🔬A Tale of The Tech Sector Pt. I

Plus: Another crypto CEO goes to jail; more US econ data sucks; and much more

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

- John Templeton

"It’s not supposed to be easy. Anyone who finds it easy is stupid."

- Howard Marks

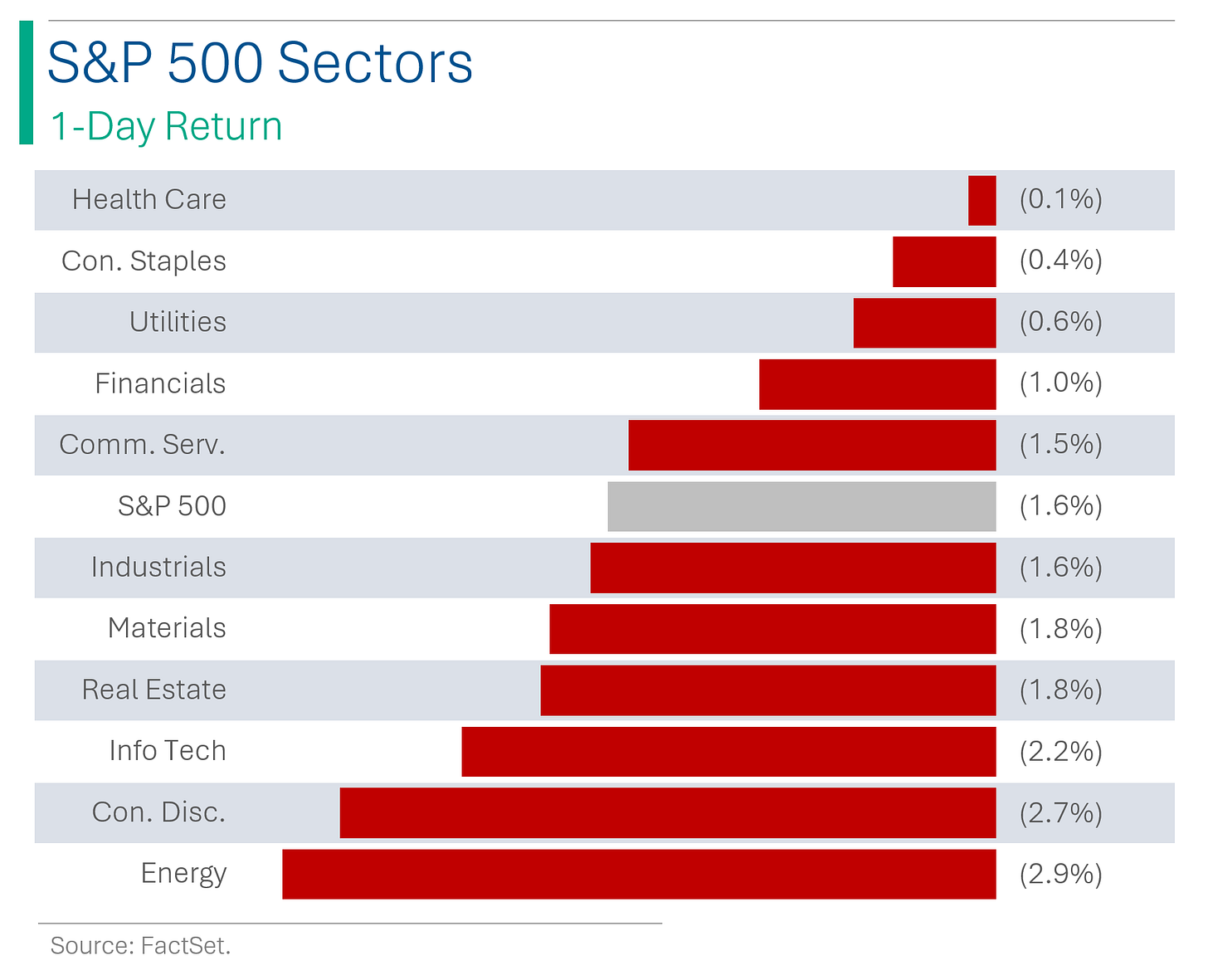

The storm after a few days of calm for the big US markets, with the S&P 500 -1.6% and Nasdaq -2.0%. Less than ideal economic data was to blame (more below).

All 11 sectors closed in the red, with Healthcare (-0.1%) faring the best. Energy (-2.9%) and Consumer Discretionary (-2.7%) got lit up the worst.

Another huge day for Q1 reporting (see ‘Market Movers’ below) with Amazon on a bit of a wild ride after reporting beats on EPS and Revenue. Shares popped 5% in after hours trading only to flop down to +1.83% once the news was digested.

Street Stories

A Tale of The Tech Sector (Pt. 1)

Tech isn’t just the coolest sector, it’s also the biggest and fastest growing. When we think of the preeminence of the US economy, we undoubtedly think about the Tech mega-caps that lead the world in innovation; be it in commerce, automation, or just getting people to click on s***.

That’s why it’s strange to think about a time when Tech wasn’t a behemoth. While there have been ‘technology’ companies well before Thomas Edison, the S&P 500 first broke out it’s famed index into tracked and indexed sectors in June 1996 (they have since provided hypothetical historical data of what they would have been, thus the above graph).

When the S&P Information Technology Sector started out in ‘96, it was far from the goliath that it is today. In fact, it was only the 6th largest sector1 with a market cap of just over $500 billion.

1. Note that Real Estate wasn’t added until 2016.

While I can’t get data for the ‘original’ Tech companies in the index (FactSet needs a fancy new subscription level to get that aspect), I can go back as far as January 2000 - the DotCom bubble peak that really put Tech on the map (for better or worse). Below are the companies still trading, as many got taken out from M&A over the years (shout out to AOL).

Times have clearly changed for tech in that period. To imagine that once Xerox had a similar market cap to Apple, or that IBM was worth 45 AMDs takes us back to a completely different age.

It is interesting to note that while the Tech sector has expanded and tripled, the companies under its umbrella back in 2000 (below in yellow) still make up a substantial piece (59%) of the current index, even 24 years later.

The success of these companies can be seen in Revenue growth which propelled the sector from 6th biggest into being 125% larger than its closest peer, Financials (13.3% of S&P 500).

Since 1999, Tech has grown Revs by 472% vs. 243% for the S&P 500 (+94% greater). And when you factor in that the bulk of that S&P growth was fueled by Tech as the index grew from a 10.1% to 30.0% weight, it’s even more astonishing.

This is probably a good place to leave things today. Check in tomorrow for Pt. 2 where I dig into the financials, valuation, and why the hell Alphabet, Amazon and Meta aren’t considered ‘Tech’ companies.

Another Crypto CEO Goes To Jail

Changpeng Zhao, the ex-big boss of Binance - the number one crypto exchange after the fall of FTX, snagged a cushy four-month vacation in prison after owning up to skirting U.S. anti-money laundering laws. Despite prosecutors pitching a three-year timeout, the court handed down a sentence that left some spectators smirking at the leniency.

Zhao, who turned Binance's rule-dodging into an art form, was forced to pay a cool $100 million in fines (read: pocket change), showing that even in crypto, crime does pay dividends.

Gross Econ Data Weighed On The Market

With the market busy trying to absorb the haymakers of a cooling US economy and annoyingly sticky inflation, it didn’t need the body blows of yesterday’s economic data.

Consumer Confidence: April CC Index came in at 97.0, well below the Street’s estimate for 104.0. Sucky.

PMIs: The business barometer Chicago Purchasing Manager's Index came in at 37.9 vs. expectations for 45.0. It’s worst reading since 2022 and it’s fifth straight monthly decline. More sucky.

Note: A reading below 50 indicates contraction.

Housing Prices: Despite mortgage rates back up towards 7%, the Case-Shiller Home Price Index continued to plow upwards.

Wages: The Employment Cost Index (ECI), a broad measure of employer costs published by the Bureau of Labor Statistics, showed that wages grew +1.2% in Q1 vs. expectations for 1.0% and after rising +0.9% in the fourth quarter. Wage growth plays an important factor in inflation.

Joke Of The Day

Did you hear about the cannibal CPA? She charges an arm and a leg.

Hot Headlines

The Associated Press / Europe’s economy shows signs of life with 0.3% growth in 1st quarter as inflation as Energy woes ease. The 20-country eurozone recorded its strongest performance since the third quarter of 2022 and improved on shrinkage of 0.1% in each of the last two quarters of 2023

Bitcoinist / Morgan Stanley unveils plans for Bitcoin ETFs into its funds. The bank submitted a filing to the SEC requesting official approval to incorporate spot Bitcoin ETFs into 12 of its investment funds. Different tack than JP Morgan, I guess.

Bloomberg / The Fed’s Quantitative Easing program cost too much. With the total bill possibly exceeding $500 billion, former NY Feb President Bill Dudley says that it worked but at likely too high a cost.

The Hill / Polls show that Trump leads Biden in major battleground states. The former President holds single-digit advantages in Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin - though the difference is within each survey’s margin of error.

CBS Sports / The SEC and Big Ten developing plan to share revenue with players in potential landmark change to college athletics. The deal would not only share revenue with players but also perhaps help settle the House v. NCAA lawsuit that goes to trial in January 2025. The antitrust lawsuit is a class-action complaint alleging the NCAA and power conferences have conspired to suppress athletes' compensation.

Trivia

Today’s trivia is on Intel.

When was Intel founded?

A) 1950

B) 1968

C) 1978

D) 1941What does "Intel" stand for?

A) Internet and Telecommunications

B) Intelligent Electronics

C) Integrated Electronics

D) International ElectronicsWhich famous campaign slogan did Intel launch in 1991?

A) Just Do It

B) Think Different

C) [company name] Inside

D) Making it all make sense.Intel's first processor to reach 1 GHz was launched in which year?

A) 1991

B) 2000

C) 2011

D) 2020

(answers at bottom)

Market Movers

Winners!

Eli Lilly (LLY) [+6.0%]: Q1 EPS outperformed though revenue fell short; both FY24 EPS and revenue guidance were raised. Revenue surged 26% y/y, mainly from strong sales of Mounjaro, Zepbound, Verzenio, and Jardiance, despite a drop in Trulicity.

Zebra Technologies (ZBRA) [+4.8%]: Q1 EPS and revenue surpassed estimates with strong margins. Guidance for Q2 and FY24 on EPS and revenue growth, and cash flow was raised, reflecting a Q4 demand improvement.

3M (MMM) [+4.7%]: Q1 EPS and revenue topped estimates with organic growth outpacing expectations. FY24 organic sales growth forecast for Transportation and Electronics was raised, signaling optimism amid litigation.

NXP Semiconductors (NXPI) [+3.7%]: Q1 results were mostly in line, with Q2 guidance slightly better than expected. The outlook indicates demand stabilization in industrials and auto sectors.

PayPal (PYPL) [+1.4%]: Q1 EPS and revenue beat predictions; total payment volumes and transaction margins exceeded estimates. Q2 revenue growth guidance was slightly below consensus, yet improvements in transaction and loan losses were noted.

Losers!

GE Healthcare Technologies (GEHC) [-14.3%]: Q1 revenue missed, earnings slightly off. Organic growth lagged, with Ultrasound and Patient Care weak. Backlog and order growth were strong. FY guidance reaffirmed, expecting H2 growth.

Coursera (COUR) [-14.1%]: Q1 revenue fell short, but EBITDA and EPS exceeded expectations. FY24 EBITDA and revenue forecasts reduced due to pressure on the consumer segment, adding to enterprise and degree challenges.

F5, Inc. (FFIV) [-9.2%]: FQ2 EPS above expectations, revenue underwhelmed. Billings and deferred revenue didn't meet expectations. Demand for new subscriptions flat, cautious customer outlook. Next-Q guidance below expectations, slight positive adjustments to FY guidance.

Northern Oil & Gas (NOG) [-6.3%]: Q1 EPS boost from stronger production and pricing, offset by higher capital expenditures. Q2 production guidance on target. FY24 Capex and production guidance maintained.

Tesla (TSLA) [-5.6%]: Reportedly, Elon Musk is laying off more employees, emphasizing the need for stringent headcount and cost control in an email.

Market Update

Trivia Answers

B) Intel was founded in 1968.

C) Intel stands for Integrated Electronics. (Ya, I didn’t know it stood for anything either).

C) Intel Inside

B) Intel’s first 1 GHz processor was launched in 2000.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.