3.6 million barrels in the week ended Nov. 10, surpassing Wall Street Journal analysts' predictions of an 800,000-barrel increase, with total stockpiles at 439.4 million barrels. Oil closed out normal trading hours down 2% to $77.40 a barrel.

DISNEY GETS (ANOTHER) ACTIVIST INVESTOR - ValueAct Capital, an activist investment fund*, has acquired a significant but undisclosed stake in Walt Disney Co., making it one of the fund's largest holdings, and is in talks with Disney's board, believing the company to be undervalued. This move by ValueAct represents the third major activist investment in Disney in less than two years, following similar actions by Nelson Peltz's Trian Fund Management and Dan Loeb's Third Point. News of ValueAct’s stake lifted Disney shares +3.7% mid-afternoon Wednesday trading. (CNBC)

*Activist funds differ from most traditional asset managers or hedge funds in that they aim to influence the way a company is run. Sometimes this can be relatively innocuous, such as minor strategy pivots, or it can be very aggressive where the fund pushes for greater control (often by recruiting other sympathetic investors) in order to enact things like management changes or the outright sale of the business.

META ALLOWS ADS CLAIMING RIGGED 2020 ELECTION - Meta Platforms has relaxed its advertising policies on Facebook and Instagram to allow political ads that question the legitimacy of past U.S. elections, including claims that they were "rigged" or "stolen," a shift influenced by free speech considerations and previous contentious elections (and money). This change comes alongside other platform policy adjustments, like reducing non-ad political content in user feeds, thereby increasing the significance of political ads in future elections. The policy change, which contrasts with Meta's previous stance against widespread voter fraud claims, aligns with similar loosening of restrictions by other platforms like Google's YouTube and X (formerly Twitter). I don’t think it’s about free speech… (WSJ)

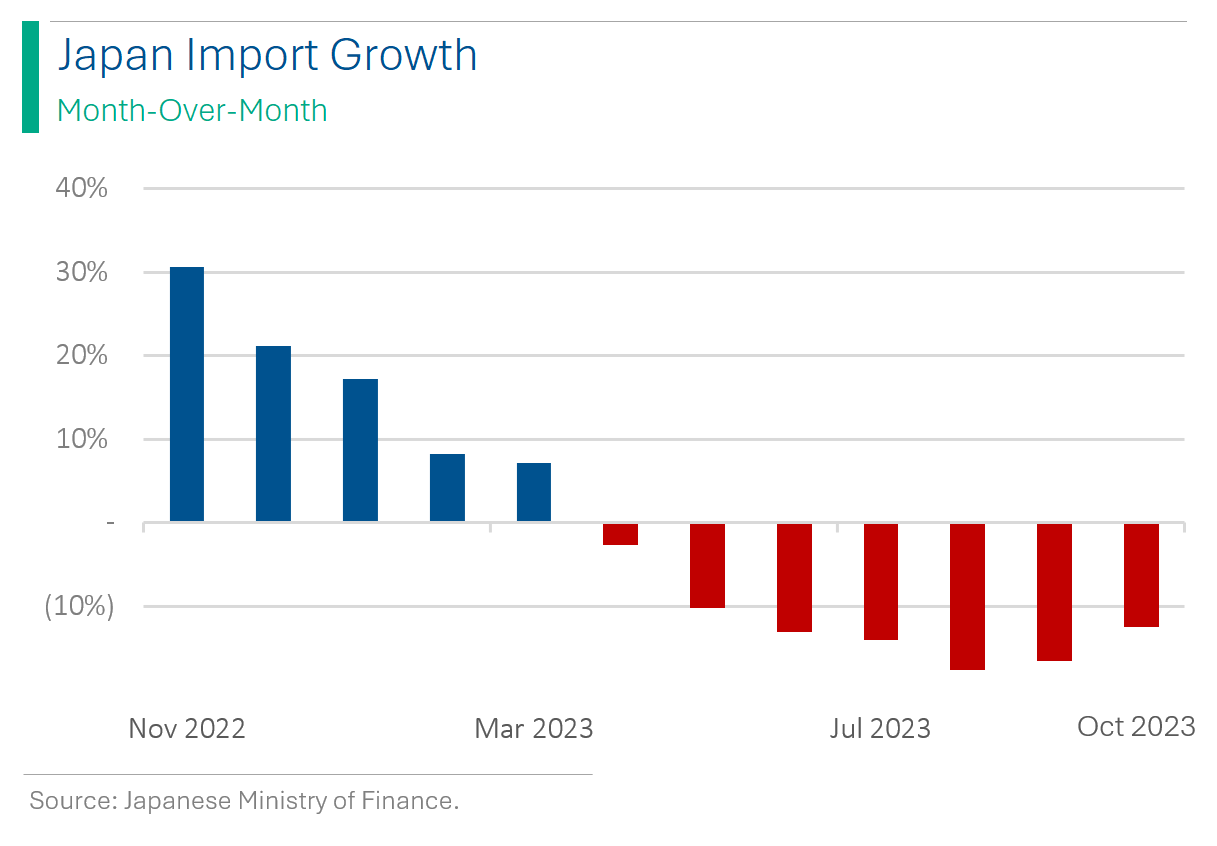

JAPAN EXPORT WEAKNESS - October grew at a slower rate of 1.6%, with a notable increase in car shipments to the U.S. but hindered by declines in chip-making gear exports, adding pressure to its fragile economy that is already grappling with inflation, limited wage growth, and a risk of technical recession. Weak exports despite decades-low currency? Ouch. I think these guys might be in trouble.

NY LEADS CRYPTO REGULATION EFFORTS - New York, always eager to lead the charge in financial regulation, has now told crypto exchanges under its watchful eye to hold off on adding any new digital coins to their portfolios until they jump through a couple more hoops: submitting and getting approval for new policies on listing and delisting these digital assets. (Axios)

(CNBC) Microsoft announces custom AI chip that could compete with Nvidia at its Ignite conference in Seattle. Not saying it’s any good, but a lot of challengers seem to be stepping up for Nvidia’s crown, and there are some pretty bullish assumptions built into their valuations.

(Axios) Biden and China's Xi agree to resume military-to-military communications following four hour meeting at APEC summit. I guess that’s better than the old ways. I guess.

(WSJ) Inside Las Vegas’s $2 Billion Sphere, the High Church of Screen Time. I don’t care, I think it’s pretty nifty.

(Axios) UAW strike settlement deal with GM going down to the wire. Only about 54% of GM votes counted as of Wednesday were to approve the settlement, while 46% were against it.

(CNBC) Citigroup begins layoffs as part of CEO Jane Fraser’s corporate overhaul [of the dumpster fire].

(MarketWatch) Dell Computers Founder and CEO Michael Dell takes a nice jab at his mortal enemy Carl Icahn. Icahn previously tried to scuttle Dell’s take-private of Dell Computers and his acquisition of DMVT, ultimately costing Dell an extra billion-plus to get the deals done.

Joke Of The Day

⛵ I’ve started a business making boats in my attic. Sails are going through the roof.

Market Movers

Winners!

Target (TGT) [+17.8%]: Beat on Q3 earnings by +40%. Q4 guidance is in line (there was worries over a possible cut). However, concerns remain about ongoing topline softness.

VF Corp (VFC) [+14.1%]: Upgraded to neutral by JP Morgan.

Catalent (CTLT) [+11.3%]: Q1 earnings and revenue exceeded expectations.

JD.com (JD) [+7.0%]: Beat on Q3 earnings and revenue estimates. The company reported a 33% year-over-year increase in net profit for Q3.

Sirius XM Holdings (SIRI) [+6.1%]: Warren Buffett’s Berkshire Hathaway acquired nearly 10M shares in Q3, as revealed in a regulatory filing. Ew, Warren.

Walt Disney (DIS) [+3.1%]: Regulatory filings indicated Trian's stake in Disney increased to 32.9M shares from 6.4M and ValueAct initiated a position. This increase follows last month's reports of Trian seeking several board seats at Disney.

Losers!

Global-e Online (GLBE) [-27.1%]: Q3 earnings surpassed expectations while revenue fell short. Q4 revenue guidance sucked.

Energizer Holdings (ENR) [-6.8%]: Downgraded by JP Morgan, Morgan Stanley, RBC, etc. (basically everyone) following a report that cut guidance due to early holiday battery demand. Analysts highlighted overvaluation and a challenging consumer environment.

Alcon AG (ALC) [-5.9%]: Q3 EPS met forecasts but revenue was below expectations.

Eli Lilly (LLY) [-3.6%]: Expected to announce plans for ‘single digit’ billions manufacturing facility in Germany. This follows massive demand for Ozempic competitor Zepbound recent approval.

Trivia

Today’s questions are on the Great Financial Crisis (GFC).

What year marked the beginning of the GFC?

A) 2006

B) 2007

C) 2008

D) 2009In the middle of the worst part of the crisis, Congress approved the Troubled Asset Relief Program (TARP) to bail out select banks and mortgage lenders. How big was TARP?

A) $350 billion

B) $500 billion

C) $700 billion

D) $1 trillionTwo of the biggest bank failures in the GFC were Bear Stearns and Lehman Brothers. Approximately how big were their market capitalizations prior to their collapse?

A) $130 billion and $14 billion

B) $40 billion and $55 billion

C) $5 billion and $30 billion

D) $20 billion and $60 billion

(answers at bottom)

Market Update

Trivia Answers

B) The GFC technically started out with the housing market meltdown in 2007.

C) TARP was $700 billion.

D) Bear Stearns market cap was around $20 billion, while Lehman Brothers was about $60 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.