🔬39th Time’s the Charm: The S&P 500's Latest All-Time High

Plus: Bitcoin is getting political; and much more!

"I don't look to jump over seven-foot bars; I look around for one-foot bars that I can step over."

- Warren Buffett

“If I’m not back in five minutes, just wait longer.”

- Ace Ventura

The Market: US equities closed higher, with the S&P 500 hitting a record while big tech stocks like TSLA, NVDA, and META surged over 4%. Outperformers included small-caps, semiconductors, and autos, while utilities, REITs, and healthcare lagged; Treasuries were mixed, and gold, crude, and Bitcoin saw gains.

The Fed: The market rallied on optimism after a 50bp Fed rate cut, with hopes of a soft landing and further cuts in 2025 boosting big tech and cyclical stocks. Focus shifted to dovish expectations despite initial hawkish Fed comments, while triple-witching and S&P 500 rebalancing loom tomorrow.

The Economy: Economic data showed lower-than-expected jobless claims and mixed manufacturing results, with home sales slightly down. Key corporate updates included TGT appointing a new CFO, while BLDR announced leadership changes and DRI partnered with Uber for Olive Garden delivery.

Notable companies:

Mobileye Global (MBLY) [+15.0%]: Intel confirmed it’s not selling its majority stake in the company, contradicting previous reports.

DoorDash (DASH) [+3.6%]: Got a sweet upgrade thanks to strong growth in the delivery space and good execution.

KKR & Co. (KKR) [+2.8%]: They’re restructuring Axel Springer to separate the media from classified businesses, keeping big names like Politico and Die Welt.

More below in ‘Market Movers’.

Street Stories

39th Time’s the Charm: The S&P 500's Latest All-Time High

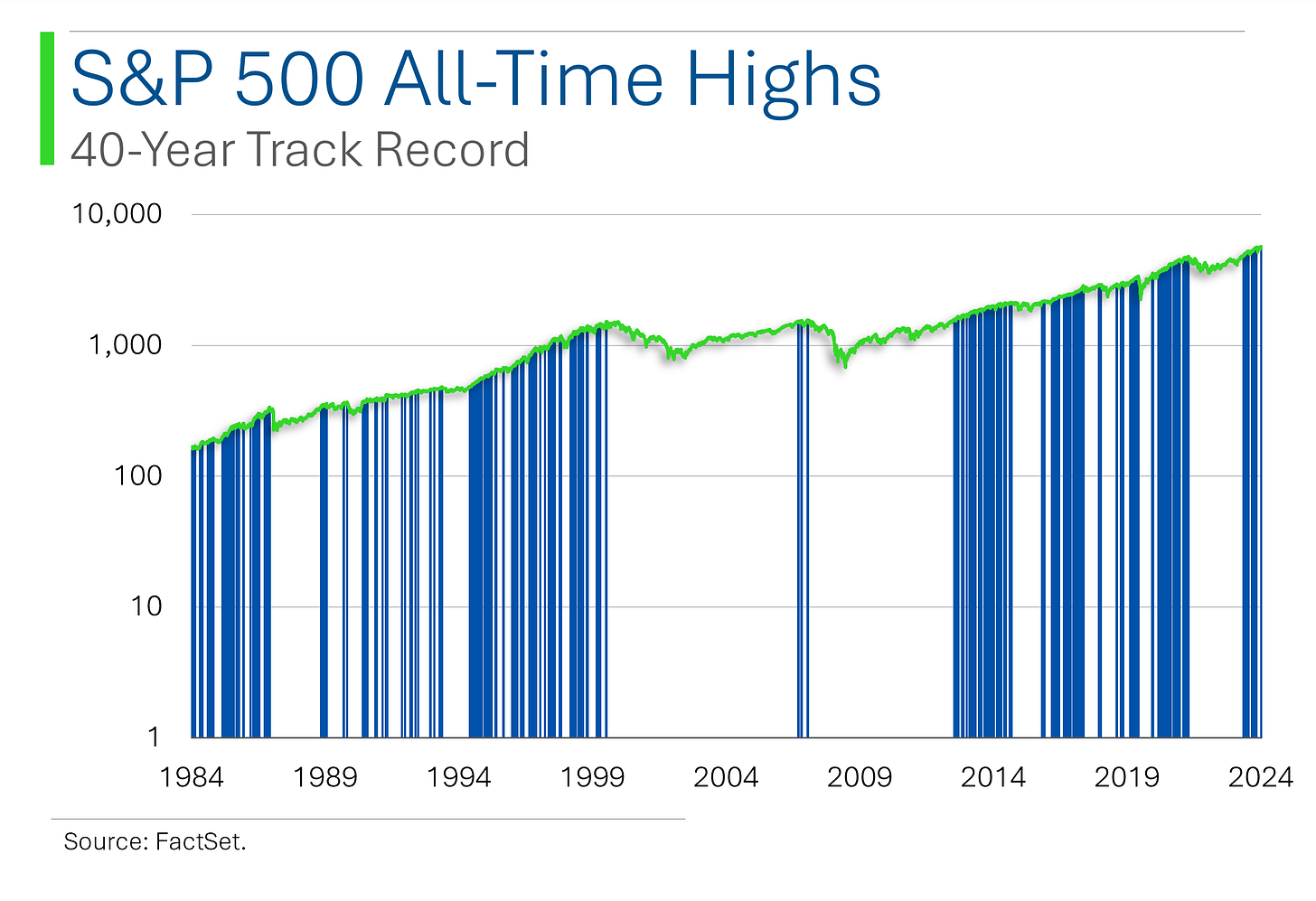

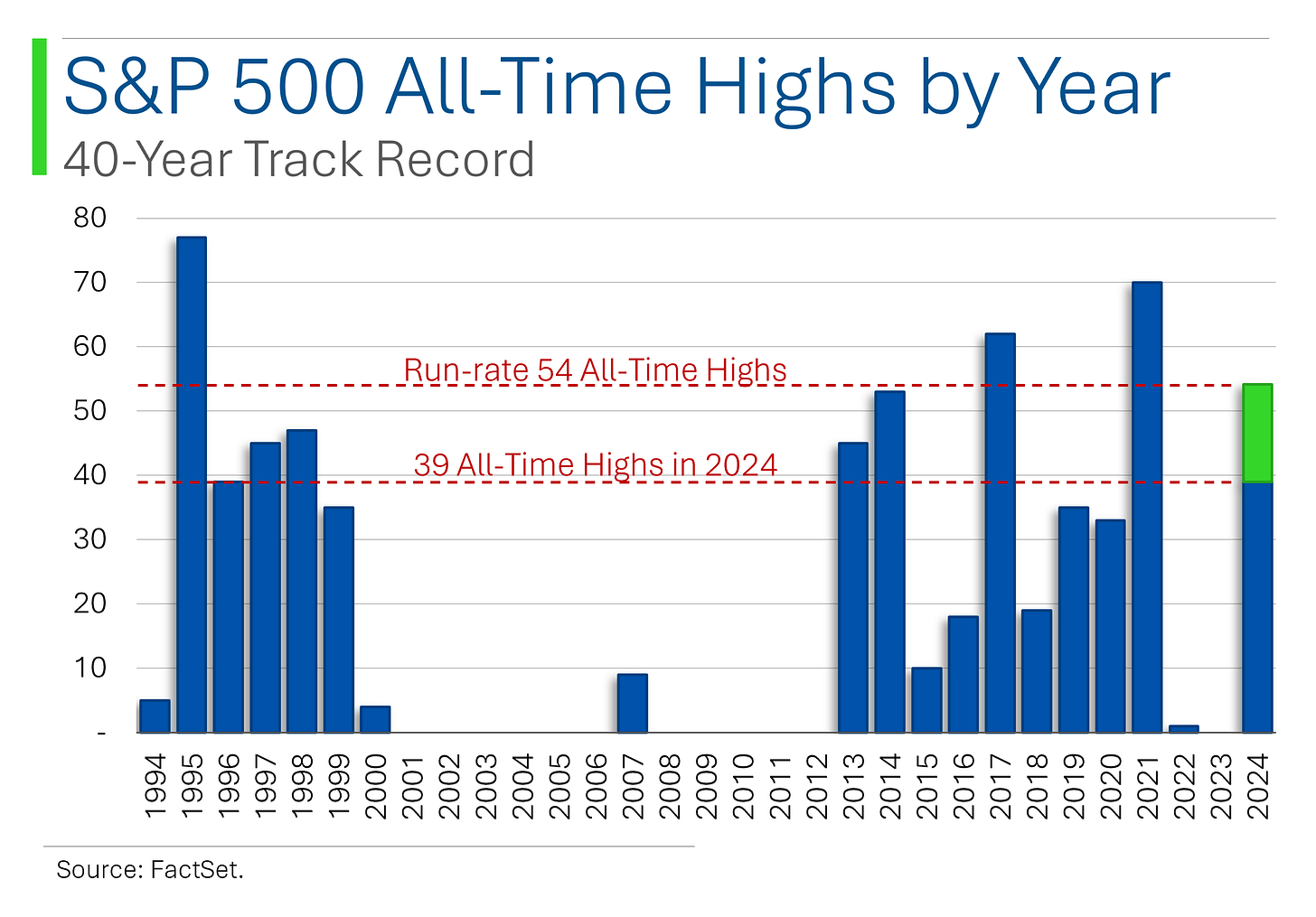

Since bottoming out during the summer sell-off on August 5th, the S&P 500 is up 10.2% and closed yesterday at a fresh new all-time high: It’s 39th of the year.

This all-time high is the first since July 16th in a year that’s been quite busy with them. We hit our first ‘ATH’ in January which got us finally over the pandemic hump, lapping the record from January 2022 that stood for just over two years.

The stock market meltdown in 2022 that marked the end of the Covid era ‘Everything Bubble’, actually took the S&P to it’s fifth furthest gap from the its ATH in the last forty years - and it’s in some pretty impressive company, from Black Monday to the GFC.

Luckily it didn’t take too long to come out of the 2022 slump. For example, after the DotCom bubble it took seven years for the market to reach a new all-time high. For the GFC it took six years.

I kinda feel bad for b******* so much about the market.

That said, it hasn’t been peachy for everyone: Real Estate is still a mile away from it’s peak back in December 2021. Energy’s peak came this April but it’s been rough sailing as a global slowdown - which China seems to be the posterchild for - has sucked the life out of energy stocks.

Perhaps most interesting is that Tech is third furthest from it’s record. Tech carried the index for most of the year but thankfully Materials, Financials, Industrials and Health Care have been able to it step up.

Oh, and don’t feel bad for Tech, it’s still up +28% year-to-date.

It’s good to enjoy the all-time highs when they hit, because you never know when the next one will be coming. I doubt anyone following the stock market on March 24, 2000 thought that that 1,527 mark for the S&P 500 would last for the next 2,624 days.

I mean as long as we got J-Pow, though, we’re probably still good…

Bitcoin + Politics

Bitcoin broke past $62k again, but the real story is the geopolitical tug-of-war shaping the crypto mining industry. Not like too many of the Bitcoiners know this amirite?

Too busy with that ascending skippity-doo-dah converging triangle star in the chart.

Anyways.

Bitmain, a Chinese behemoth controlling 90% of the Bitcoin mining rig market, is facing pressure as U.S. companies look to cut reliance on foreign hardware. Familiar theme…

As a refresher, following China’s 2021 ban on Bitcoin mining, the U.S. became the largest mining hub globally, responsible for 35.4% of the total Bitcoin hash rate.

And you would not guess who’s in third place…

The shift in dominance has been fueled by companies like Core Scientific and Marathon Digital, who are now diversifying away from Bitmain. In fact, Marathon holds $80 million in hardware from new supplier Auradine, a company that’s positioning itself to fill the gap as Trump pushes for Bitcoin to be "mined, minted, and made" in the U.S.

The stakes are high: Bitcoin mining consumes 0.6% of global electricity, making access to efficient, affordable rigs crucial…but, as we all know, computing power is being sold at a bit of a premium right now…

Joke Of The Day

How many flies does it take to screw in a lightbulb?

Just two but I have no idea how they got in there.

Hot Headlines

CNBC / August home sales drop more than expected as prices set a new record. Home sales fell 2.5% in August, marking three months under 4 million units, while prices hit a record median of $416,700. Furthermore, inventory is up 22.7% year over year and many report that it's still a seller’s market overall. This marks the second lowest reading since the fallout from the Housing Crisis. Super.

Yahoo Finance / Airbnb CEO says company focused on boosting long-term stays. Given that short-term stays face more regulation in tourist spots like Athens and Barcelona, the firm wants to focus on growing its long term business - they define this as anything longer than a month. Long-term bookings now make up 17-18% of Airbnb’s business, up from 13-14% pre-pandemic. This is also called ‘renting’.

Reuters / US holiday sales to grow 3% again with promotions in focus according to Mastercard forecasts.

CNBC / UAW warns of potential strikes at Ford and Stellantis a year after unprecedented work stoppages. Ford faces a September 25 strike deadline at a key F-150 plant, while Stellantis workers are currently voting on strike authorization. The Chinese were wrong: 2024 is the year of the strike, not the dragon.

CNBC / Elon Musk’s X and Starlink face nearly $1 million in daily fines for alleged ban evasion in Brazil. Brazil’s supreme court ruled X violated laws by failing to remove harmful content, using dynamic IP addresses to circumvent the ban. Maybe Brazil should start a space program and do something about it lol.

Trivia

Today's trivia is on NASA, the U.S. space agency that has pioneered space exploration for over six decades!

Which NASA mission was the first to successfully land humans on the Moon?

A) Apollo 8

B) Apollo 11

C) Apollo 13

D) Gemini 7What does the acronym “NASA” stand for?

A) National Aeronautics and Space Administration

B) North American Space Agency

C) National Aerospace and Satellite Agency

D) Naval Aeronautics and Space AgencyWhich NASA spacecraft has been exploring Mars since its landing in 2012?

A) Spirit

B) Curiosity

C) Opportunity

D) PerseveranceNASA’s iconic space shuttle program, which launched reusable spacecraft, began in which year?

A) 1972

B) 1981

C) 1985

D) 1990

(answers at bottom)

Market Movers

Winners!

Edgewise Therapeutics (EWTX) [+54.7%]: The company announced some great trial results for its HCM treatment, with data beating Wall Street expectations.

Mobileye Global (MBLY) [+15.0%]: Intel confirmed it’s not selling its majority stake in the company, contradicting previous reports.

Darden Restaurants (DRI) [+8.3%]: Despite a rough quarter, Darden is sticking to its full-year outlook and teaming up with Uber for Olive Garden delivery.

FactSet Research Systems (FDS) [+5.1%]: Earnings beat but revenue fell short, though growth is solid, and they announced a $300M stock buyback.

Builders FirstSource (BLDR) [+3.8%]: The company’s CFO is stepping up as CEO, and they’ve already named his replacement.

DoorDash (DASH) [+3.6%]: Got a sweet upgrade thanks to strong growth in the delivery space and good execution.

KKR & Co. (KKR) [+2.8%]: They’re restructuring Axel Springer to separate the media from classified businesses, keeping big names like Politico and Die Welt.

Losers!

Progyny (PGNY) [-32.7%]: A major client, making up 13% of revenue, is terminating its agreement, effective January 2025.

Skechers USA (SKX) [-9.6%]: Shares fell after management pointed out worse-than-expected consumer pressures in China at a conference.

Steelcase (SCS) [-5.7%]: Revenue missed due to international weakness, though U.S. orders are solid, but next quarter guidance isn’t looking great.

Terex (TEX) [-3.6%]: They cut their full-year revenue and earnings outlook, citing quicker-than-expected channel adjustments.

Five Below (FIVE) [-2.2%]: JPMorgan downgraded them, flagging falling basket values as customers tighten their budgets.

Market Update

Trivia Answers

B) Apollo 11 – In 1969, Apollo 11 successfully landed humans on the Moon, marking a historic achievement for NASA.

A) National Aeronautics and Space Administration – NASA stands for National Aeronautics and Space Administration, established in 1958.

B) Curiosity – The Curiosity rover has been exploring the surface of Mars since its landing in 2012, providing valuable data about the planet’s conditions.

B) 1981 – NASA’s space shuttle program began in 1981 with the launch of Space Shuttle Columbia, introducing reusable spacecraft to space exploration.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.