🔬A Tale of The Tech Sector (Pt. I & II)

I’m currently away on holiday in Mexico so today’s StreetSmarts will be a short one. Below is yesterday’s part 1 and below that is part 2. Hope you enjoy!

A Tale of The Tech Sector (Pt. I)

Tech isn’t just the coolest sector, it’s also the biggest and fastest growing. When we think of the preeminence of the US economy, we undoubtedly think about the Tech mega-caps that lead the world in innovation; be it in commerce, automation, or just getting people to click on s***.

That’s why it’s strange to think about a time when Tech wasn’t a behemoth. While there have been ‘technology’ companies well before Thomas Edison, the S&P 500 first broke out it’s famed index into tracked and indexed sectors in June 1996 (they have since provided hypothetical historical data of what they would have been, thus the above graph).

When the S&P Information Technology Sector started out in ‘96, it was far from the goliath that it is today. In fact, it was only the 6th largest sector1 with a market cap of just over $500 billion.

1. Note that Real Estate wasn’t added until 2016.

While I can’t get data for the ‘original’ Tech companies in the index (FactSet needs a fancy new subscription level to get that aspect), I can go back as far as January 2000 - the DotCom bubble peak that really put Tech on the map (for better or worse). Below are the companies still trading, as many got taken out from M&A over the years (shout out to AOL).

Times have clearly changed for tech in that period. To imagine that once Xerox had a similar market cap to Apple, or that IBM was worth 45 AMDs takes us back to a completely different age.

It is interesting to note that while the Tech sector has expanded and tripled, the companies under its umbrella back in 2000 (below in yellow) still make up a substantial piece (59%) of the current index, even 24 years later.

The success of these companies can be seen in Revenue growth which propelled the sector from 6th biggest into being 125% larger than its closest peer, Financials (13.3% of S&P 500).

Since 1999, Tech has grown Revs by 472% vs. 243% for the S&P 500 (+94% greater). And when you factor in that the bulk of that S&P growth was fueled by Tech as the index grew from a 10.1% to 30.0% weight, it’s even more astonishing.

A Tale of The Tech Sector (Pt. II)

And earnings growth has been even stronger, with EPS up 468% since only 2010. Next best, Consumer Discretionary, could only manage +324% with that heavily fueled by ‘techy’ Amazon and Tesla.

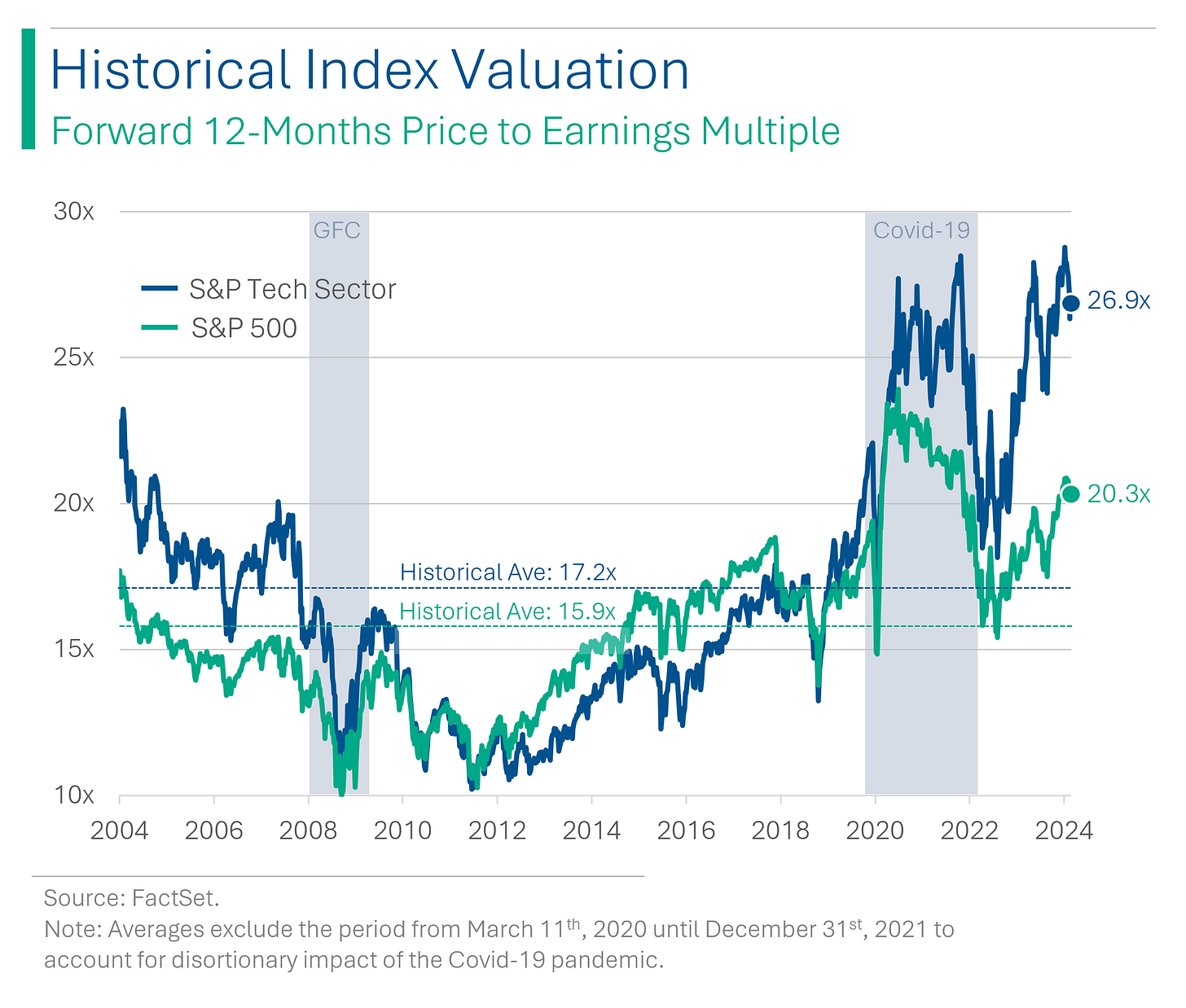

However, to own some of this growth investors had to be willing to pay a bit of premium. While on a forward P/E basis, Tech was cheaper than the overall Index for most of the 2010s, more recently the premium has grown considerably. The Tech sector now trades at ~27x forward EPS vs. ~20x for the S&P 500, a modest 33% premium.

This also makes it the most expensive sector, albeit not by much, compared to Consumer Discretionary, it’s only challenger to the growth crown.

Above I talked about how many of the legacy companies in the S&P Tech Index back in 2000 still form the core of the index today. While that’s true, it is important to note just how top heavy the index is: Currently the ‘Big 3’ of Nvidia, Apple and Microsoft hold a cumulative market capitalization of $7.7 trillion - a staggering 54% premium to the other 62 companies on the index COMBINED.

The above mentioned ‘Big 3’ are also the three biggest companies in the S&P 500.

What is interesting, though, is the spots 4 to 6 - and maybe even 10, would in most people’s minds be viewed as ‘Tech Companies’. The idea that Google-parent Alphabet and Meta have more in common with AT&T and Verizon than Microsoft, or that Amazon has more in common with McDonald’s than Apple, does seem quite odd.

If Alphabet, Meta and Amazon were to be included in the Tech sector, the result would be quite significant on the overall landscape of the S&P 500, with Tech now holding a massive 40.6% weighting.

So that’s my tale of the Tech sector, I hope you enjoyed it! If you liked this kinda of write-up and would like to see me dive into more sectors please let me know in the comments!

Now, time for a margarita (or six)!

-Ryan