🔬A Fed Rate-Cutting Retrospective...in charts!

"The early bird gets the worm, but the second mouse gets the cheese."

- Steven Wright

“If you think education is expensive, try ignorance.”

- Derek Bok

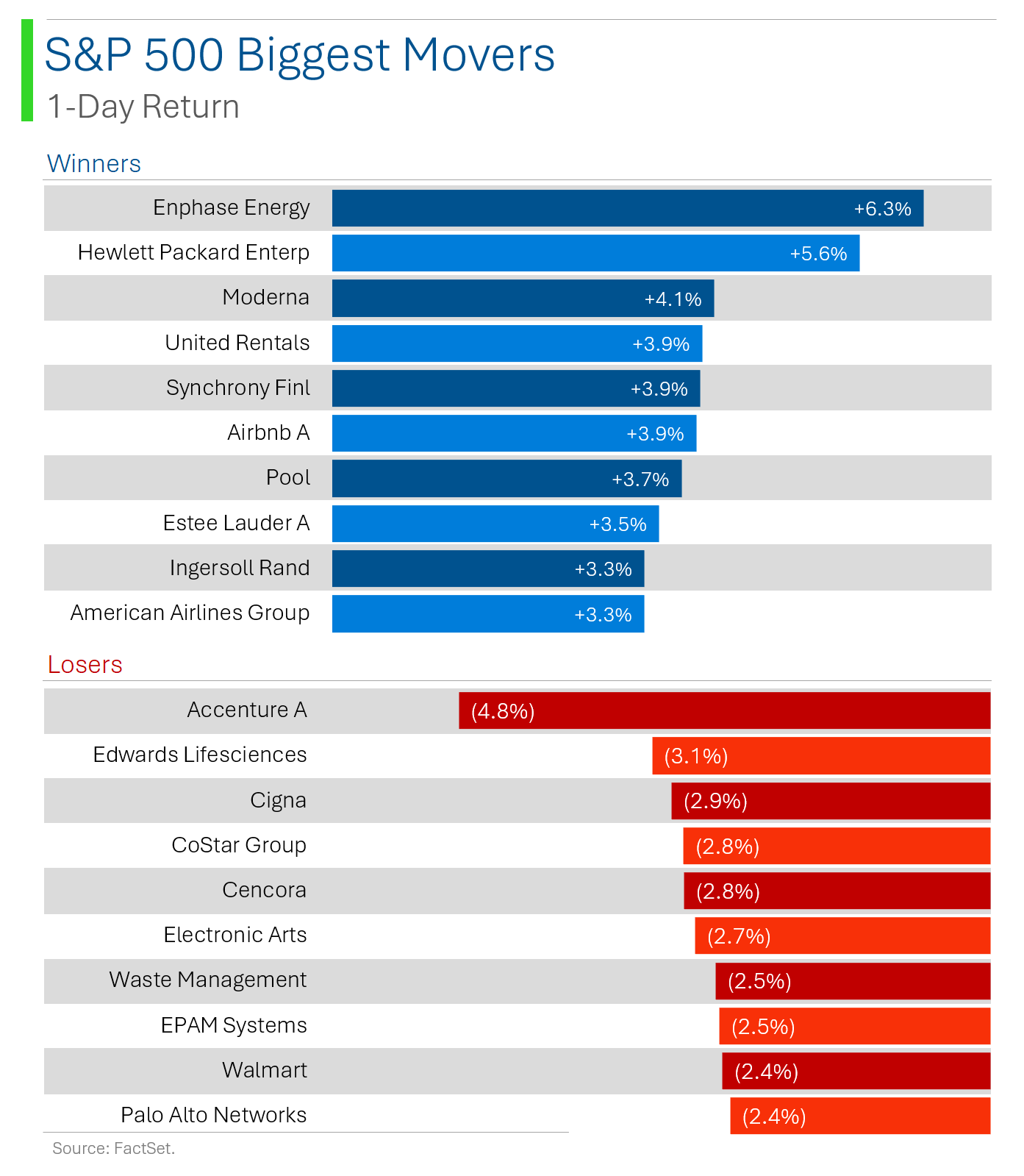

U.S. equities had a mixed day, with the S&P 500 closing slightly higher, driven by gains in big tech, energy, and financials, while sectors like semis, software, and healthcare lagged. Treasuries weakened, the dollar gained, and Bitcoin rose 3.6%, while WTI crude was up 1.6%.

August retail sales exceeded expectations, rising 0.1% m/m compared to a forecasted 0.2% decline, with stronger industrial production also boosting the economic outlook. A potential Fed rate cut remains a hot topic, with markets debating between a 25 or 50 basis point move at tomorrow's FOMC meeting.

Microsoft announced a $60B share buyback and increased its dividend, while Intel continued its rally after AI chip news. Starbucks' North America CEO will retire in November, and Hawaiian Airlines received the green light to merge with Alaska Airlines.

Notable companies:

Hewlett Packard Enterprise (HPE) [+5.6%] was upgraded to buy by Bank of America, citing cost cuts, a cyclical recovery, and AI-related growth.

New York Community Bancorp (NYCB) [+5.1%] got an upgrade from Raymond James, as lower rates are expected to improve the bank’s credit outlook, despite ongoing challenges.

Hawaiian Holdings (HA) [+3.9%] received a final regulatory exemption from the Department of Transportation, clearing the way for its merger with Alaska Airlines.

More below in ‘Market Movers’.

Street Stories

A Fed Rate-Cutting Retrospective...in charts!

Yesterday I did a deep-dive setting the economic table ahead of today’s rate cuts, so today I wanted to dive into historical rate cutting periods to potentially glean some insight into what to expect in the coming months. Tally-ho!

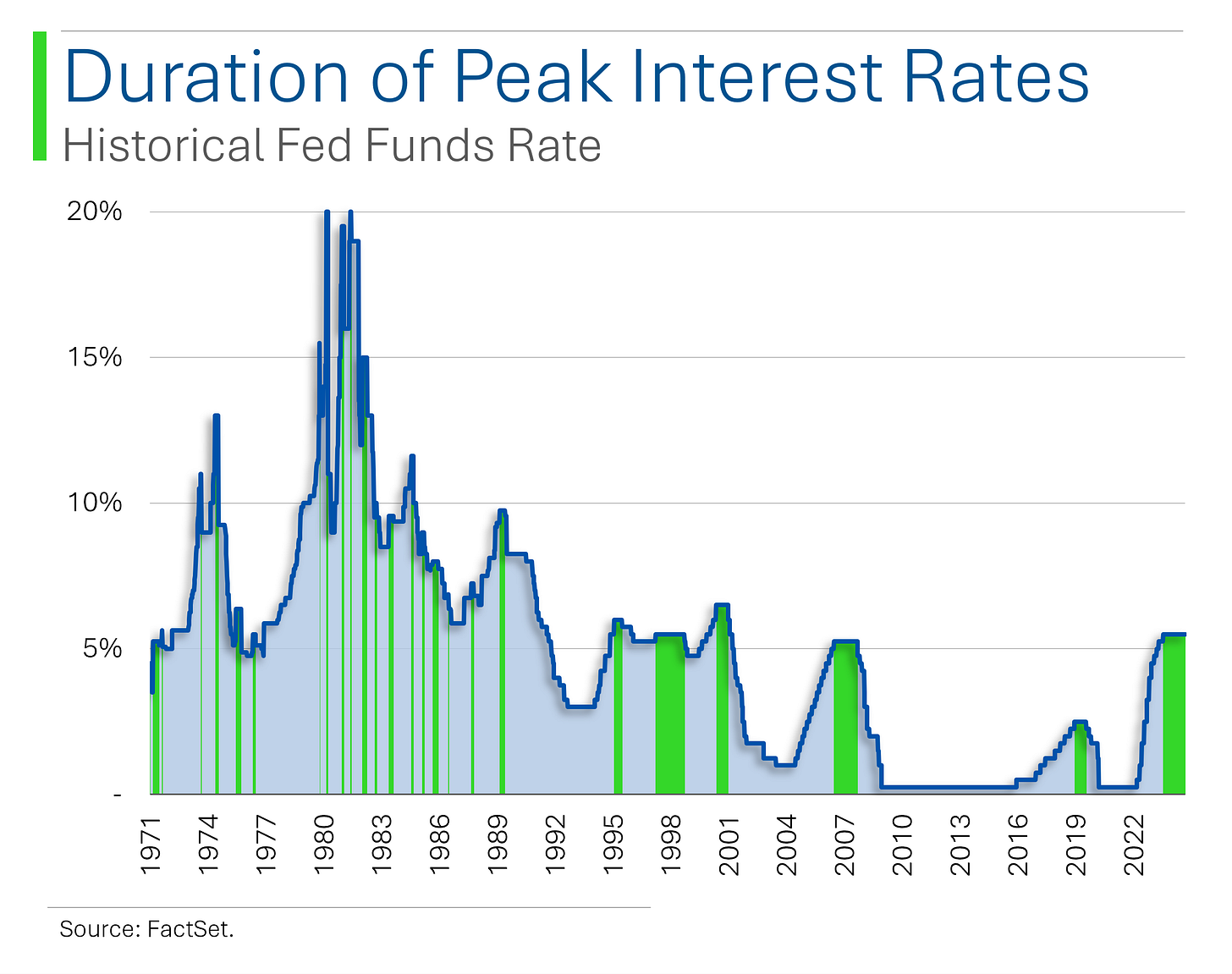

To start, we will be wrapping up the third longest period of peak cycle interest rates (gap between last raise and first cut) since the early 1970s. The last interest rate hike took place in July 2023 marking 60 weeks of rates topped out at 5.5%.

It’s also pretty clear that not only are interest rates much lower than in the ‘70s and ‘80s, the Fed is also a lot less jumpy…

So far since 2000, we’ve only seen three rate cutting periods.

If the ‘70s and ‘80s were about the Fed actively reacting to a variety of factors effecting (massive) inflation and the labor market, then the 2000/2010s have been about dealing with ‘generational’ crises where the playbook has basically been to take interest rates to record lows in the hopes to averting disaster.

Oh what a time to be alive…

Historically, rate cutting periods since 1971 have lasted for 34 weeks but since the year 2000 they’ve averaged 77 weeks.

So ya, this could be a while.

Another way in which things since 2000 have been different is that we are actually starting at a pretty low level.

Historically, the average interest rate at the start of a rate cutting cycle has been 8.9% and actually ended at a higher level than we are today (5.75% vs. 5.5% currently).

What will be interesting to see from this cutting spree is if we return to something of a ‘normal’ cycle of rate cuts. The only examples we have in the last two decades were crisis cuts to try and avert disasters (Great Financial Crisis and Covid Pandemic), and those resulted in interest rates that were basically zero (0.25%).

Once the Fed gets into slash mode will they have the fortitude to call it quits before we hit negative real rates again?

Joke Of The Day

How do you think the unthinkable?

With an itheberg.

Hot Headlines

Bloomberg / Oil hedges surged by third-most on record last week after Brent fell below $70/barrel. Investors moved to lock in heap hedges as Brent crude hits lowest levels since 2021.

Reuters / Central European floods leave a trail of devastation; new areas to evacuate. The floods are extremely severe and have already killed 22 people. While over 15,000 people have been evacuated, Poland, the Czech Republic, and Hungary are all still battling rising water levels, with damage expected to exceed €1 billion.

Reuters / Kroger-Albertson's US anti-trust trial to end but other legal blocks loom. While Kroger's $25 billion merger with Albertsons continues, the first antitrust trial is almost done which leaves trials in Washington and Colorado left to focus on more concerns over price hikes, union jobs, and local food supply competition. Hey, no one said the route to consolidation of the food supply would be easy…

CNBC / Alaska-Hawaiian merger clears DOT review, but airlines must preserve miles, routes. It is reported that they must maintain frequent flyer miles, preserve key routes, and support rural air service. Blue Horseshoe loves Bluestar Airlines.

Bloomberg / Novo says Ozempic ‘very likely’ target for next US price cut. Ozempic, priced at $968.52 per month, is "very likely" to be targeted for price reductions by 2027 under Medicare negotiations. Over 1 million Americans rely on this drug to treat diabetes - the rest of us need to be reminded that a gym membership is a fraction of this cost.

Bloomberg / Hedge fund titans breed a $14 billion pack of startup cubs. Citadel and Millennium traders have deployed billions driven by a desire to strike out independently of their much larger ex-employer hedge funds. While these multi strategy hedge fund alumni benefit from elite training, replicating their success outside the firms remains challenging, with mixed results historically.

Trivia

Today's trivia is on Elon Musk!

Which company did Elon Musk co-found that eventually became PayPal?

A) X.com

B) Zip2

C) SpaceX

D) TeslaWhat year did Elon Musk first launch a Tesla Roadster into space?

A) 2015

B) 2017

C) 2018

D) 2020Elon Musk’s SpaceX became the first private company to send humans to space in collaboration with NASA in what year?

A) 2016

B) 2018

C) 2020

D) 2021In 2021, SpaceX made history by launching the first all-civilian spaceflight. What was the name of this mission?

A) Inspiration4

B) DragonX

C) Polaris Dawn

D) Galactic Endeavor

(answers at bottom)

Market Movers

Winners!

Gannett Co. (GCI) [+18.7%] got a neutral rating from Citi, with optimism over an antitrust ruling against Google and potential asset sales.

Applovin (APP) [+6.4%] received an upgrade to buy from UBS, thanks to improving ad trends and better visibility around revenue growth.

Hewlett Packard Enterprise (HPE) [+5.6%] was upgraded to buy by Bank of America, citing cost cuts, a cyclical recovery, and AI-related growth.

New York Community Bancorp (NYCB) [+5.1%] got an upgrade from Raymond James, as lower rates are expected to improve the bank’s credit outlook, despite ongoing challenges.

Hawaiian Holdings (HA) [+3.9%] received a final regulatory exemption from the Department of Transportation, clearing the way for its merger with Alaska Airlines.

GE Vernova (GEV) [+3.1%] was upgraded by Bank of America, highlighting growing U.S. electrical demand and a positive outlook for its Gas Power Services segment.

Steel Dynamics (STLD) [+3.1%] reported weaker-than-expected Q3 earnings but analysts remained upbeat about its prospects for 2025 and its strong Fabrication backlog.

Intel (INTC) [+2.7%] announced new AI chip collaborations with AWS, a $3B CHIPS Act award, cost-cutting, and plans to spin off its Foundry business.

Lattice Semiconductor (LSCC) [+1.8%] got an upgrade from Stifel, with analysts optimistic about its new CEO and expecting modest growth in the coming months.

Losers!

Accenture (ACN) [-4.8%] is delaying most staff promotions from December to June, citing better visibility into client demand, though Bloomberg reports the industry is facing spending cuts.

Viasat (VSAT) [-3.9%] got downgraded by JP Morgan due to competition from Starlink, despite analysts saying the threat is likely overblown.

Acushnet Holdings (GOLF) [-3.8%] was downgraded to hold by Jefferies, pointing to challenges in maintaining growth after record golf participation and a recent decline in national rounds.

Healthcare Realty Trust (HR) [-2.4%] announced its CFO will depart on October 1, with interim leadership in place and reaffirmed guidance for Q3 and FY.

Philip Morris International (PM) [-2.2%] is selling its asthma-inhaler unit Vectura for $198M, significantly lower than its original $1.44B purchase price as part of its healthcare pivot.

Market Update

Trivia Answers

A) X.com - Musk co-founded X.com, which later became PayPal after a merger.

C) 2018 - Musk launched a Tesla Roadster aboard the Falcon Heavy rocket.

C) 2020 - SpaceX successfully sent humans to space with the Crew Dragon mission.

A) Inspiration4 - This was the first all-civilian crewed mission to orbit.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.